AI Research

This Artificial Intelligence (AI) Stock Could Be the Nvidia of Quantum Computing

While IonQ, Rigetti Computing, and D-Wave Quantum are central figures in the quantum computing spotlight, I see a member of the “Magnificent Seven” as the superior choice.

Back in 1999, a fledgling semiconductor company called Nvidia invented a chipset called the graphics processing unit (GPU) — a product that, at the time, few people realized they would one day need.

Two decades ago, GPUs were primarily marketed toward gamers and graphic designers. But Nvidia’s visionary CEO, Jensen Huang, saw the broad potential of these advanced chips before anyone else.

When the GPU was initially released, AI applications were both niche and barely imagined. But Huang understood that the world’s most important problems would be solved by anticipating latent needs — capabilities that people will demand at some point in the future, even if they can’t fully describe them today.

Huang realized that GPUs could be parlayed for more sophisticated problem solving that traditional CPUs at the time could not handle efficiently, ultimately becoming the foundational layer on which artificial intelligence (AI) modeling, research, and data analytics are built.

In a similar fashion, internet and cloud computing juggernaut Alphabet (GOOG 1.25%) (GOOGL 1.14%) has been quietly pushing the envelope in a new pocket of the AI realm that’s gaining attention: quantum computing.

Let’s dive into Alphabet’s innovative approach to developing quantum applications and explore how the company’s progress parallels that of Nvidia’s pioneering role in AI before it went mainstream.

How is Alphabet building quantum computing applications?

Back in December, Alphabet unveiled its latest breakthrough in the quantum computing arms race: a processor called Willow. With 105 qubits and enhanced algorithmic features across error correction, Willow might appear as just another incremental improvement over prior generations of quantum chips released by Alphabet and its peers.

Where Willow caught the attention of AI enthusiasts was through an experiment in Random Circuit Sampling (RCS), in which its quantum processing was measured against classical supercomputers. In this study, Alphabet claims that Willow solved a sophisticated series of computations in under 5 minutes that would take today’s most capable supercomputers an estimated 10 septillion years to complete.

Image source: Getty Images.

Why Alphabet is to quantum computing what Nvidia is to AI

While Alphabet’s quantum supremacy may not have ample commercial uses today, the idea here is that the company’s innovations and technological breakthroughs are similar to that of Nvidia and the invention of the GPU back in the late 1990s. Willow and the GPU both represent underlying proof that Alphabet and Nvidia have been at the forefront of innovations where conventional approaches are not able to compete at scale.

Similar to Nvidia, Alphabet is not building its AI business through a singular lens. Under its umbrella, Alphabet has TensorFlow — an open-source machine learning platform. In addition, Alphabet’s Google Quantum AI team operates an open-source software framework called Cirq, which helps Python developers research and build applications. Lastly, Google DeepMind serves as a research lab spanning various aspects of the AI spectrum, including quantum computing.

To me, the formation of Alphabet’s AI ecosystem aligns closely with Nvidia’s approach. Outside of its hardware specialty, Nvidia also offers software through its CUDA infrastructure. This decision ultimately created a virtuous cycle in which developers building generative AI applications continually demand additional GPU and software capacity — leading to a self-reinforcing technological moat for Nvidia.

I think Alphabet is employing a similar strategy, betting that classical computing will eventually become exhausted by increasingly sophisticated AI workloads. When this occurs, Alphabet will have already architected the leap from classical to quantum computing.

Just as Nvidia has done throughout the AI revolution thanks to its GPUs and software platform, Alphabet could one day be positioned as the main ecosystem on which quantum applications are developed.

Is Alphabet stock a buy right now?

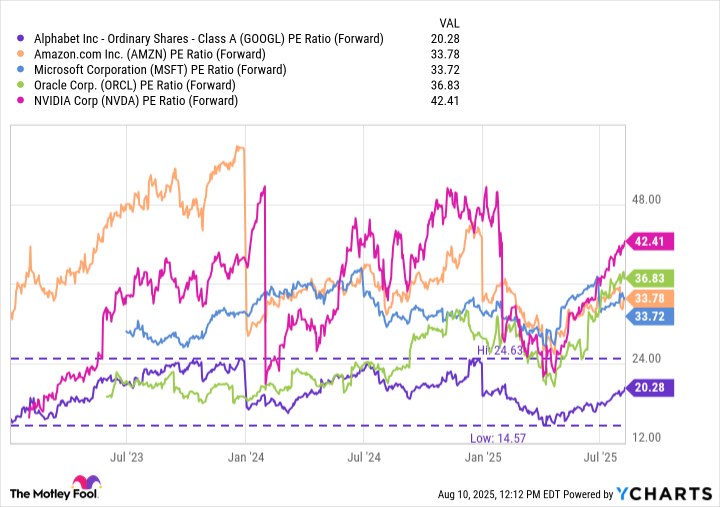

Throughout the AI revolution, many of Alphabet’s peers have experienced notable expansion in their valuation multiples.

GOOGL PE Ratio (Forward) data by YCharts

At the moment, however, Alphabet is trading roughly in line with its three-year average forward price to earnings (P/E) ratio. Not only is the valuation discount to its peers striking, but I think it’s overstated.

Over the last three years, Alphabet has continued to innovate across several areas of AI, including new capabilities in search, video, e-commerce, cybersecurity, and of course, hardware such as quantum chips. Nevertheless, the upside from these investments do not appear to be fully priced into the company’s long-term financial success.

Just as Nvidia has proven to be one of the most lucrative long-term buys of the decade, I see Alphabet positioned to follow a prolonged breakout period featuring notable valuation expansion as its AI-powered products continue to scale and become a more central part of the company’s growth narrative. For these reasons, I think that Alphabet stock is dirt cheap and looks like a compelling opportunity at its current price level.

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

AI Research

Google’s top AI scientist says this is what he thinks will be the next generation’s most needed skill

A leading Google scientist and recent Nobel laureate has highlighted “learning how to learn” as the paramount skill for future generations, given the transformative impact of Artificial Intelligence.

Demis Hassabis, CEO of Google’s DeepMind, delivered this insight from an ancient Roman theatre in Athens, emphasising that rapid technological advancements necessitate a fresh approach to education and skill acquisition. He stated that this adaptability is crucial to keep pace with AI’s reshaping of both the workplace and educational landscape.

“It’s very hard to predict the future, like 10 years from now, in normal cases. It’s even harder today, given how fast AI is changing, even week by week,” Hassabis told the audience. “The only thing you can say for certain is that huge change is coming.”

The neuroscientist and former chess prodigy said artificial general intelligence — a futuristic vision of machines that are as broadly smart as humans or at least can do many things as well as people can — could arrive within a decade. This, he said, will bring dramatic advances and a possible future of “radical abundance” despite acknowledged risks.

Hassabis emphasized the need for “meta-skills,” such as understanding how to learn and optimizing one’s approach to new subjects, alongside traditional disciplines like math, science and humanities.

“One thing we’ll know for sure is you’re going to have to continually learn … throughout your career,” he said.

The DeepMind co-founder, who established the London-based research lab in 2010 before Google acquired it four years later, shared the 2024 Nobel Prize in chemistry for developing AI systems that accurately predict protein folding — a breakthrough for medicine and drug discovery.

Greek Prime Minister Kyriakos Mitsotakis joined Hassabis at the Athens event after discussing ways to expand AI use in government services. Mitsotakis warned that the continued growth of huge tech companies could create great global financial inequality.

“Unless people actually see benefits, personal benefits, to this (AI) revolution, they will tend to become very skeptical,” he said. “And if they see … obscene wealth being created within very few companies, this is a recipe for significant social unrest.”

Mitsotakis thanked Hassabis, whose father is Greek Cypriot, for rescheduling the presentation to avoid conflicting with the European basketball championship semifinal between Greece and Turkey. Greece later lost the game 94-68.

AI Research

3 Top Artificial Intelligence Stocks to Buy in September

Artificial intelligence stocks have taken off recently, but these three laggards still look like strong long-term buys.

Many artificial intelligence (AI) stocks have taken off this year, rebounding strongly from early-year weakness. Still, there has been differentiation among AI beneficiaries. For instance, companies that have inked deals with current leader OpenAI, such as Oracle (NYSE: ORCL) and Broadcom (NASDAQ: AVGO), have soared. Meanwhile, those perceived to be on the outside of OpenAI and its immediate suppliers have lagged.

Yet, while investors have bid up recent outperformers to stratospheric valuations, we’re really just in the second inning of the artificial intelligence revolution. That means certain stocks that have sold off for short-term reasons this summer could be excellent pickups to ride the AI wave, as long as they find their place in this ongoing paradigm shift. In that light, the following three look like strong buys on weakness.

Super Micro Computer

Super Micro Computer (SMCI 2.50%) has been on a roller-coaster ride over the past year, crashing after its accounting firm quit last October, only to recover strongly after its new accountant gave the thumbs-up to its books in February.

However, Supermicro’s stock sold off after its recent earnings report, which underwhelmed on both the top and bottom lines. Supermicro said that its customers were a bit slow in making architectural decisions, while tariffs and write-downs on old inventory pressured gross margins.

But there could be better things on the horizon. Supermicro still grew revenue 47% in the fiscal year ending in June and forecasted at least 50% revenue growth in fiscal 2026. Supermicro management also said it expects to increase its large-scale data center customers from four to between six and eight in fiscal 2026. That could be a good thing for customer diversification.

Meanwhile, Supermicro is just ramping up its data center building block solutions (DCBBS), wherein the company will install not just server racks but also an entire data center in turnkey fashion, greatly speeding up deployment. Those efforts should help margins grow back toward the company’s old range of between 14% and 17%, up from 11.2% in the latest fiscal year, even if those margins don’t get all the way there in 2026.

In any case, Supermicro has sold off to a forward price-to-earnings (P/E) ratio of just 16 after the sell-off. Given the exceptionally strong longer-term guide for AI infrastructure growth provided by Oracle and others recently, that still seems like a low price to pay for a leading AI hardware player growing that quickly.

Applied Materials

Like Super Micro, Applied Materials (AMAT -1.21%) sold off after its own recent earnings release. While Applied beat revenue and earnings estimates for its third quarter, which ended July 27, management forecasted a slight revenue and earnings decline in the current quarter. Management attributed the downturn to “digestion” in China, as well as “uneven” ramps in leading-edge logic.

While that may seem worrisome, the reasons given seem reasonable. Applied’s results actually held up better than some peers during the post-pandemic downturn in semiconductors, so it may make sense that there is a little air pocket today.

And while the leading-edge logic fab buildout may be uneven, the rise of artificial intelligence should bolster growth over the medium term. Oracle forecasts robust AI data center growth through 2030, and all those data centers will need lots of chips.

Image source: Getty Images.

Applied is the most diverse semiconductor equipment supplier, so it should get a solid piece of that growing pie. Its equipment is concentrated in etch and deposition machines, which should see better-than-average growth over the next few years as chipmakers begin to implement new innovations such as gate-all-around transistors, backside power, and 3D architectures for both DRAM and logic chips, all of which are etch- and deposition-intensive.

Applied now trades at just 20 times earnings and 17 times next year’s estimates, which are below-market multiples. That seems absurdly cheap for a high-margin, cash-generating tech leader that should benefit from AI growth. Fortunately, Applied has rewarded shareholders with consistent share repurchases and a growing dividend, and that should continue going forward, even if the company has an off quarter here and there.

Intel

Finally, perhaps no tech company has been as maligned over the past few years as Intel (INTC -2.15%). After falling behind Taiwan Semiconductor Manufacturing (NYSE: TSM) in process technology and failing to anticipate the AI revolution, Intel spent the last four years on a spending spree in an attempt to catch up. That spending has added to Intel’s debt load and degraded its cash flow, while a lot of the fruits of that spending have not yet emerged.

Still, Intel recruited former board member and Cadence Design Systems (NASDAQ: CDNS) CEO Lip-Bu Tan as its new CEO, who is just a matter of months into his turnaround plan. Tan has unmatched experience and contacts within the semiconductor industry and seems like an ideal candidate to lead Intel at this stage.

Tan has made waves, cutting a massive amount of costs and restructuring the company. At a recent conference, CFO David Zinsner said Tan has already reduced management layers at the company from 11 to five. Meanwhile, Tan has also refreshed much of Intel’s leadership. In June, Tan promoted a new chief revenue officer and brought in several outside engineering leaders to lead Intel’s AI chip efforts.

At a recent industry conference, CFO David Zinsner stated that Tan would be laying out the company’s new AI roadmap soon. Then just last week, Tan named new heads of client and data center chip groups, completing his refreshment of Intel’s senior leadership. Given Tan’s wide experience as head of Cadence and his venture capital firm Walden Capital, which invests in AI start-ups, this new leadership is likely to strengthen Intel’s product portfolio.

Meanwhile, Intel’s first chip on its important 18A node will make its debut later this year, which management believes will give Intel equal or better technology than TSMC. And with the U.S. government recently taking a stake in the company and Tan having deep industry relationships, it seems likely Intel will land more external customers for its foundry, which will be another key to its success.

And yet, Intel trades just a touch above book value. But given that Tan is early in his transformation plan and the 18A node is just about to hit late this year, the stock is a great-looking risk-reward at these levels.

AI Research

Promising Artificial Intelligence Stocks To Watch Now – September 13th – MarketBeat

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers3 months ago

Jobs & Careers3 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education3 months ago

Education3 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business3 months ago

Funding & Business3 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries