Funding & Business

Pitch Deck for AI Agent Startup Artisan’s $25 Million Funding Round

One startup is on a mission to replace a bunch of repetitive work that humans do, and it just scored a big funding round to replace workers with AI agents.

The startup, Artisan, just raised a $25 million Series A funding round led by Glade Brook Capital. Oliver Jung, Day One Ventures, BOND, Soma Capital, and Sequoia Scout also participated in the round, along with the startup accelerator Y Combinator.

Artisan was a member of YC’s Winter 2024 batch, and it previously raised an $11.5 million seed round in October 2024 led by angel investor Oliver Jung.

Co-founded in 2023 by Jaspar Carmichael-Jack and Sam Stallings, Artisan is developing AI employees, called Artisans, that fully take over specific jobs that have been traditionally done by human workers. These jobs are often routine in nature — think copy and pasting data, updating CRMs, and writing emails.

Artisan’s first Artist, Ava, is a fully autonomous business development representative who can tackle every part of outbound sales, from discovering leads to researching them to outreach to booking meetings.

Some of Artisan’s marketing has garnered viral shock value — in a recent campaign, its founders donned t-shirts reading “Hire Artisans, Not Humans,” — but the startup’s broader goal is that by offboarding rote tasks to AI agents, their human co-workers are less bogged down by tasks and can focus more on creativity.

Thanks to AI advancements, that’s becoming a reality, explained Carmichael-Jack, Artisan’s CEO.

“Six months ago, all investors wanted to hear about was AI’s potential,” he told BI. “Conversations evolved from ‘What could this become?’ to ‘What’s it doing for customers right now?'”

“That’s why our ‘Stop Hiring Humans’ campaign resonated so strongly,” he said. “It tackled the question of what the role of humans moving forward will be.”

AI’s role in the workplace has been a hot-button issue lately, with both employers and employees weighing in on the benefits and detriments of using the tech on the job.

Mira Murati, OpenAI’s former CTO, who’s now running an AI startup, said last year that some jobs at risk of being replaced by AI shouldn’t have existed in the first place — prompting outrage.

The controversy hasn’t deterred a bevy of startups from developing workplace-centric AI agents. AI voice agent Vapi raised $20 million in December from Bessemer. AI agent job recruiter OptimHire landed a $5 million seed in March. And earlier this month, Spur, which uses AI agents to quality test websites, raised a $4.5 million seed round from First Round and Pear.

Check out the 16-slide pitch deck Artisan used to raise its $20 million Series A funding round.

Funding & Business

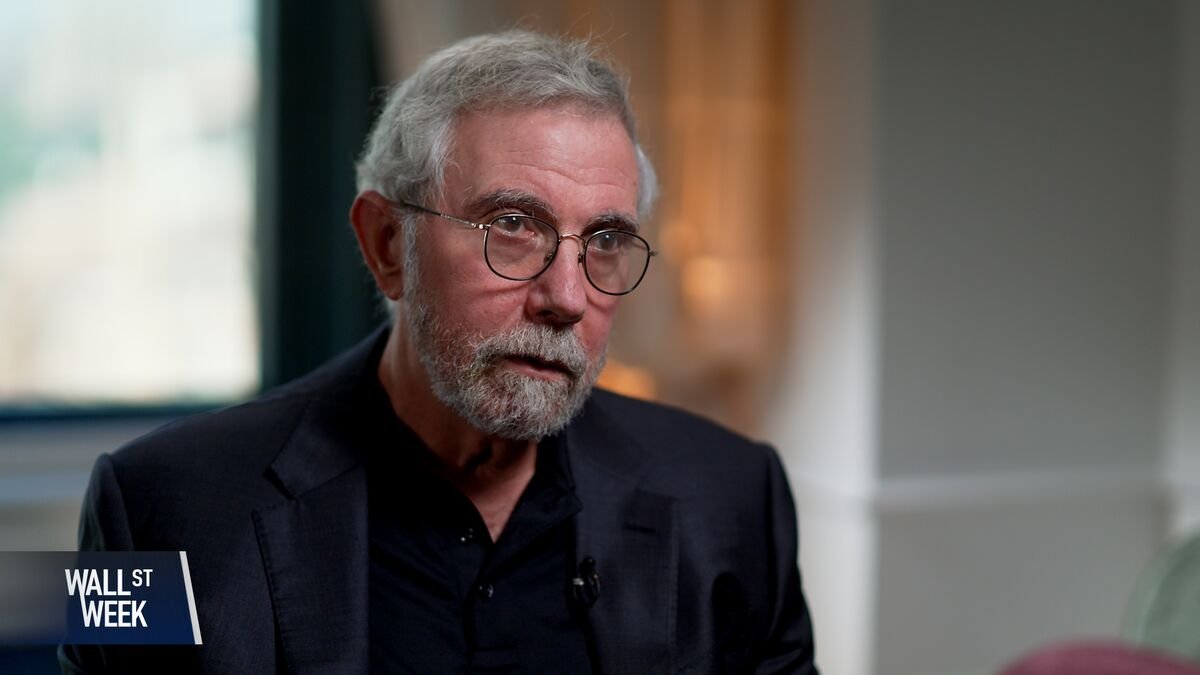

Paul Krugman Says Trump’s Tariffs Make America More Like Denmark

Nobel laureate Paul Krugman argues that tariff “chaos” and President Donald Trump’s immigration policies are the real drag on growth by raising costs, freezing investment, and ultimately hitting consumers. He says a 1950s-style manufacturing revival is illusory, tariff revenue won’t fix the deficit, and U.S. trade-rule credibility has suffered lasting damage. On New York City politics, he expects only marginal policy shifts if Democratic nominee for mayor Zohran Mamdani wins. (Source: Bloomberg)

Source link

Funding & Business

Prices Go Up and Prices Go Down, Depending on Politics and Demand

Donald Trump came to office promising lower prices, but that’s not exactly what happened.

Funding & Business

Botswana Has Credit Rating Cut by S&P on Diamond Slump

Botswana’s credit rating was cut by S&P Global Ratings, another blow to its diamond-dependent economy that’s struggling with a slump in demand for its gems.

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries