Business

Pacing AI Adoption with People Strategy Is Critical for Every Business in 2025

AI adoption and people strategy go hand in hand, but we’ve witnessed many businesses prioritize the former without taking the latter into consideration. Workforce planning in the age of AI has primarily consisted of hiring AI experts and firing those who don’t have the necessary skills required to operate these expensive AI tools, however, this is a short-term strategy that can prove insufficient in the long run.

In order to boost AI adoption, organizations need a clear strategy on how employees will be trained to use this brand-new technology that they have at their disposal. This is essential in ensuring that the workforce is able to keep up with the evolution of the organization. An AI-driven people strategy can mean the difference between successful integration and a patchy one that leads to more regrets than results.

Image: Pexels

Prioritizing AI Adoption and People Strategy Simultaneously Is the Only Way to Succeed

Businesses across the globe have been hot in pursuit of the benefits of artificial intelligence, seeking novel ways to improve their products and services exponentially in a short time. A new survey by the Boston Consulting Group (BCG) spoke to 10,600 workers across 11 countries and found that 72% of respondents use AI regularly. While the adoption rates appeared to be high across the board, India (92%), the Middle East (87%), and Spain (78%) were found to have the highest number of regular users. In the US, the frequent user numbers stood at around 64%.

This data may be surprising to some, but the other findings from the survey were significantly more alarming. Despite the high rates of AI adoption, only 36% of employees felt adequately trained in AI use. Additionally, only 25% of the frontline workers felt their leaders had provided enough guidance on using AI.

The enthusiasm for AI was not just due to the company pressure to comply, but a voluntary desire to master the tools, with 54% stating that they would use AI even if they were not authorized to do so. While the positive attitude to AI might be a good sign for employers who have been facing resistance at their own organizations, it also brings up some concerns around security and incorrect usage that could pose a threat to the business. These numbers make it apparent that a robust people strategy is essential for successful AI adoption in an organization.

Workforce Planning in the Age of AI Requires More Attention

In 2025, despite the many fears around AI and its ability to threaten jobs, many workers are willing to learn and use these tools to improve their performance and drive up the results at their organization. Unfortunately, the pathway to AI adoption remains unclear for workers who have these tools thrust upon them with demands of immediate success. The BCG survey made it clear that organizations that are succeeding in AI integration are the ones that are investing heavily in people transformation and tracking the value created by AI through tangible results.

The technology is evolving, and we are still uncovering new applications for its diverse capabilities, but this exploration has to be done in collaboration with the workforce. “Companies cannot simply roll out GenAI tools and expect transformation,” Sylvain Duranton, Global Leader of BCG X, explained in the report. “Our research shows the real returns come when businesses invest in upskilling their people, redesign how work gets done, and align leadership around AI strategy.”

Organizations need to work with their employees to uncover how exactly AI can be useful to their business, and this is work that takes time. A rushed adoption can hurt a business’ profit margins when the tools are purchased and employees are unsure of what to do with them. A careful, long-term strategy that sets measurable targets is one that can be studied and improved upon for future gains.

Boost AI Adoption with a Clear Strategy for Training the Workforce

Why do we recommend an AI-driven people strategy? It’s because AI is redefining the future of work, whether employers are ready for the transformation or not. Organizing a workforce is a mammoth task on its own, but with AI looming on the horizon, training employees to prepare for the changes that are coming is more important than ever.

There are only so many AI experts that an organization can hire, especially in a short time frame. While the education system works on manufacturing more of these experts, organizations can benefit from working with their existing employees who are already familiar with the business in order to learn and grow together. BCG recommends that organizations “commit appropriate levels of investment, time, and leadership support” towards the training of employees, and we couldn’t agree more.

While organizations plan out which AI tools and services they will invest in, they should also consider allocating some of their budget for the workers who will use the tools. The training here goes beyond learning which buttons to click to interact with the AI tools and extends to gaining an in-depth understanding of what these tools do and what can be done with the results they present. Change will not occur overnight, but businesses that tie their AI adoption strategy with their people strategy can expect to see a smoother transition in the future than businesses that do not.

Subscribe to The HR Digest for more insights into the ever-evolving landscape of work and employment in 2025.

Business

UK manufacturing downturn continues as new orders slide; Profits surge at Royal Mail – business live | Business

UK manufacturing downturn continues as new orders and new export business fall

Ouch! The UK manufacturing sector shrank again last month, as factories were hit by weaker demand at home and abroad.

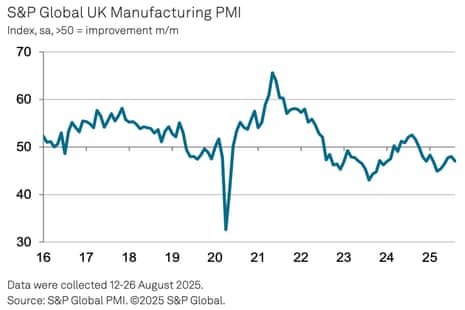

The latest monthly poll of purchasing managers across Britain’s manufacturing sector found that new orders and new export business both fell at quicker rates in August, leading to another drop in production volumes.

This pulled the S&P Global UK Manufacturing Purchasing Managers’ Index down to 47.0 in August, from July’s six-month high of 48.0. It’s the 11th month in a row in which the PMI has come in below the 50-point mark showing stagnation.

UK factories blamed lower new work inflows to “subdued client confidence”, citing tariff uncertainties, and cost increases due to the rise in the minimum wage and employer national insurance rates.

Rob Dobson, director at S&P Global Market Intelligence, says:

“Production volumes are still showing resilience in the face of global geopolitical uncertainty and US tariff policies, with both July and August having seen only slight contractions that were milder than those suffered earlier in the year. Business confidence has also lifted to a sixmonth high, reflecting hopes that the trading environment is starting to settle down.

However, August also saw a steep drop in UK manufacturers’ new orders, with total order books and overseas demand both falling at some of the fastest rates seen over the past two years. Weak market conditions, US tariffs and downbeat client confidence all contributed to the dearth of new contract wins. Job cuts were also reported for a tenth successive month, with factory headcounts dropping to one of the greatest extents postpandemic.

The outlook for the sector therefore clearly remains very uncertain. With manufacturers fearing that possible government policy decisions, including potential tax increases, could further hurt their competitiveness in domestic and export markets, the upcoming Budget will likely prove very important in guiding business confidence about the year ahead.

Key events

Manufacturing supply chains also remained stretched in August.

Today’s PMI report flags that the average wait to receive raw materials lengthened last month, due to a combination of shipping delays, vendor capacity issues, transportation re-routing to avoid the Red Sea and global material shortages.

UK factories also reported they cut jobs for the tenth consecutive month.

S&P Global says:

Lower employment was linked to weaker intakes of new work, tariff uncertainties and rising labour costs (particularly the ongoing impact of higher minimum wages and employer NICs).

UK manufacturing downturn continues as new orders and new export business fall

Ouch! The UK manufacturing sector shrank again last month, as factories were hit by weaker demand at home and abroad.

The latest monthly poll of purchasing managers across Britain’s manufacturing sector found that new orders and new export business both fell at quicker rates in August, leading to another drop in production volumes.

This pulled the S&P Global UK Manufacturing Purchasing Managers’ Index down to 47.0 in August, from July’s six-month high of 48.0. It’s the 11th month in a row in which the PMI has come in below the 50-point mark showing stagnation.

UK factories blamed lower new work inflows to “subdued client confidence”, citing tariff uncertainties, and cost increases due to the rise in the minimum wage and employer national insurance rates.

Rob Dobson, director at S&P Global Market Intelligence, says:

“Production volumes are still showing resilience in the face of global geopolitical uncertainty and US tariff policies, with both July and August having seen only slight contractions that were milder than those suffered earlier in the year. Business confidence has also lifted to a sixmonth high, reflecting hopes that the trading environment is starting to settle down.

However, August also saw a steep drop in UK manufacturers’ new orders, with total order books and overseas demand both falling at some of the fastest rates seen over the past two years. Weak market conditions, US tariffs and downbeat client confidence all contributed to the dearth of new contract wins. Job cuts were also reported for a tenth successive month, with factory headcounts dropping to one of the greatest extents postpandemic.

The outlook for the sector therefore clearly remains very uncertain. With manufacturers fearing that possible government policy decisions, including potential tax increases, could further hurt their competitiveness in domestic and export markets, the upcoming Budget will likely prove very important in guiding business confidence about the year ahead.

Eurozone factory output growth at 41-month high in August

Back in the manufacturing world, eurozone factory output growth has hit a 41-month high, as a long slump finally ended.

Factory production growth across the eurozone was the strongest in nearly three-and-a-half years in August, data provider S&P Global repoerts, despite the turmoil caused by Donald Trump’s trade war.

European manufacturers reported that new orders rose, driven by domestic markets as new export sales fell for a second successive month.

This lifted the HCOB Eurozone Manufacturing PMI back into growth territory. The index increased from 49.8 in July to 50.7 in August, showinng the first monthly improvement in operating conditions for eurzone goods producers since June 2022.

Dr. Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“The economic recovery in the manufacturing sector is broadening, as conditions are improving in six out of the eight countries for which PMIs are recorded—compared to only four countries in the previous month.

As a result, the Manufacturing PMI for the eurozone has crossed the expansion threshold for the first time since mid-2022, mainly because companies have ramped up production more rapidly.”

Profits surge at Royal Mail’s parent company

Royal Mail’s parent company has posted a surge in profits, in its first financial results since being taken over by Czech billionaire Daniel Křetínský.

International Distribution Services (IDS) has reported that pre-tax profits jumped to £429m in the year to 30 March 2025, up from £114m the previous year.

On an adjusted operating profit basis, IDS recorded earnings of £278m for the last year, up from a loss of £28m in the previous year.

This recovery in profits should cheer Křetínský, whose EP Group finalised the £3.6bn takeover of IDS this spring, and may harden suspicious that the Czech sphinx got the company at a bargain price.

Martin Seidenberg, IDS’s chief executive, says:

“It has been a year of change for IDS. Thanks to the hard work of our people and our investment in transformation, Royal Mail returned to profit for the first time in three years, marking an important milestone in the company’s turnaround.

With IDS’s acquisition by EP Group complete and Universal Service reform decided now is the time for us to drive the business forward and capitalise on our momentum.

IDS adds that Royal Mail “significantly improved its financial and operational performance”, and made an adjusted operating profit of £12m if you strip out voluntary redundancy costs. That’s its first profit in three years, following significant losses in 2022-23 and 2023-24.

IDS says:

This is in line with guidance and was achieved despite an increasingly competitive and challenging trading environment.

The company’s parcel delivery services, GLS, made an adjusted operating profit of £286m, a drop of £34m.

IDS blamed the fall on “a challenging macroeconomic and regulatory environment in Germany and Italy and foreign exchange movements”.

European Central Bank president Christine Lagarde has weighed in on the crisis in France, saying that any risk of a government falling in the euro zone is “worrying”.

Speaking to broadcaster Radio Classique, Lagarde said France is not currently in a situation that would need the International Monetary Fund (IMF) to intervene.

But she insisted that fiscal discipline remained imperative in France, and that she was looking very attentively at the French bond spreads situation.

The French government could collapse next week, when parliament hold a confidence vote over plans to slash public spending.

BAE shares rise after Norway warship deal

The London stock market has begun the new month on the front foot.

The FTSE 100 index of blue-chip shares has gained 27 points, or 0.3%, to 9213 points.

Defense firm BAE Systems are the top risers, up 2.8%, after Norway agreed a £10bn deal to buy Type 26 anti-submarine warships from the UK. They’ll be constructed at BAE’s shipyards in Glasgow.

BYD shares fall after slump in profits

Back in the world of manufacturing, China’s electric carmaker BYD is feeling the pain from a domestic price war.

Shares in BYD have fallen 4% today, after it reported a 30% drop in quarterly profits on Friday.

BYD posted a net profit of 6.36 billion yuan ($891 million) in April-June last Friday, missing estimates of 7-9 billion yuan.

BYD, which has overtaken Tesla for sales in Europe, also reported a rise in overseas sales, which helped push revenues up by 14%.

UK house prices: what the experts say

Here’s some early reaction to the news that UK house prices dipped last month.

Karen Noye, mortgage expert at Quilter, says affordability pressures are still weighing heavily on the housing market:

“Last week’s property transaction figures pointed to relatively steady buyer demand, with July seeing 95,580 residential transactions – a 4% increase compared to the same month last year. However, the most recent inflation print has complicated the outlook for interest rates. Mortgage rates have been easing slightly but typical fixed deals remain around 4%, keeping monthly payments elevated, and higher inflation will make the path to lower interest rates even longer.

“Speculation around potential reforms in the Chancellor’s upcoming budget, including possible levies on high-value homes or changes to capital gains tax on primary residences, could also cause hesitation among sellers. This would tighten supply further and paradoxically push prices higher, worsening conditions for new entrants to the market.

Tom Bill, head of UK residential research at estate agent Knight Frank, agrees that speculation over budget tax changes could cool the market.

“House prices have drifted lower since March as the market digests higher rates of stamp duty and supply continues to outstrip demand.

Steady mortgage rates mean transaction numbers have improved over that time but the recent property tax speculation risks sending both sales and prices lower as buyers and sellers deal with pre-Budget uncertainty for the second year in a row.”

According to lender @AskNationwide HPI for August: UK house prices sweated under the glare of Reeves’ property tax musings and the holiday sun. Houses prices down 0.1% month-on-month to £271,079. Moving forward they continue to “bank” on improved affordability from lower rates as… pic.twitter.com/CLcKLp7eni

— Emma Fildes (@emmafildes) September 1, 2025

Marc von Grundherr, director of estate agent Benham and Reeves, reckons the market will pick up in September….

“August’s marginal dip is no surprise, with the school holidays always proving disruptive for buyers and sellers. However, this is nothing more than a seasonal summer slump as our plans to move take a backseat in favour of holidays and longer days spent in the sun with family and friends.

Now that September has arrived it brings with it a greater degree of normality where our day to day routines are concerned and so we should see momentum return quickly, with greater consistency in both market activity and house price growth.”

Nationwide: Housing affordability could improve

Nationwide also expects income growth to continues to outpace house price growth.

That would mean that housing affordability should continue to improve, if gradually.

Their chief economist, Robert Gardner, says further cuts to UK interest could also help:

Borrowing costs are likely to moderate a little further if Bank Rate is lowered again in the coming quarters.

This should support buyer demand, especially since household balance sheets are strong and labour market conditions are expected to remain solid.

UK house prices dipped unexpectedly in August

We also start the new month with news that UK house prices fell last month.

Lender Nationwide reports that the average UK house price dipped by 0.1% in August, surprising economists who had forecast a 0.2% rise.

The average price of a property sold in the month dropped to £271,079, down from £272,664 in July.

On an annual basis, house price inflation slowed to 2.1%, from 2.4% the previous month.

In July, prices had jumped by 0.5% as the market recovered from a dip in June after the end of a tax break on stamp duty. In August, though, the market softened again.

Robert Gardner, Nationwide’s chief economist, says that high mortgage costs are weighing on the market:

“The relatively subdued pace of house price growth is perhaps understandable, given that affordability remains stretched relative to long-term norms. House prices are still high compared to household incomes, making raising a deposit challenging for prospective buyers, especially given the intense cost of living pressures in recent years.

“Combined with the fact that mortgage costs are more than three times the levels prevailing in the wake of the pandemic, this means that the cost of servicing a mortgage is also a barrier for many. Indeed, an average earner buying the typical first-time buyer property with a 20% deposit faces a monthly mortgage payment equivalent to around 35% of their take-home pay, well above the long run average of 30%.

Factory activity shrinks as US tariffs bite

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Factories across Asia-Pacific countries have been hit by a drop in activity last month, as Donald Trump’s trade wars hit demand.

Surveys of purchasing managers from across the region, which are being released today, show that manufacturing output declined during August.

In Japan, new export business contracted at the sharpest rate since March 2024, according to the latest survey from data provider S&P Global. with factory activity shrinking again.

The S&P Global Japan Manufacturing Purchasing Managers’ Index rose to 49.7 in August, up from 48.9 in July, but still below the 50-point mark separating expansion from contraction.

Annabel Fiddes, economics associate director at S&P Global Market Intelligence said:

The latest PMI data signalled that manufacturing conditions in Japan moved closer to stabilisation in August, helped by a softer fall in output.

Demand conditions remained sluggish, however, with overall new work continuing to fall modestly. Of particular concern was a steeper drop in new export business, which fell at the sharpest pace in nearly a year and-a-half.

In early August, Donald Trump latest swathe of country-specific tariffs came into effect, with Japan’s products now attracting a 15% levy.

In South Korea, manufacturers have reported ‘sustained and solid reductions in output and new orders’ last month, which they blamed on a subdued domestic economy and global trade uncertainty.

The S&P Global South Korea Manufacturing Purchasing Managers’ Index came in at 48.3 in August, up slightly from 48.0 in July, but showing the seventh successive month of worsening business conditions.

Manufacturing conditions also continue to weaken in Taiwan, where goods producers reported sharp reductions in both output and new orders.

Taiwanese manufacturers reported that customer demand had fallen both at home and overseas, and that uncertainty over US tariffs and the wider global economic climate also dampened confidence regarding the year-ahead.

S&P Global’s Annabel Fiddes reports:

“The latest PMI data indicated that the performance of Taiwan’s manufacturing sector continued to be dampened by weak global demand conditions amid lingering uncertainty over US tariffs.

Although firms signalled softer falls in output and new orders compared to July, rates of contraction remained historically marked overall, with businesses often noting that uncertainty over future US trade policy had led to greater hesitation among clients to commit to new projects.

China, which is locked in negotiations over a trade deal with the US, also continued to suffer from tariff uncertainty.

China’s manufacturing activity shrank for a fifth straight month in August, an official survey showed on Sunday, with its factory PMI rising to 49.4 from 49.3 in July.

The future of global trade was plunged into further uncertainty last week when the US court of appeals ruled that Donald Trump’s tariffs were unconstitutional, as the US president was not legally allowed to declare national emergencies and impose import taxes on other countries.

This is likely to lead to a showdown at the Supreme Court.

The agenda

-

7am BST: Nationwide’s UK house price index for August

-

9am BST: Eurozone manufacturing PMI report for August

-

9.30am BST: Bank of England’s mortgage approvals and consumer credit data

-

9.30am BST: UK manufacturing PMI report for August

-

10am BST: eurozone unemployment report

Business

UK house price growth slows in August, says Nationwide

UK house price growth slowed in August, bringing it back down to around its slowest pace in a year, according to a leading housing index.

The average price of a British home grew by 2.1% in the year to the end of last month, a slowdown from the 2.4% annual growth recorded in July, according data from lender Nationwide.

August’s rate of growth is the same as Nationwide recorded in June this year. The last time house price growth was this slow was in July 2024.

It comes amid reports that the government is considering an overhaul of property taxes in a bid to raise money and boost the housing market in the autumn Budget.

Robert Gardner, chief economist at Nationwide Building Society, told the BBC the UK needs a tax system which “allows people to move more effectively”.

“It’s definitely worth looking at UK property taxes,” he added.

The average UK home now costs £271,079, according to the lender’s data, which is based on its own mortgage activity.

Despite the drop in the pace of growth, Mr Gardner said housing remains unaffordable for many buyers.

“House prices are still high compared to household incomes, making raising a deposit challenging for prospective buyers, especially given the intense cost of living pressures in recent years,” he said.

The news comes as the government considers ways to shake up how housing is taxed in the UK, according to reports.

The introduction of National Insurance tax for landlords, removing the capital gains tax relief on selling pricier homes, abolishing stamp duty, and replacing council tax with a national property tax are some of the options reportedly being discussed.

Experts’ views on the changes are mixed, with some arguing the abolition of stamp duty in particular could speed up the housing market but cost billions in lost tax revenue.

Business

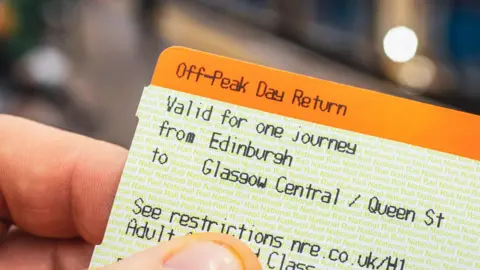

Peak time rail fares srapped on ScotRail trains

Debbie JacksonBBC Scotland News

Getty Images

Getty ImagesPeak rail fares have been scrapped on ScotRail trains, meaning passengers will no longer pay higher prices for travelling during busy weekday rush hours.

Until now, ScotRail passengers paid different fares at different times of day. The removal of the higher fares means significant savings for customers using services by the state-owned operator.

A rail ticket from Edinburgh to Glasgow will be almost 50% cheaper, with trips between Perth and Dundee a third less than previously.

The aim is to get more commuters out of cars and onto trains. Fares on routes that do not currently have peak time prices will be unchanged.

ScotRail ticketing will also be more straightforward and flexible under the new system.

A pilot scheme scrapping peak-time ScotRail fares, a policy championed by the Scottish Greens, was introduced in 2023 but ended in September 2024 after ministers said the costs of the subsidy could not be justified.

However, in his programme for government speech in May, First Minister John Swinney announced that peak fares would again be scrapped.

He told MSPs: “Last year, in the face of severe budget pressures, we took the difficult decision to end the peak fares pilot on our railways.

“But now, given the work we have done to get Scotland’s finances in a stronger position, and hearing also the calls from commuters, from climate activists and from the business community, I can confirm that, from 1 September this year, peak rail fares in Scotland will be scrapped for good.

“A decision that will put more money in people’s pockets and mean less CO2 is pumped into our skies.”

Getty Images

Getty ImagesJoanne Maguire, managing director at ScotRail told BBC Scotland News: “We are really excited at the opportunity to get more customers out of their cars and onto the railway.

“If you are travelling from Edinburgh to Glasgow you will see a saving of about 50%.

“From Inverkeithing to Edinburgh, you will save 40% and between Inverness and Elgin it is 35% – so it’s great news for our passengers.”

Peak fares used to cover tickets bought before 09:15 on weekdays and certain services between 16:42 and 18:30.

The initial pilot scheme which scrapped them began in October 2023, but was ended in September 2024 following “limited success”.

Passenger levels increased by a maximum of about 6.8% but the scheme required a 10% rise to be self-financing.

Ms Maguire said the trial period had seen an increase in passenger numbers and that ScotRail had enjoyed a successful summer of moving customers around to numerous big leisure events.

She added that the goal now was to grow the commuter passenger base.

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies