Funding & Business

Using Deal Feeds to Automatically Add Funded or Acquired Companies to Salesforce

Get companies you’re interested in automatically sent to Salesforce via deal feeds.

The CB Insights’ Salesforce integration allows you to push company data directly from a company profile or a search directly to Salesforce.

The next step based on customer requests was to automate the pushing of new and relevant companies that are of interest to you directly to your Salesforce without you having to do anything.

And that time has come.

You can now build a feed on Deal Search and have all future companies that meet that criteria automatically populate to Salesforce. So if you want:

- Every Silicon Valley technology company that raises seed or angel money

- Any medical device company with the word imaging in its description

- All Series A or B deals that Sequoia Capital or First Round Capital participate in

- Every acquisition or investment that Google, Google Ventures or Google Capital make

The possible feeds you can push to Salesforce are limitless in terms of permutations so it really just depends on what you need.

Let’s take the example above of “every Silicon Valley technology company that raises seed or angel money”. Here is how you’d do that in 2 steps.

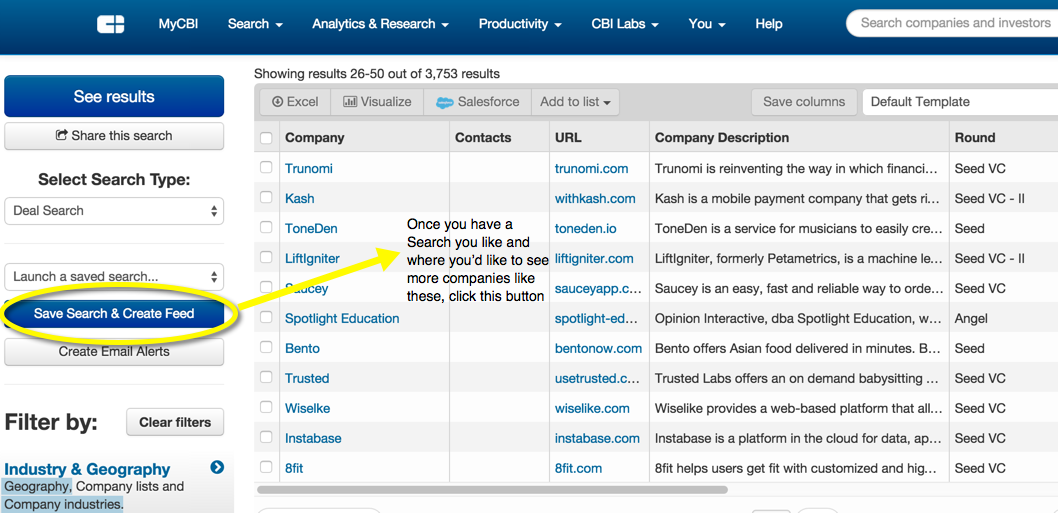

Step 1 – Run the Deal Search (see below). Once done, click “Save Search & Create Feed”

Step 2 – Name your search and click the checkbox next to “Sync new results to my Salesforce Account” and hit the “save this search” button. At this point, any new companies that meet these criteria will be automatically pushed to Salesforce.

Once in Salesforce, the data for a company will look like this.

Want to integrate CB Insights data with your Salesforce account? Sign up for a trial account below.

Funding & Business

China Factory Activity Slump Continues Despite US Tariff Relief

China’s factory activity remained stuck in contraction in August, as a government crackdown on price wars holds back production offset the boost for manufacturers of the US’ extended trade truce.

Source link

Funding & Business

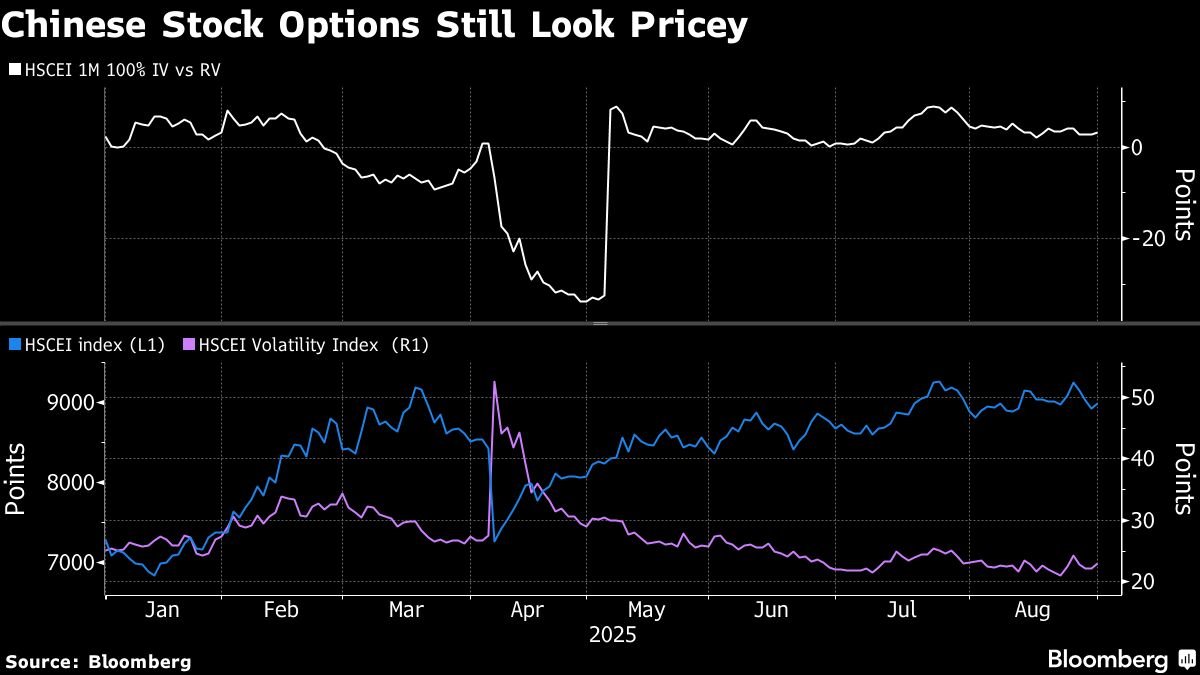

China’s Stock Rally Is Met With Skepticism in Options Market

While Chinese stocks traded in Hong Kong climbed for a fourth straight month, derivatives wagers show investors are skeptical about the market.

Source link

Funding & Business

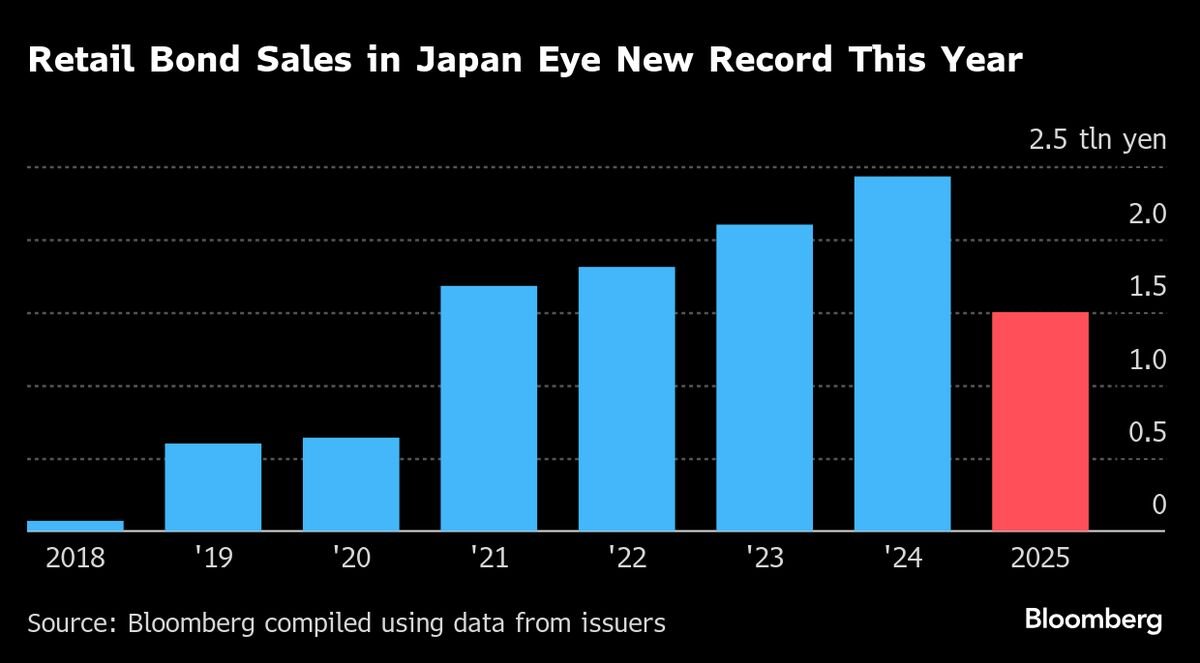

SoftBank, Rakuten Tap Japan’s Booming Retail Demand for Bonds

Sales of corporate bonds to Japan’s mom and pop investors are booming, on track to surpass last year’s record as bigger returns draw buyers looking to protect their savings from inflation.

Well-known names such as railway operator Keio Corp. and supermarket giant Aeon Co. are among those tapping the retail bond market, with the latter selling its debut retail bond on Friday.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle