Ethics & Policy

Welcome to the tech-enabled tax administration of the future!

This blog was originally published on the OECD blog. It was authored by Oliver Petzold, Fiona May and Peter Green. It has been cross-posted here to centralise relevant AI-related blogs on the OECD.AI Policy Observatory.

When kids are asked what they want to be in the future, being a tax administrator does not usually make the list. Many, though, would love to join a tech company and work with those cool technology tools. And in reality, that is increasingly what tax administrations are becoming.

People may not know, but tax administrations are transforming. They are at the forefront of innovation in the public sector. The rooms with shelves full of paper have become data centres. Artificial intelligence is being used to assist citizens, and investigation teams are using robotic process automation and machine learning to uncover hidden assets.

Welcome to the tech-enabled tax administration of the future!

When the OECD’s Forum on Tax Administration (FTA) vision for the future of tax administration – Tax Administration 3.0 – was published in 2020, many tax administrations had already embarked on a digital transformation journey, introducing new digital initiatives and innovations to support tax compliance and reduce burdens. Since then, many more have followed, fully embracing the long-term vision and working to make tax become a more seamless experience for citizens and businesses.

Containing a wealth of data, Tax Administration Digitalisation and Digital Transformation Initiatives takes a closer look at the extent and progress that the 54 FTA member tax administrations have made in their digitalisation and digital transformation journeys. For example, it shows that:

- Most taxpayers are already using a secure digital identity to access tax administration online services. Like the online banking systems many use, this provides the certainty that allows systems to interact so that data can be exchanged in real-time.

- This is allowing administrations to integrate tax interactions into third-party systems, with more than 80% of tax administrations developing application programming interfaces (APIs).

- Many taxpayers already enjoy a seamless experience through full prefilling of tax returns, drastically reducing burdens. Around 60% of administrations are already in a position to offer the complete prefilling of returns for many PIT taxpayers. Thanks to the availability of technology solutions such as electronic invoicing systems, close to 40% of tax administrations also report now being able to prefill VAT returns and around one quarter prefill CIT returns.

- Around 85% of administrations indicated that they have the required people, skills and infrastructure to analyse big data. Those that do use it, for example, to improve compliance (89%), identify trends (79%) and forecast revenue (64%). Slightly more than half of tax administrations also reported using analytics for real-time tax fraud detection and prevention.

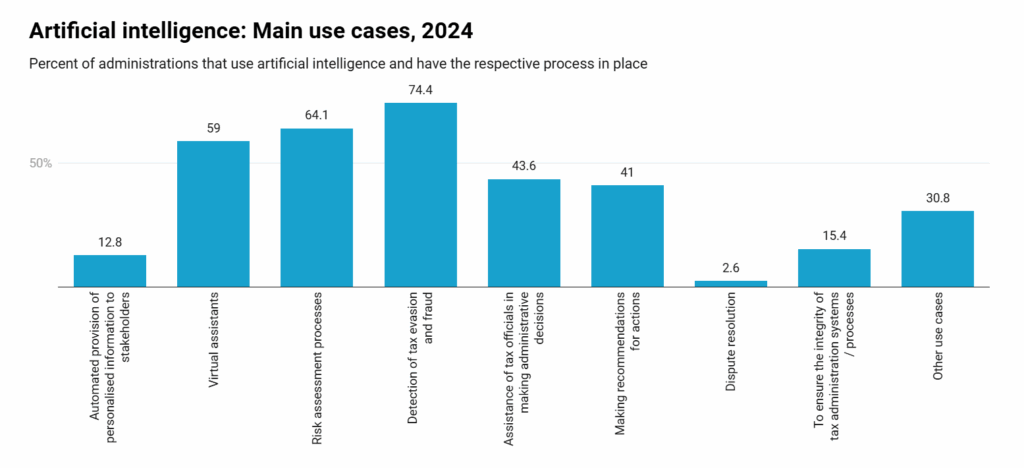

- Artificial intelligence (AI) is being used by more than 70% of tax administrations to enhance effectiveness and efficiency within the administration, for example, on compliance management, and to improve taxpayer services. The figure below shows the most common use cases.

All of this is just a glimpse at the data that the new OECD report Tax Administration Digitalisation and Digital Transformation Initiatives holds. Take a closer look to see how tax administrations are digitally transforming, to make the administration of the tax system a more seamless and frictionless experience for all. Follow one of the most interesting developments in public agencies over the coming years.

More on the data

In November 2024, the OECD published its new version of the Inventory of Tax Technology Initiatives. The inventory, which contains data on technology tools and digitalisation solutions implemented by more than 100 tax administrations globally, is the result of a global partnership. It has been put together with the assistance of the ADB, ATAF, CATA, CIAT, CREDAF, IMF, IOTA, PITAA and SGATAR. It is managed by the OECD FTA Secretariat and can be found through the following link: https://oe.cd/itti.

The report Tax Administration Digitalisation and Digital Transformation Initiatives takes a closer look at the data from the 54 tax administrations that are members of the FTA. The data has not been reviewed or validated by the OECD or any of the partner organisations. As a result, all data should be considered as self-reported by the administrations concerned.

The FTA brings together Commissioners and tax administration officials from OECD and non-OECD countries. For more information on the FTA, its publications and databases, visit https://oe.cd/fta.

The post Welcome to the tech-enabled tax administration of the future! appeared first on OECD.AI.

Ethics & Policy

Pet Dog Joins Google’s Gemini AI Retro Photo Trend! Internet Can’t Get Enough | Viral Video | Viral

Beautiful retro pictures of people in breathtaking ethics in front of an esthetically pleasing wall under the golden hour is currently what is going on on social media! All in all, a new trend is in the ‘internet town’ and it’s spreading- fast. For those not aware, it’s basically a trend where netizens are using Google’s Gemini AI to create a rather beautiful retro version of themselves. In a nutshell, social media is currently full of such pictures. However, when this PET DOG joined the bandwagon, many instantly declared the furry one the winner- and for obvious reasons. The video showed the trend being used on the pet dog- the result of which was simply heartwarming. The AI generated pictures showed the cute one draped in multiple dupattas, with ears that looked like the perfect hairstyle one can ask for- for their pets. Most netizens loved the video, while some expressed their desire to try the same on their pets. Times Now could not confirm the authenticity of the post. Image Source: Jinnie Bhatt/ Instagram

Ethics & Policy

Morocco Signs Deal to Build National Responsible AI Platform

Morocco’s Ministry of Digital Transition and Administrative Reform signed an agreement Thursday with the National Commission for the Control of Personal Data Protection (CNDP) to develop a national platform for responsible artificial intelligence.

The deal, signed in Rabat by Minister Delegate Amale Falah and CNDP President Omar Seghrouchni, will guide the design of large language models tailored to Morocco’s language, culture, legal framework, and digital identity.

Officials said the initiative will provide citizens, businesses, and government agencies with safe generative AI tools that protect fundamental rights. The ministry called the agreement a “strategic step” toward AI sovereignty, ethics, and responsibility, positioning Morocco as a digital leader in Africa and globally.

Ethics & Policy

Santa Fe Ethics Board Discusses Revisions to City Ethics Code

One of the key discussions centered around a motion to dismiss a complaint due to a lack of legal sufficiency, emphasizing the board’s commitment to ensuring that candidates adhere to ethical guidelines during their campaigns. Members expressed the need for candidates to be vigilant about compliance to avoid unnecessary hearings that detract from their campaigning efforts.

The board also explored the possibility of revising the city’s ethics code to address gaps in current regulations. A member raised concerns about the potential for counselors to interfere with city staff, suggesting that clearer rules could help delineate appropriate boundaries. Additionally, the discussion touched on the need for stronger provisions against discrimination, particularly in light of the challenges posed by the current political climate.

The board acknowledged that while the existing ethics code is a solid foundation, there is room for improvement. With upcoming changes in city leadership, members agreed that now is an opportune time to consider these revisions. The conversation underscored the board’s role as an independent body capable of addressing ethical concerns that may not be adequately resolved within the current city structure.

As the board continues to deliberate on these issues, the outcomes of their discussions could significantly impact how ethics are managed in Santa Fe, ensuring that the city remains committed to transparency and accountability in governance.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries