Business

‘Living on Universal Credit is a constant battle’

BBC News, Nottingham

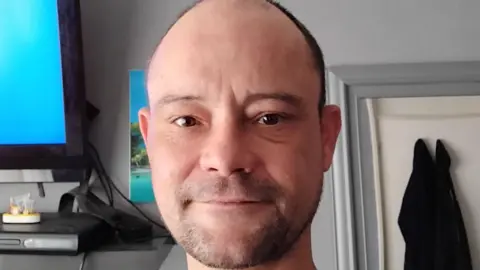

Keith Williams

Keith Williams“If it wasn’t for food banks, I’d struggle to get any sort of food. I’d starve.”

Keith Williams says living on a monthly universal credit (UC) benefit payment of £368 is “a constant battle” and the money “just isn’t enough” and usually lasts about a week.

“Running out of food feels awful, you feel like you’re letting people down,” adds Keith, from Radford in Nottingham.

A spokesperson for the Department for Work and Pensions (DWP) outlined measures taken to support households on UC, including extending the Household Support Fund and child poverty taskforce.

UC is a single benefit payment for working-age people.

It was introduced to replace a range of different benefits for unemployed and low-paid people.

There were 7.9 million people on UC in June in England, Scotland and Wales, according to official government statistics, the highest level since its introduction in 2013.

‘I paid my taxes’

For Keith, he gets help at the non-profit charity SFiCE’s social cafe and food bank in Nottingham, which provides free meals to homeless and vulnerable people in the city.

The 42-year-old worked for 21 years before losing his last job in 2022 and has since struggled to find employment.

“After paying into the system for so long, Universal Credit feels like a slap in the face,” he added.

“People will say you should be happy because you’re getting money for nothing but I’m not, I paid taxes for 20 years, I deserve more.”

John Lamb/Getty

John Lamb/GettyA UK-wide study by the University of Nottingham found that 70% of people on UC were skipping meals or going entire days without eating and losing weight.

Simon Welham, associate professor in human nutrition at the university, told the BBC that he originally began the study to understand what kinds of foods people on UC were eating and how much.

He realised the participants receiving benefits struggled to access proper nutrition, including consuming vitamins like vitamin A, iron, zinc, magnesium and selenium.

Of the participants in receipt of UC, 20% did not eat vegetables, he said.

“They couldn’t come close to achieving a normal standard of living,” said Mr Welham.

“We saw the kind of nutrient deficiencies that you see in developing countries and it seems this was driven solely by people’s financial capabilities,” he added.

Mr Welham said people on low incomes were often perceived to consume unhealthy foods at a higher rate but he “didn’t see that so much”.

However, he noticed those participants had an “over reliance” on staple foods like bread as they are “cheap and filling”.

“From the kind of things we’re seeing in our study and studies from across the country, I can’t see how anyone would willingly choose to be on Universal Credit,” Mr Welham said, addressing the stigma of benefit recipients.

SFiCE

SFiCEAshley Hetfield, from Hyson Green, who also attends SFiCE’s weekly meal service, said relying on benefits had a detrimental effect on his mental health.

He said he had tried to stay positive and optimistic, but “living on a fifth of what [he] used to get when [he was] working” affected him.

“You can’t expect people to be able to live properly on £400 a month, if they’re paying energy bills, food and rent,” said Mr Hetfield.

The 34-year-old said that he usually ate at the social cafe, but in the past, he had gone without food “to protect [his] pride”.

“When you’re on Universal Credit, you have to become accustomed to living with nothing,” he added.

The Open Kitchen, another social cafe in Nottingham, said about a quarter of the people it saw each day received UC.

Cordinator Imran Khan said before the cost of living crisis, he used to only serve about 20 to 30 people a day.

Since April 2022, that number had increased to 120 to 130 people each day, he said.

“It’s not fair for anyone to go through something like this,” he added.

The standard UC allowance will be increasing by £7 a week in April 2026.

However, Mr Khan believes it is not enough to prevent the current level of food insecurity among people on UC.

“It’s not going to get anyone very far, is it?

“It’s nothing, half-way through the month people tell me, they’ve run out of food, gas and electric,” he added.

A spokesperson for the Department for Work and Pensions (DWP) said: “No-one should be living in poverty. That’s why we’ve extended the Household Support Fund and child poverty taskforce to support families and children.

“Alongside this, we’ve increased the National Living Wage and are helping over one million households by introducing a Fair Repayment Rate on Universal Credit deductions.”

Business

AI business 'wake-up call': teach workers or miss out – The Canberra Times

AI business ‘wake-up call’: teach workers or miss out The Canberra Times

Source link

Business

C3 AI Announces Fiscal First Quarter 2026 Financial Results

C3.ai, Inc. (“C3 AI,” “C3,” or the “Company”) (NYSE: AI), the Enterprise AI application software company, today announced financial results for its fiscal first quarter ended July 31, 2025. These results are consistent with the preliminary financial results the Company announced on August 8, 2025.

Fiscal First Quarter 2026 Financial Highlights

- Revenue: Total revenue for the quarter was $70.3 million.

- Subscription Revenue: Subscription revenue for the quarter was $60.3 million. Subscription revenue constituted 86% of total revenue for the quarter.

- Subscription and Prioritized Engineering Services Revenue Combined: Subscription and prioritized engineering services revenue combined was $69.0 million, constituting 98% of total revenue for the quarter.

- Gross Profit: GAAP gross profit for the quarter was $26.4 million, representing a 38% gross margin. Non-GAAP gross profit for the quarter was $36.3 million, representing a 52% non-GAAP gross margin.

- Net Loss per Share: GAAP net loss per share was $(0.86). Non-GAAP net loss per share was $(0.37).

- Cash Balance: $711.9 million in cash, cash equivalents, and marketable securities.

“The good news is we have completely restructured the sales and services organization, including new and highly experienced leadership across the board to ensure a return to accelerating growth and increased customer success at C3 AI, and even better, we have appointed an exceptionally talented new CEO to take the company to the next level and realize the full potential of the business. The bad news is that financial performance in Q1 was completely unacceptable. Having given this a lot of thought, I attribute this to two factors. One: it is clear that in the short term, the reorganization with new sales and services leadership had a disruptive effect. Two: as we have previously announced, I have had a number of unanticipated health issues. Unfortunately, this prevented me from participating in the sales process as actively as I have in the past. With the benefit of hindsight, it is apparent that my active participation in the sales process may have had a greater impact than I previously thought. That being said, as we enter Q2, we have new leadership in place, a restructuring of the sales and services organization completed, an extraordinarily large market opportunity, a superlative product offering, and exceptional levels of customer satisfaction, and I am confident the company is positioned to accelerate going forward,” said Thomas M. Siebel, Founder and Chairman, C3 AI.

Business Highlights

During the quarter, C3 AI restructured its global sales and services organization with the addition of new sales leaders across all business units, including a new Chief Commercial Officer, General Manager of EMEA, new senior leadership in North America, the U.S. Federal business, the C3 AI Alliances program, and the new C3 AI Strategic Integrator Program that offers the opportunity for a new and expanding OEM line of business. In addition, sales and services have been combined, again under new leadership, to provide a more seamless, high-touch customer experience with a consistent focus on realizing significant economic benefit rapidly from each C3 AI customer engagement.

- In Q1, the Company closed 46 agreements, including 28 initial production deployment agreements.

- The Company entered new and expanded agreements with HII, Newport News Shipbuilding, Signature Aviation, Lawrence Livermore National Laboratory, Gypsum Management & Supply (GMS), Nucor Corporation, Koch, Qemetica, Quest Diagnostics, Curtiss-Wright, Driscoll’s, the U.S. Army, the Missile Defense Agency, the U.S. Navy, and the U.S. Intelligence Community, among others.

- The Company expanded its footprint across State and Local Government, closing eight agreements across New Jersey, Indiana, New Mexico, Washington, and California.

C3 AI Strategic Integrator Program

- C3 AI launched the C3 AI Strategic Integrator Program (SIP) , an OEM initiative that enables partners to license the C3 Agentic AI Platform to rapidly build and commercialize Enterprise AI applications. The new SIP program is being met with enthusiastic reception by many system integrators and U.S. Federal service providers.

- Introduced in Q1, SIP offers the opportunity for C3 AI to develop a substantial network of third parties utilizing the C3 Agentic AI Platform to design and develop industry- and domain-specific Enterprise AI applications that they will market to their customers. The open architecture of the C3 Agentic AI Platform enables C3 AI to operate as an OEM and allows partners to take advantage of all the Company’s existing investments in data aggregation, data ontologies, and machine learning capabilities built over more than a decade, avoiding vendor lock-in. We believe this presents an enormous opportunity for growth, and it is a channel in which we will be investing substantially in the years to come.

Partner Network

- In Q1, the Company closed 40 agreements through its partner network.

- The joint 12-month qualified opportunity pipeline with partners increased by 54% year-over-year.

- C3 AI and Microsoft jointly closed 24 agreements, with customer wins across manufacturing and the public sector. Strong customer traction and expanded deal activity contributed to a 140% year-over-year increase in qualified pipeline.

- C3 AI and McKinsey & Company advanced their strategic alliance, jointly closing a new strategic customer agreement and driving momentum through QuantumBlack engineer trainings, C3 AI Accelerator sessions, and executive roundtables.

Customer Success

- Nucor Corporation , North America’s largest steel manufacturer and recycler, expanded its commitment with C3 AI in a multi-year partnership to build an enterprise-wide AI program across its steel mills, steel products, and raw materials operations. Initial deployments of the C3 AI Supply Chain Suite — C3 AI Demand Forecasting, C3 AI Inventory Optimization, and C3 AI Production Schedule Optimization, among others — running on the C3 Agentic AI Platform are live across multiple facilities, supporting and optimizing day-to-day planning, inventory, and scheduling decisions. Building on this success, Nucor is extending C3 AI to additional plants and use cases, including agentic AI, with a continued focus on throughput and working-capital efficiency across the value chain.

- Qemetica , a global leading chemicals company, partnered with C3 AI to launch its first enterprise-scale AI program. The initial production deployment in the Salt business unit applied the C3 AI Reliability application to increase production yield. Building on this success, Qemetica is scaling the predictive maintenance solution for up to 100 manufacturing assets across multiple use cases, marking the start of a broader AI transformation across the company.

Federal Business

- In Q1, the Company closed 12 agreements across the Federal sector, accounting for 28% of total bookings.

- The Company entered into new and expansion agreements with HII, Newport News Shipbuilding, the U.S. Department of Defense, the U.S. Army, the U.S. Intelligence Community, the U.S. Air Force, the U.S. Marine Corps, the U.S. Navy, and the Missile Defense Agency, among others.

- HII , America’s largest military shipbuilder, is expanding its partnership with C3 AI to accelerate shipbuilding throughput at its Ingalls and Newport News Shipbuilding divisions. The collaboration applies Enterprise AI across planning, operations, supply chain, and labor allocation to modernize production and strengthen U.S. Navy fleet readiness. Initial deployments at Ingalls demonstrated significant reduction in the extraordinary complex shipbuilding timelines, and these AI capabilities will now scale across HII shipyards.

- The U.S. Army Rapid Capabilities and Critical Technologies Office is deploying a contested logistics application built on the C3 Agentic AI Platform to support frontline vehicles operating in high-risk environments. The system integrates with the Army’s Human Machine Interface Formation platforms, using agentic and generative AI to predict part shortages, forecast fuel consumption, and project ammunition requirements. By centralizing logistics data and delivering real-time forecasts, the application enhances sustainment, readiness, and decision speed for Army formations in contested operations.

C3 Generative AI

- The Company closed nine agreements for C3 Generative AI, including six initial production deployment agreements, with Nucor, Peacock, Koch, the University of Southern California Shoah Foundation, Subsea7, and the U.S. Intelligence Community, among others.

- Filtration Group , one of the world’s leading filtration and separation science businesses, deployed C3 Generative AI within a business unit to accelerate and streamline its request-for-quotes response process. The C3 Generative AI e-mail agent automatically generates detailed, tailored drafts that reflect each customer’s request and requirements in minutes, reducing turnaround time, increasing capacity, and creating millions of dollars in recurring annual value.

- The Company further differentiated C3 Generative AI from other agentic market offerings by introducing agentic data extraction. C3 Generative AI now automatically extracts, structures, and validates data from unstructured formats — including presentations, PDFs, and spreadsheets — so organizations can analyze enterprise information previously locked in documents. At a global biopharmaceutical company, this capability streamlined the extraction and consolidation of experimental study reports, lowering costs while improving researcher access to high-quality, validated data.

- In contrast to a recent industry report that shows that only 5% of LLM pilots are successful, the majority of C3 Generative AI deployments are delivering compelling measurable economic benefit. For example, preliminary economic benefits that C3 AI customers are realizing from C3 Generative AI include: 20% increase in employee productivity; 80% reduction in inspection planning time; 14% reduction in average call center handling time; 85% reduction in procurement contract review time; and 90% labor savings in archive analysis.

Statement About Appointment of New Chief Executive Officer

“I am extremely pleased to announce the appointment of Stephen Ehikian as Chief Executive Officer of C3 AI, effective September 1, 2025. Stephen’s wealth of experience in both the private and public sectors, and domain expertise in all things AI, make him ideally suited to drive growth and realize the full potential of the C3 AI technology platform and portfolio,” said Thomas M. Siebel, Founder and Chairman, C3 AI.

As the Company previously announced, Mr. Siebel will remain engaged at C3 AI — now in the role of Executive Chairman — to assist Mr. Ehikian as necessary and focus on important partner and strategic customer relationships, with a continued eye on product strategy and direction.

Financial Outlook:

The Company’s guidance includes GAAP and non-GAAP financial measures.

The following table summarizes C3 AI’s guidance for the second quarter of fiscal 2026:

|

(in millions) |

Second Quarter Fiscal 2026 Guidance |

|

Total revenue |

$72.0 – $80.0 |

|

Non-GAAP loss from operations |

$(49.5) – $(57.5) |

Given the appointment of a new Chief Executive Officer and the recent restructuring of the sales and services organizations, the Company is withdrawing its previous full-year fiscal 2026 guidance. The Company will provide guidance for the third quarter of fiscal 2026 and full-year fiscal 2026 when it announces its financial results for the second quarter of fiscal 2026.

A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future. Stock-based compensation expense-related charges, including employer payroll tax-related items on employee stock transactions, are impacted by the timing of employee stock transactions, the future fair market value of our common stock, and our future hiring and retention needs, all of which are difficult to predict and subject to constant change. We have provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement tables for our historical non-GAAP results included in this press release. Our fiscal year ends April 30, and numbers are rounded for presentation purposes.

Conference Call Details

Investor Presentation Details

An investor presentation providing additional information and analysis can be found at our investor relations page at ir.c3.ai .

Statement Regarding Use of Non-GAAP Financial Measures

The Company reports the following non-GAAP financial measures, which have not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

- Non-GAAP gross profit, non-GAAP gross margin, non-GAAP loss from operations, and non-GAAP net loss per share. Our non-GAAP gross profit, non-GAAP gross margin, non-GAAP loss from operations, and non-GAAP net loss per share exclude the effect of stock-based compensation expense-related charges and employer payroll tax expense related to employee stock-based compensation. We believe the presentation of operating results that exclude these non-cash items provides useful supplemental information to investors and facilitates the analysis of our operating results and comparison of operating results across reporting periods.

- Free cash flow . We believe free cash flow, a non-GAAP financial measure, is useful in evaluating liquidity and provides information to management and investors about our ability to fund future operating needs and strategic initiatives. We calculate free cash flow as net cash (used in) provided by operating activities less purchases of property and equipment and capitalized software development costs. This non-GAAP financial measure may be different than similarly titled measures used by other companies. Additionally, the utility of free cash flow is further limited as it does not represent the total increase or decrease in our cash balances for a given period.

We use these non-GAAP financial measures internally for financial and operational decision-making purposes and as a means to evaluate period-to-period comparisons. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP. Our presentation of non-GAAP financial measures may not be comparable to similar measures used by other companies. We encourage investors to carefully consider our results under GAAP, as well as our supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand our business. Please see the tables included at the end of this release for the reconciliation of GAAP to non-GAAP financial measures.

Other Information

Professional Services Revenue

Our professional services revenue includes service fees and prioritized engineering services. Service fees include revenue from services such as consulting, training, and paid implementation services.

Prioritized engineering services are undertaken when a customer requests that we accelerate the design, development, and delivery of software features and functions that are planned in our future product roadmap. When we agree to this, we negotiate an agreed upon fee to accelerate the development of the software. When the software feature is delivered, it becomes integrated to our core product offering, is available to all subscribers of the underlying software product, and enhances the operation of that product going forward. Such prioritized engineering services result in production-level computer software – compiled code that enhances the functionality of our production products – which is available for our customers to use over the life of their software licenses. Per Accounting Standards Codification (ASC) 606, Prioritized engineering services revenue is recognized as professional services over the period in which the software development is completed.

Total professional services revenue consists of:

|

|

Three Months Ended July 31, |

||||

|

|

|

2025 |

|

|

2024 |

|

|

(in thousands) |

||||

|

Prioritized engineering services |

$ |

8,663 |

|

$ |

10,649 |

|

Service fees |

|

1,297 |

|

|

3,108 |

|

Total professional services revenue |

$ |

9,960 |

|

$ |

13,757 |

Use of Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements regarding our market leadership position, anticipated benefits from our partnerships, our financial outlook for the second quarter of fiscal 2026, our ability to accelerate going forward, our sales and customer opportunity pipeline including our industry diversification, the expected benefits of our offerings (including the potential benefits of our C3 Generative AI offerings), the role and responsibilities of Mr. Siebel, our expectations with respect to the transition of the chief executive officer role to Mr. Ehikian, the expected benefits of the recent restructuring of our sales and services organizations, the expectations for our C3 AI Strategic Integrator Program, and our business strategies, plans, and objectives for future operations. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including our history of losses and ability to achieve and maintain profitability in the future, our historic dependence on a limited number of existing customers that account for a substantial portion of our revenue, our ability to attract new customers and retain existing customers, our ability to successfully transition the role of chief executive officer to Mr. Ehikian and integrate Mr. Ehikian into the C3 organization, the ability of our restructured global sales and services organization to achieve desired productivity levels in a reasonable period of time, market awareness and acceptance of enterprise AI solutions in general and our products in particular, the length and unpredictability of our sales cycles and the time and expense required for our sales efforts. Some of these risks are described in greater detail in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended April 30, 2025, and other filings and reports we make with the Securities and Exchange Commission from time to time, including our Quarterly Report on Form 10-Q that will be filed for the fiscal quarter ended July 31, 2025, although new and unanticipated risks may arise. The future events and trends discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements, or events and circumstances reflected in the forward-looking statements will occur. Except to the extent required by law, we do not undertake to update any of these forward-looking statements after the date of this press release to conform these statements to actual results or revised expectations.

About C3.ai, Inc.

C3.ai, Inc. (NYSE:AI) is the Enterprise AI application software company. C3 AI delivers a family of fully integrated products including the C3 Agentic AI Platform, an end-to-end platform for developing, deploying, and operating enterprise AI applications, C3 AI applications, a portfolio of industry-specific SaaS enterprise AI applications that enable the digital transformation of organizations globally, and C3 Generative AI, a suite of domain-specific generative AI offerings for the enterprise.

Source: C3.ai, Inc.

|

C3.AI, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share data) (Unaudited) |

|||||||

|

|

Three Months Ended July 31, |

||||||

|

|

|

2025 |

|

|

|

2024 |

|

|

Revenue |

|

|

|

||||

|

Subscription |

$ |

60,301 |

|

|

$ |

73,456 |

|

|

Professional services |

|

9,960 |

|

|

|

13,757 |

|

|

Total revenue |

|

70,261 |

|

|

|

87,213 |

|

|

Cost of revenue |

|

|

|

||||

|

Subscription |

|

41,481 |

|

|

|

33,292 |

|

|

Professional services |

|

2,336 |

|

|

|

1,755 |

|

|

Total cost of revenue |

|

43,817 |

|

|

|

35,047 |

|

|

Gross profit |

|

26,444 |

|

|

|

52,166 |

|

|

Operating expenses |

|

|

|

||||

|

Sales and marketing |

|

62,513 |

|

|

|

52,125 |

|

|

Research and development |

|

64,651 |

|

|

|

52,927 |

|

|

General and administrative |

|

24,099 |

|

|

|

19,700 |

|

|

Total operating expenses |

|

151,263 |

|

|

|

124,752 |

|

|

Loss from operations |

|

(124,819 |

) |

|

|

(72,586 |

) |

|

Interest income |

|

8,218 |

|

|

|

10,003 |

|

|

Other income (expense), net |

|

132 |

|

|

|

28 |

|

|

Loss before provision for income taxes |

|

(116,469 |

) |

|

|

(62,555 |

) |

|

Provision for income taxes |

|

300 |

|

|

|

272 |

|

|

Net loss |

$ |

(116,769 |

) |

|

$ |

(62,827 |

) |

|

Net loss per share attributable to Class A and Class B common stockholders, basic and diluted |

$ |

(0.86 |

) |

|

$ |

(0.50 |

) |

|

Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted |

|

135,375 |

|

|

|

124,979 |

|

|

C3.AI, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In thousands, except for share and per share data) (Unaudited) |

|||||||

|

|

July 31, 2025 |

|

April 30, 2025 |

||||

|

Assets |

|

|

|

||||

|

Current assets |

|

|

|

||||

|

Cash and cash equivalents |

$ |

80,941 |

|

|

$ |

164,358 |

|

|

Marketable securities |

|

630,957 |

|

|

|

578,330 |

|

|

Accounts receivable, net of allowance of $877 and $877 as of July 31, 2025 and April 30, 2025, respectively |

|

113,925 |

|

|

|

137,226 |

|

|

Prepaid expenses and other current assets |

|

25,290 |

|

|

|

24,338 |

|

|

Total current assets |

|

851,113 |

|

|

|

904,252 |

|

|

Property and equipment, net |

|

76,600 |

|

|

|

79,298 |

|

|

Goodwill |

|

625 |

|

|

|

625 |

|

|

Other assets, non-current |

|

40,401 |

|

|

|

41,707 |

|

|

Total assets |

$ |

968,739 |

|

|

$ |

1,025,882 |

|

|

Liabilities and stockholders’ equity |

|

|

|

||||

|

Current liabilities |

|

|

|

||||

|

Accounts payable |

$ |

12,084 |

|

|

$ |

15,160 |

|

|

Accrued compensation and employee benefits |

|

45,396 |

|

|

|

53,868 |

|

|

Deferred revenue, current |

|

28,948 |

|

|

|

36,561 |

|

|

Accrued and other current liabilities |

|

24,863 |

|

|

|

26,295 |

|

|

Total current liabilities |

|

111,291 |

|

|

|

131,884 |

|

|

Deferred revenue, non-current |

|

985 |

|

|

|

— |

|

|

Other long-term liabilities |

|

57,639 |

|

|

|

55,695 |

|

|

Total liabilities |

|

169,915 |

|

|

|

187,579 |

|

|

Commitments and contingencies |

|

|

|

||||

|

Stockholders’ equity |

|

|

|

||||

|

Class A common stock |

|

133 |

|

|

|

130 |

|

|

Class B common stock |

|

3 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

2,294,166 |

|

|

|

2,216,284 |

|

|

Accumulated other comprehensive (loss) income |

|

(74 |

) |

|

|

521 |

|

|

Accumulated deficit |

|

(1,495,404 |

) |

|

|

(1,378,635 |

) |

|

Total stockholders’ equity |

|

798,824 |

|

|

|

838,303 |

|

|

Total liabilities and stockholders’ equity |

$ |

968,739 |

|

|

$ |

1,025,882 |

|

|

C3.AI, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) (Unaudited) |

|||||||

|

|

Three Months Ended July 31, |

||||||

|

|

|

2025 |

|

|

|

2024 |

|

|

Cash flows from operating activities: |

|

|

|

||||

|

Net loss |

$ |

(116,769 |

) |

|

$ |

(62,827 |

) |

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities |

|

|

|

||||

|

Depreciation and amortization |

|

3,415 |

|

|

|

3,119 |

|

|

Non-cash operating lease cost |

|

88 |

|

|

|

85 |

|

|

Stock-based compensation expense |

|

64,775 |

|

|

|

54,683 |

|

|

Accretion of discounts on marketable securities |

|

(2,811 |

) |

|

|

(3,936 |

) |

|

Other |

|

262 |

|

|

|

98 |

|

|

Changes in operating assets and liabilities |

|

|

|

||||

|

Accounts receivable |

|

23,302 |

|

|

|

(10,037 |

) |

|

Prepaid expenses, other current assets and other assets |

|

(230 |

) |

|

|

1,604 |

|

|

Accounts payable |

|

(2,931 |

) |

|

|

20,033 |

|

|

Accrued compensation and employee benefits |

|

3,343 |

|

|

|

(1,755 |

) |

|

Operating lease liabilities |

|

2,187 |

|

|

|

(498 |

) |

|

Other liabilities |

|

(1,538 |

) |

|

|

6,138 |

|

|

Deferred revenue |

|

(6,628 |

) |

|

|

1,335 |

|

|

Net cash (used in) provided by operating activities |

|

(33,535 |

) |

|

|

8,042 |

|

|

Cash flows from investing activities: |

|

|

|

||||

|

Purchases of property and equipment |

|

(760 |

) |

|

|

(924 |

) |

|

Purchases of marketable securities |

|

(206,492 |

) |

|

|

(230,924 |

) |

|

Maturities and sales of marketable securities |

|

156,081 |

|

|

|

190,298 |

|

|

Net cash used in investing activities |

|

(51,171 |

) |

|

|

(41,550 |

) |

|

Cash flows from financing activities: |

|

|

|

||||

|

Taxes paid related to net share settlement of equity awards |

|

— |

|

|

|

(2,945 |

) |

|

Proceeds from exercise of Class A common stock options |

|

1,289 |

|

|

|

3,127 |

|

|

Net cash provided by financing activities |

|

1,289 |

|

|

|

182 |

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

(83,417 |

) |

|

|

(33,326 |

) |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

176,924 |

|

|

|

179,712 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

93,507 |

|

|

$ |

146,386 |

|

|

Cash and cash equivalents |

$ |

80,941 |

|

|

$ |

133,820 |

|

|

Restricted cash included in other assets, non-current |

|

12,566 |

|

|

|

12,566 |

|

|

Total cash, cash equivalents and restricted cash |

$ |

93,507 |

|

|

$ |

146,386 |

|

|

Supplemental disclosure of cash flow information—cash paid for income taxes |

$ |

452 |

|

|

$ |

292 |

|

|

Supplemental disclosures of non-cash investing and financing activities: |

|

|

|

||||

|

Purchases of property and equipment included in accounts payable and accrued liabilities |

$ |

201 |

|

|

$ |

301 |

|

|

Right-of-use assets obtained in exchange for lease obligations (including remeasurement of right-of-use assets and lease liabilities due to changes in the timing of receipt of lease incentives) |

$ |

(166 |

) |

|

$ |

1,345 |

|

|

Vesting of early exercised stock options |

$ |

5 |

|

|

$ |

105 |

|

|

C3.AI, INC. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (In thousands, except percentages) (Unaudited) |

|||||||

|

|

Three Months Ended July 31, |

||||||

|

|

|

2025 |

|

|

|

2024 |

|

|

Reconciliation of GAAP gross profit to non-GAAP gross profit: |

|

|

|

||||

|

Gross profit on a GAAP basis |

$ |

26,444 |

|

|

$ |

52,166 |

|

|

Stock-based compensation expense (1) |

|

9,290 |

|

|

|

8,408 |

|

|

Employer payroll tax expense related to employee stock-based compensation (2) |

|

586 |

|

|

|

356 |

|

|

Gross profit on a non-GAAP basis |

$ |

36,320 |

|

|

$ |

60,930 |

|

|

|

|

|

|

||||

|

Gross margin on a GAAP basis |

|

38 |

% |

|

|

60 |

% |

|

Gross margin on a non-GAAP basis |

|

52 |

% |

|

|

70 |

% |

|

|

|

|

|

||||

|

Reconciliation of GAAP loss from operations to non-GAAP loss from operations: |

|

|

|

||||

|

Loss from operations on a GAAP basis |

$ |

(124,819 |

) |

|

$ |

(72,586 |

) |

|

Stock-based compensation expense (1) |

|

64,775 |

|

|

|

54,683 |

|

|

Employer payroll tax expense related to employee stock-based compensation (2) |

|

2,220 |

|

|

|

1,272 |

|

|

Loss from operations on a non-GAAP basis |

$ |

(57,824 |

) |

|

$ |

(16,631 |

) |

|

|

|

|

|

||||

|

Reconciliation of GAAP net loss per share to non-GAAP net loss per share: |

|

|

|

||||

|

|

|

|

|

||||

|

Net loss on a GAAP basis |

$ |

(116,769 |

) |

|

$ |

(62,827 |

) |

|

Stock-based compensation expense (1) |

|

64,775 |

|

|

|

54,683 |

|

|

Employer payroll tax expense related to employee stock-based compensation (2) |

|

2,220 |

|

|

|

1,272 |

|

|

Net loss on a non-GAAP basis |

$ |

(49,774 |

) |

|

$ |

(6,872 |

) |

|

|

|

|

|

||||

|

GAAP net loss per share attributable to Class A and Class B common shareholders, basic and diluted |

$ |

(0.86 |

) |

|

$ |

(0.50 |

) |

|

Non-GAAP net loss per share attributable to Class A and Class B common shareholders, basic and diluted |

$ |

(0.37 |

) |

|

$ |

(0.05 |

) |

|

Weighted-average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted |

|

135,375 |

|

|

|

124,979 |

|

|

(1) |

Stock-based compensation expense for gross profit and gross margin includes costs of subscription and cost of professional services as follows. Stock-based compensation expense for loss from operations includes total stock-based compensation expense as follows: |

|

|

Three Months Ended July 31, |

||||

|

|

|

2025 |

|

|

2024 |

|

Cost of subscription |

$ |

8,622 |

|

$ |

7,694 |

|

Cost of professional services |

|

668 |

|

|

714 |

|

Sales and marketing |

|

24,181 |

|

|

18,833 |

|

Research and development |

|

19,323 |

|

|

18,431 |

|

General and administrative |

|

11,981 |

|

|

9,011 |

|

Total stock-based compensation expense |

$ |

64,775 |

|

$ |

54,683 |

|

(2) |

Employer payroll tax expense related to employee stock-based compensation for gross profit and gross margin includes costs of subscription and cost of professional services as follows. Employer payroll tax expense related to employee stock-based compensation for loss from operations includes total employer payroll tax expense related to employee stock-based compensation as follows: |

|

|

Three Months Ended July 31, |

||||

|

|

|

2025 |

|

|

2024 |

|

Cost of subscription |

$ |

550 |

|

$ |

326 |

|

Cost of professional services |

|

36 |

|

|

30 |

|

Sales and marketing |

|

674 |

|

|

472 |

|

Research and development |

|

793 |

|

|

364 |

|

General and administrative |

|

167 |

|

|

80 |

|

Total employer payroll tax expense |

$ |

2,220 |

|

$ |

1,272 |

Reconciliation of free cash flow to the GAAP measure of net cash (used in) provided by operating activities:

The following table below provides a reconciliation of free cash flow to the GAAP measure of net cash (used in) provided by operating activities for the periods presented:

|

|

Three Months Ended July 31, |

||||||

|

|

|

2025 |

|

|

|

2024 |

|

|

Net cash (used in) provided by operating activities |

$ |

(33,535 |

) |

|

$ |

8,042 |

|

|

Less: |

|

|

|

||||

|

Purchases of property and equipment |

|

(760 |

) |

|

|

(924 |

) |

|

Free cash flow |

$ |

(34,295 |

) |

|

$ |

7,118 |

|

|

Net cash used in investing activities |

$ |

(51,171 |

) |

|

$ |

(41,550 |

) |

|

Net cash provided by financing activities |

$ |

1,289 |

|

|

$ |

182 |

|

View source version on businesswire.com: https://www.businesswire.com/news/home/20250903161507/en/

Business

Salesforce CEO Says Company Axed 4,000 Support Jobs Because of Agentic AI

Salesforce CEO Marc Benioff has become the latest Big Tech leader to note that the company he leads has shed jobs because of the impact of artificial intelligence.

On an entrepreneurship-focused podcast called the Logan Bartlett Show, Benioff said late last week that Salesforce has managed to cut 4,000 customer support roles after making itself “customer zero” for its agentic AI capabilities.

“I was able to rebalance my headcount on my support. I’ve reduced it from 9,000 heads to about 5,000, because I need less heads,” Benioff said.

AI agents are designed to handle tasks with little input from humans and are beginning to pop up across business functions inside enterprises. Benioff said Salesforce has already started to integrate agents across the organization. Customer support is but one function where workflows have been impacted.

“If we were having this conversation a year ago, and you were calling Salesforce, there would be 9,000 people that you would be interacting with globally on our service cloud, and they would be managing, creating, reading, updating, deleting data,” he said. “Now all of a sudden here we are a year later, and the million and a half conversations that are happening…have now bifurcated. Fifty percent are with agents; 50 percent are with humans.”

Benioff said that after he “rebalanced [Salesforce’s] support headcount,” he determined that he may be able to add different jobs inside other functions, particularly sales.

“I can now put those heads into sales, so I’ve increased my distribution capacity, and now I’m also making sure that I have much more efficiency and productivity in my lead generation and in the ability to actually work with customers that are contacting me,” he said on the podcast.

That penchant for a better sales pipeline has been echoed throughout many of Benioff’s public statements in recent months. On the podcast, he noted that, during his tenure as CEO, Salesforce has failed to return more than 100 million calls; he expects Salesforce’s current team, paired with its agentic fleet, can now return any call it receives.

In Benioff’s eyes, the productivity upgrades AI has enabled to date are only the start of his aspirations. He said the jobs of the future will be significantly impacted by AI’s continued proliferation.

“This is really the beginning of every part of the company having this kind of agentic augmentation. It’s a force multiplier. It’s a synergistic effect between me and the agents,” he said, noting earlier in the conversation that he is “on a mission to make Salesforce an agentic enterprise.”

Benioff said this summer that AI handles as much as half of the work that goes on inside Salesforce today.

Benioff told Bartlett that the emerging reality is that companies will need to put guardrails in place to simultaneously manage humans and agents. When Bartlett suggested that the concept of managing automated agents “feels a little dystopian,” Benioff countered, noting that Salesforce envisions the role of an “omnichannel supervisor that’s kind of helping those agents and those humans work together” continuing to rise inside the enterprise.

“I don’t think it’s dystopian at all,” he said. “I think that this is reality, at least for me.”

Salesforce is far from the first company to act on the changes AI have made to its business model, nor the first to state its belief that AI will impact jobs outlook in the coming years. Klarna and Microsoft have each cut thousands of jobs in an effort to go all-in on AI.

In June, Amazon CEO Andy Jassy said in a memo that he expects the continued rollout of AI systems to have a negative impact on the number of jobs available inside the company’s corporate workforce.

“As we roll out more generative AI and agents, it should change the way our work is done. We will need fewer people doing some of the jobs that are being done today, and more people doing other types of jobs,” Jassy wrote in the memo.

Tobias Lütke, CEO of Shopify, has taken a similar stance—he indicated in a memo this year that AI usage will become part of employees’ performance reviews and noted that teams need to be able to justify why AI can’t do the work before hiring a human to do it.

“Before asking for more headcount and resources, teams must demonstrate why they cannot get what they want done using AI,” Lütke wrote at the time. “What would this area look like if autonomous AI agents were already part of the team? This question can lead to really fun discussions and projects.”

-

Business5 days ago

Business5 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Education2 months ago

Education2 months agoAERDF highlights the latest PreK-12 discoveries and inventions