Funding & Business

The New Shape Of AI Acquisitions

In late May, OpenAI quietly announced its $6.5 billion acquisition of Io, a little-known but highly technical company focused on model deployment and orchestration. This deal was interesting not because of the size of the deal. It was what the deal revealed.

The most aggressive buyers in AI are no longer chasing novelty. They are chasing infrastructure. As AI shifts from lab to production, the real battle is not about building models. It is about running them at scale — reliably and securely.

Volume is up, but value is polarized

Across the three half-year periods from H1 2024 to H1 2025, AI M&A volume climbed steadily, reaching 262 deals in the most recent half, Crunchbase data shows. That marks a 35% increase year over year.

On the surface, it looks like a market firing on all cylinders. But the data tells a more nuanced story. The median deal size stayed flat at $67.5 million, while the average soared past $435 million, per Crunchbase data.

That spread is significant. It reflects a bifurcated market. On one end, a small number of strategic infrastructure plays are driving billion-dollar outcomes. On the other, a long tail of smaller, often modest acquisitions is quietly taking place at a steady pace.

That long tail deserves more attention.

These companies tend to be less heavily funded, more capital efficient and focused on solving very specific business needs. Their exits may not make headlines, but they create tangible value for acquirers who need domain expertise, internal automation or edge-case capabilities.

These are disciplined businesses built for sustainability, not spectacle. In many cases, their modest M&A outcomes are not a reflection of failure but a sign of good market fit.

Beyond Big Tech: Strategic buyers step in

While companies such as Nvidia and OpenAI continue to lead in both frequency and deal value, a different class of acquirer is emerging. Mastercard, ServiceNow, Accenture and a growing roster of vertical SaaS players have stepped into the M&A market with strategic intent.

These buyers are not looking for demos or experiments. They are seeking AI that can be embedded, deployed and commercialized inside industries that demand performance and reliability. In sectors like healthcare, legal, financial services and compliance, the startups getting acquired are not pitching bold visions.

They are delivering operational results, often in regulated or high-stakes environments. That makes them highly valuable, even if they fly under the radar.

From novelty to necessity

What we are seeing now is not a trend. It is a reset. AI has matured from a futuristic edge into a commercial foundation. M&A activity reflects that shift.

The startups commanding the most interest are not those with the most powerful models or the flashiest interfaces. They are the ones solving persistent, expensive problems in a way that integrates cleanly into existing systems.

For founders, the lesson is increasingly clear. The real question is not how impressive the tech is. It is how difficult the company would be to replace. Whether the focus is on infrastructure, domain-specific automation or a narrow but mission-critical workflow, the market is rewarding precision and purpose.

These are the quiet wins that will define the next phase of AI.

Itay Sagie is a strategic adviser to tech companies and investors, specializing in strategy, growth and M&A, a guest contributor to Crunchbase News, and a seasoned lecturer. Learn more about his advisory services, lectures and courses at SagieCapital.com. Connect with him on LinkedIn for further insights and discussions.

Related Crunchbase query:

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

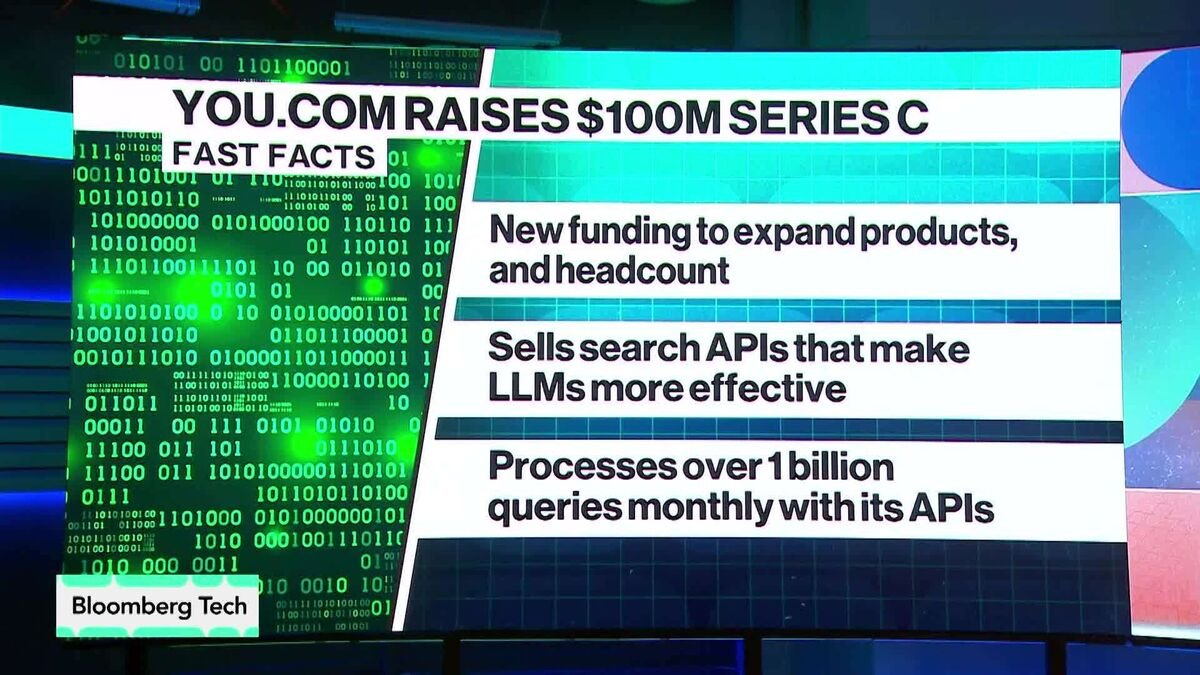

You.com Raises $100 Million to Grow AI Search

You.com has closed a $100 million funding round that values the startup at $1.5 billion. Founder and CEO Richard Socher discusses how the company plans to use the funds and the evolution of search fueled by AI agents with Caroline Hyde and Ed Ludlow on “Bloomberg Tech.” (Source: Bloomberg)

Source link

Funding & Business

Cato Networks to Buy AI Security Startup

Cato Networks plans to buy Aim Security in a bid to boost its AI offering. Cato CEO Shlomo Kramer speaks with Caroline Hyde and Ed Ludlow on “Bloomberg Tech.” (Source: Bloomberg)

Source link

Funding & Business

Rosenbluth on Recent Outperformance of Small-Cap ETFs

TMX VettaFi Head of Research Todd Rosenbluth discusses the recent outperformances of small-cap ETFs with Eric Balchunas, Katie Greifled and Scarlet Fu on ‘ETF IQ.’ (Source: Bloomberg)

Source link

-

Business5 days ago

Business5 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Education2 months ago

Education2 months agoAERDF highlights the latest PreK-12 discoveries and inventions