Major artificial intelligence (AI) service companies such as Google, OpenAI, and Dipsyck are raising prices one after another for B2B users. This is a different result from the previous prediction that AI service prices will fall as AI use becomes more common and competition among companies intensifies.

In addition to the assessment that concerns that AI companies can raise prices after securing the market have become a reality, there are also growing calls for Korea to secure “Sovereign AI” (self-AI model) to prevent domestic companies from putting pressure on AI costs.

According to the information technology (IT) industry on the 2nd, China’s DeepSeek announced in a recent announcement that it will abolish the night discount system for corporate customers and adjust input/output unit prices from the 5th.

The current input is $0.07 per million token and the output is $1.10, but the output will go up to $1.68. The input remains at $0.07 if the same data is repeatedly used, but when new data is imported, $0.56 is added. Discounts that were only applied during the night hours will also disappear.

It is the first additional increase in half a year following a five-fold increase in fares in February. At the time, inputs were up from 0.014 to 0.07, and outputs were up from $0.28 to $1.10. The industry is concerned that the end of the night discount could increase the output rate by up to three times.

An IT industry official said, “As companies are feeling the effectiveness of AI, demand will remain even if rates are raised,” adding, “AI companies will try to take advantage of this to cover enormous development costs and infrastructure investment and maintenance costs.”

A similar trend is also seen in other global AI companies. OpenAI unveiled GPT-5 in August, changing its enterprise ChatGPT pricing plan from a flat-rate to a usage-based system.

In the past, all functions could be used for a certain amount of money on a monthly basis, but in the future, credit will be purchased and used as much as necessary. If you choose an advanced function, you will be charged additional costs, and the specific unit price will vary depending on the terms of the contract, so it was not disclosed. Only team pricing plan for small organizations will have a flat rate of $25 to $30 per month per user.

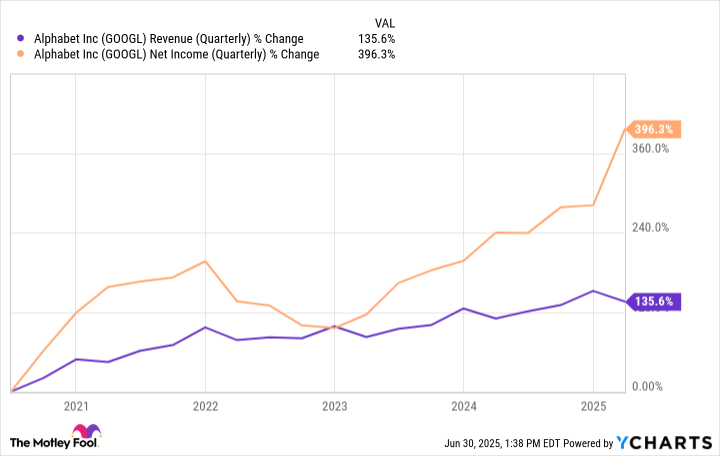

Google also raised Gemini rates in June. Input for the 2.5 Flash model increased by $0.15 to $0.30 per million token and output by $0.60 to $2.50, respectively, by nearly doubling and quadrupling. The system of differential application of rates by performance has disappeared and a single pricing system has been introduced. Instead, the flashlight model is newly established to provide relatively low-cost options of $0.10 input and $0.40 output, but from the perspective of companies, the overall unit price has risen, increasing the cost burden.

Anthropic also introduced weekly usage restrictions in July to prevent some subscribers from using Claude’s coding tools indefinitely, and the latest model Sonet 4 has a new rate system.

Sonet 4 supports a super-large context function that can process up to 1 million tokens, but from inputs exceeding 200,000 tokens, you will be charged $6 in input and $22.50 in output per 1 million token.

Some point out that even if some AI models lower unit prices, the burden on companies is increasing.

According to the Wall Street Journal (WSJ), companies that have introduced AI, such as chatbots, document summaries, and code writing, have seen their token unit prices fall, but their actual bills are increasing. The information also said, “The price of advanced AI models has not fallen in the past six months.”

In particular, the spread of agent-type AI applications has led to a surge in token usage, and the amount of computation has increased in the process of repeatedly executing the same query several times or driving its own calculation program.

Big tech such as Google, Meta, and OpenAI can afford these costs based on their enormous financial power, but startups and small and medium-sized companies are struggling with unexpected spending.

An industry official said, “In a situation where the use of AI is essential, the cost burden can hinder innovation,” adding, “In the end, there is a high risk that viable companies will be concentrated on large companies with capital power.”

[Reporter Kim Kyu-sik/ Silicon Valley correspondent Wonho-seop]