Business

US shoppers feel the heat of Trump’s trade war: ‘the prices are going up’ | Business

As temperatures soared on a sweltering July day in New York City, shoppers at Queens’s largest mall said they were feeling the heat – of rising prices.

“T-shirts, basic t-shirts, underwear, the basic necessities – the prices are going up,” said Clarence Johnson, 48, who was visiting the Macy’s at the Queen Center mall to pick up shirts he ordered online.

As Donald Trump presses on with his trade wars, retailers have been passing price increases onto customers. Department stores – which rely on a variety of imported goods and materials, from shoes to t-shirts – have particularly been scrambling to deal with the flux in prices.

At Macy’s, signs advertising sales of as much as 60% off original prices were sprinkled around the store – even next to diamond-encrusted necklaces locked inside display cases in the jewelry department. But for some customers, the prices are still too high.

Nydia Olvera, 61, said that shopping at Macy’s is typically out of her budget, but she still makes trips to the store to check out the clearance section. “I remember they used to have these t-shirts for three dollars. Now, no more,” Olvera said. “Now I pay $7 to $9 for a t-shirt.”

A recent study from analytics firm DataWeave showed that the prices of footwear, apparel and bags increased significantly from January to June. Footwear has gone up as much as 4% and apparel by nearly 2% in the last six months.

And it’s unclear how much more prices could rise. The White House is still in the midst of negotiations with dozens of countries that could face new tariffs as high as 40%. These proposed tariffs are set to go into effect 1 August, after Trump pushed back an initial negotiations deadline of 9 July.

Last week, the Trump administration announced a deal had been made with Vietnam, which is the second largest manufacturer for apparel, footwear and accessories – the bulk of what is sold at department stores – after China.

According to the deal, exports from Vietnam will face 20% tariffs – half of the proposed levy of 46% Trump announced in April. Goods made in other countries, such as China, that are shipped from Vietnam will face a 40% tariff.

While retail executives have said the deal is better than the initial tariffs that were announced, it will still increase costs for retailers. Macy’s recently adjusted down its earnings forecast, citing uncertainty around tariffs. The company’s stock price is down 25% this year.

Macy’s CEO Tony Spring told CNBC, the financial news network, in May that some prices will stay the same but others are going to be more expensive, meaning the company will have to pass on some of the levies to customers. Other executives, including leaders from Nike, Target, Best Buy and Walmart have similarly said that they will have to pass on costs.

But retailers are also absorbing costs. Macy’s chief financial officer Adrian Mitchell said during the company’s earnings call in May that, while the company has been able to gain some vendor discounts, “we’re absorbing some of that price as well”.

Retailers must decide how much of the increased costs it can pass onto consumers, without losing loyal customers.

It is a tough environment particularly for department stores, which have lost customers to online retailers over the years. Sales at department stores made up just 2.6% of retail sales in 2023, compared to 14.1% in 1993, before the rise of online shopping.

At Queens Center, some Macy’s customers said they have yet to notice any price increases, especially when using coupons the company typically issues.

“The difference isn’t big; a little bit higher,” said Raphaelina Garcia, 33, who was shopping for a dress to wear at an upcoming wedding. “When you have the coupon, it’s the same price [as before].”

Business

Elon Musk calls for dissolution of parliament at far-right rally in London | Elon Musk

Elon Musk has called for a “dissolution of parliament” and a “change of government” in the UK while addressing a crowd attending a “unite the kingdom” rally in London, organised by the far-right activist Stephen Yaxley-Lennon, known as Tommy Robinson.

Musk, the owner of X, who dialled in via a video link and spoke to Robinson while thousands watched and listened, also railed against the “woke mind virus” and told the crowd that “violence is coming” and that “you either fight back or you die”.

He said: “I really think that there’s got to be a change of government in Britain. You can’t – we don’t have another four years, or whenever the next election is, it’s too long.

“Something’s got to be done. There’s got to be a dissolution of parliament and a new vote held.”

This is not the first time Musk has involved himself in British politics. He started a war of words with the UK government over grooming gangs and also criticised 2023’s Online Safety Act, calling the legislation a threat to free speech.

He had a warm relationship with Nigel Farage, and there were even rumours he could channel a donation to his party before the Tesla boss called for the Reform UK leader to be replaced during a dispute over his support for Robinson.

Musk told the crowd in central London: “My appeal is to British common sense, which is to look carefully around you and say: ‘If this continues, what world will you be living in?’

“This is a message to the reasonable centre, the people who ordinarily wouldn’t get involved in politics, who just want to live their lives. They don’t want that, they’re quiet, they just go about their business.

“My message is to them: if this continues, that violence is going to come to you, you will have no choice. You’re in a fundamental situation here.

“Whether you choose violence or not, violence is coming to you. You either fight back or you die, that’s the truth, I think.”

Musk also told the crowd “the left are the party of murder”, referring to the death of Charlie Kirk.

He said: “There’s so much violence on the left, with our friend Charlie Kirk getting murdered in cold blood this week and people on the left celebrating it openly. The left is the party of murder and celebrating murder. I mean, let that sink in for a minute, that’s who we’re dealing with here.”

He also criticised what he called the woke mind virus and said decisions for advancement should be on merit rather than “discrimination on the basis of sex, or religion or any race or anything else”.

He said: “A lot of the woke stuff is actually super-racist, it’s super-sexist and often it’s anti-religion, but only anti-Christian, like why anti-Christian? That’s unfair … that should be all that matters, the woke mind virus, that I call it, is against all that.”

More than 110,000 people were estimated to have taken part in the far-right street rally, in what is thought to be one of the largest nationalist events in decades. The marchers were faced by about 5,000 anti-racist counter-protesters.

In addition to Musk, figures including Katie Hopkins and French far-right politician Éric Zemmour were invited to speak at the event.

PA Media contributed to this report

Business

Can Veritone’s (VERI) Expanding Government AI Focus Reshape Its Long-Term Business Model?

- In the past week, Veritone completed a US$25 million follow-on equity offering and presented at the H.C. Wainwright Global Investment Conference, showcasing its AI-driven solutions for government and law enforcement sectors as well as a promising Veritone Data Refinery pipeline.

- An interesting insight is Veritone’s focus on securing direct government contracts and progressing toward a pure AI-centric model, supported by validation from early proof-of-concept contracts with agencies such as the U.S. Navy.

- We’ll examine how Veritone’s accelerated push into government AI and recent contract validation influences the company’s investment outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Veritone Investment Narrative Recap

Investors in Veritone need conviction in the company’s ability to grow its AI and Data Refinery offerings, particularly through pipeline momentum and government contracts, while the threat of continued net losses and cash needs looms large. The recent US$25 million equity raise bolsters short-term liquidity and reduces near-term capital constraints, but it is not a fundamental game changer, persistent operating losses and the need for future fundraising remain the most pressing risk for shareholders.

Among the recent developments, completion of the US$25 million follow-on equity offering stands out as the most directly relevant. This fundraising, together with revised credit covenants, helps support operational runway as Veritone works to convert government and enterprise pipeline into revenue. However, the increased share count introduces further dilution, reinforcing the importance of achieving sustainable, profitable growth as a key catalyst.

By contrast, sustained access to capital is not guaranteed for any loss-making company for long, making it critical that investors pay close attention to…

Read the full narrative on Veritone (it’s free!)

Veritone’s narrative projects $158.0 million revenue and $20.7 million earnings by 2028. This requires 20.2% yearly revenue growth and a $114.1 million increase in earnings from -$93.4 million today.

Uncover how Veritone’s forecasts yield a $5.25 fair value, a 41% upside to its current price.

Exploring Other Perspectives

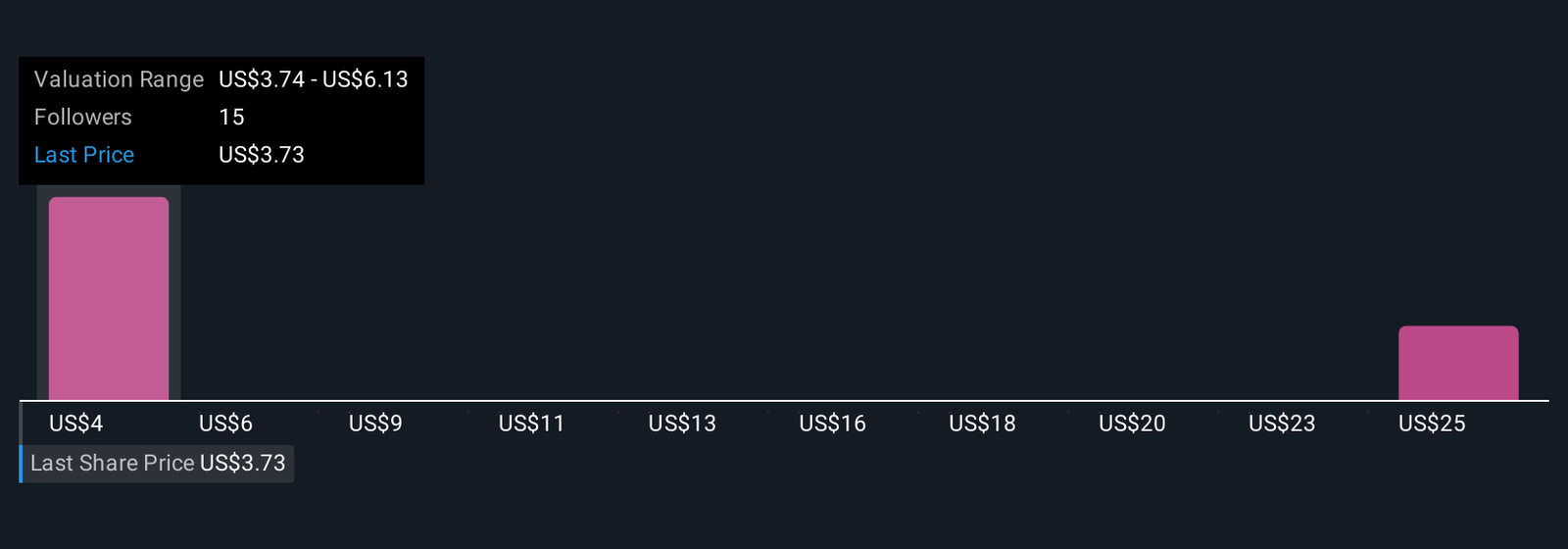

Six fair value estimates in the Simply Wall St Community span from US$3.74 to US$27.68, revealing sharply conflicting outlooks. With persistent net losses still a critical challenge, you can see why opinions differ so widely on Veritone’s future, explore how these diverse perspectives could shape your own view.

Explore 6 other fair value estimates on Veritone – why the stock might be worth just $3.74!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Business

One of Apple’s top AI executives is reportedly leaving the company

Apple is losing one of its top AI minds, according to Bloomberg.

Robby Walker, who had been the senior director of Apple’s Answers, Information, and Knowledge team since earlier this year, is reportedly set to leave the tech giant next month. Walker had previously been in charge of Siri prior to moving over to AI development. This is on top of Apple losing other high-level AI employees to Meta back in July, also reported by Bloomberg.

The report doesn’t give an explicit reason for why Walker or the other employees have left the company, but it certainly doesn’t paint an entirely positive picture of Apple’s AI development from the outside looking in. The company’s Apple Intelligence suite of AI features has notably lagged behind competitors like Google. One very noteworthy example is that Google’s Gemini Live naturalistic chatbot has been up and running for a while, even as Apple’s long-awaited AI-powered Siri upgrade has been reportedly delayed into next year.

Mashable Light Speed

It remains to be seen whether or not all of this AI business is a bubble just waiting to burst or something that’s truly here to stay, but at the pace Apple is moving, one might get the impression that the company is betting on the former.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi