Business

Why ElevenLabs Runs 20 Small Teams Even As It Scales Fast

ElevenLabs may have a few hundred employees, but its CEO said the voice-cloning AI startup isn’t scaling like a typical tech firm.

Instead of sprawling departments, ElevenLabs’ employees are split into about 20 micro-teams of five to 10 people each, CEO and cofounder Mati Staniszewski said on an episode of the “Twenty Minute VC” podcast published Monday.

Each team owns a product area — from the studio interface to enterprise voice agents — and is designed to move fast without layers of bureaucracy, he added.

“More people frequently doesn’t fix the problem,” Staniszewski said. “You don’t need that many people to do something special.”

ElevenLabs said in a blog post on Monday that it has 330 employees and surpassed $200 million in revenue, with expectations to top $300 million by year’s end. The company had been pacing to reach $100 million in annual revenue by the end of 2024, Business Insider reported last year.

Staniszewski also said ElevenLabs has managed to outperform larger rivals like OpenAI in voice-AI benchmarks and win multimillion-dollar enterprise contracts, thanks to its “mighty” team.

“We now have a very small and mighty team that can learn from each other and move pretty quickly,” he said. “I don’t think there’s a guarantee you get that in some of the other companies.”

Staniszewski said the company plans to expand head count to around 400 this year while sticking with its micro-team model. Even with hundreds of employees, he and his cofounder still interview every candidate themselves.

“It’s a good signal of who we bring into the company,” Staniszewski said, adding that he wants to keep interviewing every hire for as long as he can.

ElevenLabs lists dozens of open roles on its website, from research engineers and data scientists to sales executives and customer success managers worldwide.

It also announced on Monday a $100 million tender offer that will allow employees to cash out some of their shares. The deal, led by Sequoia and Iconiq, values the startup at $6.6 billion — double its Series C valuation from nine months ago.

Staniszewski and ElevanLabs did not respond to a request for comment from Business Insider.

The gospel of small teams

Startups and even Big Tech have been touting the gospel of lean, fast-moving teams.

Mark Zuckerberg said on Meta’s latest earnings call that he has “gotten a little bit more convinced around the ability for small, talent-dense teams to be the optimal configuration for driving frontier research.”

“It’s a bit of a different setup,” the Meta CEO said of its new superintelligence AI unit. The team includes a secretive group of hot-shot hires called TBD Lab, meant to develop the most advanced artificial intelligence models, a recent internal memo shows.

The unit represents a fraction of Meta’s total workforce of over 70,000 employees. Many of its members, including its leader, Alexandr Wang, were hired away from buzzy AI startups.

Startups are also embracing the small teams approach.

Kashish Gupta, the cofounder of Hightouch, a San Francisco–based AI marketing startup, said in a Business Insider report last month that the company has raised over $132 million while keeping its head count at about 55 engineers.

The startup, valued earlier this year at $1.2 billion, expects engineers to be self-starters who build products without requiring micromanagement from their bosses. For example, a major new AI agent launch has only four engineers working on it.

“Ultimately, the people prioritizing work are the engineers themselves or the people they work with,” Gupta said.

Business

Charlottesville-based business using AI to help vets file disability claims – The Daily Progress

Business

Flagship Enterprise Center to hold AI business conference – Herald Bulletin

Business

IREN Stock (IREN) Keeps Climbing as AI Cloud Business Grows, Nvidia GPUs Incoming

IREN Limited’s (IREN) shares have continued to extend their recent rally. The data center infrastructure provider’s stock gained over 15% at the close of trading on Tuesday to emerge as the fifth-biggest gainer of the day. Since the start of the year, the shares have also soared by over 200%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The boost comes a day after Daniel Roberts, the company’s co-founder and co-CEO, noted that the “demand for our AI Cloud is accelerating.” Roberts also said the firm is preparing to receive over 9,000 Blackwell graphics processing units (GPUs) from chipmaker Nvidia (NVDA) over the coming months to expand its artificial intelligence-powered cloud business.

IREN was recently admitted into the Nvidia Preferred Partner Program, giving the company priority access to the chip designer’s latest GPUs. As part of its expansion, the Sydney-based firm plans to install the incoming GPUs at its site in Prince George, British Columbia, Canada, where it is constructing a new facility to install Nvidia’s GB300 NVL72 systems. These systems are Nvidia’s high-end, liquid-cooled AI servers built around the Blackwell GB300 GPU.

IREN Misses Wall Street Estimates

IREN has continued to rally despite missing Wall Street’s revenue projection for its most recent quarter. In its fiscal fourth-quarter 2025 results released in late August, the company, which also mines Bitcoin, generated $187.3 million in revenue, below the estimated $188.91 million.

However, for a company that frequently reports a net loss, IREN reported a net income of $176.9 million during the recent quarter. This is even as the company looks to expand its AI Cloud server business to 10,900 Nvidia GPUs, with over 80% of those from the chipmaker’s Blackwell models.

Furthermore, IREN mined fewer Bitcoins in August, with the number dropping by over 8% from 728 BTC in July to 668 BTC in August. However, the company continues to maintain a positive outlook.

“Following record fiscal year and quarterly earnings, we delivered another month of solid performance, generating $53 million of hardware profit in August despite seasonal curtailment and electricity prices,” said co-CEO Daniel Roberts.

IREN’s brighter prospects for its AI cloud business coincide with the time investors are looking to Oracle’s (ORCL) cloud infrastructure revenue as a key driver for future growth.

Is IREN a Good Stock to Buy?

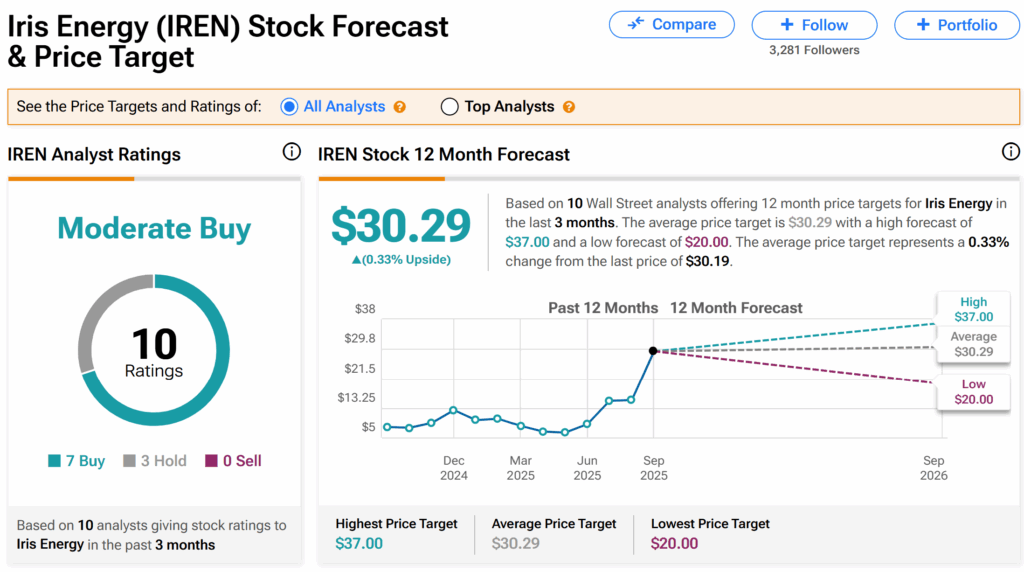

Analysts on Wall Street are generally cautious about IREN’s shares. On TipRanks, the stock has a Moderate Buy consensus recommendation based on seven Buy and three Hold ratings by 10 Wall Street analysts over the last three months.

The average IREN price target is $30.29, which indicates a potential marginal growth of 0.33% from current levels.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi