Tools & Platforms

Meta’s earnings blowout has destroyed tech’s AI concern: Opening Bid top takeaway

A Big Tech blowout.

After strong second quarter earnings reports from Alphabet (GOOG) and Netflix (NFLX), the market was ready to be amazed by Microsoft (MSFT) and Meta (META). What investors got was flat-out noteworthy given the gargantuan size of these beasts.

Meta delivered 22% revenue growth to $47.52 billion as AI investments fuel improved ad monetization. On the earnings call, co-founder and CEO Mark Zuckerberg sounded like an AI overlord, hyping up his recent hiring of Alexandr Wang to build out a superintelligence unit.

No matter that Meta guided to a roughly $30 billion year-over-year increase in capital expenditures this year!

“Meta’s 2Q results reinforced that AI is driving positive impacts on engagement and advertising, which enables Meta to invest more in AI capacity,” KeyBanc analyst Justin Patterson wrote.

Microsoft was no slouch. The company’s Azure business sales accelerated, which has analysts foaming at the mouth. Guidance looked solid too.

Guggenheim analyst John DiFucci noted, “Nights like this make us wonder why we couldn’t get there with Microsoft when it was below $400 [a share], but frankly, we didn’t see this coming, though in fairness to Microsoft management, they said it was.”

Lost in the robust tech reports is Federal Reserve chair Jay Powell sounding more like a hawk than a dove at his presser Wednesday afternoon. And an honorable mention is the 27% surge in Wingstop’s (WING) stock on Wednesday after strong earnings (watch the CEO on Opening Bid above).

Although it’s an embarrassment of riches for investors today in terms of catalysts, it’s Meta that deserves a zoom-in.

Zuckerberg delivered, and then some.

On top of the 22% sales increase, the company signaled the good times will keep on rolling as it plows deeper into artificial intelligence. Perhaps more important than the sales increase is that operating profit margins rose despite mega-spending on AI projects.

Meta’s quarterly scorecard:

-

Wins: The core advertising model is on fire. AI investments are clearly paying off. Zuckerberg is as engaged as ever.

-

Losses: Super lofty guidance for 2026 capex spending.

“In addition to bringing tools for advertisers to better reach clients, AI can also be a source of currently unpriced revenue streams at WhatsApp (only a few regions use these messaging apps to engage with customers), including with Agentic AI. Also, with Meta AI (accessible from WhatsApp or via a standalone app in the US, for example), Meta could capture more search related traffic and open new ad opportunities. Were WhatsApp standalone to attract the same ad/services dollars as Facebook or Instagram, and assuming 10% cannibalisation rate, we calculate a $50 billion revenue opportunity in 2030.” -HSBC’s Neil Churchill

Tools & Platforms

Apple faces lawsuit over alleged use of pirated books for AI training

Two authors have filed a lawsuit against Apple, accusing the company of infringing on their copyright by using their books to train its artificial intelligence model without their consent. The plaintiffs, Grady Hendrix and Jennifer Roberson, claimed that Apple used a dataset of pirated copyrighted books that include their works for AI training. They said in their complaint that Applebot, the company’s scraper, can “reach ‘shadow libraries'” made up of unlicensed copyrighted books, including (on information) their own. The lawsuit is currently seeking class action status, due to the sheer number of books and authors found in shadow libraries.

The main plaintiffs for the lawsuit are Grady Hendrix and Jennifer Roberson, both of whom have multiple books under their names. They said that Apple, one of the biggest companies in the world, did not attempt to pay them for “their contributions to [the] potentially lucrative venture.” Apple has “copied the copyrighted works” of the plaintiffs “to train AI models whose outputs compete with and dilute the market for those very works — works without which Apple Intelligence would have far less commercial value,” they wrote in their filing. “This conduct has deprived Plaintiffs and the Class of control over their work, undermined the economic value of their labor, and positioned Apple to achieve massive commercial success through unlawful means.”

This is but one of the many lawsuits filed against companies developing generative AI technologies. OpenAI is facing a few, including lawsuits from The New York Times and the oldest nonprofit newsroom in the US. Notably, Anthropic, the AI company behind the Claude chatbot, recently agreed to pay $1.5 billion to settle a class action piracy complaint also brought by authors. Similar to this case, the writers also accused the company of taking pirated books from online libraries to train its AI technology. The 500,000 authors involved in the case will reportedly get $3,000 per work.

Tools & Platforms

AI-Enhanced Pedagogy Provost Endorsement open for enrollment until Sept. 30

UNIVERSITY PARK, Pa. — Teaching and Learning with Technology at Penn State is enrolling faculty and staff until Sept. 30 in the Provost Endorsement Program: AI-Enhanced Pedagogy, which will be held during the fall 2025 semester. Participants will explore and integrate generative AI technologies into their teaching practices.

To complete the endorsement program, participants must attend seven internal Penn State events related to generative AI in instruction during the fall 2025 semester. Events will vary between in person and online options. Events will be offered by experts from Teaching and Learning with Technology, Commonwealth Campus instructional designers, the University Libraries, and the Schreyer Institute for Teaching Excellence.

Additionally, participants will use Canvas to submit a revised assignment, an insights post, and a philosophy video to receive individualized feedback from the endorsement program leads.

The goals of this endorsement program are to support the discovery of generative AI teaching and learning opportunities as a University-wide community and to support the tailoring of GenAI uses to enhance student skills development.

By completing this endorsement program, participants will:

- Identify teaching and/or learning opportunities for equity, ethical practices or disciplinary skills afforded by generative AI technologies.

- Explore and use at least three generative AI tools.

- Review and revise a course or teaching approach with generative AI to support student success.

- Create a video of an instructional philosophy with generative AI that could be given to students.

Faculty and staff can find more information and enroll on the AI-Enhanced Pedagogy webpage.

Tools & Platforms

New AI Partnerships Could Be a Game Changer for DXC Technology (DXC)

- DXC Technology recently announced partnerships with startups Acumino, CAMB.AI, and GreenMatterAI to advance AI solutions in the automotive and manufacturing industries, focusing on smart factory robotics, real-time speech translation, and synthetic data projects.

- This collaboration, made as part of the STARTUP AUTOBAHN initiative, highlights DXC’s commitment to transforming emerging technology into practical industry impact by accelerating AI adoption.

- We’ll examine how these new AI partnerships could reshape DXC Technology’s investment narrative and long-term prospects in digital transformation.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

DXC Technology Investment Narrative Recap

To be a shareholder in DXC Technology today, you need to believe that the company’s efforts in digital transformation and AI can counter persistent revenue declines and revive organic growth. While the new partnerships with Acumino, CAMB.AI, and GreenMatterAI showcase momentum in AI, the immediate effect on stabilizing short-term revenues or addressing the ongoing decline in the GIS segment is likely to be modest, given the inherent scale and timing of these projects.

Of recent announcements, DXC’s deal to create the DXC Agentic Security Operations Center with 7AI stands out as especially relevant alongside the new automotive and manufacturing AI partnerships. This reflects a deepening focus on expanding digital offerings through AI-driven solutions, which underpins the most important catalyst for the stock: improved client demand and bookings growth from digital modernization, even as near-term performance remains pressured.

However, investors should not overlook that, despite these innovation efforts, persistent challenges in revenue and margin stabilization continue to weigh on the company’s outlook, especially if…

Read the full narrative on DXC Technology (it’s free!)

DXC Technology’s outlook projects $12.1 billion in revenue and $208.6 million in earnings by 2028. This implies a 1.7% annual revenue decline and a $170.4 million decrease in earnings from the current $379.0 million.

Uncover how DXC Technology’s forecasts yield a $15.12 fair value, in line with its current price.

Exploring Other Perspectives

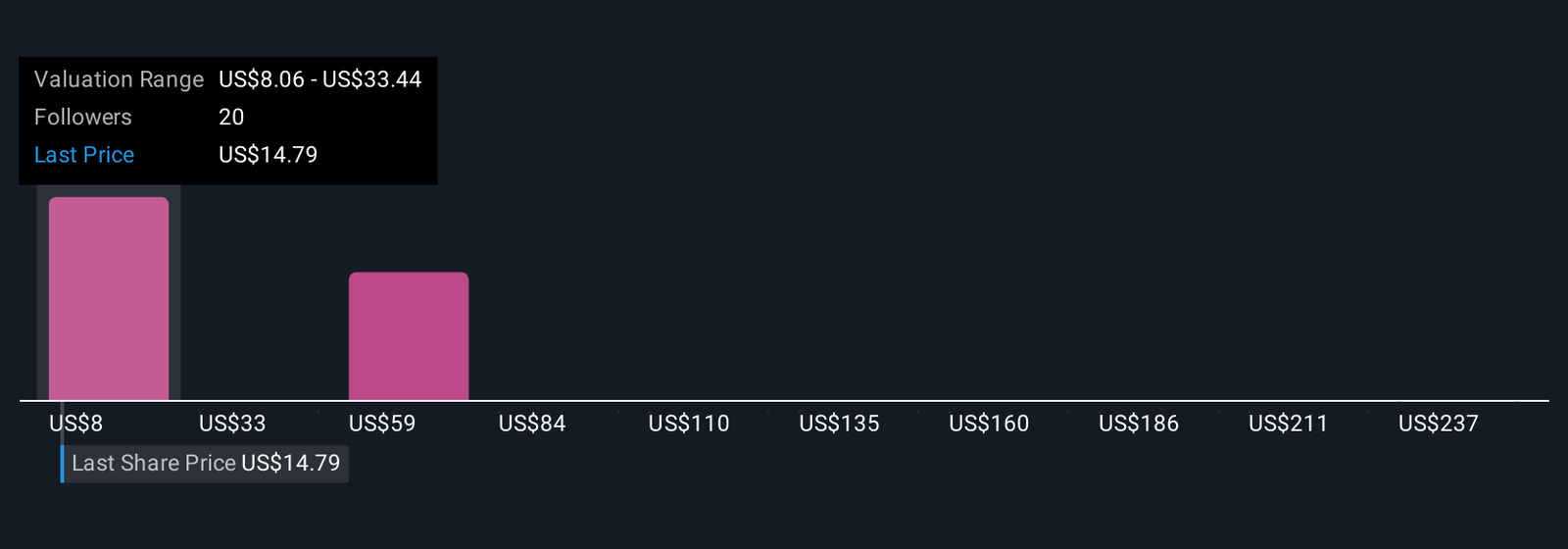

Six Simply Wall St Community members estimate DXC’s fair value between US$8.06 and US$261.89, indicating significant differences in growth assumptions. Balance these viewpoints with persistent risks to revenue and backlog conversion that could impact near-term earnings and investor sentiment.

Explore 6 other fair value estimates on DXC Technology – why the stock might be worth 46% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Interested In Other Possibilities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

-

Business1 week ago

Business1 week agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi