Business

SAP urges unified AI & data approach for ANZ business growth

SAP is calling on Australian and New Zealand organisations to rethink their approach to AI, data and application landscapes, marking a shift from future-looking speculation to real-world execution.

Held at the Centrepiece on 7 August, the event brought together more than 700 attendees and over 70 speakers to explore strategies for embedding AI across core business functions.

Angela Colantuono, Managing Director and President of SAP Australia and New Zealand, highlighted the urgency for agility and productivity amid ongoing disruption.

“Agility is no longer optional, and productivity, well, it’s front page news here in Australia,” Colantuono said.

“The Australian Government is working with business leaders on a productivity challenge over the next few weeks.”

She also highlighted SAP’s investments in sovereign cloud capabilities and a Centre of Excellence in Canberra, underscoring the company’s commitment to local innovation.

“Our applications manage the heartbeat of local business, with SAP underpinning 92% of the ASX 200,” she noted. “And of course, SAP Business AI is embedded directly into our suite.”

Colantuono stressed the importance of a solid data foundation to unlock AI’s true potential. “While everyone’s talking about AI, not enough people are talking about how to do AI well,” she said. “We know you can’t unlock AI without fixing your data landscape.”

At the event, SAP unveiled the top five AI use cases currently adopted by customers in Australia and New Zealand, based on customer data between May 2024 and May 2025:

- Automated expense generation using receipt images

- Automated invoice processing

- Expense verification and compliance checks

- Real-time alerts for supply chain disruptions

- Sales demand forecasting powered by predictive analytics

“My conversations with CEOs are increasingly revealing how they are looking to embed AI into some of the most fundamental parts of their business,” said Colantuono.

“These applications are helping Australian organisations make faster, smarter decisions, reduce risk and unlock new value. But to fully realise AI’s potential, we need to invest just as much in people as we do in technology.”

SAP’s commitment to responsible AI was echoed by keynote speaker Dr Catriona Wallace, Founder of the Responsible Metaverse Alliance.

“AI is the number one existential risk we face today. Yet only a small fraction of Australian organisations are equipped to use it responsibly,” she said.

“If we want AI to drive innovation, productivity and public trust, we must move beyond ambition to action.”

SAP Business Suite President Stefan De Barse used his keynote to explain SAP’s “flywheel” concept, where applications, data and AI are unified to increase enterprise value.

“The flywheel is all about apps, data and AI coming together to provide more value to all of you – our customers and partners,” he said. “It starts with apps that run your end-to-end business processes. Those apps also provide valuable data.”

That data forms the basis of SAP’s Business Data Cloud, in partnership with Databricks, which enables real-time integration between business systems and AI-powered decision-making.

“You spend 80% of your time managing this fragile balance between data and apps,” De Barse said. “That means only 20% of the time is invested in generating value.”

He argued that in the AI era, this disconnect is unsustainable. “For AI to deliver exponential value, it is extremely important that the end-to-end business process context is connected with the data,” he said.

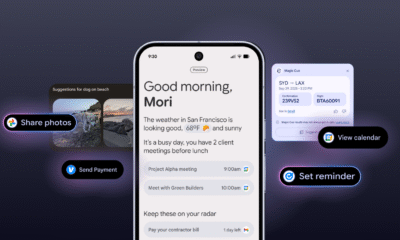

Demonstrating SAP’s AI co-pilot Joule, De Barse walked the audience through a scenario where finance, operations, procurement, HR and sales teams collaborate using shared data and embedded AI to resolve rising inventory, back orders and liquidity gaps.

Lion, a leading beverage company in Australia and New Zealand, was cited as a live example of SAP’s AI capabilities in action. After adopting SAP’s Business Technology Platform and a clean core ERP model, Lion accelerated its order-to-cash cycles and developed an AI-powered beer recommendation app, ‘Joey’, in under 10 days.

“AI is helping us move faster, make smarter decisions, and deliver better customer experiences,” said Ram Kalyanasundaram, Group Technology and Digital Transformation Director at Lion. “SAP’s AI capabilities have been a game-changer in how we think, operate and grow.”

In higher education, La Trobe University became the first in the ANZ region to go live with SAP S/4HANA Cloud Public Edition as part of its GROW with SAP journey.

The transformation is streamlining the university’s operations across finance, logistics, real estate and procurement, while laying a foundation for future AI-driven insights.

“This transformation is a major step forward in how we operate,” said Shainal Kavar, Chief Information Officer at La Trobe University.

“It sets us up to embrace innovation and unlock the potential of AI in the years ahead.”

In addition to showcasing customer success stories, SAP announced the return of its SAP Intrepid Women AI Tour in January 2026.

The four-day study programme will support senior female leaders in advancing AI literacy and leadership, building on the momentum of the 2025 edition.

“Less than 15% of senior AI executives are women today,” said Colantuono. “Last year’s programme proved that when you bring female leaders together to build AI literacy and share experiences, the impact is extraordinary.”

“This is what we believe is the future of the business suite,” he said. “And we would love to embark on this business suite journey with many of you.”

Business

Tap-in, tap-out rail ticket trial to streamline fares using GPS tracking | Rail industry

Train passengers in the East Midlands are to test technology that will let them tap in and out for journeys and be charged the best fare for their trip at the end of the day.

Trials of digital rail tickets based on GPS tracking will begin on Monday as part of the government’s plan to improve the rail network’s complex fare system.

Passengers will check in for travel on their phones with an app and have their journey tracked using satellite location technology.

The app will automatically charge them the best fare at the end of the day’s travel and provide a barcode when needed for ticket inspections or to pass through ticket barriers.

The Department for Transport (DfT) said the technology, if it proves successful, would replace the need for paper tickets and mobile tickets using QR codes, which have to be bought before travel. Passengers will be able to travel without planning or booking journeys in advance.

The technology, which has previously been tested in Switzerland, Denmark and Scotland, is being piloted in England first on East Midlands Railway services between Leicester, Derby and Nottingham, with trials to be extended to Northern Trains in Yorkshire from the end of the month. Up to 4,000 passengers are expected to take part in the pilots.

The DfT said the scheme demonstrated its commitment to improving the passenger experience and trialling innovative technology to save time and money.

The rail minister, Peter Hendy, said: “The railway ticketing system is far too complicated and long overdue an upgrade to bring it into the 21st century. Through these trials we’re doing just that, and making buying tickets more convenient, more accessible and more flexible.

“By putting passenger experience at the heart of our decision-making, we’re modernising fares and ticketing and making it simpler and easier for people to choose rail.”

after newsletter promotion

Despite widespread consensus on the need to overhaul ticketing, the DfT and rail industry have yet to find a solution. The previous government had pledged to tackle England’s complex fare system, although attempts to make savings by automating ticketing and closing ticket offices were widely resisted by MPs as well as unions.

Labour pledged a “best price guarantee” as part of fares reform under its plans for a nationalised Great British Railways, which it hopes will be up and running in 2027.

Oli Cox, the head of commercial strategy at East Midlands Railway, said more than 500 people had registered for its part in the trial. He said: “We know that complex fares can be a real barrier to travel, but this trial removes that uncertainty, making it easy to simply tap in and out on your phone, safe in the knowledge you’re always getting the best-value fare on the day.”

Business

Fintech & AI speed up lending, boost business efficiency

Fintech developments, data sharing, and artificial intelligence are reshaping the lending sector, streamlining finance approvals and enabling faster, more accurate access to funding for businesses and lenders alike.

Gus Gilkeson, Chief Executive Officer of Grow Capital, has outlined how advancements in technology are improving opportunities for those seeking finance, as well as for lending institutions, by minimising delays and inefficiency.

Gilkeson explained that these improvements are influencing both how companies operate and their financial management strategies. He highlighted the practical impact of technology, particularly AI tools, on day-to-day business operations.

“From a borrower’s perspective, AI tools offer the chance to find efficiencies both in the overall running of your business, and also in how you manage your cash flow.”

“Invoices, incomings and outgoings can be tracked accurately, and in real-time if you want, to provide a clearer picture of the business financials. Forecasting, budgeting, and identifying potential funding gaps can be done easily and efficiently.”

He noted that lending institutions also stand to benefit. “For lenders, AI and data-sharing tools are allowing key identification and financial data to be verified sooner and potentially more accurately, as raw data can be shared across platforms reducing the opportunity for human error.”

“Ultimately when finance approval times reduce and funding is being made available sooner –the borrower can make strategic decisions faster.”

Technology shift

Gilkeson compared current fintech and AI progress to earlier technological revolutions, stating that the sector is still in its early stages of transformation. “I would expect some time in the not-too-distant-future that a business will be able to log on to a portal where all their financial and business data is stored and has previously been verified, allowing them to access millions of dollars in finance with the click of a button.”

He identified several key advantages associated with emerging financial technologies:

Access to finance sooner: Quicker funding approval opens opportunities for businesses, particularly when time-sensitive investments or purchases are required or during acquisitions.

Open banking: Through the Consumer Data Right, businesses can securely give consent to share banking and other financial data with authorised parties. This process facilitates quicker verification, reduces paperwork, and minimises the need for physical document signing.

Fraud mitigation: Enabled data sharing allows financial institutions to validate raw information independently, reducing the risk of manipulated balance sheets or omitted information. Human error is also less likely when data is transferred digitally and verified across platforms.

Business efficiencies: For small to medium-sized enterprises, the option to automate financial management and administrative processes has become a reality. According to Gilkeson, “AI tools can flag cash flow risks, optimise payments and identify gaps, potentially resulting in smarter decision-making.”

Potential risks

While the benefits are evident, Gilkeson cautioned that there are risks associated with adopting new technology, particularly related to data security and identity protection.

“Do your research into the tools you are adopting and also into how the third parties you’re dealing with are storing and managing your data. Having strong cyber security should be a non-negotiable.”

He also addressed the reliability of AI-based systems in the financial services sector. “It’s also important to remember that AI is not perfect and mistakes can be made, especially if original data is entered incorrectly. You will still need professional services like brokers, accountants and financial planners to check and validate your application or strategy.”

Gilkeson acknowledged that the pace of change presents further considerations for the sector. “As with any new technology there are always risks and challenges, but the opportunities this will open up is very exciting.”

Business

Start Your AI Agency Launches 90-Day Global AI Training Program to Build Lucrative AI Service Businesses

Start Your AI Agency, under the leadership of CEO Greg Squibbs, has announced the 90-Day global AI training program that enables individuals to build lucrative, location-independent businesses by using artificial intelligence.

Dubai, United Arab Emirates–(Newsfile Corp. – August 31, 2025) – Start Your AI Agency has launched a 90-Day global AI training program to build lucrative AI service businesses. The company’s core offering is a free training program that introduces the proprietary AI Layering Strategy – a system inspired by proven practices from leading global tech innovators. This model allows entrepreneurs to streamline their outreach, automate service delivery, and operate businesses 24/7 from anywhere in the world without the need for complex software or large teams.

CEO Greg Squibbs

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8703/262414_87e4e1ac64487862_001full.jpg

For digital entrepreneurs looking to launch and scale AI-powered service businesses, Start Your AI Agency 90-Day training program focuses on actionable steps and replicable systems that are accessible to them with no prior experience in AI or coding. By simplifying advanced AI technologies and integrating them into everyday business operations, the program helps to bridge the gap between innovation and execution.

The program supports a wide range of professionals, including freelancers, consultants, and business owners, who are seeking to modernize their services using AI.

Greg Squibbs, a long-time advocate for technological innovation, emphasizes the importance of AI education for long-term success. As he has stated, “Artificial intelligence, automation, team building – if you don’t understand it – learn it. Because otherwise, you’re going to be a dinosaur within three years.”

Furthermore, Start Your AI Agency’s program helps individuals seeking to transition from traditional employment, entrepreneurs aiming to scale digital operations, and professionals interested in integrating automation into their service-based businesses.

About Start Your AI Agency:

Start Your AI Agency is a global training platform dedicated to helping individuals build and scale AI-powered service businesses. Founded with the vision to democratize access to artificial intelligence, the company provides step-by-step training, tools, and automation systems that enable entrepreneurs to launch high-profit, location-independent agencies. With a focus on simplicity, scalability, and real-world application, Start Your AI Agency has become a trusted launchpad for thousands of digital entrepreneurs worldwide. Under the leadership of CEO Greg Squibbs, the company continues to drive innovation and empower the next generation of AI-focused business owners.

For more information, visit at https://www.startyouraiagency.com.

Media Contact:

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262414

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Business2 days ago

Business2 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies