AI Research

Prediction: This Unstoppable Artificial Intelligence (AI) Stock Will Be the World’s First $10 Trillion Company by 2030

Nvidia’s projected growth allows it to easily become a $10 trillion business by 2030.

Currently, Nvidia (NVDA) is the world’s largest company, with a market cap of $4.2 trillion. So, predicting that a stock will reach a $10 trillion market cap by 2030 is daunting. However, I think that Nvidia is up to the task, as it’s slated to capitalize on massive and growing AI computing capacity.

As AI spending rises, so will Nvidia’s stock. Companies are a long way from completing the buildout of necessary AI computing power, and this demand is what will drive Nvidia to become a $10 trillion company by 2030.

Image source: Getty Images.

The AI hyperscalers are still ramping up their data center spending

Nvidia makes graphics processing units (GPUs), which are the computing muscle behind nearly every AI model you can use today. They possess a unique attribute that enables them to process multiple calculations in parallel, providing superior computing power compared to traditional computing devices. They can also be connected in clusters to amplify this effect, which is why you hear about data centers with hundreds of thousands of GPUs.

2025 was a record-setting year for data center capital expenditures, and that trend appears to be continuing. Many AI hyperscalers have already warned investors that spending in 2026 will be even greater than in 2025, which also indicates further growth beyond 2026.

Most data centers take several years to complete construction, so the money spent in 2025 to purchase land, design the facility, and initiate construction will translate into these clients purchasing Nvidia GPUs in 2026 or 2027. So, whenever you hear an AI hyperscaler announce that they’re building a facility in a location, it’s safe to assume that Nvidia’s growth horizon was extended at least another two or three years.

This jives with what Nvidia’s management has told investors during various conference calls. In the second quarter, they estimated that the big four AI hyperscalers will spend around $600 billion on data center capital expenditures. However, they expect that figure to rise to $3 trillion to $4 trillion when all customers worldwide are included. With Nvidia retaining an estimated 35% of this data center spend, it’s slated to capitalize on massive growth during the next few years.

This is the fuel that Nvidia needs to reach a $10 trillion market cap, and I won’t be surprised if Nvidia eclipses this monumental threshold by 2030.

Nvidia could be a much larger company than just $10 trillion

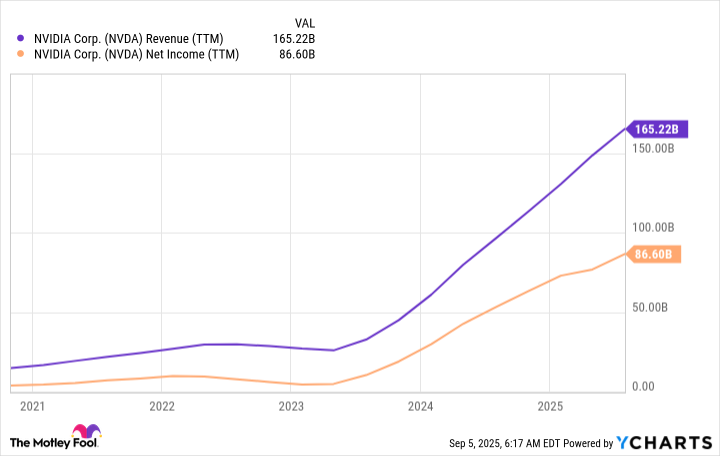

Using the bottom end of the estimated range, $3 trillion, and dropping Nvidia’s take to 30% to bake in a bit of conservatism, indicates Nvidia would generate $900 billion in revenue by 2030. If Nvidia maintains its 50% profit margin, that would translate into net income of $450 billion by 2030. Over the past 12 months, Nvidia has generated $165 billion in revenue and $87 billion in profits, indicating a substantial increase.

NVDA Revenue (TTM) data by YCharts

But are those figures enough to make Nvidia a $10 trillion company? Remember, this is only data center revenue, not any revenue the company generates from other business pursuits. Therefore, the actual revenue and profit totals are likely to be significantly higher.

Even only considering projected data center growth, it’s still sufficient to reach $10 trillion for Nvidia.

If we assign Nvidia a price-to-earnings (P/E) ratio of 30 times earnings, a reasonable price tag considering Nvidia’s growth and importance, that would indicate that Nvidia’s stock could be worth $13.5 trillion by 2030. That’s far above the $10 trillion threshold, and that only includes the data center business. Additionally, this was due to Nvidia losing some of its share in the spending pie and the lower end of Nvidia’s projection.

As a result, I’m confident that Nvidia can easily pass the $10 trillion threshold by 2030, making it a no-brainer buy today.

AI Research

Microsoft Revamps File Explorer with Artificial Intelligence

Redazione RHC : 12 September 2025 17:58

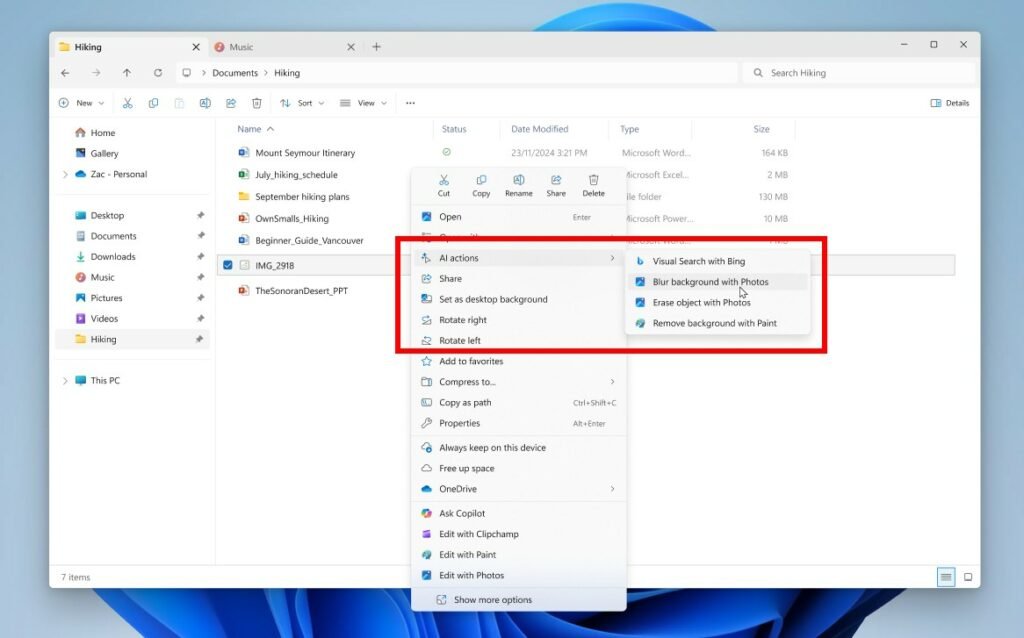

Microsoft has begun testing new AI-powered features in File Explorer in Windows 11. These features will allow users to interact with images and documents directly from File Explorer, without having to open files in separate apps.

The new feature is called “AI Actions” and currently works with JPG, JPEG, and PNG images, allowing you to do the following:

- Remove Background in Paint: Quickly cut out the background of an image, leaving only the Subject;

- Remove Objects with the Photos app: Remove unwanted elements from photos using generative AI.

- Blur Background using the Photos app: Focuses on the subject while blurring the background.

- Search Images with Bing Visual Search: Visual Search with Bing finds similar images, objects, landmarks, and more across the web.

“AI Actions in File Explorer make working with files faster and easier—just right-click, for example, to edit an image or get a summary of a document,” say Microsoft representatives Amanda Langowski and Brandon LeBlanc.

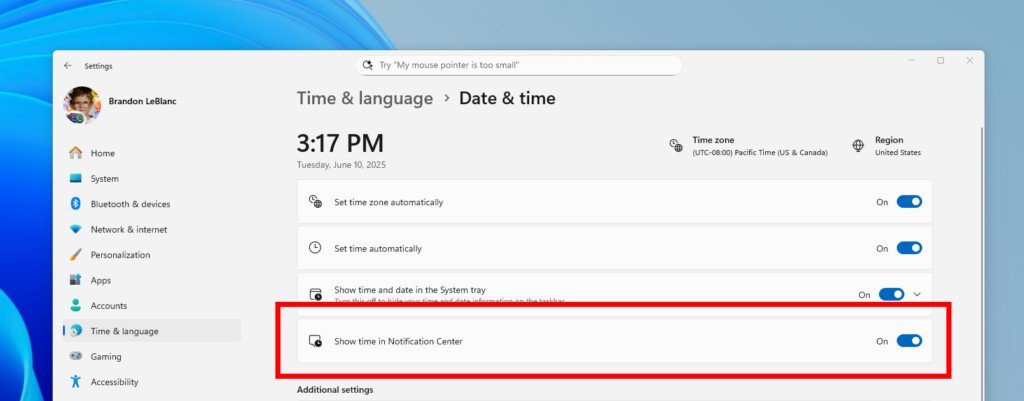

These new features are available in Windows 11 Insider Preview Build 27938. Along with these, another useful feature has been introduced: under Settings > Privacy & Security > Text & Image Generation, you now see a list of third-party apps that have recently used Windows local generative AI models.

You can view this activity and manage these apps’ access to AI features.

In early May, Microsoft also introduced AI agents, intelligent assistants that can change Windows settings with a voice or text command. These features are now available on Copilot+ PCs and Snapdragon processors.

Redazione

RedazioneThe editorial team of Red Hot Cyber consists of a group of individuals and anonymous sources who actively collaborate to provide early information and news on cybersecurity and computing in general.

AI Research

AI Research Healthcare: Transforming Drug Discovery –

Artificial intelligence (AI) is transforming the pharmaceutical industry. More and more, AI is being used in drug discovery to predict which drugs might work and speed up the whole development process.

But here’s something you probably didn’t see coming: some of the same AI tools that help find new drug candidates are now being used to catch insurance fraud. It’s an innovative cross-industry application that’s essential in protecting the integrity of healthcare systems.

AI’s Core Role in Drug Discovery

The field of drug discovery involves multiple stages, including initial compound screening and preclinical testing to clinical trials and regulatory framework compliance. These steps are time-consuming, expensive, and often risky. Traditional methods can take over a decade and cost billions, and success rates remain frustratingly low. This is where AI-powered drug discovery comes in.

The technology taps machine learning algorithms, deep learning, and advanced analytics so researchers can process vast amounts of molecular and clinical data. As such, pharmaceutical firms and biotech companies can reduce the cost and time required in traditional drug discovery processes.

AI trends in drug discovery cover a broad range of applications, too. For instance, specialized AI platforms for the life sciences are now used to enhance drug discovery workflows, streamline clinical trial analytics, and accelerate regulatory submissions by automating tasks like report reviews and literature screenings. This type of technology demonstrates how machine learning can automatically sift through hundreds of models to identify the optimal one that best fits the data, a process that is far more efficient than manual methods.

In the oncology segment, for example, it’s responsible for innovative precision medicine treatments that target specific genetic mutations in cancer patients. Similar approaches are used in studies for:

- Neurodegenerative diseases

- Cardiovascular diseases

- Chronic diseases

- Metabolic diseases

- Infectious disease segments

Rapid development is critical in such fields, and AI offers great help in making the process more efficient. These applications will likely extend to emerging diseases as AI continues to evolve. Experts even predict that the AI drug discovery market will grow from around USD$1.5 billion in 2023 to between USD$20.30 billion by 2030. Advanced technologies, increased availability of healthcare data, and substantial investments in healthcare technology are the main drivers for its growth.

From Molecules to Fraud Patterns

So, how do AI-assisted drug discovery tools end up playing a role in insurance fraud detection? It’s all about pattern recognition. The AI-based tools used in drug optimization can analyze chemical structures and molecular libraries to find hidden correlations. In the insurance industry, the same capability can scan through patient populations, treatment claims, and medical records to identify suspicious billing or treatment patterns.

The applications in drug discovery often require processing terabytes of data from research institutions, contract research organizations, and pharmaceutical sectors. In fraud detection, the inputs are different—claims data, treatment histories, and reimbursement requests. The analytical methods remain similar, however. Both use unsupervised learning to flag anomalies and predictive analytics to forecast outcomes, whether that’s a promising therapeutic drug or a suspicious claim.

Practical Applications In and Out of the Lab

Let’s break down how this dual application works in real-world scenarios:

- In the lab: AI helps identify small-molecule drugs, perform high-throughput screening, and refine clinical trial designs. Using generation models and computational power, scientists can simulate trial outcomes and optimize patient recruitment strategies, leading to better trial outcomes and fewer delays and ensure drug safety.

- In insurance fraud detection: Advanced analytics can detect billing inconsistencies, unusual prescription patterns, or claims that don’t align with approved therapeutic product development pathways. It protects insurance systems from losing funds that could otherwise support genuine patients and innovative therapies.

This shared analytical backbone creates an environment for innovation that benefits both the pharmaceutical sector and healthcare insurers.

Challenges and Future Outlook

The integration of AI in drug discovery and insurance fraud detection is promising, but it comes with challenges. Patient data privacy, for instance, is a major concern for both applications, whether it’s clinical trial information or insurance claims data. The regulatory framework around healthcare data is constantly changing, and companies need to stay compliant across both pharmaceutical and insurance sectors.

On the fraud detection side, AI systems need to balance catching real fraud without flagging legitimate claims. False positives can delay patient care and create administrative headaches. Also, fraudsters are getting more sophisticated, so detection algorithms need constant updates to stay ahead.

Despite these hurdles, the market growth for these integrated solutions is expected to outpace other applications due to their dual benefits. With rising healthcare costs and more complex fraud schemes, insurance companies are under increasing pressure to protect their systems while still covering legitimate treatments.

Looking ahead, AI-driven fraud detection is likely to become more sophisticated as it learns from drug discovery patterns. And as healthcare fraud becomes more complex and treatment options expand, we can expect these cross-industry AI solutions to play an even bigger role in protecting healthcare dollars.

Final Thoughts

The crossover between AI drug discovery tools and insurance fraud detection shows how pattern recognition technology can solve problems across different industries. What started as a way to find new medicines is now helping catch fraudulent claims and protect healthcare dollars.

For patients, this dual approach means both faster access to new treatments and better protection of the insurance systems that help pay for their care. For the industry, it’s about getting more value from AI investments; the same technology that helps develop drugs can also stop fraud from draining resources. It’s a smart example of how one innovation can strengthen healthcare from multiple angles.

Related

AI Research

Research Tip Sheet: AI and Heart Failure Plus Recent Headlines

LOS ANGELES (Sept. 12, 2025) — An artificial intelligence (AI) program created by Cedars-Sinai may reduce hospitalizations in people diagnosed with heart failure, a new study reports.

The study, published in JACC: Heart Failure, included 50 people who had been diagnosed with a condition called heart failure with reduced ejection fraction, in which the heart’s main pumping chamber, the left ventricle, becomes too weak to circulate blood throughout the body.

For three months, patients used a smartphone app to transmit home blood pressure readings to their cardiologists. The blood pressure readings were analyzed by an AI program that generated prescribing recommendations to the cardiologists, such as whether a new drug should be added or a dosage changed. The software, named HF-AI (for heart failure AI) was trained using data from Cedars-Sinai patients with heart failure between 2020 to 2022 and incorporates national and international heart failure guidelines.

Cardiologists accepted HF-AI medication and dose recommendations 90.8% of the time. This meant they more than doubled their use of guideline-directed heart failure medications. The program also dramatically decreased hospitalizations. Among the 50 enrolled patients, 23 were hospitalized in the six months before enrolling in the trial. In the six months after the intervention, only six were hospitalized, a 74% reduction.

Investigators plan to use and study the program with more Cedars-Sinai patients.

“People with heart failure are among our most fragile patients, with extremely high risk of hospitalization and death,” said first author and co-inventor Raj Khandwalla, MD, division chief of Cardiology at Cedars-Sinai Medical Group and director of Digital Therapeutics at the Smidt Heart Institute. “By translating home blood pressure data into treatment advice, HF-AI lets us fine-tune medications sooner and keep more patients out of the hospital.”

This study was funded by Cedars-Sinai Technology Ventures.

“This research is a testament to the mission of Cedars-Sinai Technology Ventures to invest in innovative technology and improve clinical outcomes for patients,” said James Laur, JD, chief intellectual property officer for Technology Ventures.

Other Cedars-Sinai authors of the study include Alex Shvartser, MS; Raymond J. Zimmer, MD; Merije Chukumerije, MD; Michael Share, MD; Ronit Zadikany, MD; Michael Farkouh, MD; Yaron Elad, MD; and Michelle Maya Kittleson, MD, PHD.

Gregg Fonarow, MD, of UCLA Medical Center also authored the study.

Declaration of interests: The paper describes software that is the subject of U.S. Provisional Patent Application number 63/314,207, filed by Cedars-Sinai Medical Center on February 25, 2022. Dr. Fonarow has done consulting for Abbott, Amgen, AstraZeneca, Bayer, Boehringer Ingelheim, Cytokinetics, Eli Lilly, Johnson and Johnson, Medtronic, Merck, Novartis, and Pfizer. All other authors have reported that they have no relationships relevant to the contents of this paper to disclose.

In Case You Missed It

Recent headlines from the Cedars-Sinai Newsroom

Cedars-Sinai Health Sciences University is advancing groundbreaking research and educating future leaders in medicine, biomedical sciences and allied health sciences. Learn more about the university.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi