AI Research

Orfium receives EU grant to tackle copyright attribution in AI-generated music

Music rights company Orfium has been awarded a major grant from the European Commission to lead a groundbreaking research project addressing one of the most pressing challenges facing the music and broader creative industries: detecting and attributing the use of copyrighted works in AI-generated music.

The research funding is part of the EU’s drive to remain competitive in the AI sector in the face of increasing global competition. It’s part of a €7.5 million project, named AIXPERT, by the EU’s Horizon Europe programme under the Explainable and Robust AI initiative, which aims to improve transparency and accountability in AI systems across sectors.

Orfium will work as part of a pan-European consortium and was one of only three proposals selected from 135 applications to obtain the grant.

The consortium includes:

- Sorbonne University,

- Athens Research Centre,

- Amsterdam University Medical Centre,

- Barcelona Supercomputing Centre,

- The University of Barcelona, Novelcore,

- Furhat Robotics, Kyklos Ltd..

- Workable,

- Infinitivity

- Design Labs,

- ITML,

- Martel Innovate,

- Philips Consumer Lifestyle,

- The University of Groningen,

- The Vector Institute for Artificial Intelligence and

- The French National Centre for Scientific Research.

It is tasked with developing AI technologies that can explain their decision-making processes. It will seek to deliver a comprehensive, human-centric AI framework grounded in FATE principles: Fairness, Accountability, Transparency, and Ethics. The project will create AI systems that are transparent, traceable, and inclusive by design.

Orfium has a global team of over 700 experts working across eight key locations. Its clients include music publishers, record labels, broadcasters, studios, production companies and collection societies. The company is the only member of the consortium using explainable models to identify when and how AI-generated music incorporates elements of existing human-made compositions.

Detecting these instances is the first step in enabling accurate attribution and compensation for original songwriters, composers and rightsholders.

The pioneering technology behind this project aims to ensure that original human creators — songwriters, composers, and publishers — are not left behind, enabling them to benefit financially. As the first research of its kind at this scale, it could pave the way for new AI-era standards in copyright regulation, licensing, and monetisation that protect and empower human creativity in the music industry.

According to Rob Wells, CEO of Orfium, the project is hugely significant for the music industry and closely aligns with the startup’s mission to apply AI for the benefit of the sector.

“As generative AI reshapes the entertainment landscape, we are building the infrastructure to ensure creators remain at the centre of that evolution.

To be selected by the European Commission is a strong validation of Orfium’s position at the forefront of innovation in music rights management. It aligns with our commitment to leverage AI to tackle the entertainment industry’s most complex challenges.”

Haris Papageorgiou, AIXPERT Coordinator, said:

“We are at a critical inflexion point where AI’s tremendous potential can only be fully realised if we get the fundamentals right from the ground up.

This isn’t just about building more powerful systems – it’s about building AI that people can actually trust and understand.

We are essentially creating AI that can explain itself in human terms while maintaining the rigour and performance that makes it valuable in the first place.”

AI Research

This 30-year-old CEO says his AI negotiator can successfully haggle down the price of a car by thousands of dollars

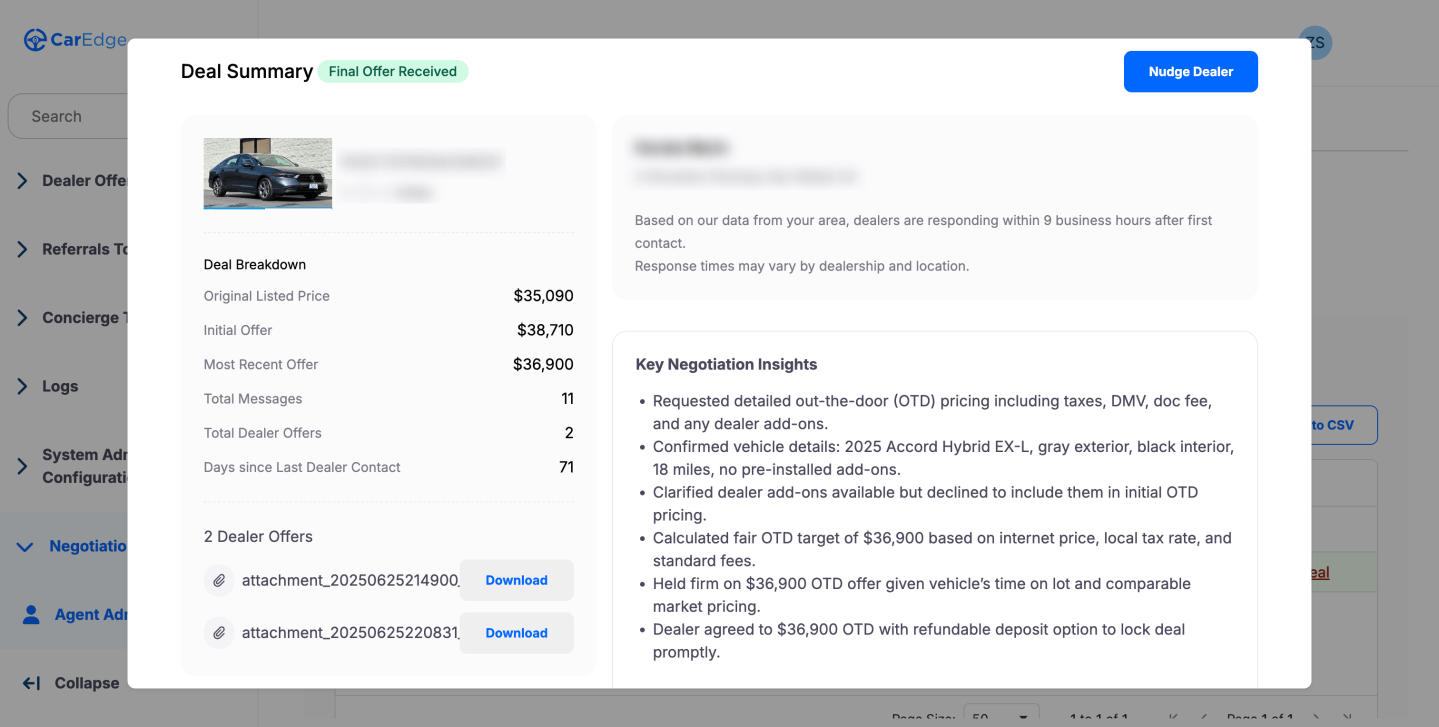

Zach Shefska claims his artificial intelligence can negotiate better car deals than most humans ever could. The 30-year-old chief executive of CarEdge, which he founded with his father Ray in July 2020, says his company’s AI negotiator has saved customers thousands of dollars by handling the back-and-forth haggling that typically makes car buying such a dreaded experience.

Shefska told Fortune the AI negotiator took about four months to develop. “We launched it on July 17th and have helped over 2,000 paying customers,” he said. The system is built on top of existing large language models but enhanced with CarEdge’s proprietary market insights and negotiation training. “CarEdge creates instances of AI agents that are deployed on behalf of users. The agents have proprietary market insights and negotiation training from CarEdge. Each agent creates a unique email and phone number and contacts dealers on behalf of customers,” Shefska told Fortune.

The idea emerged from a simple frustration. “Consumers don’t want to get screwed,” Shefska told PYMNTS in an interview. “And it’s not even necessarily about getting the best price; it’s just not wanting to be taken advantage of.”

CarEdge’s AI negotiator works simply: Customers specify exactly what vehicle they want, and the AI creates anonymous email addresses and phone numbers to contact dealerships directly. The artificial intelligence then handles all the price negotiations while keeping the buyer’s personal information completely private.

Notably, the service isn’t free. Customers pay $40 for a month of access without auto-renewal. “Customers pay because we do not want car dealers to be flooded with users who are simply testing the tech,” Shefska told Fortune. “The goal is for only those who are highly qualified and serious shoppers to leverage the agent to help save them time and money.”

According to CarEdge, though, the results speak for themselves. In one example cited by the company, CarEdge’s AI negotiated a Toyota RAV4 from an initial dealer quote of $37,356 down to $35,600—a savings of nearly $1,800. Customer testimonials published on CarEdge’s website show even bigger wins, with the company claiming that one man, Brian G., reported CarEdge helped him get a 2023 Chrysler Pacifica Hybrid for “$4,000 under MSRP after fees.” Another customer testimonial on the site, attributed to Wes S., says he secured a 2023 Corvette C8 for $5,000 under sticker price.

“On average the agent saves users over $1,000 and ~5 hours of back and forth with dealers via email and text,” Shefska told Fortune. CarEdge says the AI negotiator has been deployed over 10,000 times since launching, collecting pricing data from thousands of dealerships across the country.

CarEdge

The negotiation advantage

What gives the AI such an edge? Unlike consumers who buy cars every three to five years, the artificial intelligence negotiates deals constantly, learning from each interaction. CarEdge has fed the system six years of pricing data from hundreds of thousands of car transactions, giving it deep insights into what constitutes a fair deal.

The AI also eliminates the emotional and psychological pressures that often derail human negotiations. It doesn’t get flustered by high-pressure sales tactics or feel rushed to make a decision. Instead, it methodically compares offers, identifies hidden fees, and pushes for better terms with the persistence of a seasoned negotiator.

According to CarEdge, one customer looking for a Honda Accord got to experience the benefits firsthand when the AI negotiator managed 13 back-and-forth messages with a dealer and ultimately saved him $1,280 off the original out-the-door price.

Beyond the financial savings, the AI negotiator addresses another major pain point in car shopping: privacy invasion. Traditional car shopping websites often expose buyers to a barrage of spam calls and emails from multiple dealerships. CarEdge’s system flips this dynamic entirely: The AI absorbs all the dealer communications while the customer stays anonymous until they’re ready to make a purchase.

This approach has resonated with consumers increasingly concerned about data privacy. The AI uses what CarEdge calls “protected alias” contact information, ensuring that dealers never get access to the buyer’s real phone number or email address during negotiations.

Buying cars in the future

CarEdge’s AI negotiator represents part of a larger transformation in how high-value transactions are conducted. Just as real estate has buyer’s agents, Shefska envisions a future where AI agents routinely handle complex negotiations on behalf of consumers.

As artificial intelligence becomes more sophisticated and car buying remains one of consumers’ most stressful retail experiences, tools like CarEdge’s AI negotiator may become standard practice. For an industry built on information asymmetry and adversarial relationships, that change can’t come soon enough.

For this story, Fortune used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.

AI Research

2 Artificial Intelligence (AI) Leaders

Key Points

-

Companies can’t get enough AI chips, and that spells more growth for Taiwan Semiconductor Manufacturing.

-

Apple has competitive advantages that could make it a sleeper AI stock to buy right now.

-

10 stocks we like better than Taiwan Semiconductor Manufacturing ›

The artificial intelligence (AI) market is expected to add trillions to the global economy, and investors looking for rewarding buy-and-hold investments in the field don’t need to take high risks. Investing in companies that are supplying the computing hardware to power AI technology, as well as those that could benefit from growing adoption of AI-powered consumer products, could earn satisfactory returns. Here are two stocks to consider buying for the long term.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

1. Taiwan Semiconductor Manufacturing

AI doesn’t work without the right chips to train computers to think for themselves. While Nvidia and Broadcom report strong growth, Taiwan Semiconductor Manufacturing (NYSE: TSM) is the one making the chips for these semiconductor companies. TSMC controls over 65% of the chip foundry market, according to Counterpoint, making it the default chip factory for smartphones, computers, and AI.

TSMC manufactures chips that are used in several other markets, including automotive and smart devices. This means that when one market is weak, such as automotive, strength from another (high-performance computing and AI, for example) can pick up the slack.

TSMC’s manufacturing capacity is immense. It can make 17 million 12-inch equivalent silicon wafers every year.

Its massive scale and expertise at making the most advanced chips in the world put it in a lucrative position. Over the last year, it earned $45 billion in net income on $106 billion of revenue. It has delivered double-digit annualized revenue growth over the last few decades, and management expects this growth to continue.

In the second quarter, revenue grew 44% year over year. This growth has pushed the stock up 51% over the past year. Management expects AI chip revenue to grow at an annualized rate in the mid-40s range over the next five years, which is a catalyst for long-term investors.

With Wall Street analysts expecting the company’s earnings per share to grow at an annualized rate of 21% in the coming years, the stock should continue to hit new highs, as it still trades at a reasonable forward price-to-earnings ratio (P/E) of 24.

2. Apple

Apple (NASDAQ: AAPL) hasn’t made a huge splash in AI yet. Apple Intelligence brought some useful features to its devices, such as AI summaries and image creation, but it’s not as robust as customers were expecting. However, investors shouldn’t count the most valuable consumer brand out just yet. Apple has a large installed base of active devices, and millions of customers trust Apple with their personal data, which could put it in a strong position to benefit from AI over the long term.

Apple previously partnered with OpenAI for ChatGPT integration across its products, but with OpenAI now positioning itself as a competitor after bringing in Apple’s former product designer Jony Ive, Apple is rumored to be exploring a partnership with Alphabet‘s Google’s Gemini to power its Siri voice assistant.

Apple appears to be a sleeping giant in AI. Millions of people are walking around with a device that Apple can turn into a super-intelligent assistant with a single software update. Its large installed base of over 2.35 billion active devices is a major advantage that shouldn’t be underestimated.

But Apple has another important advantage that other tech companies can’t match: consumer trust. Apple has built its brand around protecting user privacy, whereas Alphabet’s Google and Meta Platforms have profited off their users’ data to grow their advertising revenue. A partnership with Google for AI would not comprise Apple’s position on user privacy, since Google would need to provide a custom model that runs on Apple’s private cloud.

For these reasons, Apple is well-positioned to be a leader in AI, making its stock a solid buy-and-hold investment. It says a lot about its growth potential that analysts still expect earnings to grow 10% per year despite the fact that the company is lagging behind in AI. The stock’s forward P/E of 32 is on the high side, but that also reflects investor optimism about its long-term prospects.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $671,288!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,031,659!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

John Ballard has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Apple, Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

AI Research

Agentic AI Market Size, Share & Growth Report by 2033

Agentic AI Market Overview

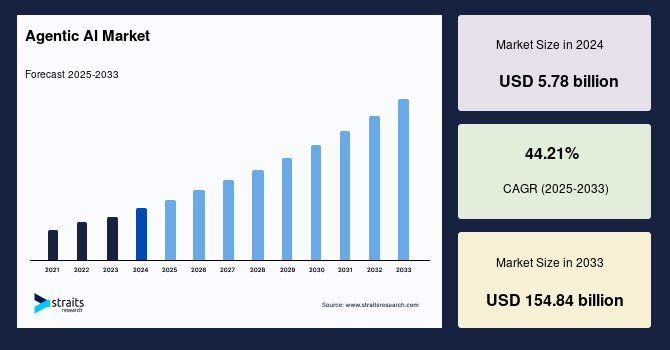

The global agentic AI market size was valued at USD 5.78 billion in 2024 and is estimated to grow from USD 8.31 billion in 2025 to reach USD 154.84 billion by 2033, growing at a CAGR of 44.21% during the forecast period (2025–2033). Rising demand for intelligent automation, enhanced decision-making, and efficiency across enterprises is driving the agentic AI market. Advanced ML, multi-agent systems, and ready-to-deploy solutions enable scalable operations, improved customer experiences, and reduced operational costs worldwide.

Key Market Trends & Insights

- North America held the largest market share, over 40% of the global market.

- By technology, the machine learning segment held the highest market share of over 30.5%.

- By agent system, the single agent systems segmentis expected to witness the fastest CAGR of 47.14%.

- By type, the ready-to-deploy agents segment is expected to witness the fastest CAGR of 42.44%.

- By application, the customer service and virtual assistants segment held the highest market share of over 30%

- By end-user, the enterprise segment held the highest market share of over 35%.

Market Size & Forecast

- 2024 Market Size: USD 78 billion

- 2033 Projected Market Size: USD 84 billion

- CAGR (2025-2033): 21%

- North America: Largest market in 2024

Agentic AI refers to artificial intelligence systems capable of acting independently to achieve goals, rather than only responding to human instructions. These AI agents can plan, make decisions, and execute tasks autonomously, often using reinforcement learning, natural language processing, and advanced algorithms. By continuously observing environments, predicting outcomes, and adapting strategies, agentic AI can solve complex problems, manage workflows, or optimize operations with minimal human intervention, effectively functioning as self-directed digital agents.

The growth of agentic AI is fueled by advancements in computational power, cloud infrastructure, and real-time data analytics, enabling faster and more efficient autonomous operations. Industries such as healthcare, logistics, and finance can leverage agentic AI to enhance precision, reduce operational costs, and improve service delivery. Moreover, integration with IoT and robotics presents opportunities for innovative applications, from smart manufacturing to personalized services, allowing organizations to automate complex tasks while gaining insights for strategic decision-making.

Latest Market Trend

Shift toward autonomous decision-making

The global agentic AI market is witnessing a clear shift toward autonomous decision-making, where AI agents are moving beyond simple task execution to making context-aware, strategic choices with minimal human intervention. This trend is fueled by advances in generative AI, reinforcement learning, and multi-agent collaboration systems.

Businesses are increasingly adopting these autonomous agents to handle dynamic operations such as supply chain optimization, financial trading, and customer engagement. The ability of agentic AI to adapt, self-learn, and respond in real time enhances efficiency and scalability. As trust and explainability improve, autonomous decision-making is becoming a defining feature of next-gen AI adoption.

Market Driver

Rising investments in AI research

Rising investments in AI research are a key driver of the global agentic AI market, enabling rapid advancements in autonomy, reasoning, and multi-agent collaboration. Major technology companies, governments, and venture capital firms are increasingly funding projects that push the boundaries of intelligent decision-making systems.

- For instance, in July 2025, Thinking Machines Lab, founded by former OpenAI CTO Mira Murati, secured a record-breaking $2 billion Series A funding round at a $10 billion valuation, underscoring investor confidence in agentic AI.

Such significant capital inflows accelerate innovation, attract top talent, and drive the commercialization of next-generation AI solutions across industries worldwide.

Market Restraint

High computational and infrastructure costs

High computational and infrastructure costs remain a major restraint in the global agentic AI market. Deploying advanced agentic AI systems requires powerful GPUs, high-performance cloud platforms, and extensive storage to process vast datasets. This leads to significant capital expenditure, making adoption difficult for small and mid-sized enterprises.

Moreover, ongoing expenses for system maintenance, energy consumption, and software updates further strain budgets. These high costs limit large-scale deployment and create disparities between tech giants and smaller players, slowing down overall market penetration.

Market Opportunity

Emerging applications in defense & space

Emerging applications in defense and space present significant opportunities for the agentic AI market, as militaries and space agencies increasingly seek autonomous solutions for complex and high-risk operations. Agentic AI enables real-time decision-making, mission planning, and multi-agent coordination in environments where human intervention is limited or unsafe.

- For instance, in May 2025, Applied Intuition introduced two defense-focused product lines—Axion and Acuity—designed to accelerate deployment of autonomous systems across air, land, sea, and space. Notably, the company also converted a GM Infantry Squad Vehicle to full autonomous operation within just 10 days, showcasing rapid adaptability.

Such advancements highlight how agentic AI is becoming central to next-generation defense strategies and space exploration initiatives.

- 📊 Preview Report Scope and Structure – Gain immediate visibility into key topics, market segments, and data frameworks covered.

- 📥 Evaluate Strategic Insights – Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

North America: Dominant Region

North America remains the dominant region in the agentic AI market, supported by advanced technological infrastructure, strong R&D capabilities, and robust investment in AI-driven innovation. The region leads in enterprise adoption across sectors such as finance, healthcare, and retail, where AI agents streamline operations and customer engagement. For example, major automotive firms in North America are integrating multi-agent systems for autonomous vehicle testing and deployment. With a mature digital ecosystem and significant venture funding, the region continues to set benchmarks for global agentic AI adoption.

- The United States agentic AI market is witnessing strong adoption across enterprises, driven by demand for automation, customer service enhancement, and intelligent decision-making tools. Companies are deploying ready-to-deploy agents to streamline workflows, improve productivity, and personalize customer experiences. With extensive use cases in sectors such as financial services, healthcare, and defense, the U.S. is rapidly scaling AI-driven innovations.

- Canada’s agentic AI market is expanding steadily, with enterprises embracing AI to optimize processes, improve service delivery, and enhance decision-making. Industries such as healthcare, logistics, and retail are integrating intelligent agents to manage complex operations more efficiently. Ready-to-deploy solutions are particularly popular, helping businesses achieve faster digital transformation without heavy technical resources.

Asia-Pacific: Significantly Growing Region

The Asia-Pacific region is experiencing significant growth in the agentic AI market, fueled by rapid digitalization, strong government support, and expanding enterprise adoption. Countries across the region are deploying agentic AI in applications like e-commerce, financial services, and manufacturing, driving both efficiency and innovation.

For example, leading telecom operators in Asia-Pacific have integrated virtual assistants to handle large-scale customer service demands, reducing costs while enhancing user satisfaction. With increasing investments in AI infrastructure and rising demand for intelligent automation, the region is emerging as a global growth hotspot.

- China’s agentic AI market is accelerating, supported by large-scale investments, strong government backing, and an ecosystem of leading tech companies. Enterprises are leveraging multi-agent systems and machine learning-based agents for applications in manufacturing, smart cities, and retail. The rise of AI-powered virtual assistants and robotics in consumer and enterprise sectors highlights China’s leadership in applied innovation.

- India’s agentic AI market is growing rapidly, driven by digital transformation initiatives across industries such as banking, healthcare, and e-commerce. Enterprises are adopting ready-to-deploy agents for customer service, process automation, and data-driven decision-making. The increasing demand for multilingual virtual assistants is also boosting adoption, catering to the country’s diverse user base. With strong government-led AI initiatives and expanding startup ecosystems, India is positioning itself as a key growth hub.

Market Segmentation

The global agentic AI market is bifurcated by technology, agent system, type, application, and end-user.

Technology Insights

The Machine Learning segment dominates the global agentic AI market, driving advanced predictive capabilities, decision-making, and automation across industries. Its ability to learn from data, adapt to patterns, and optimize outcomes makes it the backbone of intelligent agents. From fraud detection and recommendation engines to autonomous navigation, machine learning algorithms are powering scalable and reliable agentic solutions. With rising adoption in finance, healthcare, and enterprise automation, machine learning remains the key technology propelling innovation and shaping the competitive edge in agentic AI.

Agent System Insights

The multi-agent systems segment dominates the agentic AI landscape, offering collaborative intelligence where multiple agents interact to achieve complex objectives. This approach enables scalability, resilience, and real-time adaptability in dynamic environments. Widely applied in logistics, defense, and smart city infrastructure, these systems enhance decision-making by distributing tasks across interconnected agents. Their ability to manage interdependencies and deliver coordinated outcomes makes them essential for industries demanding efficiency and autonomy.

Type Insights

The Ready-to-Deploy Agents segment dominates the market, offering organizations pre-built, easily integrable solutions that reduce development costs and deployment time. Businesses increasingly favor these agents for applications like customer service, IT helpdesks, and process automation, where quick implementation is crucial. Their plug-and-play nature allows enterprises to scale AI adoption without heavy technical expertise, making them ideal for improving productivity and user experience. As demand for faster time-to-value rises, ready-to-deploy agents continue to capture the largest market share.

Application Insights

The Customer Service and Virtual Assistants segment represents the largest application segment, dominating due to the growing enterprise focus on enhancing customer experience. These AI-driven agents handle inquiries, resolve issues, and provide 24/7 support, reducing operational costs while improving satisfaction. From retail and banking to telecom, virtual assistants streamline interactions and personalize services, making them indispensable for businesses. With advancements in natural language processing and conversational AI, this segment is expanding rapidly in the global market.

End-User Insights

The Enterprise segment dominates the agentic AI market, as organizations adopt intelligent agents to optimize operations, decision-making, and customer engagement. Enterprises leverage these systems for automating workflows, managing resources, and enhancing productivity across multiple departments. From HR and finance to supply chain and marketing, agentic AI enables cost savings, efficiency, and data-driven insights. With the growing demand for scalability, security, and personalization, enterprises are leading adoption, positioning themselves at the forefront of leveraging agentic AI.

Company Market Share

The agentic AI market is characterized by strong competition, with leading companies focusing on diverse strategies to expand their presence. Many are investing heavily in research and development to advance machine learning, natural language processing, and multi-agent system capabilities. Others are concentrating on building ready-to-deploy agents to meet growing enterprise demand for rapid integration and scalability.

OpenAI

OpenAI, started in 2015 as an AI research organization, has evolved from open collaboration to building advanced large language models. With milestones like GPT series, it now pioneers agentic AI, focusing on autonomous systems, reasoning, and safer, scalable intelligence to transform industries while ensuring responsible innovation.

- In August 2025, OpenAI officially released GPT-5, introducing it as its most advanced and intelligent model to date. Featuring a unified system that swiftly balances quick responses with deeper reasoning, GPT-5 demonstrates expert-level performance across coding, health, writing, and multimodal tasks, significantly reducing hallucinations and boosting usability.

List of key players in Agentic AI Market

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Apple Inc.

- Baidu

- IBM Corporation

- Meta

- Microsoft

- NVIDIA Corporation

- Salesforce, Inc.

- Anthropic

- C3.ai

- CrewAI

- LivePerson

- Moveworks

- NICE Ltd.

- OpenAI

- Oracle

- ServiceNow

Recent Development

- February 2025 – GitHub launched Agent Mode for GitHub Copilot, significantly improving its AI-powered coding capabilities. The update enables Copilot to autonomously process high-level instructions, generate code spanning multiple files, detect errors, and apply fixes with minimal human guidance.

Agentic AI Market Segmentations

By Technology (2021-2033)

- Machine Learning

- Natural Language Processing (NLP)

- Deep Learning

- Computer Vision

- Others

By Agent System (2021-2033)

- Single Agent Systems

- Multi-Agent Systems

By Type (2021-2033)

- Ready-to-Deploy Agents

- Build-Your-Own Agents

By Application (2021-2033)

- Customer Service and Virtual Assistants

- Robotics and Automation

- Healthcare

- Financial Services

- Security and Surveillance

- Gaming and Entertainment

- Marketing and Sales

- Human Resources

- Legal and Compliance

- Others

By End-User (2021-2033)

- Consumer

- Enterprise

- Industrial

By Region (2021-2033)

-

North America

- U.S.

- Canada

-

Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Nordic

- Benelux

- Rest of Europe

-

APAC

- China

- Korea

- Japan

- India

- Australia

- Taiwan

- South East Asia

- Rest of Asia-Pacific

-

Middle East and Africa

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Egypt

- Nigeria

- Rest of MEA

-

LATAM

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Rest of LATAM

Frequently Asked Questions (FAQs)

The global agentic AI market size was valued at USD 5.78 billion in 2024 and is estimated to grow from USD 8.31 billion in 2025 to reach USD 154.84 billion by 2033, growing at a CAGR of 44.21% during the forecast period (2025–2033).

Rising investments in AI research are a key driver of the global agentic AI market, enabling rapid advancements in autonomy, reasoning, and multi-agent collaboration.

The Ready-to-Deploy Agents segment dominates the market, offering organizations pre-built, easily integrable solutions that reduce development costs and deployment time.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi