AI Insights

The United Arab Emirates Releases a Tiny But Powerful AI Model

The United Arab Emirates (UAE) has released an open source model that performs advanced reasoning as well as the best offerings from both the United States and China—one of the strongest signs so far that the nation’s big investments in artificial intelligence are starting to pay off.

The new model, K2 Think, comes from researchers at Mohamed bin Zayed University of Artificial Intelligence (MBZUAI) located in UAE’s capital Abu Dhabi. The model—one of the first so-called “sovereign” AI models that incorporates technical advances needed for reasoning—is being made available for free by G42, an Emirati tech conglomerate backed by Abu Dhabi’s sovereign wealth funds. G42 is running the model on a cluster of Cerberas chips, an alternative to Nvidia’s hardware.

K2 Thinking is one of the UAE’s contributions to the global race to demonstrate prowess in a technology widely expected to have huge economic and geopolitical implications. The United States and China are considered the dominant players in this contest. But many smaller nations, especially ones with considerable wealth to invest, are also racing to develop their own “sovereign” AI models.

K2 Think is relatively modest in size, with 32 billion parameters. It is not a complete large language model but rather a model specialized for reasoning, capable of answering complex questions through a simulated kind of deliberation rather than quickly synthesizing information to provide an output. For such tasks, the researchers say it performs on par with reasoning models from OpenAI and DeepSeek, which have more than 200 billion parameters.

“This is a technical innovation or, in my opinion, a disruption,” Eric Xing, MBZUAI’s president and lead AI researcher told WIRED ahead of today’s announcement.

Xing says the model demonstrates a particularly effective combination of a number of recent technical innovations. These include fine tuning on long strings of simulated reasoning; an agentic planning process that breaks problems down in different ways; and reinforcement learning that trains the model to reach verifiably correct answers. Other innovations allow the model to be served very efficiently on Cerebras chips.

“How to make a smaller model function as well as a more powerful one—that’s a lesson to learn, if other people want to learn from us,” Xing said.

Xing adds that K2 Think was developed using several thousands of GPUs (he declined to give a precise number), and the final training run involved 200-300 chips. The plan is to incorporate K2 Think into a full LLM in the coming months. MBZUAI has open sourced the model and published a technical report that details how different innovations were combined to create it.

Other nations in the Middle East, including Saudi Arabia, are also investing heavily in AI infrastructure and research. President Donald Trump traveled to the region in May to announce numerous AI deals involving US tech companies.

The UAE’s leadership has invested billions to establish itself as a strategically important research hub. The country has already revealed some cutting edge AI research and established an outpost in Silicon Valley. The UAE has lessened its ties to China in return for access to the US silicon needed to train frontier models.

Peng Xiao, CEO of G42, and a MBZUAI board member, said in a statement: “By proving that smaller, more resourceful models can rival the largest systems, this achievement shows how Abu Dhabi is shaping the next wave of global innovation.”

AI Insights

Trust in Businesses’ Use of AI Improves Slightly

WASHINGTON, D.C. — About a third (31%) of Americans say they trust businesses a lot (3%) or some (28%) to use artificial intelligence responsibly. Americans’ trust in the responsible use of AI has improved since Gallup began measuring this topic in 2023, when just 21% of Americans said they trusted businesses on AI. Still, just under half (41%) say they do not trust businesses much when it comes to using AI responsibly, and 28% say they do not trust them at all.

###Embeddable###

These findings from the latest Bentley University-Gallup Business in Society survey are based on a web survey with 3,007 U.S. adults conducted from May 5-12, 2025, using the probability-based Gallup Panel.

Most Americans Neutral on Impact of AI

When asked about the net impact of AI — whether it does more harm than good — Americans are increasingly neutral about its impact, with 57% now saying it does equal amounts of harm and good. This figure is up from 50% when Gallup first asked this question in 2023. Meanwhile, 31% currently say they believe AI does more harm than good, down from 40% in 2023, while a steady 12% believe it does more good than harm.

###Embeddable###

The decline from 2023 to 2025 in the percentage of Americans who believe AI will do more harm than good is driven by improvements in attitudes among older Americans. Generally speaking, older Americans are less concerned than younger Americans when it comes to AI’s total impact on society. While skepticism about AI and its impact exists across all age groups, it tends to be higher among younger Americans.

Majority of Americans Are Concerned About AI Impact on Jobs

Those who believe AI will do more harm than good may be thinking at least partially about the technology’s impact on the job market. The majority (73%) of Americans believe AI will reduce the total number of jobs in the United States over the next 10 years, a rate that has remained stable over the past three years in which Gallup has asked this question.

###Embeddable###

Younger Americans aged 18 to 29 are slightly more optimistic about the potential of AI to create more jobs. Fourteen percent of those aged 18 to 29 say AI will lead to an increase in the total number of jobs, compared with 9% of those aged 30 to 44, 7% of those aged 45 to 59 and 6% of those aged 60 and over.

Bottom Line

As AI becomes more common in personal and professional settings, Americans report increased confidence that businesses will use it responsibly and are more comfortable with its overall impact.

Even so, worries about AI’s effect on jobs persist, with nearly three-quarters of Americans believing the technology will reduce employment opportunities in the next decade. Younger adults are somewhat more optimistic about the potential for job creation, but they, too, remain cautious. Still, concerns about ethics, accountability and the potential unintended consequences of AI are top of mind for many Americans.

These results underscore the challenge businesses face as they deploy AI: They must not only demonstrate the technology’s benefits but also show, through transparent practices, that it will not come at the expense of workers or broader public trust. How businesses address these concerns will play a central role in shaping whether AI is ultimately embraced or resisted in the years ahead.

Learn more about how the Bentley University-Gallup Business in Society research works.

Learn more about how the Gallup Panel works.

###Embeddable###

AI Insights

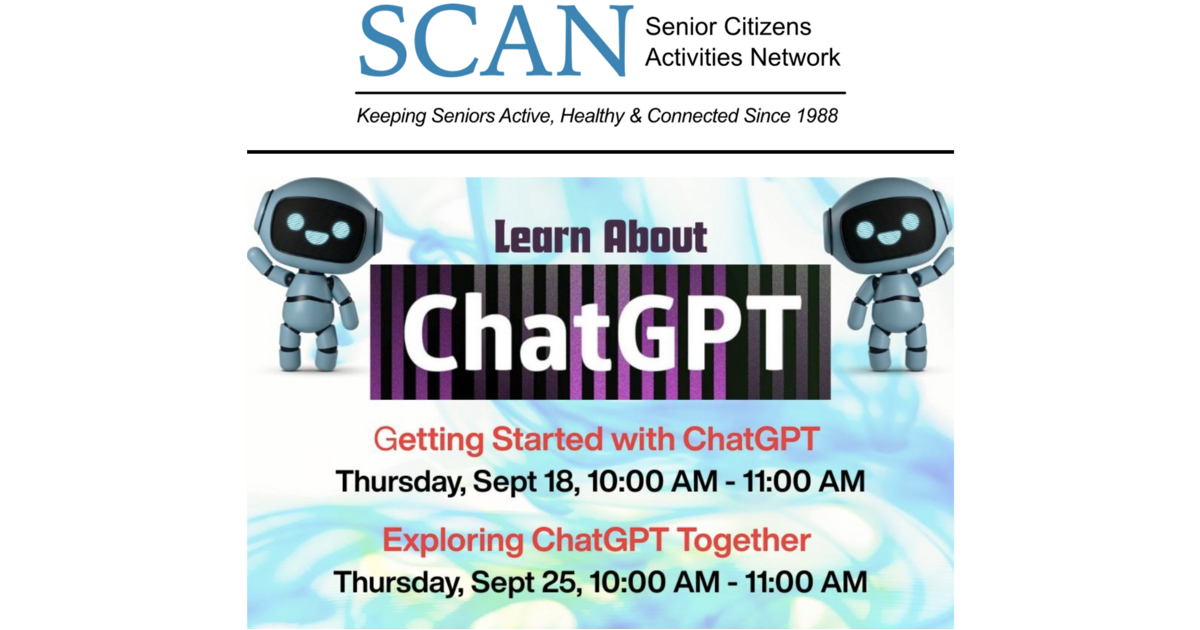

SCAN Keeps Older Americans in the Know! Sign-up for Artificial Intelligence Classes. Learn more: – TAPinto

AI Insights

This Scorching Hot Artificial Intelligence (AI) Stock Just Exploded Higher and Could Be Headed to the $1 Trillion Club Much Earlier Than Expected

This artificial intelligence (AI) specialist leveraged decades of expertise in information technology (IT) and cloud systems and is on a path to earn membership in a very exclusive fraternity.

There’s no denying the trajectory of artificial intelligence (AI) over the past few years. Many of the companies that have pivoted to adopt this game-changing technology have ascended the ranks of the world’s largest companies when measured by market cap. When the stock market closed on Tuesday, there were 11 members of the vaunted $1 trillion club, the vast majority of which have significant ties to AI.

After the market close, industry stalwart Oracle (ORCL 1.37%) reported its recent quarterly results, and despite missing Wall Street’s expectations, the stock surged higher and never looked back. Why? In a stunning turn of events, the company signed numerous multibillion-dollar contracts that kicked its future growth potential into overdrive.

Given the magnitude of these deals, it seems the writing is on the wall for Oracle to join this elite fraternity. The company’s growth is at a tipping point, and management’s commentary suggests the company has a long AI-centric runway for growth ahead.

Image source: Getty Images.

A trusted partner

Oracle holds a coveted place in the technology community, as roughly 98% of Global Fortune 500 companies make up its customer rolls. The industry stalwart provides its customers with a strategic combination of cloud, database, and enterprise software. Naturally, when the shift to AI began in earnest, this captive audience began to turn to Oracle for its expanding collection of cloud and AI solutions.

The company’s growth has been uneven, but the future looks bright. During Oracle’s fiscal 2026 first quarter (ended Aug. 31), total revenue grew 11% year over year to $14.9 billion, while its adjusted earnings per share (EPS) of $1.47 grew by 6%. Both numbers accelerated compared to Q4, but missed Wall Street’s consensus estimates, which called for revenue of $15 billion and adjusted EPS of $1.48.

However, that wasn’t the headline. Last quarter, CEO Safra Catz noted that the company had reached a “tipping point,” noting that revenue growth was accelerating, “and it’s only going up from here.”

That turned out to be an understatement. Oracle reported explosive growth in its remaining performance obligation (RPO) — or contractual obligations not yet included in revenue — which skyrocketed 359% year over year to $455 billion, up from $138 billion in Q4.

Catz explained, “We signed four multibillion-dollar contracts with three different customers in Q1,” calling the results “astonishing.” He went on to say that demand for Oracle Cloud “continues to build.” The company expects to sign “several additional multi-billion-dollar customers and RPO is likely to exceed half a trillion dollars.”

Looking to the future, Oracle is forecasting Oracle Cloud Infrastructure revenue to grow 77% to $18 billion this year — but that’s just the beginning:

- Fiscal 2027 cloud revenue of $32 billion, up 78%.

- Fiscal 2028 cloud revenue of $73 billion, up 128%.

- Fiscal 2029 cloud revenue of $144 billion, up 97%.

Mind you, this is just Oracle Cloud Infrastructure revenue, and Catz noted that “most of the revenue in this five-year forecast is already booked in our reported RPO.” That means that any future contracts will probably increase those growth targets.

The path to $1 trillion just got much shorter

Oracle is leveraging its position as a trusted partner to help customers choose suitable AI and cloud solutions and profit from the growing adoption of generative AI.

Before today’s results, Wall Street was expecting Oracle to generate revenue of $66.75 billion in its fiscal 2026 (which began June 1), giving it a forward price-to-sales (P/S) ratio of about 10. Assuming its P/S remained constant, Oracle needed to generate revenue of approximately $98 billion annually to support a $1 trillion market cap. Given those figures, Oracle could have achieved a $1 trillion market cap before 2028.

Wall Street hasn’t yet had time to update its models, but given the magnitude of the company’s results, previous forecasts are out the window. Barring unforeseen circumstances, I predict Oracle will join the $1 trillion club within the next 12 months.

Estimates regarding the market potential of generative AI continue to ratchet higher. Big Four accounting firm Price Waterhouse Coopers (PwC) calculates the opportunity could be worth as much as $15.7 trillion annually by 2030, which illustrates the magnitude of the opportunity.

Given the recent contract wins, Oracle has proven that it is leveraging its experience to profit from this windfall. The writing is on the wall, and Oracle is poised to join the fraternity of trillionaires in short order.

Danny Vena has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle. The Motley Fool has a disclosure policy.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi