Business

What is the rate and why are prices still rising?

BBC

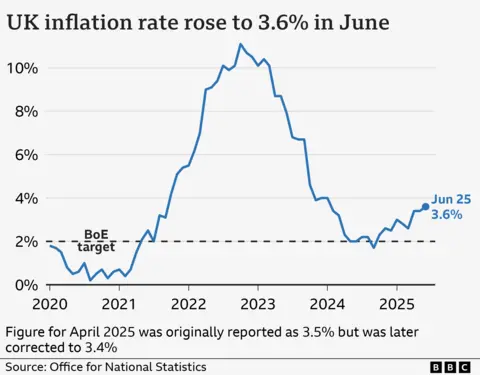

BBCPrices in the UK rose by 3.6% in the 12 months to June, driven by increases in the cost of food and fuel.

It means inflation remains above the Bank of England’s 2% target.

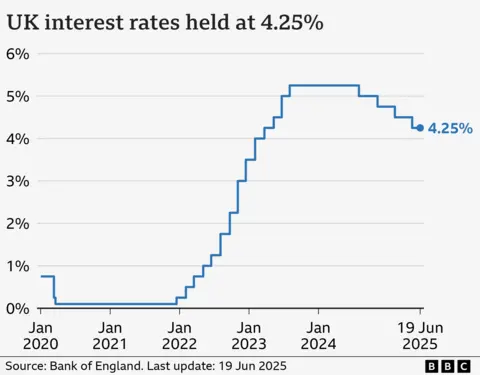

The Bank moves interest rates up and down to try to keep inflation at that level, and has cut interest rates four times since August 2024.

What is inflation?

Inflation is the increase in the price of something over time.

For example, if a bottle of milk costs £1 but is £1.05 a year later, then annual milk inflation is 5%.

How is the UK’s inflation rate measured?

The prices of hundreds of everyday items, including food and fuel, are tracked by the Office for National Statistics (ONS).

This virtual “basket of goods” is regularly updated to reflect shopping trends, with virtual reality headsets and yoga mats added in 2025, and local newspaper adverts removed.

The Bank also considers other measures such as “core inflation” when deciding whether and how to change rates.

It doesn’t include food or energy prices because they tend to be very volatile, so can be a better indication of longer term trends.

Core CPI rose by 3.7% up from 3.5% in the year to May.

Why are prices still rising?

Inflation has fallen significantly since hitting 11.1% in October 2022, which was the highest rate for 40 years.

But that doesn’t mean prices are falling – just that they are rising less quickly.

Inflation soared in 2022 because oil and gas were in greater demand after the Covid pandemic, and energy prices surged again when Russia invaded Ukraine.

It then remained well above the 2% target partly because of higher food prices.

These continue to be a significant factor in the current inflation figures. In the year to June 2025, food prices rose by 4.5%.

Industry experts said this reflected higher costs for key ingredients such as chocolate, butter, coffee and meat, as well as increased energy and labour costs.

In addition, fuel prices fell only slightly between May and June 2025, compared to a larger drop in the same period in 2024.

Why does putting up interest rates help to lower inflation?

When inflation was well above its 2% target, the Bank of England increased interest rates to 5.25%, a 16-year high.

The idea is that if you make borrowing more expensive, people have less money to spend. People may also be encouraged to save more.

In turn, this reduces demand for goods and slows price rises.

But it is a balancing act – increasing borrowing costs risks harming the economy.

For example, homeowners face higher mortgage repayments, which can outweigh better savings deals.

Businesses also borrow less, making them less likely to create jobs. Some may cut staff and reduce investment.

What is happening to UK interest rates and when will they go down again?

The Bank of England cut rates in August and November 2024, and again in February and May 2025, taking rates to 4.25%.

It held rates in June, but at the time Bank of England governor Andrew Bailey indicated that further “gradual and careful” cuts could follow, perhaps as early as the summer.

Despite the increase in inflation in June, most analysts still expect the Bank to cut rates at its next meeting on 7 August.

Earlier in July, Mr Bailey said the Bank was prepared to make larger interest rate cuts if the job market showed signs of slowing down.

He told the Times that although he still believed rates were on a downward path, caution was necessary while inflation remains above target.

He has repeatedly warned that the introduction of US tariffs has shown “how unpredictable the global economy can be”.

The Bank now expects the tariffs to slow the UK economy and lead to lower inflation than expected.

It had previously said it thought inflation would spike at 3.7% between July and September 2025 before dropping back towards the end of 2027.

Are wages keeping up with inflation?

Annual average regular earnings growth was 5.5% for the public sector and 4.9% for the private sector.

Meanwhile, separate ONS figures showed the number of vacancies fell again to 727,000 for the April to June period, marking three continuous years of falling job openings.

The unemployment rate also increased to 4.7% in the three months to May, from 4.6% in three months to April.

This marked the highest level of unemployment since June 2021, and is likely to factor into the Bank of England’s decision whether to cut rates.

What is happening to inflation and interest rates in Europe and the US?

The US and EU countries have also been trying to limit price increases.

The inflation rate for countries using the euro was 1.9% in May, down from 2.2% in April and March 2025.

In June 2024, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first fall in five years.

In June 2025, after several further cuts, its key rate stood at 2%.

Inflation in the US fell to 2.7% in June, which was up from 2.4% the previous month. It remains above the US central bank’s 2% target.

After a string of cuts in the latter part of 2024, the US central bank again chose not to change rates at its July 2025 meeting, the fifth hold in a row.

That leaves its key interest rate unchanged in a range of 4.25% to 4.5%.

The Federal Reserve has repeatedly come under attack from President Trump, who wants to see further interest rate cuts.

Business

DRUID AI raises $31 million Series C, appoints new CEO

DRUID AI, a Romanian-born technology company, today announced it has secured $31 million in Series C financing to advance the global expansion of its enterprise-ready agentic AI platform under the leadership of its new CEO Joseph Kim. The strategic investment, which will advance DRUID AI’s mission to empower companies to create, manage, and orchestrate conversational AI agents, was led by Cipio Partners, with participation from TQ Ventures, Karma Ventures, Smedvig, and Hoxton Ventures.

“This investment is both a testament to DRUID AI’s success and a catalyst to elevate businesses globally through the power of agentic AI,” said Kim. “Customer success is what it’s all about, and delivering real business outcomes requires understanding companies’ pain points and introducing innovations that help those customers address their complex challenges. That’s the DRUID AI way, and now we’re bringing it to the world through this new phase of global growth.”

Kim has more than two decades of operating executive experience in application, infrastructure, and security industries. Most recently, he was CEO of Sumo Logic. He serves on the boards of directors of SmartBear and Andela. In addition, he was a senior operating partner at private equity firm Francisco Partners, CPTO at Citrix, SolarWinds, and Hewlett Packard Enterprise, and chief architect at GE.

DRUID AI cofounder and Chief Operating Officer Andreea Plesea, who had been interim CEO, commented: “I am delighted Joseph is taking the reins as CEO to drive our next level of growth. His commitment to customer success and developing the exact solutions customers need is in total sync with the approach that has fueled our progress and positioned us to raise new funds. Joseph and the Series C set up DRUID AI and our clients for expanded innovation and impact.”

The appointment of Kim as CEO and the new funding come on the heels of DRUID AI earning a Challenger spot in the Gartner Magic Quadrant for Conversational AI Platforms for 2025. This is just the latest development validating the maturity of DRUID AI’s platform and its readiness to deliver business results in a market that is experiencing rapid advancement and adoption.

In 2024, DRUID AI grew ARR 2.7x year-over-year. Its award-winning platform has powered more than 1 billion conversations across thousands of agents. In addition, the DRUID AI global partner ecosystem has attracted industry giants Microsoft, Genpact, Cognizant, and Accenture.

The founder of Druid AI, Liviu Dragan, had passed away unexpectedly in May 2025.

DRUID AI is trusted by more than 300 global clients across banking, financial services, government, healthcare, higher education, manufacturing, retail, and telecommunications. Leading organizations such as AXA Insurance, Carrefour, the Food and Drug Administration (FDA), Georgia Southern University, Kmart Australia, Liberty Global Group, MatrixCare, National Health Service, and Orange Auchan have adopted DRUID AI to redefine the way they operate.

Companies have embraced DRUID AI to help teams accelerate digital operations, reduce the complexity of day-to-day work, enhance user experience, and maximize technology ROI. Powered by advanced agentic AI and driven by the DRUID Conductor, its core orchestration engine, the DRUID platform enables businesses to effortlessly deploy AI agents and intelligent apps that streamline processes, integrate seamlessly with existing systems, and fulfill complex requests efficiently. DRUID AI’s end-to-end platform delivers 98% first response accuracy.

Business

WhatsApp expands business tools in India with payments, AI support and citizen services

WhatsApp hosted its second annual Business Summit in Mumbai on 16 September, unveiling a suite of new features designed to deepen business–customer engagement, simplify transactions, and boost discoverability. The announcements also underscored how the platform is increasingly being used by Indian state governments to deliver citizen services at scale.

Payments integrated into WhatsApp Business

Small businesses can now accept secure payments directly within the WhatsApp Business app. Merchants will be able to generate QR codes in a single tap, enabling customers to complete transactions via their preferred payment methods. Meta said the feature is intended to streamline the checkout process and shorten sales cycles.

In-app calling and AI-powered support

WhatsApp is rolling out in-app calling, allowing customers to place calls to larger businesses or receive them when requested. Future updates are expected to include voice messages and video calls, with potential use cases spanning industries such as telehealth. Businesses are also piloting Business AI, a tool that uses voice calling to deliver automated customer support at scale.

Centralised campaign management

Through Meta’s Ads Manager, businesses will now be able to manage campaigns across WhatsApp, Facebook and Instagram in one place. The platform said the integration would allow companies to repurpose creatives, budgets and workflows while AI-driven optimisation tools such as Advantage+ improve campaign performance across channels.

Discoverability via Status and Channels

WhatsApp is expanding discoverability features within the Updates tab, which is used by 1.5 billion people globally. Businesses and creators will be able to run ads in Status, promote channels and offer subscriptions. Early adopters include Maruti Suzuki, Air India and Flipkart. WhatsApp stressed that these updates will remain separate from personal chats and inboxes and will roll out gradually.

Flexibility for small enterprises

To give small businesses more room to scale, WhatsApp now allows the Business App and Business Platform to be used simultaneously with the same phone number. This will enable firms to handle large message volumes through the API while continuing everyday conversations via the app.

Citizen services on WhatsApp

Meta highlighted that 91% of online adults in India already interact with businesses weekly on WhatsApp. The company is also extending partnerships with state governments. In Andhra Pradesh, for instance, the “Mana Mitra” chatbot delivers over 700 multilingual services and is already being used by more than 4 million citizens. Odisha, Maharashtra and Tamil Nadu are among other states offering essential services through the platform.

Business

One year in, Business Insider’s AI search is boosting click-throughs

A year in, Business Insider’s AI onsite search is driving deeper engagement, though not necessarily broader adoption.

The AI search tool, which Business Insider launched in October 2024, is one of several AI-powered products developed by the company in the past year and discussed by BI CTO Harry Hope during a talk at this week’s Digiday Publishing Summit in Miami, Florida.

Although Business Insider’s AI search tool is currently only used by roughly one percent of Business Insider’s readership — Hope said that this was the percentage of readers who had used BI’s previous search tool, and that the “percentage hasn’t grown that dramatically in a year of use” — it has significantly increased the engagement of those who do use the tool, with click-through to articles increasing by 50 percent since October, per Hope.

“The goal here was to really find a way to build something that promoted journalism, not try and cover it up or paint it over with AI, right? We felt strongly that, when it comes to AI and chatbots, it’s not a one-size-fits-all solution,” Hope said. “We can do creative things to actually promote the work that our journalists do day-in and day-out — and it worked quite well.”

Business Insider’s updated search tool isn’t the company’s only AI product that has grown over the past year. Consumption of BI’s AI audio briefings, which launched in June, has also grown by 20 percent month-over-month, per Hope. In addition to front-facing tools like the AI search and audio briefing, Business Insider staff have stepped up their internal use of AI, with Hope estimating that between 80 and 90 percent of staff were using AI tools — an increase from the roughly 70 percent of BI staff using AI tools in May.

“People are particularly interested in building GPTs for specific use cases. I think we have about 200 right now across our organization that people have created just for different, sometimes surprising, utilities,” said Hope, who elaborated that BI staff are using AI chatbots to simulate notes from editors or feedback from potential advertisers.

Business Insider was not the only publication that discussed AI search tools on the stage at this week’s conference. Wirecutter executive director of commerce Leilani Han said that the publication’s new AI-powered search feature had “definitely” improved click-throughs to its product recommendations, although she declined to share a specific growth figure.

Han added that Wirecutter was actively looking to optimize its content for AI search — but that it had found that the playbook for AI search optimization is not a huge shift from the playbook for traditional search optimization.

“The planning doesn’t seem to be drastically different,” she said. “For us, our focus has always been certainly the readers, and that hasn’t really changed.”

During his Publishing Summit talk, Hope acknowledged that Business Insider’s AI tools aren’t yet a significant revenue stream for the company, although BI views products such as the AI audio briefing as potential advertising or sponsorship inventory down the line. For now, Business Insider is investing in AI because it believes it will improve the company’s bottom line in the future — not because it’s a huge moneymaker in 2025.

“The ROI doesn’t look great — I’m not going to lie to you, just if you compare the dollars and cents — but we need to weigh that against where we see the future panning out, where the puck is going,” Hope said. “And part of it involves buy-in and faith from your organization that it is valuable to spend some of your resources on these tools and these technologies.”

-

Business3 weeks ago

Business3 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers3 months ago

Jobs & Careers3 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education3 months ago

Education3 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business3 months ago

Funding & Business3 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries