Tools & Platforms

Meet ‘Element’, Rs 42 Lakh AI Robot That Kills Weeds, Fixes Farms

Los Banos: Oblivious to the punishing midday heat, a wheeled robot powered by the sun and infused with artificial intelligence carefully combs a cotton field in California, plucking out weeds.

As farms across the United States face a shortage of laborers and weeds grow resistant to herbicides, startup Aigen says its robotic solution — named Element — can save farmers money, help the environment and keep harmful chemicals out of food.

“I really believe this is the biggest thing we can do to improve human health,” co-founder and chief technology officer Richard Wurden told AFP, as robots made their way through crops at Bowles Farm in the town of Los Banos. “Everybody’s eating food sprayed with chemicals.”

Wurden, a mechanical engineer who spent five years at Tesla, went to work on the robot after relatives who farm in Minnesota told him weeding was a costly bane. Weeds are becoming immune to herbicides, but a shortage of laborers often leaves chemicals as the only viable option, according to Wurden.

“No farmer that we’ve ever talked to said ‘I’m in love with chemicals’,” added Aigen co-founder and chief executive Kenny Lee, whose background is in software. “They use it because it’s a tool — we’re trying to create an alternative.” Element the robot resembles a large table on wheels, solar panels on top. Metal arms equipped with small blades reach down to hoe between crop plants.

“It actually mimics how humans work,” Lee said as the temperature hit 90 degrees Fahrenheit (32 degrees Celsius) under a cloudless sky. “When the sun goes down, it just powers down and goes to sleep; then in the morning it comes back up and starts going again.”

The robot’s AI system takes in data from on-board cameras, allowing it to follow crop rows and identify weeds. “If you think this is a job that we want humans doing, just spend two hours in the field weeding,” Wurden said. Aigen’s vision is for workers who once toiled in the heat to be “upskilled” to monitor and troubleshoot robots.

Along with the on-board AI, robots communicate wirelessly with small control centers, notifying handlers of mishaps.

Future giant?

Aigen has robots running in tomato, cotton, and sugar beet fields, and touts the technology’s ability to weed without damaging the crops. Lee estimated that it takes about five robots to weed 160 acres (65 hectares) of farm. The robots made by the 25-person startup — based in the city of Redmond, outside Seattle — are priced at $50,000.

The company is focused on winning over politically conservative farmers with a climate-friendly option that relies on the sun instead of costly diesel fuel that powers heavy machinery. “Climate, the word, has become politicized but when you get really down to brass tacks farmers care about their land,” Lee said.

The technology caught the attention of Amazon Web Services (AWS), the e-commerce giant’s cloud computing unit. Aigen was chosen for AWS’s “Compute for Climate” fellowship program that provides AI tools, data center power, and technical help for startups tackling environmental woes. “Aigen is going to be one of the industry giants in the future,” said AWS head of climate tech startups business development Lisbeth Kaufman.

“I think about Ford and the Model T, or Edison and the light bulb — that’s Kenny and Rich and Aigen.”

(Except for the headline, this story has not been edited by ETV Bharat staff and is published from a syndicated feed.)

Read More

Tools & Platforms

New AI Partnerships Could Be a Game Changer for DXC Technology (DXC)

- DXC Technology recently announced partnerships with startups Acumino, CAMB.AI, and GreenMatterAI to advance AI solutions in the automotive and manufacturing industries, focusing on smart factory robotics, real-time speech translation, and synthetic data projects.

- This collaboration, made as part of the STARTUP AUTOBAHN initiative, highlights DXC’s commitment to transforming emerging technology into practical industry impact by accelerating AI adoption.

- We’ll examine how these new AI partnerships could reshape DXC Technology’s investment narrative and long-term prospects in digital transformation.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

DXC Technology Investment Narrative Recap

To be a shareholder in DXC Technology today, you need to believe that the company’s efforts in digital transformation and AI can counter persistent revenue declines and revive organic growth. While the new partnerships with Acumino, CAMB.AI, and GreenMatterAI showcase momentum in AI, the immediate effect on stabilizing short-term revenues or addressing the ongoing decline in the GIS segment is likely to be modest, given the inherent scale and timing of these projects.

Of recent announcements, DXC’s deal to create the DXC Agentic Security Operations Center with 7AI stands out as especially relevant alongside the new automotive and manufacturing AI partnerships. This reflects a deepening focus on expanding digital offerings through AI-driven solutions, which underpins the most important catalyst for the stock: improved client demand and bookings growth from digital modernization, even as near-term performance remains pressured.

However, investors should not overlook that, despite these innovation efforts, persistent challenges in revenue and margin stabilization continue to weigh on the company’s outlook, especially if…

Read the full narrative on DXC Technology (it’s free!)

DXC Technology’s outlook projects $12.1 billion in revenue and $208.6 million in earnings by 2028. This implies a 1.7% annual revenue decline and a $170.4 million decrease in earnings from the current $379.0 million.

Uncover how DXC Technology’s forecasts yield a $15.12 fair value, in line with its current price.

Exploring Other Perspectives

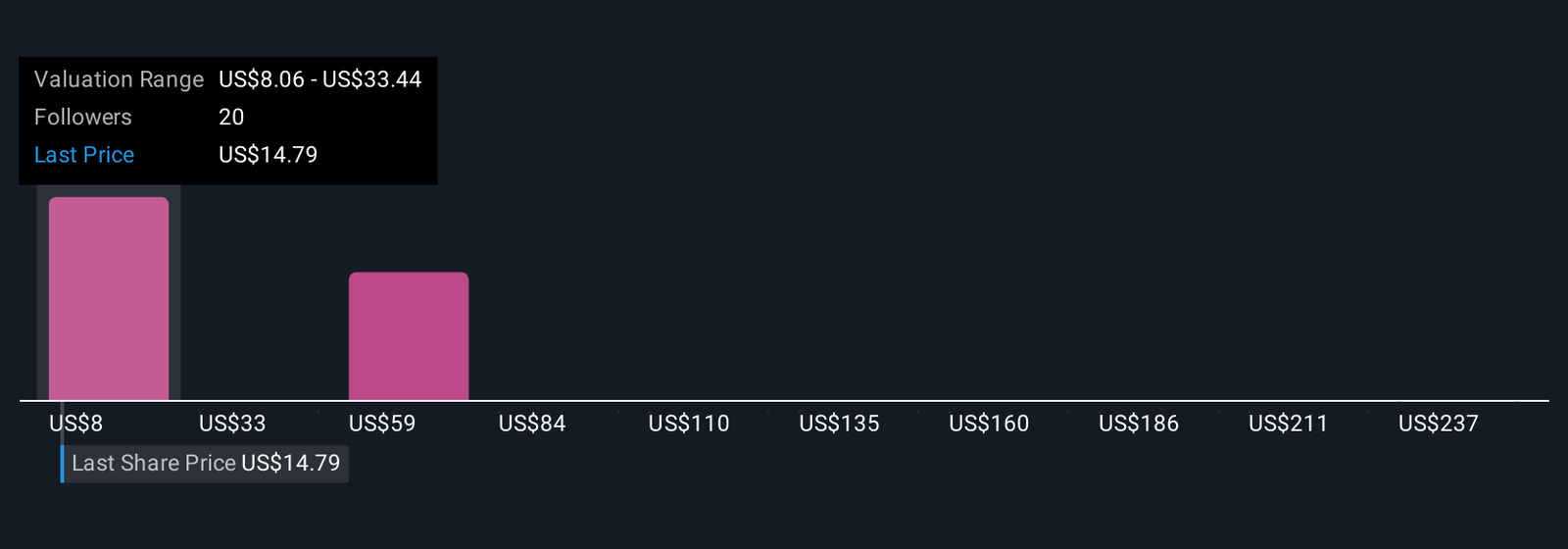

Six Simply Wall St Community members estimate DXC’s fair value between US$8.06 and US$261.89, indicating significant differences in growth assumptions. Balance these viewpoints with persistent risks to revenue and backlog conversion that could impact near-term earnings and investor sentiment.

Explore 6 other fair value estimates on DXC Technology – why the stock might be worth 46% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Interested In Other Possibilities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Tools & Platforms

Will Sea Dagger’s AI-Driven Tech Shift Leidos Holdings’ (LDOS) Role in Government Defense Contracts?

- Leidos recently unveiled the Sea Dagger, a next-generation Commando Insertion Craft for the Royal Navy, featuring high speed, modular mission systems, and autonomous technologies tailored for modern maritime operations.

- This unveiling positions Leidos as a prominent innovator in advanced maritime defense solutions, aligning with major UK and AUKUS defense modernization priorities.

- We’ll explore how the Sea Dagger launch, leveraging autonomy and AI, could shape Leidos Holdings’ government contract growth outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Leidos Holdings Investment Narrative Recap

To be a shareholder in Leidos Holdings, you need confidence in the company’s ability to capture long-term government spending on defense modernization and advanced technology, while managing its reliance on large public sector contracts. The announcement of Sea Dagger enhances Leidos’ credentials in maritime autonomy and aligns with top spending priorities, but gives only an incremental boost to near-term government contract momentum, which remains the company’s key catalyst. The largest risk continues to be shifts in government funding priorities, which could disrupt expected revenue growth if budgets tighten.

Among recent developments, Leidos winning a $128 million FBI task order for agile software development illustrates how its expertise in secure, high-tech government solutions is translating into new business opportunities. This aligns with the same digital innovation and defense modernization themes seen in the Sea Dagger project, further supporting the company’s biggest catalyst: continued multi-year growth in national security and technology contracts.

Yet, despite these advances, if defense spending priorities change faster than expected, investors need to be aware that…

Read the full narrative on Leidos Holdings (it’s free!)

Leidos Holdings is projected to reach $18.6 billion in revenue and $1.5 billion in earnings by 2028. This outlook requires a 3.0% annual revenue growth rate and a $0.1 billion increase in earnings from the current $1.4 billion.

Uncover how Leidos Holdings’ forecasts yield a $186.69 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from US$102 to US$285.81. While high expectations for government modernization support optimism, investor forecasts remind you opinions vary widely and signal multiple possible outcomes for Leidos’ future.

Explore 8 other fair value estimates on Leidos Holdings – why the stock might be worth as much as 60% more than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Tools & Platforms

AI giant Anthropic to pay $1.5 bn over pirated books

Anthropic will pay at least $1.5 billion to settle a US class action lawsuit over allegedly using pirated books to train its artificial intelligence models, according to court documents filed Friday.

“This landmark settlement far surpasses any other known copyright recovery,” said plaintiffs’ attorney Justin Nelson. “It is the first of its kind in the AI era.”

The settlement stems from a class-action lawsuit filed by authors Andrea Bartz, Charles Graeber, and Kirk Wallace Johnson, who accused Anthropic of illegally copying their books to train Claude, the company’s AI chatbot that rivals ChatGPT.

In a partial victory for Anthropic, US District Court Judge William Alsup ruled in June that the company’s training of its Claude AI models with books—whether bought or pirated—so transformed the works that it constituted “fair use” under the law.

“The technology at issue was among the most transformative many of us will see in our lifetimes,” Alsup wrote in his decision, comparing AI training to how humans learn by reading books.

However, Alsup rejected Anthropic’s bid for blanket protection, ruling that the company’s practice of downloading millions of pirated books to build a permanent digital library was not justified by fair use protections.

“We remain committed to developing safe AI systems that help people and organizations extend their capabilities, advance scientific discovery, and solve complex problems,” Anthropic deputy general counsel Aparna Sridhar said in response to an AFP inquiry.

San Francisco-based Anthropic announced this week that it raised $13 billion in a funding round valuing the AI startup at $183 billion.

Anthropic competes with generative artificial intelligence offerings from Google, OpenAI, Meta, and Microsoft in a race that is expected to attract hundreds of billions of dollars in investment over the next few years.

Thousands of books

According to the legal filing, the settlement covers approximately 500,000 books, translating to roughly $3,000 per work—four times the minimum statutory damages under US copyright law.

Under the agreement, Anthropic will destroy the original pirated files and any copies made, though the company retains rights to books it legally purchased and scanned.

“This settlement sends a strong message to the AI industry that there are serious consequences when they pirate authors’ works to train their AI, robbing those least able to afford it,” said Mary Rasenberger, CEO of the Authors Guild, in a statement supporting the deal.

The settlement, which requires judicial approval, comes as AI companies face growing legal pressure over their training practices.

A US judge in June handed Meta a victory over authors who accused the tech giant of violating copyright law by training Llama AI on their creations without permission.

District Court Judge Vince Chhabria in San Francisco ruled that Meta’s use of the works to train its AI model was “transformative” enough to constitute “fair use” under copyright law.

Apple Intelligence

Meanwhile, Apple on Friday was targeted with a lawsuit by a pair of US authors accusing the iPhone maker of using pirated books to train generative AI built into its lineup of devices.

The tech titan’s suite of capabilities called “Apple Intelligence” is part of a move to show it is not being left behind in the AI race.

“To train the generative-AI models that are part of Apple Intelligence, Apple first amassed an enormous library of data,” read the suit.

“Part of Apple’s data library includes copyrighted works—including books created by plaintiffs—that were copied without author consent, credit, or compensation.”

Apple “scraped” works from sources including “shadow libraries” stocked with pirated books, the suit contends.

Apple did not immediately reply to a request for comment.

The suit filed against Apple by Grady Hendrix, author of “My Best Friend’s Exorcism,” and Jennifer Roberson of Arizon, whose books include “Sword-Bound,” seeks class action status.

© 2025 AFP

Citation:

AI giant Anthropic to pay $1.5 bn over pirated books (2025, September 6)

retrieved 6 September 2025

from https://techxplore.com/news/2025-09-ai-giant-anthropic-pay-bn.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

-

Business1 week ago

Business1 week agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi