Good morning. Home Depot reported a slight increase in sales yesterday, a small ray of sunshine in an extremely cloudy housing market (see second item below). The company said, however, that big home renovation projects remain “on hold” due to high rates and economic uncertainty. This hasn’t stopped Home Depot’s stock from edging towards the all-time highs set back in 2021. Nothing slows down the biggest US stocks these days. Email us: [email protected].

Semiconductor stocks

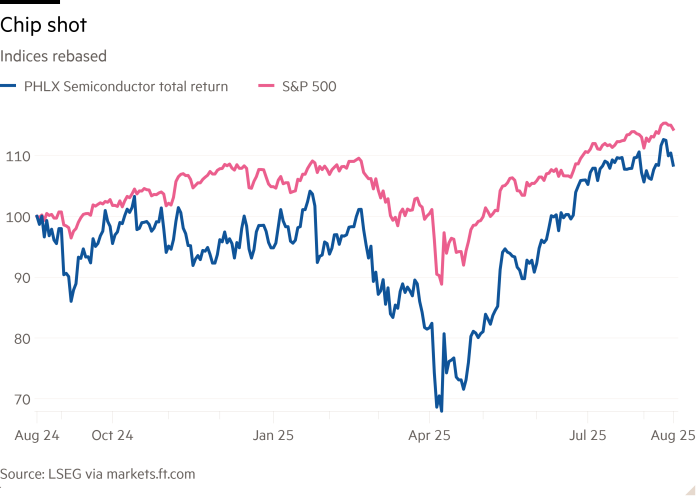

Semiconductor stocks peaked last July, and a few weeks later, Unhedged wrote the following, in a piece called “RIP Semiconductor Rally”:

The silicon intensity of the world economy is increasing — similar to the way the steel intensity of the world economy increased in the last century. But the chip business is a much better business than steel, with higher barriers to entry. Whatever the cyclical story may be today, that secular story is still in place. If what looked like a cyclical recovery turns into a downturn, that’s an opportunity.

That’s sort of how it played out — but only sort of. The rally was over, but the sector ground sideways for the rest of 2024, underperforming the wider market, and then got absolutely whacked by tariff fears in the first four months of 2025 — only to come roaring back since April. “Liberation day”, or thereabouts, was the big opportunity.

But this story is all tangled up with the artificial intelligence hype cycle. The products of chip companies such as Nvidia and Broadcom go into AI data centres, which has made them two of the most valuable companies in the world. I’m interested in a less highfalutin flavour of chips, used in industry for signalling, power management, automation, and the like — mostly so-called analogue chips. Analogue chip companies are intensely cyclical, and their cycle tends to lead the larger economic and business cycle.

So how are the analogue semi companies doing, and what does that tell us about the economy? Here’s a one-year chart of the share performance of some of the largest players:

Again, the pattern is underperformance before “liberation day” followed by outperformance after it; but many of the stocks are still cheaper than they were a year ago. What is really interesting, however, is the pattern of revenue growth — which has turned up since bottoming:

Not only does this suggest that there may be room to run for the analogue shares, it also suggests that the global industrial economy might just be heading for an upswing.

But it’s not that simple (is it ever?). There are two related complicating factors, as Chris Caso, chip analyst at Wolfe Research, explained to me. It is not clear how much the revenue growth early this year was down to customers trying to get ahead of tariffs. It is also uncertain whether the recent increase in sales reflects the fact that customers have worked through excess inventory, or that there has been an upswing in final demand. “That’s the debate in the industry now,” Caso says. “We’re still waiting for a clean signal on demand.”

We’ll get more insight when Analog Devices reports today.

Housing starts

The latest homebuilding data from the US Census Bureau yesterday came in unexpectedly strong, with housing starts up 5 per cent in July from the month before. Hope for the most beat-up corner of the US economy?

No. Housing starts are noisy. The data can register large swings due to factors such as weather. The three-month moving average shows a rather muted increase:

Oliver Allen at Pantheon Macroeconomics agrees that “the jump in housing starts in July is noise rather than a sign that new residential construction is turning a corner”. The numbers were flattered by the fact that starts fell to an 11-month low in June. And most of the gains came from multi-family units rather than houses.

One better, more stable gauge of housing market conditions is new housing permits. They dropped 2.8 per cent on a monthly basis in July, and point to a far weaker story over the past year:

As Rick Palacios of John Burns Research and Consulting told Unhedged: “The permits data is what we put more faith behind. The starts data [yesterday] was a surprise — it didn’t really tie to anything that we’ve seen in the industry.” Further discrepancies between the strong headline starts number and actual weakness are corroborated by private data sources. In a John Burns survey of nationwide homebuilders, 63 per cent reported lay-offs in the past month:

As a homebuilder, you’re not doing lay-offs at that scale if you’re stepping on the gas with housing starts, which is what the single family starts numbers indicated. You’d be hard pressed to talk to a homebuilder that would tell you starts are getting more bullish on adding housing inventory in this environment.

Could interest rate cuts by the Federal Reserve give the sector the boost it needs? Mortgages are not priced off of the federal funds rate. And the longer rates that do determine mortgage rates depend on many factors. There is a big gap between the market 30-year fixed mortgage rate — currently at about 6.5 per cent — and the lower rates many homeowners locked in before inflation rose. To boost demand for new homes, there needs to be a significant fall in long rates to narrow the gap and boost demand, Pantheon’s Allen says. Why the Fed is lowering rates will also be critical, he adds. A scenario in which labour market weakness, rather than falling inflation, prompts lower rates won’t be much help for the housing market if potential buyers are feeling nervous about their job prospects.

More importantly, Allen believes homebuilders could remain caught in the trap of too much supply, even when rate cuts come:

If mortgage rates come down and boost demand for housing, that’s good. But if that, at the same time, is encouraging existing homeowners to move, put their homes on the market and free up more supply . . . then homebuilders have more competition from existing homes. So it’s hard to see a way out for the home builders. They’ve got a massive inventory, and something needs to happen with it. There’s not loads of really good scenarios.

One good read

Thinking about supply and demand helps with predictions.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.