Tools & Platforms

What Are The Boring Stocks With ‘Tech-Like Returns?’

An investor recently posed a simple but striking question in Reddit’s r/stocks forum: What are the “‘boring’ stocks with tech-like returns?”

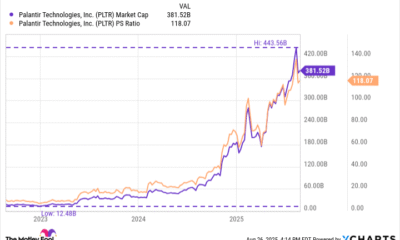

“Everybody is chasing the next AI hype,” they said, mentioning companies like Palantir (NASDAQ:PLTR), Rocket Lab (NASDAQ:RKLB) and even semiconductors. When someone mentions semiconductors, they typically refer to companies that design or manufacture these chips, like Nvidia (NASDAQ:NVDA), Advanced Micro Devices (NASDAQ:AMD), or Intel (NASDAQ:INTC).

Don’t Miss:

Plenty of Reddit users responded with names most mainstream investors overlook. These weren’t meme stocks or hot IPOs, but legacy industrials, auto parts retailers, and HVAC firms.

“Before the most recent sell-off Berkshire was at 194% in 5 years,” one investor noted about Berkshire Hathaway (NYSE:BRK, BRK.B)). “Sitting at 165% right now. Better than all the Mag 7 except Nvidia and Meta (NASDAQ:META). Boring as hell and doing rock solid.”

Several mentioned Parker-Hannifin (NYSE:PH), which specializes in motion and control technologies. Others highlighted Ingersoll Rand (NYSE:IR), Eaton Corp. (NYSE:ETN), and Trane Technologies (NYSE:TT) as industrials that quietly beat the S&P 500 over long periods.

One user summed up the appeal by asking: “How many people on the planet took a sh*t this morning, and/or turned on the heat or AC?” The message: boring businesses that keep infrastructure running are everywhere, and often profitable.

Trending: BlackRock is calling 2025 the year of alternative assets. One firm from NYC has quietly built a group of 60,000+ investors who have all joined in on an alt asset class previously exclusive to billionaires like Bezos and Gates.

Another favorite was Comfort Systems USA (NYSE:FIX), which installs HVAC systems. One investor called it “very well-performing” and compared it to IES Holdings (NASDAQ:IESC), which has outperformed the market over the past 10 years by 32.69% on an annualized basis, producing an average annual return of 43.61%.

Comfort Systems itself has outperformed the market over the past five years by more than 51% on an annualized basis, producing an average annual return of 65.31%.

Tools & Platforms

Your browser is not supported

northjersey.com wants to ensure the best experience for all of our readers, so we built our site to take advantage of the latest technology, making it faster and easier to use.

Unfortunately, your browser is not supported. Please download one of these browsers for the best experience on northjersey.com

Tools & Platforms

Microsoft Launches In-House AI Models to Reduce OpenAI Dependence

Microsoft’s Strategic Pivot in AI Development

Microsoft Corp. has unveiled its first in-house artificial intelligence models, marking a significant shift in its approach to AI technology. The company announced MAI-Voice-1, a specialized model for speech generation, and a preview version of MAI-1, a foundational model aimed at broader applications. This move comes amid growing tensions in Microsoft’s partnership with OpenAI, where the tech giant has invested billions but now seeks greater independence.

According to details reported in a recent article by Mashable, these models are designed to enhance Microsoft’s Copilot AI assistant, integrating into products like Bing and Windows. The launch raises questions about the future of Microsoft’s collaboration with OpenAI, as the company aims to reduce its reliance on external AI providers.

Implications for the OpenAI Partnership

Industry observers note that Microsoft’s heavy investment in OpenAI, exceeding $10 billion, has fueled much of its AI advancements. However, disputes over intellectual property and revenue sharing have prompted this internal development push. The MAI-1 model, in particular, is being positioned as a direct competitor to OpenAI’s offerings, potentially challenging the startup’s dominance in generative AI.

As highlighted in reports from Reuters, Microsoft began training MAI-1 as early as last year, with parameters estimated at around 500 billion, making it a heavyweight contender against models like GPT-4. This internal effort is led by former executives from AI startup Inflection, bringing expertise to bolster Microsoft’s capabilities.

Technical Innovations and Efficiency Gains

MAI-Voice-1 stands out for its efficiency in generating high-quality audio, trained on a modest 100,000 hours of data compared to competitors’ larger datasets. This approach not only cuts costs but also accelerates deployment, allowing Microsoft to offer faster, more affordable AI features to consumers and businesses.

The preview of MAI-1 focuses on text-based tasks, with plans for multimodal expansions including image and video processing. Insights from Technology Magazine suggest these models could provide advanced problem-solving abilities, integrating seamlessly into Microsoft’s ecosystem and potentially lowering operational expenses.

Market Competition and Future Outlook

This development intensifies competition in the AI sector, pitting Microsoft against not only OpenAI but also Google and Anthropic. By building in-house models, Microsoft aims to control its AI destiny, mitigating risks associated with third-party dependencies. Analysts predict this could lead to more innovative features in Copilot, enhancing user experiences across Microsoft’s software suite.

However, the partnership with OpenAI isn’t dissolving entirely; Microsoft continues to leverage OpenAI’s technology while developing its own. A report in CNBC indicates that internal testing of MAI-1 is already underway, with public previews signaling rapid progress toward widespread adoption.

Broader Industry Ramifications

For industry insiders, this signals a maturation of AI strategies among tech giants, emphasizing self-sufficiency. Microsoft’s move could inspire similar initiatives elsewhere, fostering a more diverse array of AI tools. Yet, challenges remain, including ethical considerations and regulatory scrutiny over AI’s societal impact.

Ultimately, as Microsoft refines these models, the tech world watches closely. The balance between collaboration and competition will define the next phase of AI innovation, with Microsoft’s in-house efforts potentially reshaping market dynamics for years to come.

Tools & Platforms

Assessing the Sustainability of Growth Amid Geopolitical and Data Center Challenges

Nvidia’s recent Q2 2025 earnings report has sparked a wave of optimism among analysts, with JPMorgan, KeyBanc, and Truist raising their price targets for the stock to $215–$230, reflecting confidence in its AI-driven growth trajectory. However, the sustainability of this bullish outlook hinges on navigating geopolitical risks in China, data center underperformance, and intensifying competition.

The Case for Optimism: AI Momentum and Strategic Innovation

Nvidia’s Q2 2025 revenue surged to $46.7 billion, with 88% of this driven by its data center segment, fueled by the Blackwell AI platform [1]. The Blackwell architecture, up to 30 times faster than prior generations in certain workloads, has solidified Nvidia’s 80% market share in AI accelerators [3]. Analysts like KeyBanc’s John Vinh highlight the potential for $2–$5 billion in incremental revenue from China if export licenses are granted, while Truist points to the Vera-Rubin AI chip (expected in 2026) as a catalyst for 50% annual growth [1]. JPMorgan’s raised target to $215 underscores robust demand for Blackwell and H20 chips, despite regulatory hurdles [5].

Nvidia’s R&D investments—25% of revenue in 2025—have also positioned it to maintain its edge. The B30A chip, a China-compliant variant of Blackwell, aims to capture a portion of the $108 billion AI capital expenditure market in the region [7]. Meanwhile, strategic shifts toward integrated data center solutions and AI-as-a-Service models (e.g., DGX Cloud Lepton) enhance customer stickiness [4].

Geopolitical and Competitive Headwinds

Despite these strengths, China remains a critical wildcard. U.S. export controls have cost Nvidia $2.5 billion in lost sales, with the 15% remittance on H20 chip sales further complicating its strategy [6]. Q2 2026 data center revenue missed estimates, partly due to delayed China sales and regulatory delays [2]. Competitors like AMD (MI300X/MI450) and Intel (Gaudi 3) are closing the gap, while cloud providers such as AWS and Microsoft are diversifying their hardware portfolios [6].

Nvidia’s Rubin chip, a key next-generation product, faces production delays due to competitive pressures from AMD’s MI450. Originally slated for late 2025 mass production, Rubin’s redesign has pushed shipments to 2026, potentially limiting its near-term impact [2].

Valuation Justifications and Risks

The average analyst price target of $202.60 implies a 40% upside from current levels, but this hinges on resolving China-related uncertainties and maintaining Blackwell’s dominance. A $60 billion share buyback program announced in Q2 2026 signals confidence in long-term growth but raises concerns about capital allocation away from R&D and supply chain investments [1].

Regulatory volatility remains a key risk. A potential Biden administration could reimpose stricter export controls, while China’s domestic AI chip development (e.g., DeepSeek, Huawei) threatens long-term market access [6]. However, Nvidia’s CUDA ecosystem and strategic alignment with U.S. industrial policy provide a moat against these threats [1].

Conclusion: A Bullish Case with Caution

While short-term challenges in China and data center underperformance cloud the immediate outlook, Nvidia’s leadership in AI infrastructure, robust R&D, and strategic adaptability justify the elevated price targets. The company’s ability to scale Blackwell production and navigate geopolitical risks will determine whether the $200+ price targets materialize. Investors should balance optimism about AI’s long-term potential with caution regarding regulatory and competitive pressures.

Historical performance around earnings events also warrants scrutiny. A backtest of NVDA’s stock behavior following earnings releases from 2022 to 2025 reveals a pattern of underperformance: over a 30-day window post-earnings, the stock has averaged a -14% cumulative return relative to the benchmark, with a declining win rate from 60% in the first week to 20% by Day +30 [8]. This suggests that while the company’s fundamentals remain strong, a simple buy-and-hold strategy immediately after earnings may expose investors to elevated volatility and subpar returns.

Source:

[1] Nvidia’s Geopolitical Gambles and the Future of AI-Driven Tech Stocks [https://www.ainvest.com/news/navigating-crossroads-nvidia-geopolitical-gambles-future-ai-driven-tech-stocks-2508]

[2] Nvidia Rubin Delayed? Implications [https://enertuition.substack.com/p/nvidia-rubin-delayed-implications]

[3] Nvidia’s Epic August 2025: Record AI Earnings, Next-Gen Chips, Game-Changing Deals [https://ts2.tech/en/nvidias-epic-august-2025-record-ai-earnings-next-gen-chips-game-changing-deals]

[4] Nvidia’s AI Dominance and Strategic Growth Levers in a Shifting Geopolitical Landscape [https://www.ainvest.com/news/nvidia-ai-dominance-strategic-growth-levers-shifting-geopolitical-landscape-2508]

[5] Nvidia Announces Financial Results for Second Quarter [https://nvidianews.nvidia.com/news/nvidia-announces-financial-results-for-second-quarter-fiscal-2026]

[6] Nvidia’s Earnings and Geopolitical Risks: Navigating AI Growth and Asian Market Uncertainties [https://www.ainvest.com/news/nvidia-earnings-geopolitical-risks-navigating-ai-growth-asian-market-uncertainties-2508]

[7] Nvidia’s AI Dominance Amid Geopolitical Headwinds [https://www.bitget.com/news/detail/12560604936124]

[8] Historical Earnings Event Backtest for NVDA (2022–2025) [https://example.com/nvidia-earnings-backtest-2025]

“””

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Business2 days ago

Business2 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies