AI Insights

Unraveling global malaria incidence and mortality using machine learning and artificial intelligence–driven spatial analysis

Trends and global distribution of malaria burden

Trends in Malaria Burden (2000–2022): (A) Global malaria cases (in millions, left y-axis) and number of affected countries (black curve, right y-axis). (B) Global malaria deaths, with (left y-axis) and number of affected countries (black curve, right y-axis). (C) Geographic distribution of malaria cases (millions). (D) Geographic distribution of malaria deaths.

The global trends of malaria burden from 2000 to 2022 highlight fluctuations in malaria cases and deaths across different regions. The highest number of malaria cases was recorded in 2022 (251.75 million), while malaria-related deaths peaked in 2020 (99,554) (Table S3). Over the years, Nigeria (1,332.99 million) reported the highest malaria cases, followed by the Democratic Republic of the Congo (623.16 million) and India (319.83 million). Meanwhile, South Sudan (149,753), Zambia (143,546), and the Central African Republic (124,801) experienced the highest malaria-related mortality. Countries such as Burkina Faso (485.6, 194.5), Sierra Leone (404.59, 188.3), and Niger (355.45, 154.6) exhibited the highest average malaria incidence and mortality rates. Additionally, Bolivia (Plurinational State of) (41,612) and the Republic of Korea (37,169) reported the highest indigenous malaria cases, with Guyana (42,021) and Afghanistan (37,492) leading in Plasmodium falciparum cases, while Plasmodium vivax cases were most prevalent in Bolivia (Plurinational State of) (51,034) and Eritrea (44,310) (Figs. 1 and 2 and Table S3–S6).

Spatial patterns in malaria incidence and mortality

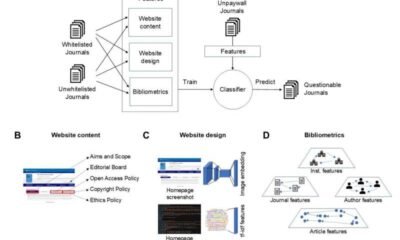

(A) Moran’s I test for malaria incidence (per 1000 population), (B) Moran’s I for mortality rates (per 100,000 population), (C) Hotspot detection for malaria incidence (per 1000 population) using Getis-Ord Gi*, (D) Hotspot detection for malaria mortality rates (per 100,000 population) using Getis-Ord Gi*.

The analysis of spatial autocorrelation using Local Moran’s I identifies statistically significant spatial clusters of malaria incidence and mortality. High-high clusters (areas with high values surrounded by other high values) for malaria incidence were observed in Burundi (1.562, p-value = 0.029), Benin (2.593, p-value < 0.001), and Burkina Faso (3.751, p-value = 0.001). Similarly, high-high clusters for malaria mortality were found in Benin (0.713, p-value = 0.001), Central African Republic (0.793, p-value = 0.012), and Liberia (3.055, p-value = 0.001) (Tables S7-S8). These findings highlight regions with higher rates of malaria incidence and mortality, indicating targeted areas for intervention (Fig. 3). The Gi* statistic further identifies hotspots for malaria incidence in Benin (3.655, < 0.001), Burkina Faso (3.205, p-value = 0.001), Central African Republic (2.534, p-value = 0.011), Democratic Republic of the Congo (2.676, p-value = 0.007), and Ghana (3.663, p value < 0.001). Hotspots for malaria mortality were identified in Benin (3.377, p-value = 0.001), the Central African Republic (2.525, p-value = 0.012), the Democratic Republic of the Congo (2.094, p-value = 0.036), and Ghana (3.448, p-value = 0.001) (Table S6). Other regions either exhibited non-significant clustering or were identified as spatial outliers (Fig. 3).

Correlational analysis of malaria and its determinants

A notable negative correlation exists between malaria incidence and arable land (−0.64), suggesting that regions with more arable land tend to have lower malaria burdens. Life expectancy and hypertension prevalence exhibit a positive correlation (r = 0.48), whereas access to basic drinking water services is negatively associated with malaria incidence (r = −0.49). Additionally, air pollution exhibits a positive correlation with malaria incidence, while healthcare infrastructure and economic factors demonstrate mixed effects, highlighting the complex interplay of determinants in shaping the global malaria burden (Fig. S1 and Table S9).

Selecting the best model

Among the evaluated models, XGBoost demonstrated the best performance with an RMSE (0.63), R² (0.93), adjusted R² (0.92), and MAE (0.46). This significantly outperforms other models, such as the Naive Bayes model (RMSE: 2.36, R²: −0.03, adjusted R²: −0.04, MAE: 2.22) and SVM (RMSE: 1.05, R²: 0.8, adjusted R²: 0.78, MAE: 0.76). DT (RMSE: 1.31, R²: 0.68, adjusted R²: 0.65, MAE: 0.94) also showed moderate performance, while LightGBM (RMSE: 0.68, R²: 0.91, adjusted R²: 0.91, MAE: 0.5) performed well but not as strongly as XGBoost. We integrated the XGBoost model with XAI and CAI techniques to enhance interpretability and causal analysis, thus improving the reliability and transparency of our results (Fig. S2 and Table S10).

Feature importance in predicting malaria incidence and mortality

The feature importance analysis, utilizing MeanSHAP values, identifies the ten most significant variables in forecasting malaria incidence and mortality. The key features encompass the percentage of the population using at least basic sanitation services (1.003), the percentage of the population accessing at least basic drinking-water services (0.426), and population growth (0.339). Access to electricity (0.318), the percentage of agricultural land (0.132), and the number of medical doctors per 10,000 population (0.159) are also significant contributors. Further essential features are the total population (0.102), hospital bed density (0.141), air pollution (0.065), and under-5 mortality rate (0.051). These factors collectively contribute significantly to the model’s predictive capability, highlighting the intricate interaction among health outcomes, environmental variables, demographic and socioeconomic elements, and health system infrastructure concerning malaria incidence and mortality (Fig. 4 and Table S11).

(A) Summary plot: top 10 most SHAP predicted features. (B) Ranking of the feature classes, (C) Casual relationship of the top 10 features on malaria, (D) Feature importance (using CAI); y1: Medical doctors (per 10,000); y2: Population using at least basic drinking-water services (%);; y6: GDP growth (annual %); y7: Hospital bed density (per 10,000 population); y9: Density of pharmaceutical personnel (per 10,000 population); y12: Mortality rate under 5 per 1000 live births; y14: Access to electricity; y15: Land area (sq. km); y18: Forest area (% of land area); y19: Air pollution;.

The categories contributing the most to the model’s predictive power are health outcomes and environmental factors (57.15%), followed by demographic and socioeconomic factors (20.99%) and health systems and infrastructure (19.52%) (Fig. 4 and Table S12). Structural Equation Modeling (SEM) results further emphasize the significance of these variables. The most notable factors include access to electricity (−1.145), indicating that areas with higher access to electricity tend to have lower malaria incidence. Population growth (0.892) exhibits a positive relationship, suggesting that higher population growth is associated with increased malaria incidence. The under-5 mortality rate (0.906) is also a significant predictor, with higher mortality rates linked to higher malaria incidence. Other factors, such as the number of medical doctors per 10,000 population (−0.199), hospital bed density (−0.592), and air pollution (0.678), also play crucial roles. These findings highlight the intricate interplay between health, environmental, demographic, and infrastructure factors that influence malaria incidence and mortality (Fig. 4 and Tables S13, S14).

Prediction accuracy and future trends in malaria incidence and mortality

The prediction accuracy of the model for 2022 is exceptionally high, with an R-squared value (0.969) and an Area Under the Curve (AUC) (0.834) (Table S15). These metrics confirm the model’s robustness in capturing variability and its discriminative ability for malaria incidence and mortality (Fig. 5, S3, and Table S15).

Forecasts from 2023 to 2040 indicate a concerning upward trend in malaria incidence (per 1,000 population) and mortality (per 100,000 population). The average incidence (per 1000 population) is projected to rise from 81.83 in 2023 to 160.22 in 2040, affecting an increasing number of countries. Similarly, average mortality (per 100,000 population) is expected to increase from 19.14 in 2023 to 56.12 in 2040. This escalation underscores the urgent need for intensified malaria control efforts (Fig. 5). The countries predicted to have the highest average malaria incidence (per 1000 population) for 2023–2024 are Burundi (828.52) and Solomon Islands (804.86), while Liberia (252.55) and Sao Tome and Principe (238.62) are expected to experience the highest mortality rates (per 100,000 population) during the same period (Table S16, S17). These findings provide crucial insights for policymakers and health authorities to allocate resources effectively and implement targeted interventions to mitigate the impact of malaria in the most affected regions (Fig. 5 and Tables S16, S17).

AI Insights

Alibaba’s Shares Soar 15% After Making Headway in China AI Boom

Alibaba Group Holding Ltd.’s stock leapt almost 15% after reporting a surge in revenue from AI, underscoring the steady progress it’s making against rivals in a post-DeepSeek Chinese development frenzy.

Source link

AI Insights

Alphabet Lands $10 Billion Meta Cloud Deal, a Win for Google’s Artificial Intelligence Ambitions and Investors

Meta’s six-year deal with Google Cloud is indicative of where hyperscalers are headed.

Over the last few years, hyperscalers like Amazon, Microsoft, and Alphabet (GOOGL 0.63%) (GOOG 0.56%) have poured hundreds of billions of dollars into artificial intelligence (AI) infrastructure.

Much of this capital has been geared toward securing graphics processing units (GPUs) and designing custom silicon from Nvidia, Advanced Micro Devices, and Broadcom — the backbones of the AI infrastructure revolution.

But why has big tech been so relentless in its pursuit of AI hardware? On the surface, the answer is simple: build sprawling data centers filled with clusters of high-performance chips to power AI workloads. Yet the deeper motivation is becoming clearer, and Meta Platforms (META -1.69%) may have just handed us the biggest clue.

According to reports, Meta struck a six-year $10 billion deal with Alphabet’s Google Cloud Platform (GCP). This isn’t just about the price tag. It signals how hyperscalers are positioning themselves for the next chapter of cloud computing in the AI era.

Let’s dig into Meta’s recent infrastructure investments and see how they align with this new cloud deal. For Alphabet, the implications of this deal could be huge — and investors should be watching closely.

Meta’s spending spree continues and…

Meta’s partnership with Google Cloud comes as the company is ramping up record capital expenditures.

META Capital Expenditures (TTM) data by YCharts; TTM = trailing 12 months.

Beyond its huge data center buildouts, Meta recently invested $14.3 billion in Scale AI, a leading data-labeling start-up. For those who are unfamiliar with what data labelling is, it’s the process of tagging raw data (i.e. images, audio) so AI models can understand and learn from it. This is vital for Meta because higher-quality datasets are the foundation to accurately train and scale its AI systems. Meta also unveiled a new research group, dubbed Meta Superintelligence Labs (MSL). Together, these initiatives highlight Meta’s ambitions to push past traditional large language models (LLMs) and position itself at the forefront of the next frontier in AI: artificial general intelligence (AGI).

… this time it’s Alphabet that benefits

Meta’s collaboration with Google Cloud follows a similar partnership between Alphabet’s cloud platform and ChatGPT maker OpenAI, signaling a subtle but important shift in the cloud landscape.

Even companies deeply tied to incumbents like Microsoft Azure and Amazon Web Services (AWS) are now diversifying to access Google’s tensor processing unit (TPU) chips and its AI-optimized infrastructure, which includes advanced cybersecurity protocols as a major differentiator.

While AWS pioneered the public cloud and Azure figured out how to dominate the enterprise information-technology landscape, Alphabet has carved out a role as an AI-first cloud provider, emphasizing machine learning and data analytics. The fact that both Meta and OpenAI have chosen Google Cloud underscores how strongly Alphabet’s strategy resonates with the companies setting the pace for the AI revolution.

At the same time, multicloud strategies are now becoming the industry norm. Businesses no longer want to be locked into a single vendor, especially as AI training and inference workloads grow more complex. By distributing workloads across providers, companies can optimize for cost, performance, and availability, while avoiding computing bottlenecks.

For Meta, this flexibility is crucial. As it scales up next-generation generative AI tools, develops agentic assistants, and enhances its advertising algorithms, tapping Google Cloud ensures both the capacity and unique specialization required to compete in an intense AI landscape.

Image source: Getty Images.

Is Alphabet stock a buy?

For Alphabet, the Meta deal stresses its strategic importance in the AI cloud ecosystem. Securing a multiyear, multibillion-dollar partnership not only boosts revenue visibility for Google Cloud but also validates years of heavy investment in AI infrastructure.

GOOGL PE Ratio (Forward) data by YCharts.

Yet despite this progress, Alphabet stock remains undervalued relative to peers in the cloud space.

Trading at a forward price-to-earnings multiple (P/E) of just 21, the market still appears to underappreciate the accelerating momentum across the company’s business.

To me, Alphabet stock is a no-brainer opportunity right now. It looks dirt cheap, and the new Meta deal further reinforces the company’s leading position among AI hyperscalers, even if the stock price doesn’t reflect that.

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AI Insights

Billionaire Steve Mandel Just Sold Microsoft Stock to Buy This Dominant Artificial Intelligence (AI) Stock Up Nearly 800% Over the Past Decade

Mandel increased his Amazon stake by a sizable amount.

Billionaire Steve Mandel and his hedge fund Lone Pine Capital have been a great one to follow for individual investors. Although some hedge funds have a poor record of underperforming the broader market, Mandel has substantially outperformed the market over the past three years. So, when he makes a move in his portfolio, investors should pay attention.

One thing Mandel did during Q2 was sell off some of his Microsoft shares. Although it wasn’t a massive move, the hedge fund reduced its position by about 5%. Then, Mandel used some of those funds to invest in another promising AI stock that has increased in value by nearly 800% over the past decade.

That stock? Amazon (AMZN -1.16%).

Image source: Getty Images.

AWS is the best reason to invest in Amazon right now

Amazon may not be the first company that comes to mind when you think about AI. Instead, it probably seems more like an e-commerce investment. While that sentiment is true for the consumer-facing portion, the reality is that a large chunk of Amazon’s profits comes from AI-related revenue streams.

The biggest is from Amazon Web Services (AWS), its cloud computing arm. Cloud computing firms are having a strong year, thanks to the massive demand generated by AI workloads. Because more companies can’t justify spending millions (or even billions) of dollars on a data center dedicated to training AI models, it’s far more reasonable to rent computing power from a firm that already has the capacity. That’s the idea behind cloud computing, and it has translated into strong growth for the business unit.

In Q2, AWS’s sales rose 17% to $30.9 billion. That’s strong growth, but it is a bit slower than its peers, Microsoft Azure and Google Cloud, which each grew revenue by more than 30% in Q2. However, AWS is much larger than both of these units, so it shouldn’t surprise investors that AWS is growing at a slower rate. AWS accounted for about 18% of Amazon’s total revenue in Q2, but it made up 53% of its operating profit. That’s because AWS has far superior margins compared to its commerce business units, making AWS a critical part of the Amazon investment thesis.

AWS is experiencing a significant boost from AI, making it a strong stock pick in this space.

But Microsoft is also a solid AI pick, so why is Mandel moving from Microsoft to Amazon?

Amazon’s stock looks more promising over the long term

From a valuation perspective, both companies trade at fairly expensive levels for their growth. However, they’re both priced about the same from a forward price-to-earnings (P/E) standpoint.

AMZN PE Ratio (Forward) data by YCharts

One thing Amazon has going for it that Microsoft doesn’t is the steady upward pressure on Amazon’s margins. Thanks to AWS and its advertising service business units being the fastest growing in Amazon, its margins are steadily improving. Although Amazon’s revenue growth rate appears to be somewhat slow, its operating income growth rate is actually quite rapid.

AMZN Revenue (Quarterly YoY Growth) data by YCharts

This trend still has years to unfold, which is a solid reason to transition from Microsoft to Amazon. I believe this will be a winning trade over the long term, as Amazon’s profits are expected to grow at a significantly faster rate than Microsoft’s, resulting in the stock outperforming its peer over the long term due to their similar valuations.

However, both stocks are still solid AI picks, and you can’t go wrong with either one.

Keithen Drury has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Business2 days ago

Business2 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle