For information on reprint rights or other inquiries, please contact reprints@cbinsights.com.

Funding & Business

State of Insurtech Q1’25 Report

From a new $1B unicorn to a 9-year low for early-stage funding, we break down the trends reshaping insurtech using CB Insights data.

The insurtech landscape is increasingly competitive. Median deal sizes are down, and early-stage insurtech funding is at a nearly 9-year low, despite a rebound in global insurtech funding to $1.3B in Q1’25.

Insurtech does not exist in a vacuum, and the broader venture environment is centered on AI funding. In Q1’25, OpenAI raised nearly 31 times the total funding of all insurtechs combined, underscoring where capital is flowing.

AI capabilities are poised to reshape the future of insurance — whether through 100-day-old startups or 100-year-old incumbents adapting to a new competitive reality.

Download the full report to access comprehensive data and charts on the evolving state of insurtech.

Key takeaways from the report include:

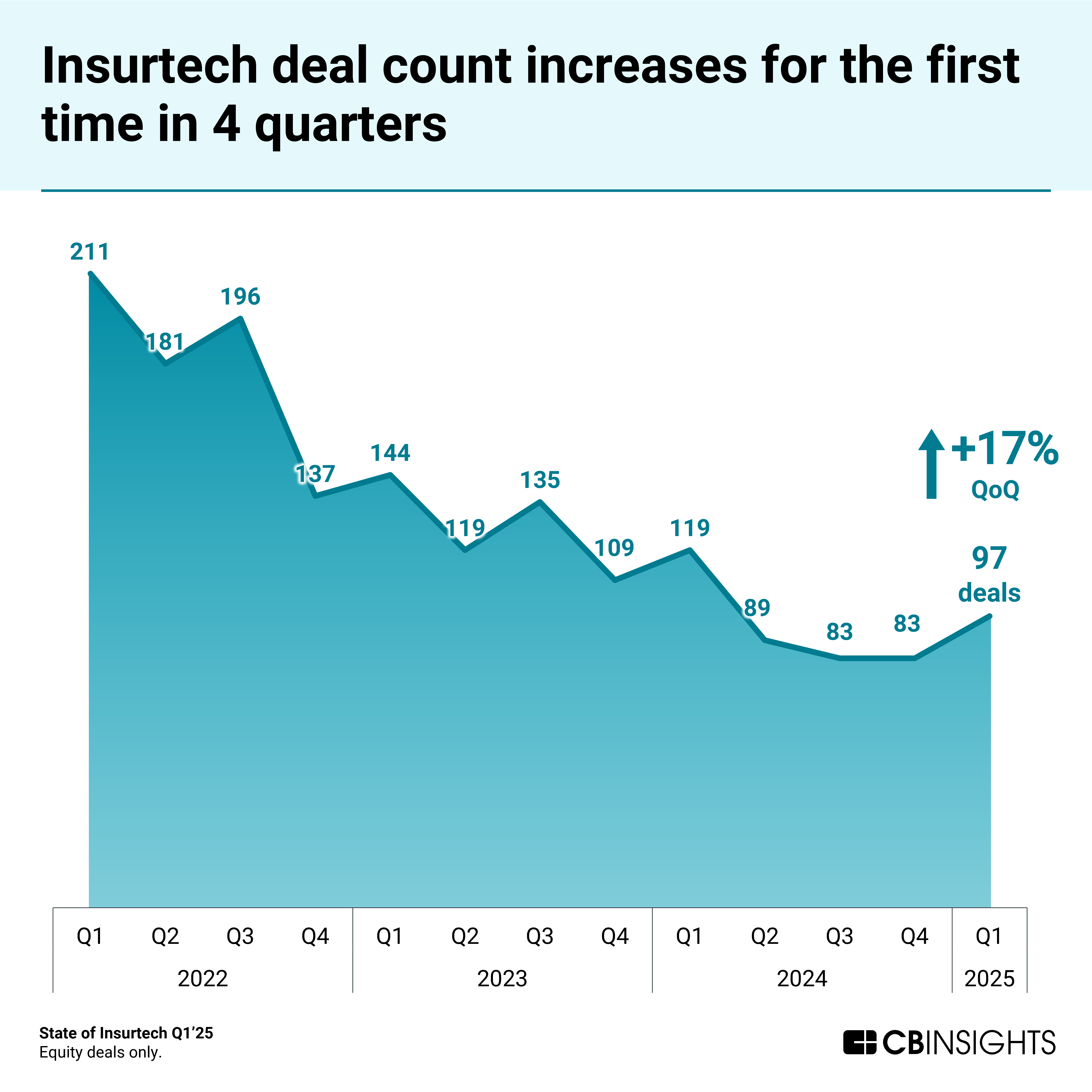

- Insurtech dealmaking increases for the first time in a year. Global insurtech deal count increased 17% quarter-over-quarter (QoQ), from 83 in Q4’24 to 97 in Q1’25. Property & casualty insurtech drove the increase, from just 51 deals — a near 8-year low — in Q4’24 to 70 in Q1’25.

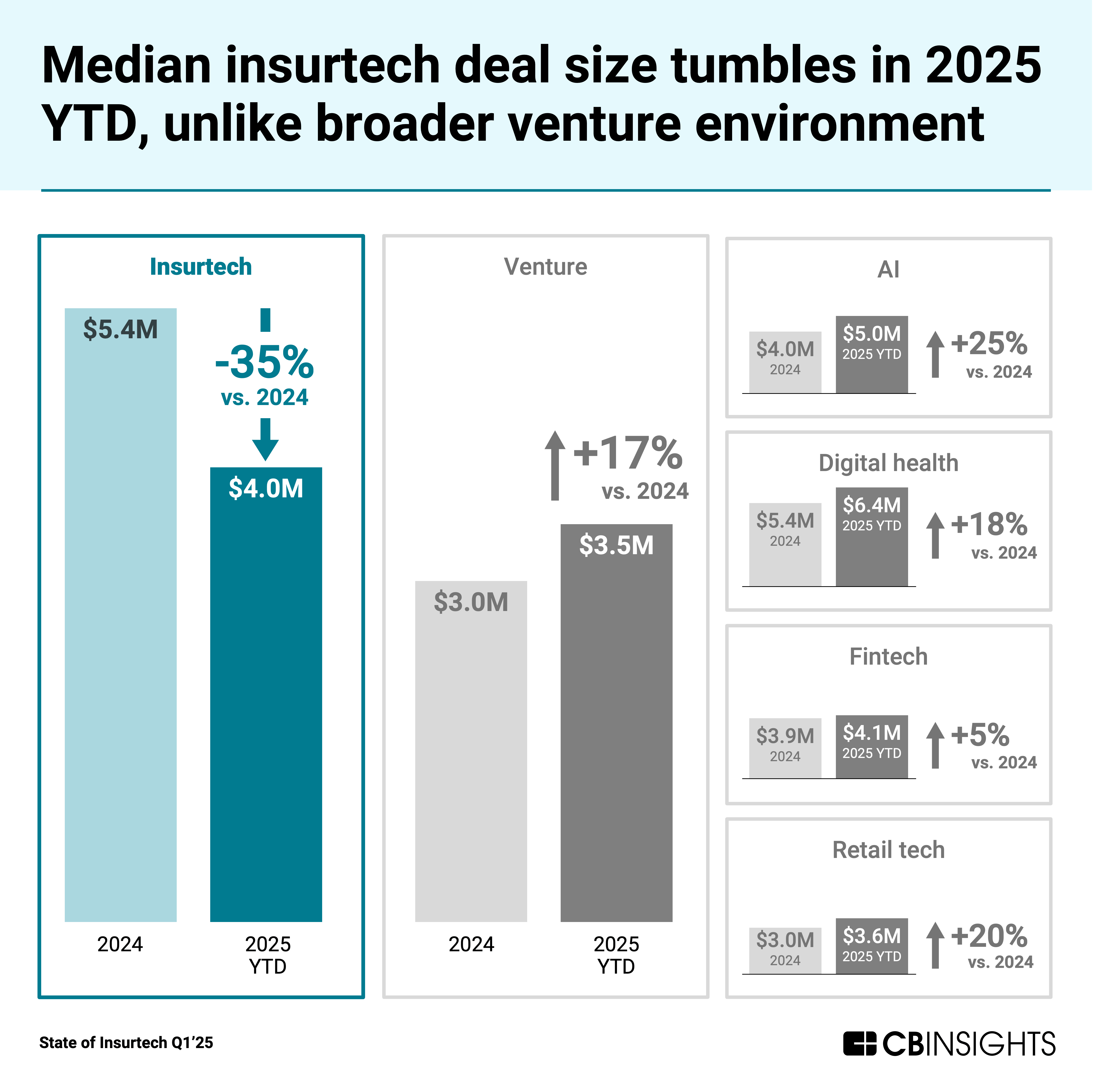

- Median insurtech deal size tumbles 35% in 2025 YTD (year to date) to $4.0M. The median insurtech deal size has not been lower since 2019 ($3.4M). The decline stands out because median deal sizes across the broader venture environment rose 17% YTD to $3.5M, while insurtech’s fell.

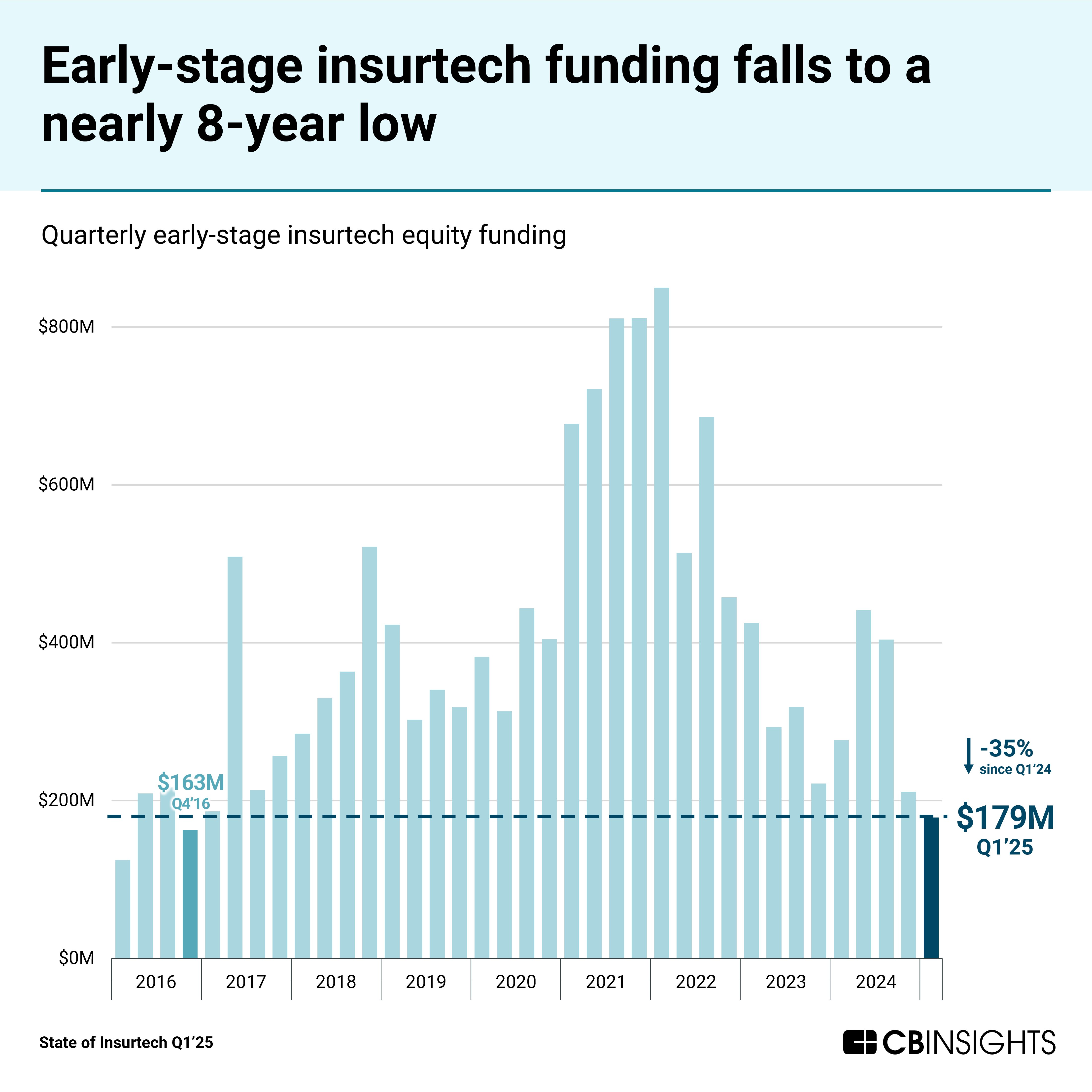

- Early-stage insurtech funding reaches a nearly 8-year low — $179M. Early-stage insurtech funding fell 35% year-over-year (YoY) from $277M in Q1’24.

- Late-stage insurtech dealmaking paints a cautious growth picture. The 7 insurtechs that raised Series D+ deals in Q1’25 saw median headcount growth of just 3% over the past 12 months — far lower than insurtechs raising at earlier stages.

- Silicon Valley sees 1 in 5 global insurtech deals. Silicon Valley’s share of global insurtech equity deals has nearly doubled YoY, from 10.9% in Q1’24 to 21.9% in Q1’25. Funding to Silicon Valley-based insurtech increased to $0.3B — the highest level since Q4’23 ($0.4B).

Insurtech dealmaking increases for the first time in a year

Insurtech deal count increased 17% QoQ, from 83 deals in Q4’24 to 97 in Q1’25 — a reversal of the broader venture trend, where deal count declined 7% over the same period.

The rebound was driven by property & casualty insurtech, which jumped from just 51 deals — a near 8-year low — in Q4’24 to 70 in Q1’25. Meanwhile, life & health insurtech saw deal count dip to 27 in Q1’25.

This increase in activity followed an abnormally weak Q4, when funding had fallen to $0.8B. In Q1’25, insurtech funding surged 63% to $1.3B — slightly above the 10-quarter average of $1.2B. Notably, insurtech was the only fintech vertical to post a funding gain this quarter.

Nearly $400M toward three $100M+ mega-round deals contributed to the broader funding rebound:

- Quantexa, a data management and financial crime prevention platform, raised a $175M Series F deal.

- Openly, a homeowners-focused general agency and program administrator, raised a $123M Series E deal.

- Instabase, an AI platform for unstructured data, raised a $100M Series D deal.

Future implication: These mega-rounds signal investors’ readiness to write large checks for select insurtechs — even in a cautious funding environment. For incumbents, this underscores the importance of tracking well-capitalized startups that could pose competitive threats through 2025.

Median insurtech deal size tumbles in Q1’25

Half of the quarter’s top 10 insurtech deals went to AI-centered startups: Quantexa, Instabase, Nirvana, Taktile, and Naked. But unlike the broader venture market, insurtech lacked the depth of large-dollar AI deals needed to lift the median.

While the average insurtech deal size ticked up 6% to $15.8M in 2025 YTD, the median insurtech deal size tumbled from $5.4M in 2024 to $4.0M — its lowest point since 2019 ($3.4M). This trend diverged from the broader venture environment, where a spike in $100M+ mega-rounds pushed medians higher.

Early-stage insurtech saw a similar dynamic, with median deal sizes declining to $3.0M in 2025 YTD — even as the broader venture landscape saw an increase, from $2.0M in 2024 to $2.8M. Fertility-focused platform Gaia raised the largest early-stage insurtech deal in Q1’25 ($15M Series A).

Future implication: Smaller check sizes could give incumbent insurers an opening to partner with capital-constrained insurtechs — potentially securing more favorable terms and early access to emerging tech that would be harder to land in a hotter market.

Early-stage insurtech funding reaches a nearly 8-year low

Early-stage insurtech startups raised just $178.5M across 56 deals in Q1’25 — the lowest total since Q4’16 ($162.8M). Funding has dropped sharply over the past year, falling 35% from Q1’24.

Early-stage insurtech deal share has also tumbled over the past few years. In 2022, 71% of deals went to early-stage insurtechs, while in 2025 YTD, it was just 58%.

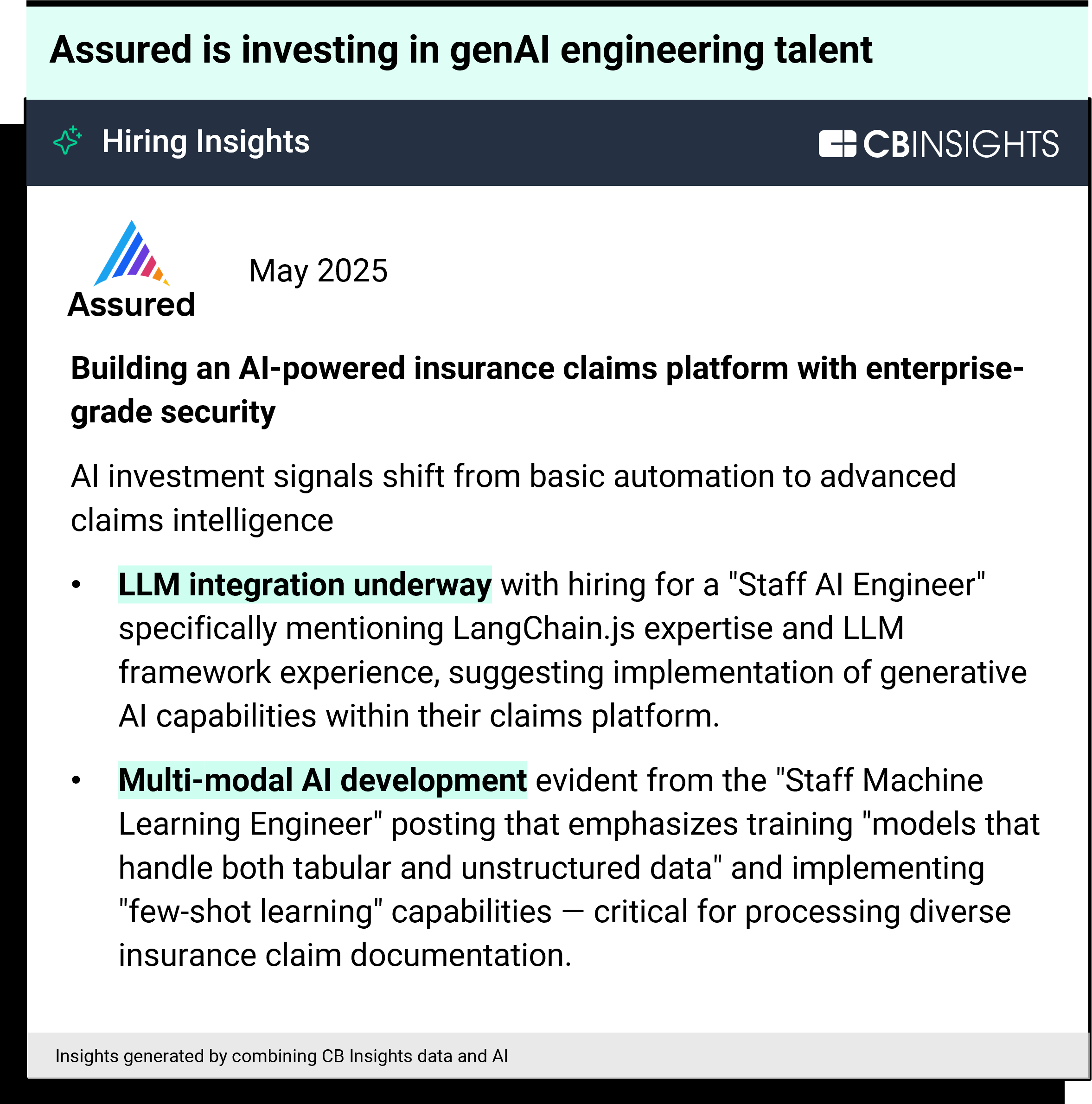

Still, the quarter delivered one notable early-stage highlight: AI claims platform Assured became just the second new insurtech unicorn since Q4’23. The startup raised an undisclosed Series A round at a $1B valuation, backed by ICONIQ Capital and Kleiner Perkins.

Assured also ranks in the global top 4% of companies for hiring momentum and is actively prioritizing genAI-focused hires:

Future implication: The sustained drop in early-stage insurtech funding risks shrinking the industry’s future innovation pipeline. To stay ahead, insurance execs should prioritize identifying and building relationships with promising startups now — before competition for a smaller pool of standouts intensifies.

Late-stage insurtech dealmaking paints a cautious growth picture

The 7 insurtechs that raised Series D+ rounds in Q1’25 posted median 12-month headcount growth of just 3% — significantly lower than their earlier-stage peers. Only one of them — insurance customer communication platform Ushur — saw double-digit growth over the same period.

Ushur is also the only insurtech among the 7 with an above-average M&A probability within the next 2 years. This signals a potential standstill in the late-stage insurtech market, especially as the IPO pipeline remains frozen — just 2 insurtechs have gone public since 2023.

Future implication: With just 3% median headcount growth, late-stage insurtechs are showing signs of stagnation. In a market where public investors expect clear growth momentum, more of these companies may be pushed toward M&A exits — often at compressed valuations.

Silicon Valley sees 1 in 5 global insurtech deals

Silicon Valley has now seen 2 consecutive quarters of elevated insurtech dealmaking. The share of global insurtech deals to Silicon Valley-based startups nearly doubled YoY, rising from 10.9% in Q1’24 to 21.9% in Q1’25. Comparatively, 9% of deals across the broader venture environment went to Silicon Valley-based companies in Q1’25.

2 of the quarter’s top 5 insurtech deals went to Silicon Valley-based insurtechs: Instabase and Nirvana ($80M Series C). As a result, Silicon Valley’s insurtech funding in Q1’25 increased to $0.3B — the highest level since Q4’22 ($0.4B). By comparison, Europe’s insurtech market saw $0.4B in funding across 26 deals in Q1’25, slightly edging out Silicon Valley’s total.

Silicon Valley also saw a major insurtech exit in Q1’25: Munich Re announced its acquisition of Palo Alto-based Next Insurance — one of insurtech’s most-promising startups — at a $2.6B valuation.

Future implication: As the world’s premier tech ecosystem, Silicon Valley remains a leading indicator for insurtech innovation. Insurance executives should track tech talent migration into insurtech as a signal of where future competitive threats may emerge.

MORE INSURTECH RESEARCH FROM CB INSIGHTS

If you aren’t already a client, sign

up for a free trial to learn more about our platform.

Funding & Business

Elon Musk Forms New Political Party

Elon Musk says he’s formed a new political party called the America Party to “give you back your freedom.” President Donald Trump calls it “ridiculous.” Bloomberg’s Craig Trudell reports. (Source: Bloomberg)

Source link

Funding & Business

Martin Wiggen: Oil Inventories Still Low

Since global oil inventories are still low, there is little risk that OPEC’s decision to increase production will lead to a supply shock says Nadia Martin Wiggen, Director at Svelland Capital. Nadia spoke to Francine Lacqua on ‘Bloomberg: The Pulse’. (Source: Bloomberg)

Source link

Funding & Business

VC-Backed Startups That Stitch AI And Fashion Together See Strong Investor Interest

Venture capitalists, as a group, aren’t exactly notorious for their keen fashion sense, but many have taken a strong interest in backing startups that thread AI technology into the apparel industry.

Overall numbers are still relatively small for this emerging sector, but venture investment in fashion-related AI startups has risen or held steady in the past five-plus years. That’s even as VC funding generally has fallen from its pandemic-era highs, Crunchbase data shows.

Funding to startups at the intersection of AI and apparel spiked to $162 million in 2022 — when China-based Zhiyi Tech, which helps clothing brands spot and predict fashion trends, raised $100 million alone — and has clocked in around $100 million annually since then.

Investors’ interest in fashion-related tech makes sense, given that as a species, we’re estimated to spend an astonishing $1.8 trillion globally each year on attiring ourselves. That figure is projected to climb to $2.3 trillion by 2030.

The true economic and environmental costs of the fashion industry are of course much higher, by the time you account for production waste and pollution, the resources that go into shipping clothes halfway across the world, and frequent returns and exchanges — not to mention concerns about labor conditions in garment factories.

We identified dozens of companies operating at the fashion-and-AI intersection that raised venture funding in recent years, many of them working on issues such as more efficient manufacturing or faster trend-spotting. Some offer AI-driven creative design tools, others are focused on AI-enabled demand prediction or manufacturing, and several companies offer personalized shopping or customized garments. Let’s take a closer look.

Predicting fashion (before it’s no longer fashionable)

The best-funded startup at the intersection of fashion and AI appears to be Zhiyi Tech. The Xiaoshan, China-based company, which works with many China-based apparel companies, searches the internet and social media for trending designs, and combines that with sales data from e-commerce platforms to help brands quickly capitalize on viral trends.

Investors appear to be particularly eager to back companies that tap AI to predict fashion trends.

In the U.S., another top funding recipient is Finesse, which has raised close to $45 million total from investors. The Los Angeles-based startup describes itself as the “first AI-led fashion house” and creates fast-fashion clothes based on social media votes, shopping data and viral trends spotted by its machine learning technology.

“I call it ‘Zara meets Netflix,’ ” CEO and co-founder Ramin Ahmari told Crunchbase News in 2021, when the company raised its $4.5 million seed round. “We all love fashion and the beauty industry, but fashion is a huge world largely untouched by technology. There are now new trends in efficiency and data, and Finesse is all about using data to reduce the tons of waste in fashion.”

While reviews of its clothes have been mixed, the company went on to raise a $40 million Series A led by TQ Ventures.

Another well-funded startup in the fashion demand prediction realm is Syrup Tech. The New York-based company has raised $25.1 million total for its AI-driven predictive software used by fashion brands.

AI fashion design and creation tools

Fashion designers are also increasingly using generative AI to help them design clothes and make 3D digital mockups of items before they ever go into production.

Along those lines, funded startups include Raspberry AI, which earlier this year raised $24 million in an Andreessen Horowitz-led Series A. The New York-based startup’s platform turns designers’ sketches into photorealistic renderings, showing in rich detail how products will look, fit and drape in real life.

Another AI fashion design tool is AI.Fashion. The Los Angeles-based startup makes AI-driven tools for virtual photoshoots and fashion content creation. It raised a $3.6 million seed round led by Neo in February 2024.

BLNG, meanwhile, applies generative AI to jewelry design, converting sketches or text prompts into photorealistic 3D renders. The Los Angles-based company has raised $4.5 million, including a $3 million seed round in April, per Crunchbase.

Discovery and personalization

AI is also changing how consumers discover clothing and footwear. Startups in this category use machine learning to personalize recommendations, improve product tagging and offer smarter shopping experiences for consumers to help them better find what they want.

Among the most high-profile recently funded companies in this cohort is Daydream, an AI-powered shopping platform founded by e-commerce veteran Julie Bornstein, who previously founded The Yes and sold it to Pinterest three years ago. Her new startup makes personalized fashion recommendations through a chat-based interface. The San Francisco-based company raised a $50 million seed round in June from investors including Forerunner Ventures and Index Ventures.

Other companies in this subsector include Lily AI. Its platform translates retailer product attributes into more consumer-friendly language, with the aim of improving site search and personalization. The Mountain View, California-based startup has raised $71.9 million to date.

Other funded fashion discovery startups include:

- Tel Aviv-based Karma, which has raised $34 million in funding to date for its browser-based shopping tools;

- London-based Hey Savi, which raised $2.85 million in pre-seed funding last year for its AI fashion search engine; and

- Shoppin, an India-based startup that helps users discover clothing using prompts and images, raised $1 million in a pre-seed funding in January.

Virtual try-ons, precision fit and customization

Tracking down what looks like the perfect dress to wear to that summer wedding reception is one thing. Knowing it will actually fit and look good on you when it arrives is another.

Companies tackling that problem include several virtual try-on startups that aim to make it easier to gauge how a garment will fit before you buy it online — both to reduce buyer frustration and to reduce the chances of costly returns for retailers.

Along those lines, virtual try-on and social shopping app Doji last month raised $14 million in a seed round led by Thrive Capital. The San Francisco-based company’s app lets users create avatars for virtual try-ons of clothing.

Similarly, Paris-based Veesual offers diverse AI-generated virtual models to showcase how clothes look on different bodies. The startup has raised $7.6 million to date, mostly in a seed round last year led by AVP and Techstars.

A smaller subset of startups is working on actually personalizing the size and fit of shoes and clothes. Among the most notable of the bunch is New York-based IAMBIC, which uses AI to make precision-fit footwear. The company, whose completely custom sneakers were named to TIME’s Best Inventions list in 2023, has raised $1.3 million through research grants.

Another is New York-based Laws of Motion, a seed-funded DTC brand that has raised $10.2 million on the promise of precision-fit clothing for women through virtual body scans and AI technology.

Smart manufacturing and supply chain optimization

Other startups are turning to AI to improve the way garments are made. Funded companies in this group include those working on demand forecasting, advanced textiles and material optimization, process automation, and textile recycling.

For example, Smartex.ai installs AI and computer vision technology into textile factories to help them automatically detect textile defects. The Portugal-based startup has raised $27.6 million in funding, per Crunchbase.

Several startups focused on fashion-related sustainability have also raised funding in recent years. They include Matoha Instrumentation, which builds AI-enabled infrared scanners for rapid textile sorting to support recycling. The London-based startup raised £1.5 million in an April seed round.

Refiberd, meanwhile, uses AI and hyperspectral imaging to enable intelligent sorting in textile-to-textile recycling. The Cupertino, California-based company has raised $2.7 million total from venture rounds and grants.

There’s also some funding in the area of new textile technologies developed with the help of AI. One example is Solena Materials, which raised a $6.7 million seed round in May. The startup, also based in London, uses AI-driven protein sequence design to engineer new biodegradable fibers produced by microbes.

Looking ahead: AI will stay on trend

With AI overall en vogue with investors, startups weaving that technology into the fashion industry seem poised for more growth. We expect that as clothing brands continue to battle supply-chain pressures, consumer churn and shifting online behavior, AI tools will remain on trend in coming seasons.

Related Crunchbase query:

Related reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

-

Funding & Business7 days ago

Kayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Jobs & Careers6 days ago

Mumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Mergers & Acquisitions6 days ago

Donald Trump suggests US government review subsidies to Elon Musk’s companies

-

Funding & Business6 days ago

Rethinking Venture Capital’s Talent Pipeline

-

Jobs & Careers6 days ago

Why Agentic AI Isn’t Pure Hype (And What Skeptics Aren’t Seeing Yet)

-

Funding & Business4 days ago

Sakana AI’s TreeQuest: Deploy multi-model teams that outperform individual LLMs by 30%

-

Funding & Business7 days ago

From chatbots to collaborators: How AI agents are reshaping enterprise work

-

Jobs & Careers6 days ago

Astrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle

-

Jobs & Careers6 days ago

Telangana Launches TGDeX—India’s First State‑Led AI Public Infrastructure

-

Funding & Business4 days ago

HOLY SMOKES! A new, 200% faster DeepSeek R1-0528 variant appears from German lab TNG Technology Consulting GmbH