Jobs & Careers

Larry Ellison Tops Elon Musk to Become World’s Richest Person After Oracle Stock Surge

Larry Ellison has become the world’s richest person, overtaking Tesla chief Elon Musk after an unprecedented rally in Oracle’s stock added more than $100 billion to his fortune in a single day.

The 81-year-old Oracle co-founder and chief technology officer saw his net worth climb to around $393 billion, according to the Bloomberg Billionaires Index. The leap dethroned Musk, whose wealth has been under pressure amid a slide in Tesla shares and the volatile performance of his other ventures.

The trigger came from Oracle’s fiscal first-quarter results which revealed explosive growth in the company’s artificial intelligence-driven cloud business.

Investor enthusiasm sent Oracle’s stock soaring more than 40 percent, pushing the software giant’s market value up by nearly $200 billion in a single session.

Analysts described the rally as one of the most dramatic in the company’s history, fueled by a swelling order book for AI cloud services that is now approaching half a trillion dollars

Oracle Corporation reported fiscal first-quarter 2026 revenue of $14.9 billion on Tuesday, up 12% year-over-year in US dollars and 11% in constant currency.

Cloud revenue, including infrastructure and applications, rose 28% to $7.2 billion. Infrastructure-as-a-Service (IaaS) revenue grew 55% to $3.3 billion, while Software-as-a-Service (SaaS) applications revenue increased 11% to $3.8 billion. Within SaaS, Fusion Cloud ERP revenue was $1 billion, up 17%, and NetSuite Cloud ERP revenue also reached $1 billion, up 16%.

Oracle CEO Safra Catz said the company has signed major cloud contracts with top AI players such as OpenAI, xAI, Meta, NVIDIA, and AMD. “At the end of Q1, remaining performance obligations, or RPO, now to $455 billion. This is up 359% from last year and up $317 billion from the end of Q4. Our cloud RPO grew nearly 500% on top of 83% growth last year,” she said.

“MultiCloud database revenue from Amazon, Google and Microsoft grew at the incredible rate of 1,529% in Q1,” said Ellison. “We expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 datacenters to our three Hyperscaler partners, for a total of 71.”

Eliision added that next month at Oracle AI World, the company will introduce a new Cloud Infrastructure service called the ‘Oracle AI Database’ that enables customers to use LLMs of their choice, including Google’s Gemini, OpenAI’s ChatGPT, xAI’s Grok, etc., directly on top of the Oracle Database to easily access and analyse all their existing database data.

Oracle also raised its forecast for Oracle Cloud Infrastructure, projecting 77% growth this fiscal year to $18 billion, up from an earlier estimate of 70%.

Over the longer term, the company expects cloud infrastructure revenues to accelerate dramatically, targeting $32 billion next year and as much as $144 billion within five years.“We now expect Oracle Cloud Infrastructure will grow 77% to $18 billion this fiscal year and then increase to $32 billion, $73 billion, $114 billion and $144 billion over the following 4 years,” said Catz.

The post Larry Ellison Tops Elon Musk to Become World’s Richest Person After Oracle Stock Surge appeared first on Analytics India Magazine.

Jobs & Careers

Pune-Based Astrophel Aerospace Develops Indigenous Cryogenic Pump for Rocket Engines

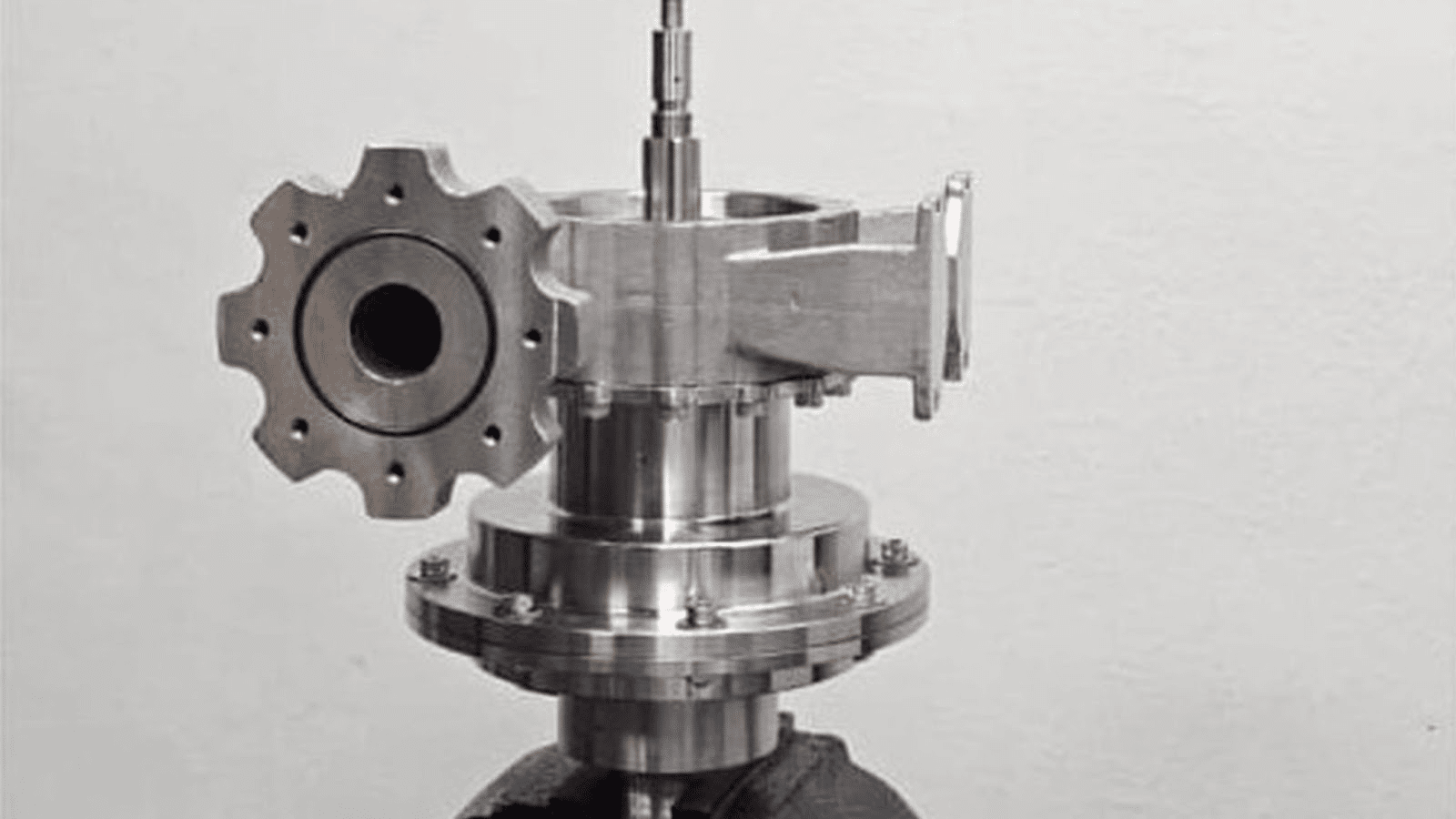

Astrophel Aerospace, a space tech startup from Pune, has developed an indigenous cryogenic pump designed to power its upcoming Astra C1 rocket engine. The pump, capable of spinning at 25,000 revolutions per minute, is undergoing testing at Indian Space Research Organisation (ISRO) facilities.

The company plans to upgrade it into a turbopump for integration into its first and second stage engines by late 2026.

Astrophel announced the development, stating that it positions the firm among the first private Indian startups to build an in-house cryogenic pump. “This milestone is a testament to how India can indigenously develop advanced propulsion technologies at a fraction of global costs,” Suyash Bafna, co-founder of Astrophel Aerospace, said.

The company recently raised ₹6.84 crore (~$800,000) in a pre-seed funding round to develop a reusable semi-cryogenic launch vehicle and missile-grade guidance systems.

Testing and Global Plans

The company is also preparing to sign a memorandum of understanding with a US-based partner (unnamed them as of now) and exploring global collaborations for export opportunities at the sub-component level. These efforts aim to meet rising demand in both the space sector and industries such as oil and gas, which use cryogenic liquids.

According to Astrophel, the pump, though the size of a one-litre bottle, produces 100 to 150 horsepower, equivalent to a family car. The turbopump version will scale this to 500 to 600 horsepower for larger launch vehicles.

“ISRO’s certification will validate not just our pump, but India’s ability to innovate world-class space hardware with global export opportunities,” Bafna added.

Astrophel’s announcement comes as India works to expand its space economy from $8.4 billion in 2022 to $44 billion by 2033, aiming to capture 8% of the global market.

“This milestone represents the culmination of years of frugal engineering and is a stepping stone toward India’s first privately developed gas generator cycle,” Immanuel Louis, co-founder of Astrophel Aerospace, said.

The post Pune-Based Astrophel Aerospace Develops Indigenous Cryogenic Pump for Rocket Engines appeared first on Analytics India Magazine.

Jobs & Careers

Esri India, Dhruva Space Partner to Expand Satellite Data Access

Sanjana Gupta

An information designer by training, Sanjana likes to delve into deep tech and enjoys learning about quantum, space, robotics and chips that build up our world. Outside of work, she likes to spend her time with books, especially those that explore the absurd.

Jobs & Careers

‘On-demand Tech Fuels Growth, but Rising Costs Threaten Gains for Enterprises’

On-demand technologies such as public cloud, software-as-a-service (SaaS) and generative AI are reshaping digital strategies as companies pursue innovation, agility and competitive advantage, according to a report from the Capgemini Research Institute.

However, the report highlighted that spiralling costs, fragmented management and governance gaps are eroding value, raising questions over the sustainability of returns.

The study, titled ‘The On-Demand Tech Paradox: Balancing Speed and Spend’, surveyed 1,000 executives from companies with annual revenues above $1 billion across 12 industries and 14 countries.

It found that nearly eight in 10 organisations see on-demand technologies as critical to growth, but struggle to rein in spending.

Three-quarters exceeded their public cloud budgets by an average of 10%, while 68% overspent on generative AI and 52% on SaaS, the report revealed.

Inflationary pressures, surging AI adoption and mounting digital infrastructure needs were cited as key drivers. Meanwhile, underutilised resources, decentralised procurement and unmanaged purchases, particularly in SaaS, added to the inefficiencies.

Nearly all executives admitted to bypassing IT departments for technology acquisitions, heightening costs and security risks.

While IT budgets are set to expand, with on-demand tech’s share expected to rise from 29% to 41% in the next year, the study shows that a few companies are capturing expected returns.

Only 29% realised projected SaaS savings, 33% reported improved cloud service quality, while 38% achieved faster innovation with generative AI.

Capgemini said most organisations are at an early stage of financial operations (FinOps) maturity.

Although three-quarters have or plan to establish FinOps teams, their scope remains narrow. Just 2% oversee cloud, SaaS and generative AI holistically and less than half influence business decisions.

“While on-demand technology expenses are projected to double over the next three to four years, organisations must find a way to gain transparency and control over costs while elevating value. Those that align their cloud strategy with their overall business goals are well-positioned to harness this opportunity,” Karine Brunet, CEO of Capgemini’s Cloud Infrastructure Services, said in the statement.

“By designing scalable, modular, cloud-native and frugal architecture, they are set to drive sustainable value through smarter FinOps, integrated governance, and AI-driven automation.”

Beyond financial waste, more than half of the surveyed organisations said the poor use of on-demand tech drives excess energy consumption and emissions.

Yet, only 36% have sustainability built into FinOps, despite opportunities to reduce both costs and carbon through energy-efficient architectures and workload optimisation.

The post ‘On-demand Tech Fuels Growth, but Rising Costs Threaten Gains for Enterprises’ appeared first on Analytics India Magazine.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi