Funding & Business

The Big 5 Still Aren’t Buying Many Startups

If the five most-valuable U.S. technology companies want to buy startups, they can certainly afford to do so.

Today, the Big Five — Nvidia, Apple, Microsoft, Alphabet and Amazon — have a combined market capitalization of more than $16 trillion. They’ve also got close to $400 billion in cash on the books between them.

Even with that massive spending power, however, the largest tech companies have not bought many startups this year. Per Crunchbase data, they’ve disclosed just 10 deals to purchase private seed or venture-funded companies.

This doesn’t reflect a change in M&A appetite. Rather, It’s a continuation of a trend toward fewer acquisitions that’s persisted for a few years, as charted below.

Wiz is the one really big deal amid several smaller ones

Before we push the slow M&A narrative any further, however, it would be remiss not to mention that this year’s tally does include the largest planned startup acquisition of all time. That would be Google’s agreement, announced in March, to buy cloud security provider Wiz for $32 billion in cash.

It’s not a done deal, as the transaction still faces scrutiny from antitrust regulators. It may help that Google is planning to buy a cybersecurity company, and not, say, a giant acquisition of a search engine or advertising platform. But still, the sheer dollar size means some pushback is likely.

Meanwhile, among the rest of this year’s disclosed Big Five startup acquisitions, listed below, none comes with a reported price.

Still, these could be big deals, and there could be more

Some deals without disclosed prices still do involve companies that previously raised quite a bit of funding and likely sold for good-sized sums.

For instance, Gretel, a synthetic data platform for AI, raised about $68 million in seed and early-stage funding before selling to Nvidia in March. And Axio, a Bangalore-based fintech startup, raised more than $200 million in debt and equity before selling to Amazon early this year.

In other cases, the Big Five snapped up companies still in seed stage. This spring, for instance, Google snatched up design startup Galileo AI, which had raised a few million in seed funding. And Amazon snagged Bee, the seed-backed developer of an AI-enabled wearable.

It’s also likely there were more acquisitions we haven’t heard about. It’s not impossible for a tech giant to pick up a seed-stage or stealth startup without an announcement or attracting attention, if it so desires.

Also, because the Big Five are so valuable, they may not have to disclose details for acquisitions that might qualify as significant and require reporting for a smaller company.

Other strategies: partnerships and wooing startup talent

Of course, tech giants don’t need to buy a company to have a stake in it or otherwise benefit from its success.

All of the Big Five are prolific startup investors. That includes leading several of the larger GenAI financings and taking equity stakes as well as forming partnership agreements.

They’re also big acquirers of talent and have ways to pursue this goal without buying companies outright. Last year, for example, Microsoft drew headlines when it lured two co-founders of GenAI startup Inflection AI away from the company, hired most of its 70-person staff, and licensed its technology.

The new normal?

If something that looks like a trend or cycle persists long enough, it’s logical to conclude that it might instead be the new normal. This is one interpretation of the persistent slow pace of startup acquisitions by the Big Five.

While a couple decades ago, getting acquired by one of the top tech giants was an oft-discussed startup exit path, that strategy now looks passé. After all, the Big Five have plenty of reasons not to do an acquisition, including regulatory and compliance burdens and the prospect of antitrust pushback. Additionally, they can pay whatever it takes to simply license a technology or lure top talent.

So far, there’s zero indication that public markets care about the Big Five’s slow M&A pace. Companies don’t get valuations in the trillions because investors are pessimistic about their prospects.

Related Crunchbase query:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

Botswana Has Credit Rating Cut by S&P on Diamond Slump

Botswana’s credit rating was cut by S&P Global Ratings, another blow to its diamond-dependent economy that’s struggling with a slump in demand for its gems.

Source link

Funding & Business

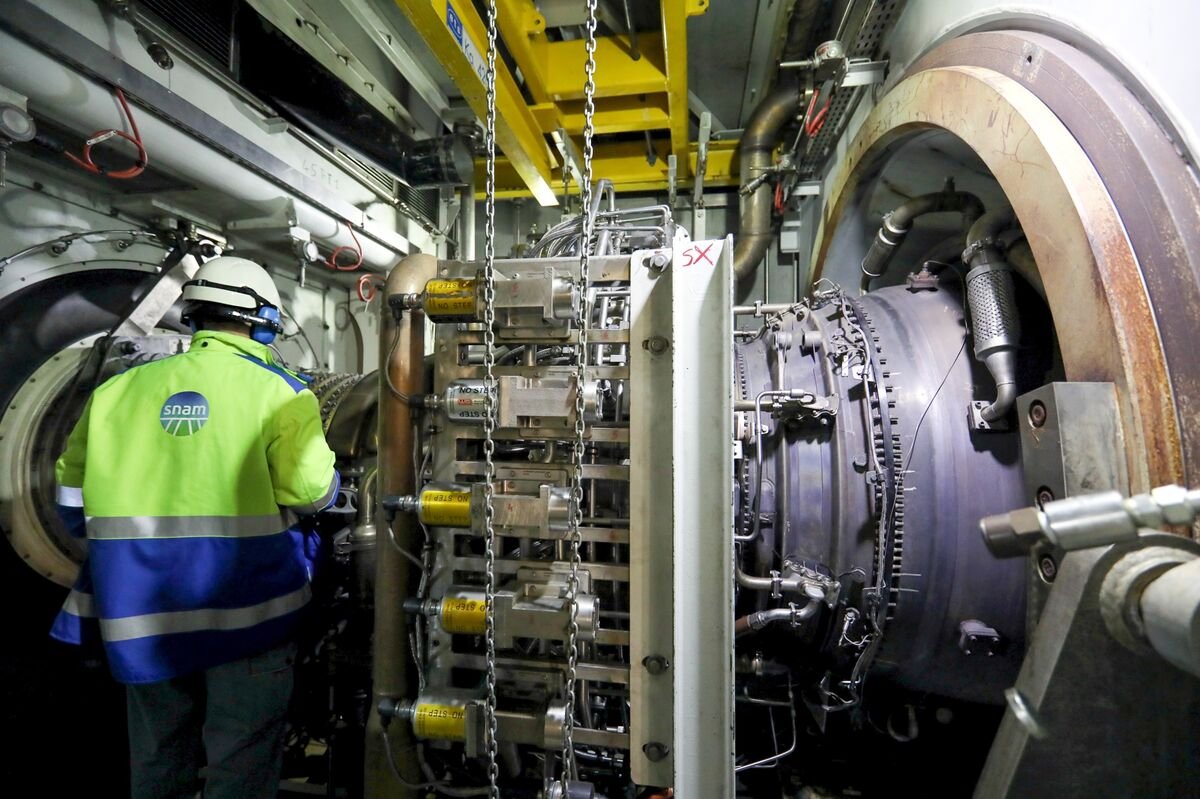

Italy’s Snam Plans to Delay Open Grid Europe Deal, Sole Says

Snam SpA’s purchase of a stake in German gas network operator Open Grid Europe from Abu Dhabi’s Infinity Investments is unlikely to close this month as planned, Il Sole 24 Ore reported.

Source link

Funding & Business

<strong>Vaneer Bhansali on Losing Fed Independence as the Biggest Tail Risk Right Now</strong>

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries