Business

Trump officials urge Fed to remove governor after she refuses to quit | Federal Reserve

The Trump administration is ratcheting up pressure on the Federal Reserve to remove governor Lisa Cook, after the economist declared she had “no intention of being bullied” into stepping down.

Cook, who was appointed to the US central bank’s powerful board of governors by Joe Biden, has been accused by Donald Trump’s officials of committing mortgage fraud. The allegations are unconfirmed.

The US president has waged an extraordinary war on the Fed’s independence, breaking with precedent to demand interest rate cuts and urge its chair, Jerome Powell, to resign. Trump promptly called on Cook to quit on Wednesday.

The Department of Justice is reported to have indicated it is investigating the allegations, with a top Trump official telling Powell the case “requires further examination” – and calling on him to remove Cook from the Fed’s board.

“At this time, I encourage you to remove Ms Cook from your Board,” Ed Martin, the official, wrote in a letter, according to Bloomberg News. “Do it today before it is too late! After all, no American thinks it is appropriate that she serve during this time with a cloud hanging over her.”

The Fed declined to comment. The justice department declined to comment.

Despite Martin’s demand, the Fed chair has no authority under the Federal Reserve Act to remove another member of the board of governors. On Wednesday, the Wall Street Journal reported that Trump had discussed how to fire Cook for cause, citing an unnamed administration official.

The White House did not respond to a request for comment on the report.

On Wednesday morning, Bill Pulte, head of the US Federal Housing Finance Agency, who has become – beyond the president himself – one of the Trump administration’s most vocal critics of Powell and the Fed, published allegations against Cook.

Pulte says the finance agency is investigating a third property owned by Cook.

In June 2021, Cook entered into a 15-year mortgage agreement on a property in Ann Arbor, Michigan, and declared her intention to use it as her principal residence, according to Pulte. In July 2021, Cook bought a property in Atlanta, Georgia, and also committed to use that property as her primary residence when taking out a 30-year mortgage, according to Pulte.

In a statement, Cook said: “I do intend to take any questions about my financial history seriously as a member of the Federal Reserve and so I am gathering the accurate information to answer any legitimate questions and provide the facts.”

She is the latest figure to be targeted by Trump officials over claims of mortgage fraud. Pulte has made similar allegations about the New York attorney general, Letitia James, and the California senator Adam Schiff, both Democrats. The justice department is reportedly investigating.

James has dismissed the claims as “baseless”, while Schiff has vehemently denied the allegations, and accused the administration of weaponizing the US justice system.

Business

Can Veritone’s (VERI) Expanding Government AI Focus Reshape Its Long-Term Business Model?

- In the past week, Veritone completed a US$25 million follow-on equity offering and presented at the H.C. Wainwright Global Investment Conference, showcasing its AI-driven solutions for government and law enforcement sectors as well as a promising Veritone Data Refinery pipeline.

- An interesting insight is Veritone’s focus on securing direct government contracts and progressing toward a pure AI-centric model, supported by validation from early proof-of-concept contracts with agencies such as the U.S. Navy.

- We’ll examine how Veritone’s accelerated push into government AI and recent contract validation influences the company’s investment outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Veritone Investment Narrative Recap

Investors in Veritone need conviction in the company’s ability to grow its AI and Data Refinery offerings, particularly through pipeline momentum and government contracts, while the threat of continued net losses and cash needs looms large. The recent US$25 million equity raise bolsters short-term liquidity and reduces near-term capital constraints, but it is not a fundamental game changer, persistent operating losses and the need for future fundraising remain the most pressing risk for shareholders.

Among the recent developments, completion of the US$25 million follow-on equity offering stands out as the most directly relevant. This fundraising, together with revised credit covenants, helps support operational runway as Veritone works to convert government and enterprise pipeline into revenue. However, the increased share count introduces further dilution, reinforcing the importance of achieving sustainable, profitable growth as a key catalyst.

By contrast, sustained access to capital is not guaranteed for any loss-making company for long, making it critical that investors pay close attention to…

Read the full narrative on Veritone (it’s free!)

Veritone’s narrative projects $158.0 million revenue and $20.7 million earnings by 2028. This requires 20.2% yearly revenue growth and a $114.1 million increase in earnings from -$93.4 million today.

Uncover how Veritone’s forecasts yield a $5.25 fair value, a 41% upside to its current price.

Exploring Other Perspectives

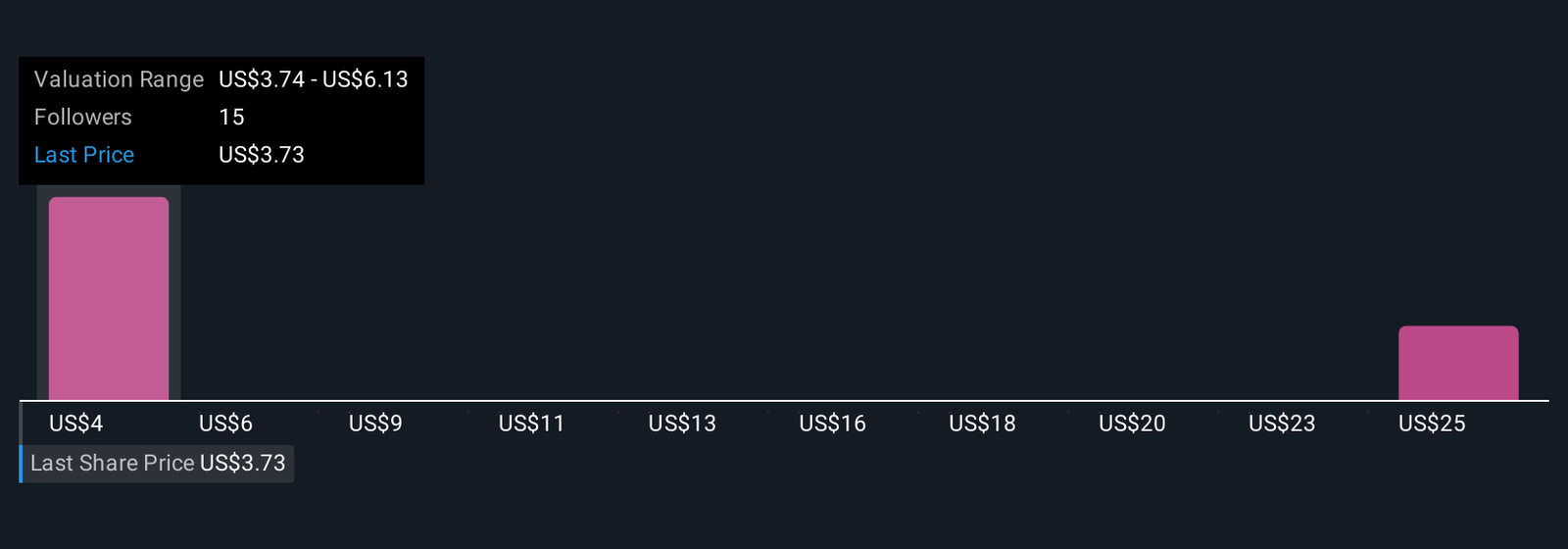

Six fair value estimates in the Simply Wall St Community span from US$3.74 to US$27.68, revealing sharply conflicting outlooks. With persistent net losses still a critical challenge, you can see why opinions differ so widely on Veritone’s future, explore how these diverse perspectives could shape your own view.

Explore 6 other fair value estimates on Veritone – why the stock might be worth just $3.74!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Business

One of Apple’s top AI executives is reportedly leaving the company

Apple is losing one of its top AI minds, according to Bloomberg.

Robby Walker, who had been the senior director of Apple’s Answers, Information, and Knowledge team since earlier this year, is reportedly set to leave the tech giant next month. Walker had previously been in charge of Siri prior to moving over to AI development. This is on top of Apple losing other high-level AI employees to Meta back in July, also reported by Bloomberg.

The report doesn’t give an explicit reason for why Walker or the other employees have left the company, but it certainly doesn’t paint an entirely positive picture of Apple’s AI development from the outside looking in. The company’s Apple Intelligence suite of AI features has notably lagged behind competitors like Google. One very noteworthy example is that Google’s Gemini Live naturalistic chatbot has been up and running for a while, even as Apple’s long-awaited AI-powered Siri upgrade has been reportedly delayed into next year.

Mashable Light Speed

It remains to be seen whether or not all of this AI business is a bubble just waiting to burst or something that’s truly here to stay, but at the pace Apple is moving, one might get the impression that the company is betting on the former.

Business

Elon Musk Just Said 80% of Tesla’s Value Will Come From This Artificial Intelligence (AI) Business, Which Jensen Huang Says Could Be Worth Trillions (Hint: It’s Not Robotaxi)

Key Points

-

Musk has long expressed grand ambitions in the world of artificial intelligence (AI).

-

One of Tesla’s main pursuits in the artificial intelligence realm is developing a fleet of autonomous robotaxis.

-

Nevertheless, Musk thinks most of Tesla’s future value will be derived by something else entirely.

Elon Musk is no stranger to bold statements. His comments, often hyperbolic, consistently capture far more attention than the standard rhetoric from corporate executives. Over the past several years, Musk has articulated a vision to evolve Tesla(NASDAQ: TSLA) beyond its roots as an electric vehicle (EV) and energy-storage company into a broader technology platform centered on artificial intelligence (AI).

At the heart of this strategy is Tesla’s push toward fully autonomous driving. While robotaxis dominate the conversation around Tesla’s AI roadmap, there is another opportunity quietly flying under the radar that could carry even greater implications: Optimus, the company’s humanoid robotics project.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

What once sounded like science fiction is slowly becoming a legitimate, tangible reality. Industry leaders such as Nvidia‘s Jensen Huang have pointed to the multitrillion-dollar potential at the intersection of AI and robotics. Musk has gone even further, asserting that Optimus could one day account for 80% of Tesla’s value once the platform is scaled.

For investors, this raises an important question: Is Optimus another example of Musk’s grandiose promises, or could it really become Tesla’s most impactful product ever?

Why are humanoid robots important in the broader AI narrative?

In recent years, much of the progress in artificial intelligence has come from the development of large language models (LLMs) capable of generating detailed, context-rich answers to user queries. While these systems have boosted efficiencies across certain workflows, they remain fundamentally reactive — waiting for prompts before offering value.

This limitation highlights why humanoid robotics is such an ambitious frontier. Unlike traditional industrial robots, humanoid robots are built with arms, legs, and advanced dexterity, enabling them to perform human-level tasks in real-world environments.

In many ways, humanoid robotics represent the closest manifestation of achieving generalized intelligence — AI that doesn’t just respond but actively engages with the physical world.

Image source: Getty Images.

What companies does Tesla Optimus compete with?

Thanks in part to Musk’s star power, Optimus has become an increasingly recognized prototype in the humanoid robot landscape. However, Tesla is far from alone in pursuing this technology.

Boston Dynamics — backed by Hyundai — continues to show off mobility and agility capabilities through its humanoid robot platform, Atlas.

Meanwhile, Figure AI — a start-up backed by AI heavyweights such as Microsoft, Nvidia, OpenAI, and Jeff Bezos — is building a competing humanoid system with an initial focus on manufacturing and logistics applications.

Could Optimus really account for 80% of Tesla’s future value?

Today, Tesla’s revenue and profitability are largely driven by its EV and energy-storage businesses. Optimus introduces an entirely new frontier: labor automation. Designed as a general-purpose worker, Optimus has the potential to support manufacturing and production on factory floors while also handling routine tasks in household settings.

The implications are twofold. Internally, deploying Optimus in its gigafactories could yield significant labor efficiencies — lowering operating costs and expanding profit margins as vehicle production scales. Externally, commercialization unlocks the doors to penetrating new markets such as logistics, retail, and healthcare — all areas where reliable labor needs are rising.

Unlike vehicles, which remain commoditized products subject to cyclical demand, Optimus could become a recurring, mission-critical asset for businesses seeking to offset labor shortages or inflationary costs. If successful, this would provide Tesla with a much-needed durable growth engine beyond its legacy auto and energy solutions.

This is why Musk contends that Optimus could ultimately become Tesla’s largest business. Recurring demand and the high-margin nature of robotics have the potential to dwarf even the most optimistic scenarios for Tesla’s car business, which will always face shifting consumer preferences and intense competition from other automakers.

If Tesla executes on its robotics pursuit, the upside could be enormous, potentially reaching $10 trillion, according to Musk. With that said, Optimus should still be viewed largely as a moonshot. The product remains years away from global adoption and is unlikely to move the financial needle for Tesla anytime soon.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia:if you invested $1,000 when we doubled down in 2009,you’d have $461,190!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,486!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $640,916!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you joinStock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of September 8, 2025

Adam Spatacco has positions in Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries