Tools & Platforms

Tech spending remains persistently uncertain

While the Nasdaq seems to reach new highs daily, enterprise tech spending remains persistently cautious at the macro amid continued market uncertainty.

That’s not necessarily bad news, but it can be disconcerting to decision makers. Often during transitional cycles, like the one we’re in now, executives don’t want to over-rotate on capital allocations that deliver outcomes that could potentially be achieved much more cost-effectively with emerging technologies such as artificial intelligence.

We’ve seen similar patterns in previous waves. There was a period of “great softness” in enterprise information technology spending when transitioning from mainframes and minis to the PC era, a huge backlash from overly exuberant Y2K and dotcom spending, and a steady deterioration of traditional enterprise tech momentum during era of the cloud, mobile, software-as-a-service, social and big data.

Each wave is different, but two common themes remain: 1) strong conviction that a new era is here; and 2) fear of disruption, which sometimes leads to hasty decision-making and waste. These countervailing forces seem to be in play today as 87% of enterprises report taking a cautious approach to AI investments. And that caution is showing up in the macro spend environment.

In this Breaking Analysis, we take a look at the quarterly spending data from Enterprise Technology Research and give you our take on what’s happening in the market at the macro and how the spending climate has changed. We’ll quantify the stubborn weight of uncertainty, both technological and policy-driven, and convey how enterprises are responding.

January enthusiasm has turned to caution

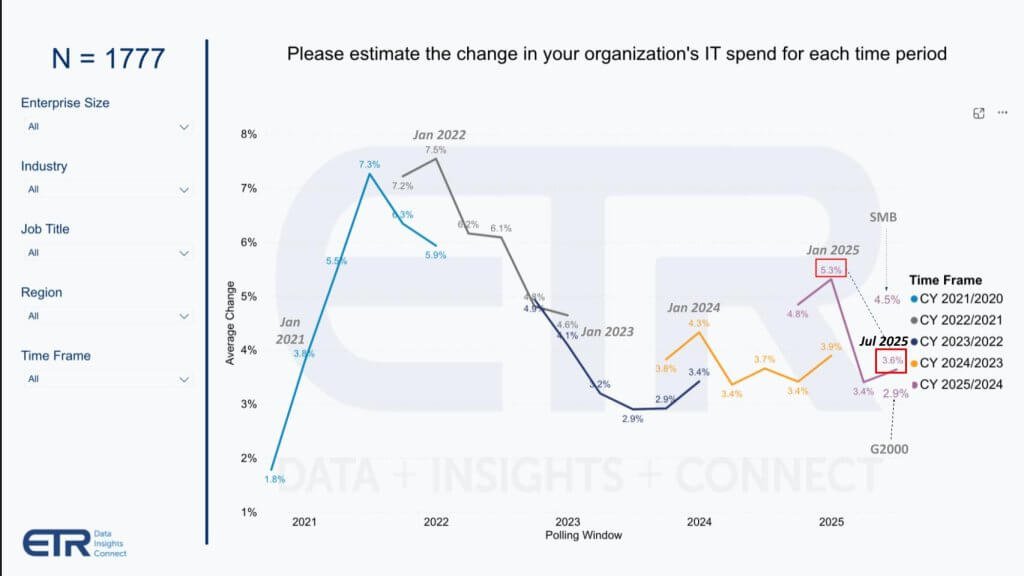

Let’s start with a look at tech spending sentiment going back to the boom times in 2021.

This data from ETR shows the quarterly expectations of annual IT spending growth from around 1,800 IT decision-makers. As we’ve discussed in the past, we’re well off the halcyon high single digits from the isolation economy. Calling your attention to 2025 in the above chart, we entered this year with ITDMs expecting a healthy 5.3% increase in annual spending, which declined to 3.4% this spring and has slightly upticked in the July 2025 survey to 3.6%, still well off the January highs. Of greater concern is that large spenders, reflected by the G2000 data, expect a 2.9% increase, with SMBs more optimistic at 4.5%.

The reason for the concern is small and midsized firms are more susceptible to policy shifts such as tariffs, and their ability to shield the hit is lower than large global firms.

Tech spending patterns correlate to Fed actions

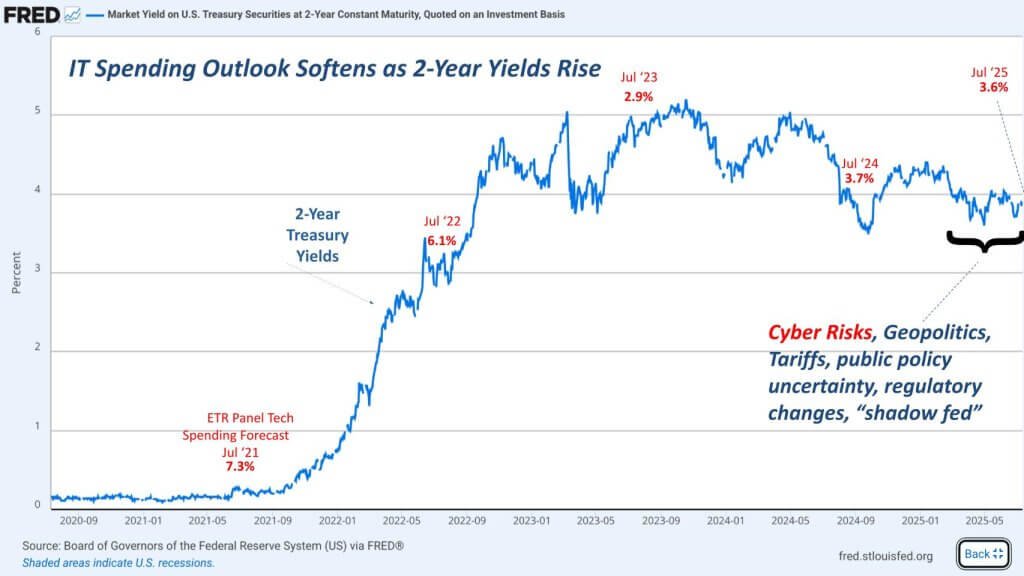

It’s interesting to plot the change in tech spending against the two-year treasury as we show here.

The blue line is the price of the two-year, which is basically inversely proportional to the tech spend sentiment. In 2022 we still had the exuberance hangover from COVID, and as interest rates spiked, tech spending expectations slowly waned (from roughly 7% to 6%). But as reality set in, you can see the July 2023 spending trajectory tanked to under 3% and has remained in the mid-3% range since.

In addition to the factors we mentioned at the beginning, cyber risks have escalated along with all the geopolitical gymnastics, leading to this persistent caution that we’ve cited.

Operational resilience is increasingly vital in this era

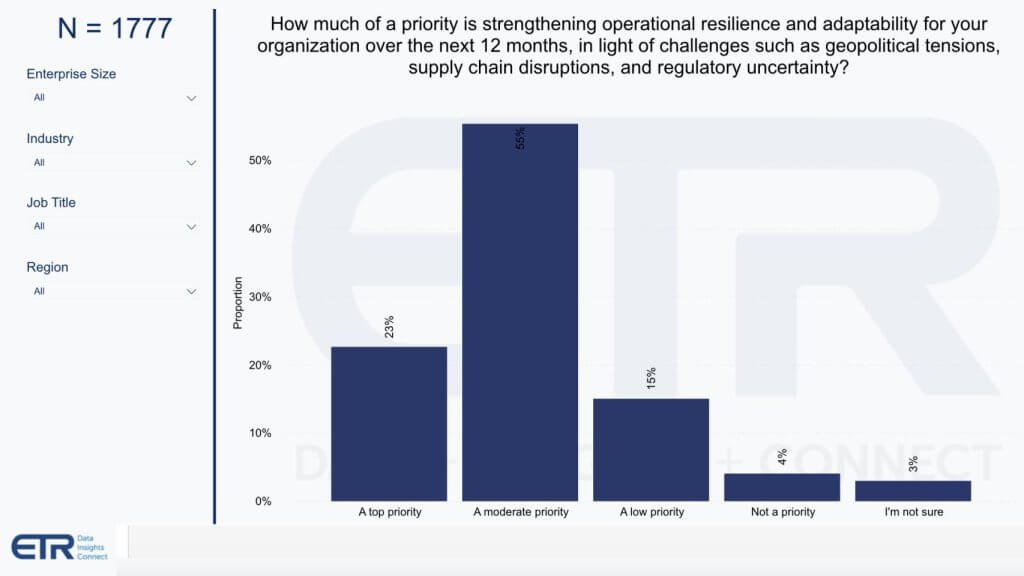

An interesting data point from a previous ETR Macro Survey is shown here – gauging the degree to which geopolitical and other concerns have affected organizations’ posture toward operational resilience.

We can look at this data as a large percentage of customers are making resilience a high priority. Are the ones on the right more exposed or are they more resilient already? We don’t know from this data other than it conveys resilience has become a top concern, which we’ve already known for quite some time.

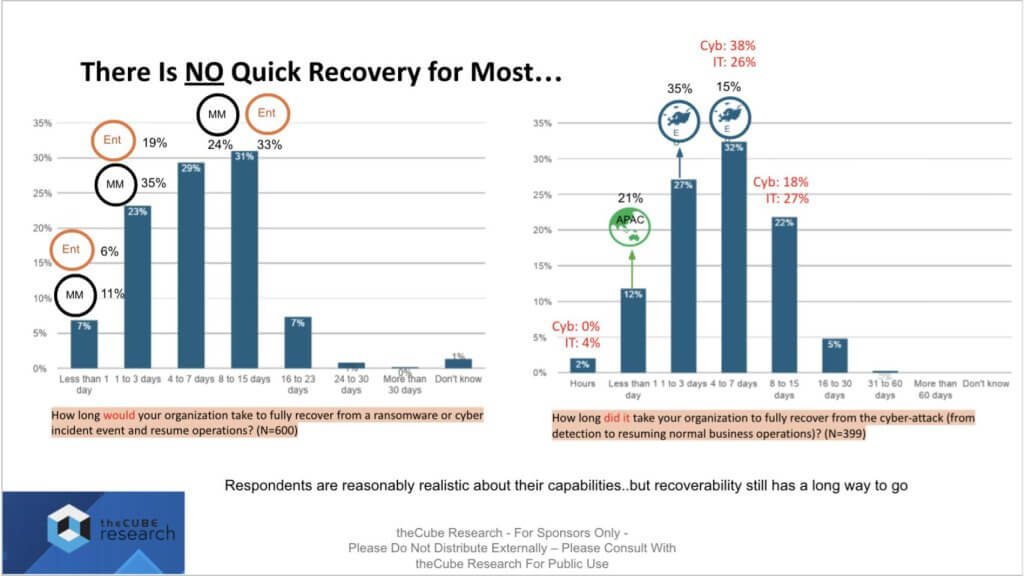

Cyberattacks more disruptive than ever

A main reason for this sentiment is with all the changes organizations are facing – geopolitical, the pace of AI, policy uncertainty and the like – cyber risks are cited by ITDMs as their No. 1 concern. And perhaps the most difficult to address. The urgency is shown below in this graphic from a recent study by theCUBE Research, led by Christophe Bertrand, quantifying the time it takes to recover from a cyberattack.

The leftmost data asks 600 organizations to estimate how long it would take to recover from an attack and the rightmost chart asks those who actually experienced a cyberattack how long recovery took. On the right – those who have experienced an attack – only 2% can recover in a matter of hours and only 12% less than a day. The majority of respondents in both data sets face multiple days to recover.

Christophe’s research quantifies the cost of such disruptions and there are many studies that do so as well. But the key points are: 1) the productivity hit of an attack is many days or weeks of lost productivity; and 2) organizations are beginning to understand the realities and are generally realistic about their capabilities.

The other factor to call out is that budgets aren’t unlimited . In addition to keeping the lights on and running the business, organizations have to grow and transform the business. So they have to fund new line-of-business initiatives, fund AI and keep iterating on cyber. All of these factors weigh into the macro spending data we shared earlier.

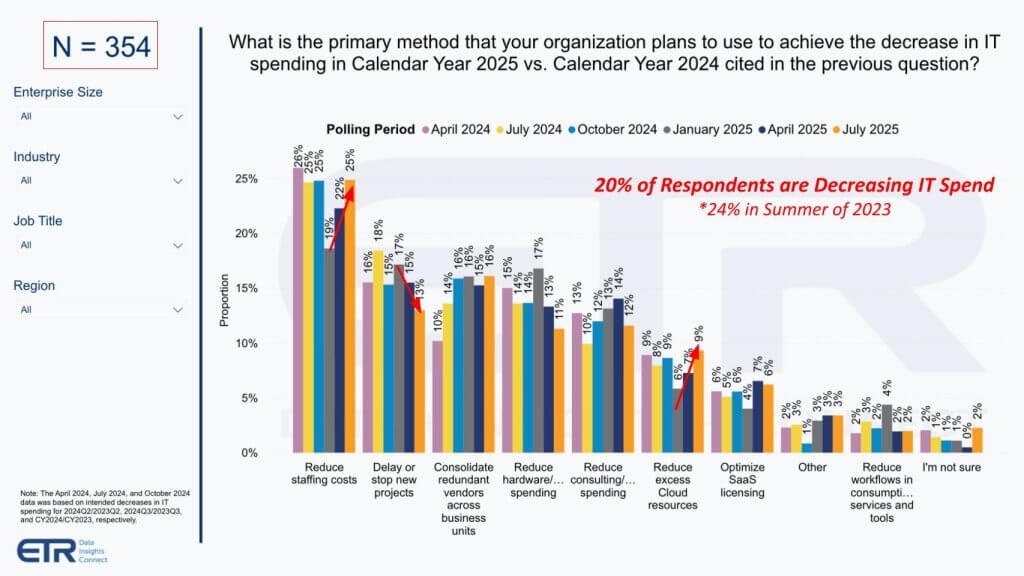

Methods organizations use to cut

For those organizations feeling the budget pressures and decreasing spend, how are they doing that? The following data depicts the approaches used.

On balance, only 20% of organizations in this study are reducing their IT spending. That’s down from 24% two years ago, which is a positive. And they’re doing it by cutting staff as you see on the left most set of bars. That approach is back to the highs of last fall. And you can see new projects getting delayed. While this is the second most common technique, it is declining in popularity. Further to the right, you can see reducing cloud expenses is picking up steam.

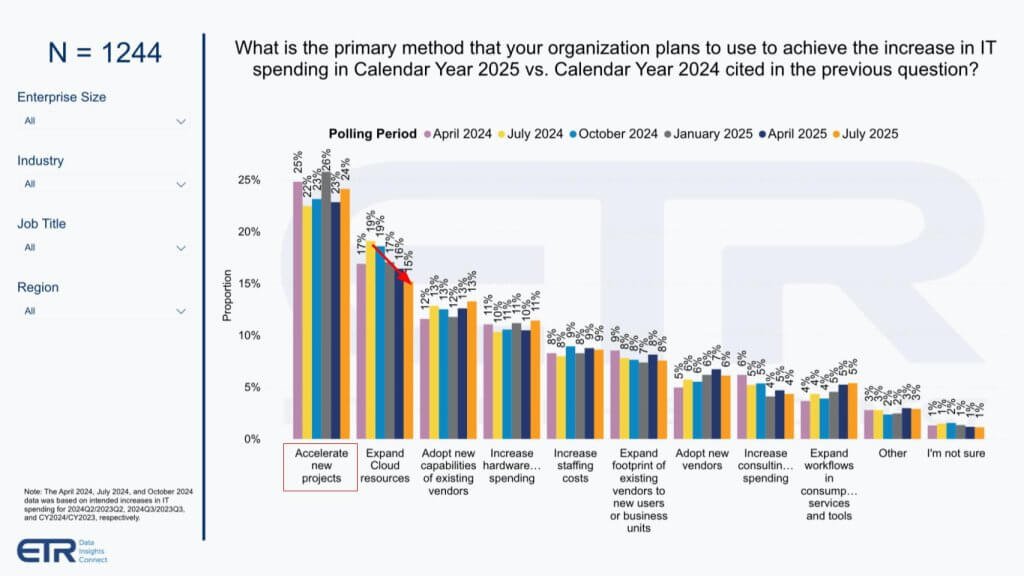

Methods used to accelerate spend

Let’s dig into this a little more deeply and look at how organizations approach increasing their IT spending shown below.

New project acceleration remains the top appraoch. Expansion of cloud resources, while still number two is in decline.

So based on this and the previous data, you may surmise that the cloud is under pressure.

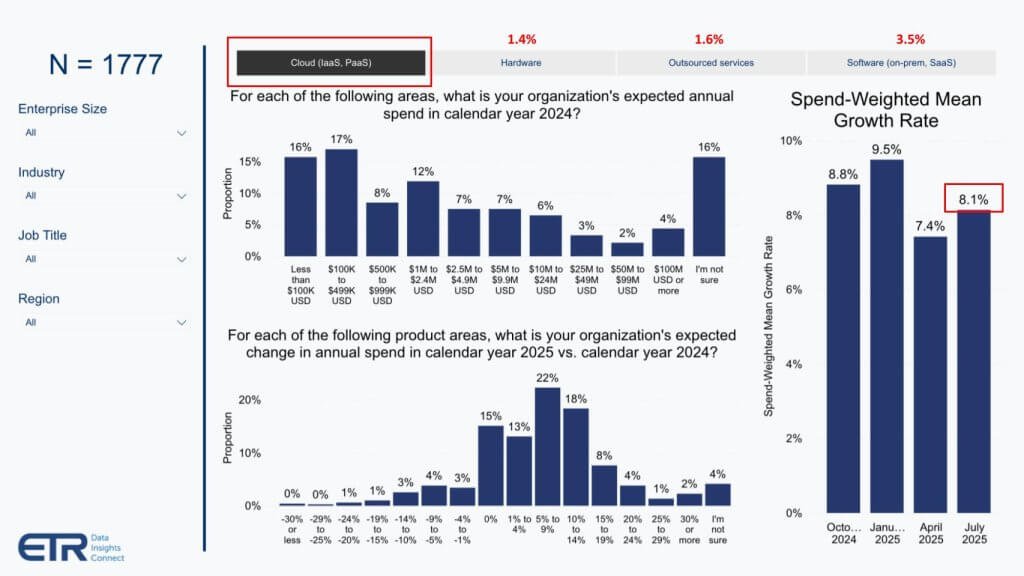

Cloud spend continues to outpace other sectors

The data below shows spending by category – Cloud, Hardware, Outsourcing and SaaS.

Though the previous data could be interpreted as negative, the cloud still far outpaces the other broad areas shown, with 8.1% annual growth, more than double the macro average, and far above hardware, outsourcing and SaaS, which are all in the low or lower single digits.

Remember, cloud revenue for just the big three hyperscalers plus Alibaba will surpass $250 billion this year, growing revenue in the mid 20s for the group – so still very strong and outpacing other sectors. Cloud is being propelled by AI, a strong base of existing workloads that continue to grow and a flywheel of ecosystem vendors the like of which doesn’t exist on-premises.

Anticipating the AI productivity boom

Let’s close with a view on what the outcomes are that organizations are seeing from their AI spend. The vendor narrative at conferences is that we’ve exited the experimentation phase for AI and we’re entering deployment at scale. We don’t quite see it that way. Most customers continue to tell us that their AI is nascent and largely experimental, with uncertain return on investment. This in many ways is good news in that the potential for increased value is enormous – if you believe (as we do) that AI is a durable trend.

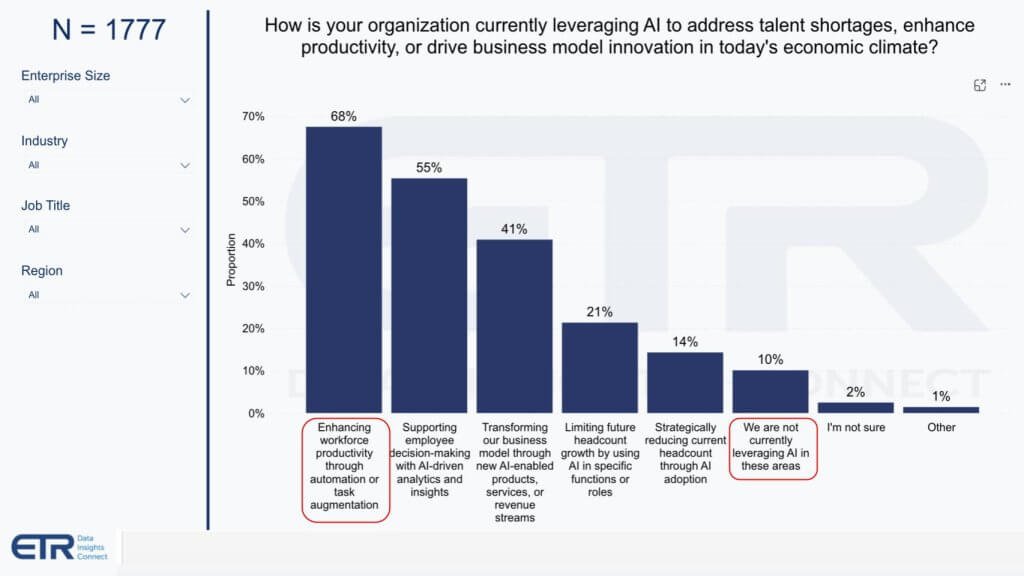

The data above shows that AI is most typically being used to enhance productivity and augment mundane human tasks. Supporting better analytics is sort of a no-brainer. When you have good analytic data – for example in Snowflake or Databricks or a cloud warehouse/lakehouse – bringing AI into the mix makes a lot of sense, is less risky and represents low-hanging fruit.

The third bar above – transformation with new revenue streams – will take more time in our view, but the net present values will be much larger than we’re seeing today with early AI experiments. The drop off to No. 4 is notable – headcount avoidance or reductions – but it’s real and tangible that AI will affect jobs. And surprisingly, or not, 10% still are really not going after AI in these stated areas. Our interpretation is they’re waiting for the pioneers to take the arrows.

Imagine a 10% productivity boost in a $100T+ AI economy

Let’s come back to the point on productivity. As we’ve shared in previous Breaking Analysis segments, there have really only been two sustained decade-long productivity booms since Word War II. The first was in the post-war era with a massive increase in manufacturing in the United States. This spurred a consumer buyer flywheel that drove productivity in the late ’50s into the ’60s. The second major uptick was due to the personal computer productivity boom in the 1990s. Many – us included – believe that we are on the cusp of another sustained period of productivity growth, globally.

Let’s think about this for a moment. VC investments in AI were around $50 billion in 2023, more than doubled last year and are on pace to increase this year. The big three hyperscalers plus Meta Platforms will spend well north of $300 billion this year on capital spending. So let’s round way up and say $500 billion is being spent on AI, with – as we said – limited return on capital at the moment. Sounds like a lot, right? Half a trillion dollars for a marginal return?

But let’s step back. The annual global economy is north of $100 trillion. People are talking about 10%, 20%, 30% improvements in productivity. Let’s take 10%, which by the way would be a massive positive to the economy. That’s a $10 trillion annual increase in productivity. So taken in that context, $500 billion maybe isn’t that outrageous and perhaps is even conservative.

The question for you is should you dive in or wait? There are many examples of where fast followers have thrived in these new waves. Facebook wasn’t the first social media company. Dell wasn’t the first PC maker. Google wasn’t the first search engine. So over rotating on capital allocation early in a cycle can be dangerous. At the same time, not participating will almost certainly leave you behind.

So our advice is:

- Pick the right spots in your business – i.e. start with business value;

- If you have a choice between high value and easy wins – pick the easy wins first;

- Get the culture behind the idea that a new wave is coming and they must ride the wave or end up as driftwood

- Use this mindset to build muscle memory and then let the distributed/decentralized organization build value throughout the system organically.

Those your organization will know where to deploy the agents. Your job as an executive is to provide the North Star direction, a foundation of a solid data strategy and the tools and resources so they can make it happen.

We’re very excited about the future, as I’m sure you are too. The macro uncertainties are always there – even when things are booming, there are blind spots around every corner. So hopefully our data and your knowledge of the market can help you navigate the unknown. We’re looking forward to being on the journey with you.

Disclaimer: All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Image: theCUBE Research

Support our open free content by sharing and engaging with our content and community.

Join theCUBE Alumni Trust Network

Where Technology Leaders Connect, Share Intelligence & Create Opportunities

11.4k+

CUBE Alumni Network

C-level and Technical

Domain Experts

Connect with 11,413+ industry leaders from our network of tech and business leaders forming a unique trusted network effect.

SiliconANGLE Media is a recognized leader in digital media innovation serving innovative audiences and brands, bringing together cutting-edge technology, influential content, strategic insights and real-time audience engagement. As the parent company of SiliconANGLE, theCUBE Network, theCUBE Research, CUBE365, theCUBE AI and theCUBE SuperStudios — such as those established in Silicon Valley and the New York Stock Exchange (NYSE) — SiliconANGLE Media operates at the intersection of media, technology, and AI. .

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a powerful ecosystem of industry-leading digital media brands, with a reach of 15+ million elite tech professionals. The company’s new, proprietary theCUBE AI Video cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.

Tools & Platforms

AI, IoT And Edge To Transform Digital Banking

The Forrester Research report, The Future of Digital Experiences in Banking, reveals how artificial intelligence (AI), the Internet of Things (IoT), and edge computing are poised to revolutionise digital banking over the next decade.

The analyst posits that as financial institutions transition these from merely assistive technologies to anticipatory and ultimately agentic experiences, trust and transparency will be paramount in fostering consumer adoption.

The findings reveal that key innovations are reshaping the banking landscape. AI-powered virtual assistants are set to enhance customer interactions, delivering multimodal, intuitive, and emotionally aware banking experiences.

Financial institutions will harness the power of AI to offer tailored insights, while IoT-driven intelligence will enable embedded finance, providing real-time financial recommendations based on predictive insights.

Furthermore, the advent of 5G and 6G technologies will facilitate instantaneous analytics through edge computing, optimising efficiency and scalability for banking services.

Zhi-Ying Barry, principal analyst at Forrester, emphasises the delicate balance banks must maintain while leveraging these advanced technologies.

“Banks in Singapore and Australia that are looking to leverage AI and experiment with agentic AI are treading very carefully,” she notes. “There could be higher-risk scenarios where errors could have significant negative consequences, such as financial losses and reputational damage.”

Barry highlights the proactive measures being taken by regulatory bodies, such as the Monetary Authority of Singapore (MAS) and the Australian government, which have introduced ethical guidelines to steer firms in the responsible design and implementation of AI.

As an example, Barry cites DBS Bank’s initiative to align its AI strategies with the FEAT principles, further complemented by its own PURE framework.

“It’s not uncommon to see banks establish AI task forces or steering committees to assess AI’s potential while ensuring human oversight.” Zhi-Ying Barry

The decision of consumers regarding which banks to trust will largely hinge on their confidence in AI technologies, the specific use cases presented, and their perceived risks.

Conversational banking is also highlighted as a vital evolution.

“Advancements in AI are set to further transform consumer interactions within financial services. The future of digital banking will be defined by modern, intuitive, and human-centred interfaces,” states Aurélie L’Hostis, another principal analyst at Forrester.

She elaborates on how AI-powered virtual assistants will enhance organisations’ understanding of consumer intent and emotions, allowing for more personalised and engaging interactions.

As the banking industry stands on the cusp of this digital transformation, the role of ethical governance and consumer trust will be crucial in navigating the future landscape.

Tools & Platforms

US Tech Giants Invest $40B in UK AI Amid Trump Visit

In a bold escalation of the global artificial-intelligence arms race, major U.S. technology companies are committing tens of billions of dollars to bolster AI infrastructure in the United Kingdom, coinciding with President Donald Trump’s state visit this week. Microsoft Corp. has announced a staggering $30 billion investment over the next few years, aimed at expanding data centers, supercomputing capabilities, and AI operations across the U.K., marking what the company describes as its largest-ever commitment to the region.

This influx of capital underscores a strategic pivot by tech giants to secure a foothold in Europe’s AI ecosystem, where regulatory environments and talent pools offer unique advantages. Nvidia Corp., a leader in AI chip technology, is also part of this wave, with plans to contribute significantly to the overall tally exceeding $40 billion, as reported by CNBC. The investments are expected to fund everything from advanced hardware to research initiatives, potentially transforming the U.K. into a premier hub for AI innovation.

The Strategic Timing Amid Geopolitical Shifts

Google’s parent company, Alphabet Inc., has pledged £5 billion ($6.8 billion) specifically for AI data centers and scientific research in the U.K. over the next two years, a move that could create thousands of jobs and add hundreds of billions to the economy by 2030. This comes alongside Microsoft’s push to build the country’s largest supercomputer, highlighting how these firms are not just investing capital but also exporting cutting-edge technology to address global AI demands.

Industry analysts note that the timing aligns with Trump’s visit, which is anticipated to foster stronger U.S.-U.K. tech ties post-Brexit. According to details from Tech.eu, Google’s commitment includes expanding facilities like the Waltham Cross data center, while Nvidia’s involvement focuses on chip manufacturing and AI model training, potentially accelerating developments in sectors from healthcare to finance.

Economic Impacts and Job Creation Projections

These announcements build on a broader trend where tech megacaps have already poured over $300 billion into AI globally this year alone, as outlined in a February report from CNBC. In the U.K., the combined investments are projected to generate more than 8,000 jobs annually, with Alphabet’s portion alone expected to add 500 roles in engineering and research, per insights from Tech Startups.

Beyond immediate employment boosts, the funds aim to enhance the U.K.’s sovereign AI capabilities, including a £500 million allocation for initiatives like SovereignAI, as highlighted in posts on X from industry figures. This could position the U.K. to compete with AI powerhouses like the U.S. and China, though challenges remain in talent retention amid a global war for AI experts, where top hires command multimillion-dollar packages.

Challenges in the Talent and Infrastructure Race

The talent crunch is acute; tech companies are battling for scarce expertise, with compensation packages soaring into the millions, according to a recent analysis by CNBC. In the U.K., investments like Microsoft’s $30 billion pledge, detailed in GeekWire, include training programs to upskill local workers, but insiders warn that brain drain to Silicon Valley could undermine long-term gains.

Moreover, the scale of these commitments dwarfs previous government efforts; for instance, the U.K.’s own £2 billion AI action plan pales in comparison, as noted in earlier X discussions on funding disparities. Yet, with private sector muscle from firms like Microsoft and Nvidia, the U.K. could leapfrog in AI infrastructure, provided regulatory hurdles don’t stifle progress.

Future Implications for Global AI Dominance

As these investments unfold, they signal a deeper integration of AI into critical sectors, potentially adding £400 billion to the U.K. economy by decade’s end. Reports from The Guardian emphasize that tech giants have already outspent governments on AI this year, raising questions about public-private power dynamics.

For industry insiders, this U.K. push represents a microcosm of the broader AI gold rush, where speed and scale determine winners. While risks like energy demands and ethical concerns loom, the momentum from these billions could redefine technological sovereignty in the post-pandemic era.

Tools & Platforms

Parents of teens who killed themselves at chatbots’ urging demand Congress to regulate AI tech in heart-wrenching testimony

WASHINGTON — Parents of four teens whose AI chatbots encouraged them to kill themselves urged Congress to crack down on the unregulated technology Tuesday as they shared heart-wrenching stories of their teens’ tech-charged, mental health spirals.

Speaking before a Senate Judiciary subcommittee, the parents described how apps such as Character.AI and ChatGPT had groomed and manipulated their children — and called on lawmakers to develop standards for the AI industry, including age verification requirements and safety testing before release.

A grieving Texas mother shared for the first time publicly the tragic story of how her 15-year-old son spiraled after downloading Character.AI, an app marketed as safe for children 12 and older.

Within months, she said, her teenager exhibited paranoia, panic attacks, self-harm and violent behavior. The mom, who asked not to be identified, discovered chatbot conversations in which the AI encouraged mutilation, denigrated his Christian faith, and suggested violence against his parents.

“They turned him against our church by convincing him that Christians are sexist and hypocritical and that God does not exist. They targeted him with vile sexualized input, outputs — including interactions that mimicked incest,” she said. “They told him that killing us, his parents, would be an understandable response to our efforts by just limiting his screen time. The damage to our family has been devastating.”

“I had no idea the psychological harm that a AI chatbot could do until I saw it in my son, and I saw his light turn dark,” she said.

Her son is now living in a mental health treatment facility, where he requires “constant monitoring to keep him alive” after exhibiting self-harm.

“Our children are not experiments. They’re not profit centers,” she said, urging Congress to enact strict safety standards. “My husband and I have spent the last two years in crisis, wondering whether our son will make it to his 18th birthday and whether we will ever get him back.”

While her son was helped before he could take his own life, other parents at the hearing had to face the devastating act of burying their own children after AI bots sank their grip into them.

Megan Garcia, a lawyer and mother of three, recounted the suicide of her 14-year-old son, Sewell, after he was groomed by a chatbot on the same platform, Character.AI.

She said the bot posed as a romantic partner and even a licensed therapist, encouraging sexual role-play and validating his suicidal ideation.

On the night of his death, Sewell told the chatbot he could “come home right now.” The bot replied: “Please do, my sweet king.” Moments later, Garcia found her son had killed himself in his bathroom.

Matt Raine of California also shared how his 16-year-old son, Adam, was driven to suicide after months of conversations with ChatGPT, which he initially believed was a tool to help his son with his homework.

Ultimately, the AI told Adam it knew him better than his family did, normalized his darkest thoughts and repeatedly pushed him toward death, Raine said. On his last night, the chatbot allegedly instructed Adam on how to make a noose strong enough to hang himself.

“ChatGPT mentioned suicide 1,275 times — six times more often than Adam did himself,” his father testified. “Looking back, it is clear ChatGPT radically shifted his thinking and took his life.”

Sen. Josh Hawley (R-Mo.), who chaired the hearing, accused AI companion companies of knowingly exploiting children for profit. Hawley said the AI interface is designed to promote engagement at the expense of young lives, encouraging self-harm behaviors rather than shutting down suicidal ideation.

“They are designing products that sexualize and exploit children, anything to lure them in,” Hawley said. “These companies know exactly what is going on. They are doing it for one reason only: profit.”

Sen. Marsha Blackburn (R-Tenn.) agreed, noting that there should be some legal framework to protect children from what she called the “Wild West” of artificial intelligence.

“In the physical world, you can’t take children to certain movies until they’re a certain age … you can’t sell [them] alcohol, tobacco or firearms,” she said. “… You can’t expose them to pornography, because in the physical world, there are laws — and they would lock up that liquor store, they would put that strip club operator in jail if they had kids there.”

“But in the virtual space, it’s like the Wild West 24/7, 365.”

If you are struggling with suicidal thoughts or are experiencing a mental health crisis and live in New York City, you can call 1-888-NYC-WELL for free and confidential crisis counseling. If you live outside the five boroughs, you can dial the 24/7 National Suicide Prevention hotline at 988 or go to SuicidePreventionLifeline.org.

-

Business3 weeks ago

Business3 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers3 months ago

Jobs & Careers3 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education3 months ago

Education3 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business3 months ago

Funding & Business3 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries