Dublin, Sept. 02, 2025 (GLOBE NEWSWIRE) — The “Big Data and Artificial Intelligence Market Report 2025” has been added to ResearchAndMarkets.com’s offering.

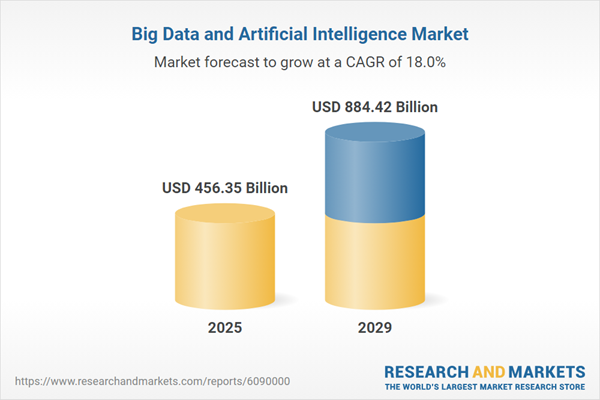

The big data and artificial intelligence market size has grown rapidly in recent years. It will grow from $385.89 billion in 2024 to $456.35 billion in 2025 at a compound annual growth rate (CAGR) of 18.3%.

The growth observed during the historic period can be attributed to several factors, including an increasing focus on ethical artificial intelligence, rising demand for data-driven decision-making, greater adoption of artificial intelligence, heightened efforts by tech giants, and a growing demand for automation.

The big data and artificial intelligence market size is expected to see rapid growth in the next few years. It will grow to $884.42 billion in 2029 at a compound annual growth rate (CAGR) of 18%. The growth projected for the forecast period can be attributed to several factors, including the increasing generation of data across industries, greater adoption of cloud computing, rising investments in artificial intelligence, growing cybersecurity threats, and the escalating volume of data generated.

Key trends during this period include the rise of edge computing, investments in advanced big data tools, technological advancements, strategic collaborations, and the expansion of artificial intelligence in cybersecurity.

The growth of the big data and artificial intelligence market is expected to be driven by the increasing volume of data generated. The amount of data is growing rapidly due to the rise of internet of things (IoT) devices, social media, digital transactions, high-resolution media, and real-time analytics. Big data and artificial intelligence play a crucial role in managing this data by automating data collection, improving real-time processing, and extracting insights from various digital sources.

This integration allows businesses to optimize decision-making, enhance efficiency, and foster innovation across different industries. For example, in September 2023, the International Telecommunication Union reported that 67% of the global population, or 5.4 billion people, had internet access in 2022, marking a 4.7% increase from 2021. This growth in internet access is contributing to the rise in data generation, driving the expansion of the big data and artificial intelligence market.

Companies in the big data and artificial intelligence market are focusing on developing services such as AI-driven retrieval systems to maintain their competitive edge. These intelligent systems use artificial intelligence to extract, organize, and present relevant information from both structured and unstructured data sources. For instance, in February 2025, Snowflake Inc., a US-based cloud data storage company, introduced Cortex Agents, a retrieval service designed to enhance AI-driven data access and decision-making for businesses. The agents help retrieve structured data from Snowflake tables and unstructured data from object storage such as PDFs. Additionally, Cortex Search improves the retrieval of unstructured data and claims to outperform OpenAI’s embedding models by at least 11% across various benchmarks. These innovations enable businesses to analyze large datasets more efficiently, improving AI-driven decision-making and governance.

In August 2024, Advanced Micro Devices Inc. (AMD), a US-based semiconductor company, acquired Silo AI for $665 million. This acquisition aims to accelerate the development and deployment of artificial intelligence (AI) models on AMD hardware, enhancing the company’s AI capabilities and expanding its position in the AI-driven computing market. Silo AI, based in Finland, specializes in providing AI services and utilizes big data to create customized AI-driven solutions.

Major players in the big data and artificial intelligence market are Amazon Web Services Inc., Microsoft Corporation, Dell Technologies, Intel, IBM, Cisco Systems, Oracle, Google, SAP, Hewlett Packard Enterprise Company, NVIDIA Corporation, Salesforce Inc., Adobe Inc., Infosys Limited, SAS Institute Inc., LTI Mindtree Ltd., Teradata Corporation, QlikTech International AB, ScienceSoft USA Corporation, Yalantis, Cyfuture India Pvt. Ltd., Feathersoft Info Solutions Pvt Ltd., and Addepto.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 175 |

| Forecast Period | 2025 – 2029 |

| Estimated Market Value (USD) in 2025 | $456.35 Billion |

| Forecasted Market Value (USD) by 2029 | $884.42 Billion |

| Compound Annual Growth Rate | 18.0% |

| Regions Covered | Global |

Key Topics Covered:

1. Executive Summary

2. Big Data and Artificial Intelligence Market Characteristics

3. Big Data and Artificial Intelligence Market Trends and Strategies

4. Big Data and Artificial Intelligence Market – Macro Economic Scenario Macro Economic Scenario Including the Impact of Interest Rates, Inflation, Geopolitics, and the Recovery from COVID-19 on the Market

5. Global Big Data and Artificial Intelligence Growth Analysis and Strategic Analysis Framework

5.1. Global Big Data and Artificial Intelligence PESTEL Analysis

5.2. Analysis of End Use Industries

5.3. Global Big Data and Artificial Intelligence Market Growth Rate Analysis

5.4. Global Big Data and Artificial Intelligence Historic Market Size and Growth, 2019-2024, Value

5.5. Global Big Data and Artificial Intelligence Forecast Market Size and Growth, 2024-2029, 2034F, Value

5.6. Global Big Data and Artificial Intelligence Total Addressable Market (TAM)

6. Big Data and Artificial Intelligence Market Segmentation

6.1. Global Big Data and Artificial Intelligence Market, Segmentation by Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Predictive Analytics

- Fraud Detection

- Customer Analytics

- Risk Management

- Supply Chain Management

6.2. Global Big Data and Artificial Intelligence Market, Segmentation by Deployment Model, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

6.3. Global Big Data and Artificial Intelligence Market, Segmentation by Technology, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Machine Learning

- Natural Language Processing

- Data Mining

- Data Visualization

- Deep Learning

6.4. Global Big Data and Artificial Intelligence Market, Segmentation by End Use, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Banking, Financial Services, and Insurance

- Healthcare

- Retail

- Manufacturing

- Telecommunications

6.5. Global Big Data and Artificial Intelligence Market, Sub-Segmentation of Predictive Analytics, by Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Machine Learning-Based Predictive Analytics

- Statistical Modeling

- Data Mining

- Forecasting and Optimization

6.6. Global Big Data and Artificial Intelligence Market, Sub-Segmentation of Fraud Detection, by Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Identity Fraud Detection

- Transaction Fraud Detection

- Behavioral Analytics

- Anomaly Detection

6.7. Global Big Data and Artificial Intelligence Market, Sub-Segmentation of Customer Analytics, by Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Customer Segmentation

- Sentiment Analysis

- Personalized Recommendations

- Customer Churn Prediction

6.8. Global Big Data and Artificial Intelligence Market, Sub-Segmentation of Risk Management, by Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Credit Risk Assessment

- Market Risk Analysis

- Operational Risk Management

- Compliance and Regulatory Risk Management

6.9. Global Big Data and Artificial Intelligence Market, Sub-Segmentation of Supply Chain Management, by Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Demand Forecasting

- Inventory Optimization

- Supplier Risk Management

- Logistics and Transportation Analytics

7-29. Big Data and Artificial Intelligence Market Regional and Country Analysis

30. Big Data and Artificial Intelligence Market Competitive Landscape and Company Profiles

30.1. Big Data and Artificial Intelligence Market Competitive Landscape

30.2. Big Data and Artificial Intelligence Market Company Profiles

30.2.1. Amazon Web Services Inc. Overview, Products and Services, Strategy and Financial Analysis

30.2.2. Microsoft Corporation Overview, Products and Services, Strategy and Financial Analysis

30.2.3. Dell Technologies Inc. Overview, Products and Services, Strategy and Financial Analysis

30.2.4. Intel Corporation Overview, Products and Services, Strategy and Financial Analysis

30.2.5. International Business Machines Corporation Overview, Products and Services, Strategy and Financial Analysis

31. Big Data and Artificial Intelligence Market Other Major and Innovative Companies

31.1. Cisco Systems Inc.

31.2. Oracle Corporation

31.3. Google LLC.

31.4. SAP SE

31.5. Hewlett Packard Enterprise Company

31.6. NVIDIA Corporation

31.7. Salesforce Inc.

31.8. Adobe Inc.

31.9. Infosys Limited

31.10. SAS Institute Inc.

31.11. LTI Mindtree Ltd.

31.12. Teradata Corporation

31.13. QlikTech International AB

31.14. ScienceSoft USA Corporation

31.15. Yalantis

32. Global Big Data and Artificial Intelligence Market Competitive Benchmarking and Dashboard

33. Key Mergers and Acquisitions in the Big Data and Artificial Intelligence Market

34. Recent Developments in the Big Data and Artificial Intelligence Market

35. Big Data and Artificial Intelligence Market High Potential Countries, Segments and Strategies

35.1 Countries Offering Most New Opportunities

35.2 Segments Offering Most New Opportunities

35.3 Growth Strategies

For more information about this report visit https://www.researchandmarkets.com/r/n4vrac

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.