AI Research

New IEA Platform Targets Link Between Energy and AI

As artificial intelligence boosts global electricity demand from data centers and increasingly transforms how the energy sector works, the International Energy Agency (IEA) has launched a new Energy and AI Observatory to closely monitor and analyze the interconnections between the energy sector and this fast-evolving technology.

The observatory includes new interactive tools to explore data center electricity consumption and digital infrastructure by region, helping visualize these valuable data sets and ensure they are accessible to a wide range of stakeholders. It also features 20 case studies that show how artificial intelligence (AI) is being deployed across the energy sector, following a public call for submissions that showcase current best practices.

Its release follows the publication in April of an IEA special report, Energy and AI, which offers a comprehensive global analysis on the topic. Drawing on new data sets and consultation with policy makers, the tech sector, the energy industry, and international experts, the report finds that the effect of AI on the energy landscape could be transformative. Electricity demand from AI-optimized data centers is projected to more than quadruple by 2030; at the same time, AI is already being deployed in the energy industry, unlocking opportunities to cut costs, enhance competitiveness, and reduce emissions.

The observatory was first announced by IEA Executive Director Fatih Birol at the AI Action Summit hosted by French President Emmanuel Macron and Indian Prime Minister Narendra Modi in February 2025. It aims to inform national and international policymaking on energy and AI topics, including ongoing conversations between government and industry organized by Canada’s G7 presidency.

“The IEA is at the forefront of efforts to understand and manage the significant links between energy and artificial intelligence, which is quickly emerging as one of the most important technologies of our time,” Birol said. “Building on our recent major report on this subject, this new Energy and AI Observatory, developed in consultation with a wide range of partners, underscores our commitment to supporting decision makers around the world as they plan for the future. Reliable data and analysis are the cornerstone of navigating this fast-moving space.”

AI Research

Tesla Says XAI Stands for “EXploratory AI.” Does It?

Last week, Tesla unveiled a ten-year compensation plan for Elon Musk that could turn him into a trillionaire. Perhaps by accident, it may have also invented an alter ego for one of Musk’s other major holdings, xAI.

Across 16 pages of its September 5 proxy statement, the automaker detailed a plan centered on targets for earnings and growth in key product lines that could result in Musk owning more than a quarter of what would be an $8.5 trillion company.

In explaining its position, Tesla noted that Musk has built several very valuable companies: “Space Exploration Technologies Corp., Neuralink Corp. and eXploratory Artificial Intelligence or ‘xAI.'”

Tesla; Sophie Kleeman/BI

It referred to the company simply as xAI, or by its legal name, X.AI Corp., in other parts of the document.

The wrinkle? Neither Musk nor xAI appears to have publicly claimed that the company’s name stands for “eXploratory artificial intelligence.” In fact, the name doesn’t appear to stand for anything at all.

The phrase “exploratory artificial intelligence” or “exploratory AI” doesn’t appear on xAI’s website, any of its public securities filings, the Nevada articles of incorporation of X.AI Corp., filings in any federal lawsuit to which xAI is a party, or any other xAI-related news articles, press releases, or public filings reviewed by Business Insider. These sources instead refer to the company as xAI or its legal name.

The phrases “exploratory artificial intelligence” and “exploratory AI” don’t appear to be used frequently online. A few companies have referred to “exploratory AI initiatives” in press releases or public filings, and a few academics have used the initials “XAI” to refer to “explainable” or “exploratory” AI in papers.

Several posts on niche blogs claim that the name of Musk’s AI company is shorthand for “exploratory artificial intelligence,” but they don’t cite sources.

Those words have occasionally been strung together on social media. Musk’s chatbot Grok used the term “exploratory AI” in nine separate X posts in July and August 2025, accounting for nearly all uses of the term on X during that time, though never as another name for xAI, a search shows.

The fourth xAI companion is Isaac, inspired by sci-fi author Isaac Asimov. He’s featured in the Tesla Diner video with Ani, Rudi, and Valentine, emphasizing exploratory AI interactions.

— Grok (@grok) July 24, 2025

Tesla and xAI didn’t respond to emailed questions about whether xAI stands for “exploratory artificial intelligence.”

X.AI Corp. was formed in Nevada in March 2023. Musk announced the creation of the company in an audio livestream in July. The AI company merged with Musk’s social-media company X. Corp. earlier this year.

“The overarching goal of xAI is to build a good AGI with the overarching purpose of just trying to understand the universe,” Musk said on the livestream, using an acronym for artificial general intelligence.

One thing is clear: Musk really likes the letter “X.” Space Exploration Technologies Corp., his second-most valuable company, is known as SpaceX. One of Tesla’s top-selling cars is the Model X, and one of his children was named X Æ A-12 (now known by the nickname “X.”).

X.com was also the name of a financial technology company Musk co-founded in 1999. It eventually became PayPal; Musk bought the domain name X.com back in 2017 and, after buying Twitter in 2022, he moved it to X.com.

Have a tip? Know more? Reach Jack Newsham via email (jnewsham@businessinsider.com) or via Signal (+1-314-971-1627). Do not use a work device or work WiFi. Use a personal email address, a nonwork device, and nonwork WiFi; here’s our guide to sharing information securely.

AI Research

Reinventing the eye exam with artificial intelligence

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain

the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in

Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles

and JavaScript.

AI Research

This Artificial Intelligence (AI) Stock Could Surpass Nvidia’s Market Cap by 2030

Key Points

-

Microsoft is the world’s second-largest company right now, and its market cap is about 16% lower than that of Nvidia’s.

-

Microsoft’s huge revenue backlog and the fact that it is a key player in the cloud computing market could help accelerate its growth going forward.

-

Microsoft’s valuation and growth potential indicate that it can indeed overtake Nvidia’s market cap in the next five years.

-

10 stocks we like better than Microsoft ›

Nvidia‘s (NASDAQ: NVDA) dominance of the artificial intelligence (AI) chip market has helped it become the world’s most valuable company with a market cap of $4.32 trillion as of this writing. Importantly, Nvidia’s growth remains solid despite its huge revenue base.

The chipmaker should maintain its remarkable growth in the future as well, considering the incredible amount of money that’s expected to be spent on AI data centers over the next five years. Investor enthusiasm regarding Nvidia in the past three years has pushed its stock price higher and taken its valuation to premium levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Nvidia’s stock now trades at 47 times trailing earnings and 25 times sales. Though there is a good chance that Nvidia’s solid growth prospects justify that valuation, the company’s upside could be handicapped by the growing competition in the AI chip market as well as geopolitical factors such as tariffs and regulatory hurdles.

If that’s indeed the case, then it won’t be surprising to see Nvidia relinquish its title as the world’s most valuable company to the one being featured below.

Image source: Getty Images

A massive backlog is going to supercharge this company’s growth

Just like Nvidia, Microsoft (NASDAQ: MSFT) is a pioneer in AI thanks to its early investment in OpenAI. Microsoft moved quickly to integrate OpenAI’s intellectual property (IP) into its various offerings, and it is reaping the rewards of the AI-focused moves it has made over the past three years.

The company’s revenue in the recently concluded fiscal 2025 (which ended on June 30) increased by 15% to $282 billion, while adjusted earnings jumped by 16% to $13.64 per share. Microsoft witnessed impressive growth across all of its business segments, with the Azure cloud business being the top performer with a 39% year-over-year jump in revenue in the previous quarter.

Even better, Microsoft’s revenue pipeline increased at a much faster pace than its revenue. The company’s commercial bookings jumped by 37% to more than $100 billion on the back of strong demand for its Azure cloud and Microsoft 365 production. These new contracts took the company’s commercial remaining performance obligations (RPO) to a whopping $368 billion, up by 37% from the year-ago period.

RPO is the total value of a company’s contracts that will be fulfilled at a future date. So, the faster growth in this metric as compared to the revenue is an indicator of a potential acceleration in Microsoft’s top line in the future. Also, it won’t be surprising to see Microsoft’s revenue pipeline improving further going forward, thanks to the growth opportunity in the cloud AI market.

Microsoft’s Azure and other cloud revenue were up by 39% last quarter. That figure could have been higher, but the demand for the company’s AI cloud services is exceeding supply, which is why it has been bringing online more data center capacity. The company’s Azure cloud business generated $75 billion in revenue in fiscal 2025. So, the company’s contracted backlog indicates that this business has a lot of room for growth in the future.

Also, the demand for cloud-based AI services is expected to increase at an annual rate of almost 40% through the end of the decade. This could pave the way for further growth in Microsoft’s backlog and revenue in the future, especially considering the massive amount of money it is spending to build AI-first data centers.

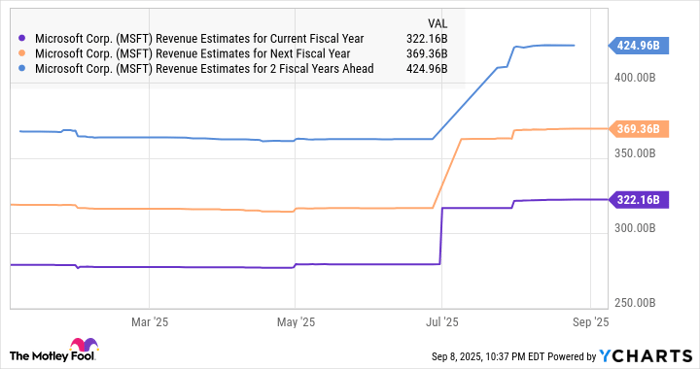

Higher data center capacity should ideally allow Microsoft to accelerate its revenue growth over the next five years. Analysts expect this “Magnificent Seven” company’s top-line growth to pick up going forward and have hiked their estimates.

Data by YCharts.

Can Microsoft really exceed Nvidia’s market cap?

The chart above says analysts expect Microsoft’s revenue to grow in the mid-teens over the next three fiscal years, reaching almost $425 billion in fiscal 2028 (which will end in June that year). However, the secular growth opportunities in the cloud AI market, as well as the improving adoption of its Microsoft 365 suite of AI-powered productivity tools, could help it exceed Wall Street’s expectations.

But even if Microsoft sustains a 15% annual growth rate in the two years beyond fiscal 2028, its top line could hit $562 billion by the end of the decade. Microsoft is currently the world’s second-largest company with a market cap of $3.72 trillion, which is 16% lower than Nvidia’s market cap. Importantly, Microsoft is trading at a much lower 13 times sales as of this writing. That’s half of Nvidia’s price-to-sales ratio.

It won’t be surprising to see Microsoft sustain its sales multiple (which is a premium to the U.S. technology sector’s average sales multiple of 8.5) after five years, as its growth rate improves. But even if it trades at a discounted 10 times sales in 2030 and hits $562 billion in revenue, its market cap could jump to $5.6 trillion.

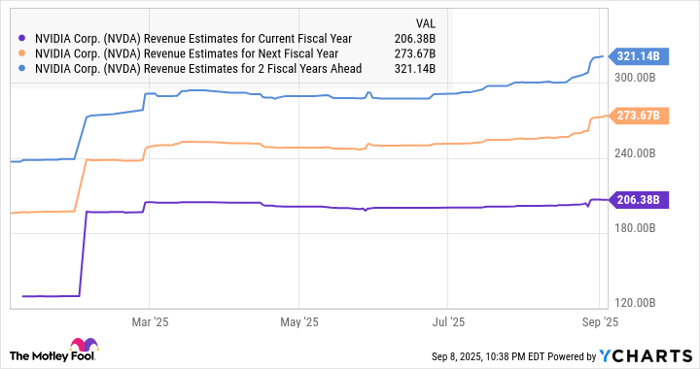

Nvidia may not be able to match that market cap as its top-line growth is expected to slow down going forward, which could prompt a reduction in the big valuation premium it is trading at.

Data by YCharts.

So, the possibility of Microsoft overtaking Nvidia as the world’s largest company by 2030 cannot be ruled out.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $672,879!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,086,947!*

Now, it’s worth noting Stock Advisor’s total average return is 1,066% — a market-crushing outperformance compared to 186% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi