AI Research

Metaforms Raises $9M to Reinvent Market Research with AI Agents

In the high-stakes world of market research—where timelines are shrinking and complexity is rising—many agencies face a painful paradox: more demand than they can handle. Enter Metaforms, a fast-growing AI startup that’s quietly powering a major shift in how insight work gets done. Today, Metaforms announced a $9 million Series A funding round to scale its platform of AI-powered research agents designed specifically for market research agencies.

The round was led by Peak XV Partners (formerly Sequoia India), with participation from Nexus Venture Partners and Together Fund. With this raise, Metaforms has secured over $10 million in total funding, positioning it to expand into new workflows like automated report generation and voice-based research, and deepen integrations with key tools such as SPSS, Decipher, and Confirmit.

Automating the Bottlenecks, Not the Brains

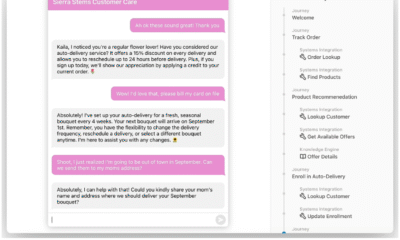

At its core, Metaforms is not trying to replace market researchers—it’s giving them leverage. The platform offers intelligent agents purpose-built for the workflows that underpin survey design, data processing, and panel coordination. Instead of writing endless validation scripts or emailing panel providers for quota updates, researchers can now deploy agents that handle those repetitive tasks at scale.

For instance, when a pharmaceutical company wants to determine whether doctors prefer pills or sachets for a new drug, Metaforms can instantly convert complex questionnaires into functioning survey code, validate logic, distribute to multiple panel partners, and flag bad data—all while the human team focuses on analysis and strategic insights.

The technical architecture behind Metaforms is based on AI agents trained to operate within industry-standard platforms and protocols. These agents aren’t just general-purpose bots—they’re engineered with deep context about research-specific tasks and terminology. From routing logic to quota balancing, the system understands the nuances that define a successful study.

Born From Pain, Built for Scale

Metaforms was founded in 2022 by Akshat Tyagi and Arjun S, who faced their own struggles accessing quality research while launching earlier startups. Realizing the bottleneck wasn’t demand but agency bandwidth, they launched Metaforms to give agencies the operational scale they were missing.

“Our goal is simple: help great research teams spend less time firefighting and more time doing the work that actually matters,” said Akshat Tyagi, Metaforms’ co-founder and CEO. “When you automate the grunt work, you make high-quality research more accessible to more companies.”

That mission has struck a chord. In just six months since launching commercially, Metaforms has signed four of the world’s top 20 research agencies, including Strat7, and is already processing more than 1,000 surveys each month. Every customer that started with a single AI agent has expanded their usage, a rare feat that demonstrates both product-market fit and real operational value.

Investors and clients alike are bullish. Shailendra Singh, Managing Director at Peak XV, praised Metaforms for enabling global research agencies to “automate workflows such as survey programming and data processing through their suite of AI agents.” Jonathan Tice, former Chief Customer Officer at Forsta, highlighted Metaforms’ ability to “embed seamlessly into the workflows, tools, and platforms researchers already use.”

A Glimpse Into the Future of Market Research

The rise of Metaforms is not just a startup success story—it’s a signal of deeper transformation within the $130 billion global research industry. As demand for data-driven decision-making accelerates, agencies are under immense pressure to deliver faster, broader, and more nuanced insights—without growing their headcount or compromising on quality.

What Metaforms is enabling reflects a broader shift from project-based labor to system-based leverage. AI agents like those developed by Metaforms are not just task automators; they are infrastructure—modular systems that integrate into legacy tools, scale with demand, and adapt to industry-specific constraints. This is a significant departure from previous waves of AI hype, which often focused on general-purpose assistants rather than vertical-specific operators with domain fluency.

This evolution opens new possibilities for how market research is conducted. Instead of being limited by human hours, agencies can reallocate their expertise toward designing better methodologies, interpreting patterns with greater sophistication, and exploring new types of insight work altogether—like real-time qualitative analysis or voice-driven longitudinal studies.

Moreover, as Metaforms moves into areas like voice-based research and multilingual automation, the industry could see a democratization of access. Smaller companies, which previously couldn’t afford custom research or multinational studies, might now find it within reach. And for global brands, the ability to iterate and deploy studies quickly across languages and geographies could become a competitive advantage in fast-moving markets.

AI Research

Deutsche Bank on ‘the summer AI turned ugly’: ‘more sober’ than the dotcom bubble, with som troubling data-center math

Deutsche Bank analysts have been watching Amazon Prime, it seems. Specifically, the “breakout” show of the summer, “The Summer I Turned Pretty.” In the AI sphere, analysts Adrian Cox and Stefan Abrudan wrote, it was the summer AI “turned ugly,” with several emerging themes that will set the course for the final quarter of the year. Paramount among them: The rising fear over whether AI has driven Big Tech stocks into the kind of frothy territory that precedes a sharp drop.

The AI news cycle of the summer captured themes including the challenge of starting a career, the importance of technology in the China/U.S. trade war, and mounting anxiety about the impact of the technology. But in terms of finance and investing, Deutsche Bank sees markets “on edge” and hoping for a soft landing amid bubble fears. In part, it blames tech CEOs for egging on the market with overpromises, leading to inflated hopes and dreams, many spurred on by tech leaders’ overpromises. It also sees a major impact from the venture capital space, boosting startups’ valuations, and from the lawyers who are very busy filing lawsuits for all kinds of AI players. It’s ugly out there. But the market is actually “more sober” in many ways than the situation from the late 1990s, the German bank argues.

Still, Wall Street is not Main Street, and Deutsche Bank notes troubling math about the data centers sprouting up on the outskirts of your town. Specifically, the bank flags a back-of-the-envelope analysis from hedge fund Praetorian Capital that suggests hyperscalers’ massive data center investments could be setting up the market for negative returns, echoing past cycles of “capital destruction.”

AI hype and market volatility

AI has captured the market’s imagination, with Cox and Abrudan noting, “it’s clear there is a lot of hype.” Web searches for AI are 10 times as high as they ever were for crypto, the bank said, citing Google Trends data, while it also finds that S&P 500 companies mentioned “AI” over 3,300 times in their earnings calls this past quarter.

Stock valuations overall have soared alongside the “Magnificent Seven” tech firms, which collectively comprise a third of the S&P 500’s market cap. (The most magnificent: Nvidia, now the world’s most valuable company at a market cap exceeding $4 trillion.) Yet Deutsche Bank points out that today’s top tech players have healthier balance sheets and more resilient business models than the high flyers of the dotcom era.

By most ratios, the bank said, valuations “still look more sober than those for hot stocks at the height of the dot-com bubble,” when the Nasdaq more than tripled in less than 18 months to March 2000, then lost 75% of its value by late 2002. By price-to-earnings ratio, Alphabet and Meta are in the mid-20x range, while Amazon and Microsoft trade in the mid-30x range. By comparison, Cisco surpassed 200x during the dotcom bubble, and even Microsoft reached 80x. Nvidia is “only” 50x, Deutsche Bank noted.

Those data centers, though

Despite the relative restraint in share prices, AI’s real risk may be lurking away from its stock-market valuations, in the economics of its infrastructure. Deutsche Bank cites a blog post by Praetorian Capital “that has been doing the rounds.” The post in “Kuppy’s Korner,” named for the fund’s CEO Harris “Kuppy” Kupperman, estimates that hyperscalers’ total data-center spending for 2025 could hit $400 billion, and the bank notes that is roughly the size of the GDP of Malaysia or Egypt. The problem, according to the hedge fund, is that the data centers will depreciate by roughly $40 billion per year, while they currently generate no more than $20 billion of annual revenue. How is that supposed to work?

“Now, remember, revenue today is running at $15 to $20 billion,” the blog post says, explaining that revenue needs to grow at least tenfold just to cover the depreciation. Even assuming future margins rise to 25%, the blog post estimates that the sector would require a stunning $160 billion in annual revenue from the AI powered by those data centers just to break even on depreciation—and nearly $480 billion to deliver a modest 20% return on invested capital. For context, even giants like Netflix and Microsoft Office 365 at their peaks brought in less than a fraction of that figure. Even at that level, “you’d need $480 billion of AI revenue to hit your target return … $480 billion is a LOT of revenue for guys like me who don’t even pay a monthly fee today for the product.” Going from $20 billion to $480 billion could take a long time, if ever, is the implication, and sometime before the big AI platforms reach those levels, their earnings, and presumably their shares, could take a hit.

Deutsche Bank itself isn’t as pessimistic. The bank notes that the data-center buildout is producing a greatly reduced cost for each use of an AI model, as startups are reaching “meaningful scale in cloud consumption.” Also, consumer AI such as ChatGPT and Gemini is growing fast, with OpenAI saying in August that ChatGPT had over 700 million weekly users, plus 5 million paying business users, up from 3 million three months earlier. The cost to query an AI model (subsidized by the venture capital sector, to be sure) has fallen by around 99.7% in the two years since the launch of ChatGPT and is still headed downward.

Echoes of prior bubbles

Praetorian Capital draws two historical parallels to the current situation: the dotcom era’s fiber buildout, which led to the bankruptcy of Global Crossing, and the more recent capital bust of shale oil. In each case, the underlying technology is real and transformative—but overzealous spending with little regard for returns could leave investors holding the bag if progress stalls.

The “arms race” mentality now gripping the hyperscalers’ massive capex buildout mirrors the capital intensity of those past crises, and as Praetorian notes, “even the MAG7 will not be immune” if shareholder patience runs out. Per Kuppy’s Korner, “the megacap tech names are forced to lever up to keep buying chips, after having outrun their own cash flows; or they give up on the arms race, writing off the past few years of capex … Like many things in finance, it’s all pretty obvious where this will end up, it’s the timing that’s the hard part.”

This cycle, Deutsche Bank argues, is being sustained by robust earnings and more conservative valuations than the dotcom era, but “periodic corrections are welcome, releasing some steam from the system and guarding against complacency.” If revenue growth fails to keep up with depreciation and replacement needs, investors may force a harsh reckoning—one characterized not by spectacular innovation but by a slow realization of negative returns.

AI Research

Training on AI, market research, raising capital offered through Jamestown Regional Entrepreneur Center – Jamestown Sun

Sevearl training events will be held for the public through the Jamestown Regional Entrepreneur Center in September.

On Sept. 9-12, a “Get Found Masterclass” will be offered to the public. This four-part workshop series is designed specifically for small business service providers who are focused on growth through smarter systems, trusted tools and clear visibility strategies. Across four focused sessions, participants will learn how to protect their brand while embracing automation, use Google’s free tools to enhance online visibility and send the right visibility signals to today’s AI-powered search engines. Participants will discover how AI can support small businesses, how to build ethical systems that scale, and what really influences trust, authority and ranking.

On Sept. 10, a stand-alone workshop on “Market and Customer Research” will be held. This workshop will guide participants on where and how to find customers. The presentation will

also discuss which SEO keywords competitors are using for free. Participants will compare current methods of social media marketing and discuss the variety of free market research tools that offer critical information on your industry and customers.

On Sept. 23, “AI tools for Social Media Marketing” is planned. Discuss the use of tools like ChatGPT to brainstorm post ideas, captions, and scripts; Lately.ai to repurpose long-form content into social media snippets; Canva + Magic Studio for fast, on-brand visuals and Metricool or later for AI-assisted scheduling and analytics. Automate so you can focus on connection and creativity.

On Sept. 24 is a high-level presentation led by Kat Steinberg, special counsel, and Amy Reischauer, deputy director of the of the Securities and Exchange Commision’s Office of the Advocate for Small Business Capital Formation, on the regulatory framework and SEC resources surrounding raising capital. They will also share broad data from their most recent annual report on what has been happening in capital raising in recent years. The office seeks to advocate and advance the interests of small businesses seeking to raise capital and the investors who support them at the SEC and in the capital markets. The office develops comprehensive educational materials and resources while actively engaging with

industry stakeholders to identify both obstacles and emerging opportunities in the capital

formation landscape. Through events like this, the office creates platforms for meaningful

dialogue, collecting valuable feedback and disseminating insights about capital-raising

pathways for small businesses from early-stage startups to established small public companies.

To register for these training events, visit www.JRECenter.com/Events. Follow the Jamestown

Regional Entrepreneur Center at Facebook.com/JRECenter, on Instagram at JRECenter and on

LinkedIn. Questions may be directed to Katherine.Roth@uj.edu.

AI Research

1 Brilliant Artificial Intelligence (AI) Stock Down 30% From Its All-Time High That’s a No-Brainer Buy

ASML is one of the world’s most critical companies.

Few companies’ products are as critical to the modern world’s technological infrastructure as those made by ASML (ASML 3.75%). Without the chipmaking equipment the Netherlands-based manufacturer provides, much of the world’s most innovative technology wouldn’t be possible. That makes it one of the most important companies in the world, even if many people have never heard of it.

Over the long term, ASML has been a profitable investment, but the stock has struggled recently — it’s down by more than 30% from the all-time high it touched in July 2024. I believe this pullback presents an excellent opportunity to buy shares of this key supporting player for the AI sector and other advanced technologies.

Image source: Getty Images.

ASML has been a victim of government policies around the globe

ASML makes lithography machines, which trace out the incredibly fine patterns of the circuits on silicon chips. Its top-of-the-line extreme ultraviolet (EUV) lithography machines are the only ones capable of printing the newest, most powerful, and most feature-dense chips. No other companies have been able to make EUV machines thus far. They are also highly regulated, as Western nations don’t want this technology going to China, so the Dutch and U.S. governments have put strict restrictions on the types of machines ASML can export to China or its allies. In fact, even tighter new regulations were put in place last year that prevented ASML from servicing some machines that it previously was allowed to sell to Chinese companies.

As a result of these export bans, ASML’s sales to one of the world’s largest economies have been curtailed. This led to investors bidding the stock down in 2024 — a drop it still hasn’t recovered from.

2025 has been a relatively strong year for ASML’s business, but tariffs have made it challenging to forecast where matters are headed. Management has been cautious with its guidance for the year as it is unsure of how tariffs will affect the business. In its Q2 report, management stated that tariffs had had a less significant impact in the quarter than initially projected. As a result, ASML generated 7.7 billion euros in sales, which was at the high end of its 7.2 billion to 7.7 billion euro guidance range. For Q3, the company says it expects sales of between 7.4 billion and 7.9 billion euros, but if tariffs have a significantly negative impact on the economic picture, it could come up short.

Given all the planned spending on new chip production capacity to meet AI-related demand, investors would be wise to assume that ASML will benefit. However, the company is staying conservative in its guidance even as it prepares for growth. This conservative stance has caused the market to remain fairly bearish on ASML’s outlook even as all signs point toward a strong 2026.

This makes ASML a buying opportunity at its current stock price.

ASML’s valuation hasn’t been this low since 2023

Compared to the last five years, ASML trades at a historically low price-to-earnings (P/E) ratio and a forward P/E ratio.

ASML PE Ratio data by YCharts.

With expectations for ASML at low levels, investors shouldn’t be surprised if its valuation rises sometime over the next year, particularly if management’s commentary becomes more bullish as demand increases in line with chipmakers’ efforts to expand their production capacity.

This could lift ASML back into its more normal valuation range in the mid-30s, which is perfectly acceptable given its growth level, considering that it has no direct competition.

ASML is a great stock to buy now and hold for several years or longer, allowing you to reap the benefits of chipmakers increasing their production capacity. Just because the market isn’t that bullish on ASML now, that doesn’t mean it won’t be in the future. This rare moment offers an ideal opportunity to load up on shares of a stock that I believe is one of the best values in the market right now.

-

Business1 week ago

Business1 week agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi