Business

Lack of charging facilities a ‘barrier’ for electric lorries

David WaddellBusiness reporter, Cambridgeshire

BBC

BBCSitting in the cab of an electric lorry for the first time, I am struck by the silence.

The hum of the electric motor is imperceptible, and it is only at speed that the sound of the rolling wheels on the road breaks through.

Liam Ely is driving. He’s been with his firm, Welch’s Transport, for four years. This Renault e-Tech T is his primary workspace – one of the UK’s first electric heavy goods vehicles (eHGVs).

The firm has three in a fleet of 70 otherwise diesel lorries. Based in Duxford, Cambridgeshire, Welch operates across the UK.

Of the driving experience you get from an eHGV, Liam tells me he enjoys appreciates the “instant torque” helping him to pull away at junctions.

He also describes a “very smooth uptake of power”. That’s how it feels for me in the passenger seat.

This truck is as powerful as its diesel cousins, but the range is much more limited. Hauling a full load, these cabs can go as far as 200 miles (320km) on one charge, while the range of a diesel truck could be as much as 1,500 miles.

So Welch limits its three eHGVs to regional excursions within about two hours of the main depot – a radius of 160km.

Within that range, the mileage cost is cheaper than diesel – although it’s complicated when taking account other factors, such as higher capital costs, lower maintenance costs and the unclear impact of depreciation.

Liam highlights the operational challenges that being limited to 160km brings. “The range is the main thing – trying to plan that into your routes. It brings in differences for planning operations, as well as for me as the driver.”

Welch’s Transport

Welch’s TransportBut then it’s cleaner. There are no tailpipe emissions, and electric lorries also draw their power increasingly from renewable sources of energy.

Last year, renewable energy accounted for 50.8% of electricity generation in the UK, the first time it had exceeded half. And the figure globally in 2024 was 40%, according to one study.

The environmental aspect of eHGVs appeals to some operators, and especially their customers.

Liam’s assignment when I joined him was to collect samples and equipment from the British Antarctic Survey’s (BAS’s) research ship Sir David Attenborough, which was docked at the Port of Harwich in Essex. And then deliver them to the BAS warehouse near Cambridge.

BAS, the UK government organisation for polar research, is working towards a target of net zero by 2040. So it says that the collaboration with Welch and its electric haulage is “key to achieving that goal”.

Road freight is an essential part of the supply chain, essentially everywhere in the world. And every year millions of lorries cross borders, many of them on long-haul routes.

So why not use eHGVs which just stop and recharge as necessary? After 200 miles drivers are likely to need a break in any case. There are two big obstacles.

Firstly, specialist public charging facilities for eHGVs are currently few and far between; not just in the UK, but across Europe, and in much of the world.

Presently there are just two that are said to be operational in the UK, although many more are planned.

Meanwhile, there are now 1,100 public charging points for eHGVs across western Europe, including the UK, according to one study, which said that “expansion is essential”.

The other big issue is that the price of public charging for eHGVs is currently high. At the time of writing, Welch’s Transport was paying 17 pence per kilowatt hour (KWh) to charge at its base. This compares with 79 pence per KWh, the price offered by one of the public charging sites.

“The main barrier to operating our eHGV fleet more nationally is infrastructure,” says Welch’s managing director Chris Welch, the great grandson of the founder.

“There are very few HGV accessible public charging points. Add to that the pricing points of said infrastructure, it’s a very hard equation to crack.”

All this means eHGVs struggle to compete on the vehicle sales market, especially amongst long-haul operators. The capital cost, for a vehicle alone, is two or three times more than diesel HGVs.

Yet sales are growing. Last year were were 1,271 eHGVs in the UK, a 28% rise on 2023, according to one study. This contributes over a fifth to the rise in the total number of HGVs, up 0.2% to 742,316.

In the EU, 3,400 eHGVs were sold in 2024. In the US the figure was 2,000.

With all new HGVs in the UK and EU needing to be electric-powered by 2040, Chris Welsh says that the haulage industry needs to work together to ensure that the pathway to net zero is viable.

The UK’s Department of Transport says it is “determined to support the HGV sector to make the switch to electric vehicles become more reliable and affordable”. It has a new £30m grant to help pay for more depot charging, and another grant to help firms buy eHGVs.

Clean transport pressure group Transport & Environment says that boosting depot charging is key. This is because it finds that almost half of trucks on French, German and British roads could be electrified on depot charging alone as few travel more than 300km (186 miles) in a day.

Tom Parke is transport specialist at Green Finance Institute, a UK-based advisory group focused on increasing funding for schemes that transition to net zero. He expects to see affordable public charging for eHGVs “becoming more widely available” as more companies are encouraged to invest in such facilities.

He points to one new facility opened this year by European provider Milence in the Lincolnshire port of Immingham that is offering fast charging at around half the price seen elsewhere.

So electric vehicle roll-out is advancing, as is the charging infrastructure.

The next challenge? Growing electricity grid capacity fast enough to meet accelerating demand.

In a Europe-wide study, Transport & Environment concluded that grid extension plans underestimate the future demand for battery electric truck charging in depots. It’s an issue, they claim, “which needs urgently addressing by government”.

Business

When is the Budget and what might be in it?

Jennifer Clarke & Tom EspinerBBC News

Reuters

ReutersThe Chancellor Rachel Reeves will set out plans for the economy when she delivers the Budget on 26 November.

There have been warnings that she will have to put up taxes or cut spending if she wants to stick to her own rules on government borrowing.

Before the 2024 general election, Labour promised not to increase income tax, National Insurance or VAT for working people.

What is the Budget?

In her Budget statement, the chancellor of the exchequer will outline the government’s plans for raising or lowering taxes.

It will also include big decisions about spending on health, schools, police and other public services.

The statement is made to MPs in the House of Commons.

Alongside the Budget, additional details about the measures and costs will be published by the Treasury, the government’s economic and finance ministry.

The independent Office for Budget Responsibility (OBR), which monitors government spending, will also publish an assessment of the health of the UK economy and a forecast of what it thinks will happen in the future.

What time is the Budget and what happens afterwards?

The Budget speech usually starts at about 12:30 UK time – after Prime Minister’s Questions – and lasts about an hour.

It will be broadcast live on the BBC iPlayer and on the BBC News website.

The Leader of the Opposition, Conservative MP Kemi Badenoch, will respond to the speech in the House of Commons.

MPs debate the measures for four days, before voting on them.

If approved by MPs, tax changes can come into effect immediately. However, the government must pass a finance bill to make them permanent.

What might be in the Budget?

There has been lots of speculation that Reeves might raise taxes in the Budget.

This is because she is expected to need to raise extra money to meet her self-imposed rules for government finances, called fiscal rules.

Reeves has two main rules, which she has said are “non-negotiable”:

- Not to borrow to fund day-to-day public spending by the end of this parliament

- To get government debt falling as a share of national income by the end of this parliament

However, in its last estimate in March, the OBR said the chancellor only had £10bn headroom to meet these rules, which it called a “very small margin”.

Since then the government has U-turned on planned benefit cuts that had aimed to save billions, while the cost of government borrowing has also increased.

Tax thresholds

There has been speculation that if the government wants to raise more tax without increasing income tax, VAT or National Insurance for working people, it could extend the current freeze on income tax thresholds, which is due to end in 2028.

Freezing the thresholds means that, over time as salaries rise, more people reach an income level at which they start paying tax or qualify for higher rates. This is often referred to as a “stealth tax”.

Property taxes

There have also been reports that property taxes will be reformed.

This could include replacing stamp duty – a tax buyers pay on properties above a certain value in England and Northern Ireland – with a property tax.

Landlords could have to pay more taxes, and council tax could be replaced.

One report suggested the government was considering taxing the money people make when they sell their main home in certain circumstances – this would mean changing the capital gains tax rules.

Isa reform

In July, the chancellor ruled out any immediate reform to cash Isas (Individual Savings Accounts). There had been speculation that she wanted to reduce the annual allowance to push people into investing in shares instead, to help boost economic growth.

It is possible that reform could still happen, but other measures to encourage people towards personal investment are considered more likely.

Pension changes

There is often speculation about possible changes to pension rules ahead of the Budget, such as the tax relief available to savers and the level of the tax-free lump sum which can be withdrawn.

However, previous chancellors who have been tempted to change to the higher rate tax relief on pension contributions have not done so. Cutting the relief would save the Treasury money, but may make pension savings less attractive.

Other taxes

The TUC, the umbrella group for trade unions in the UK, has called for higher taxes on online gaming companies and on banks’ profits.

How is the UK economy doing?

The Labour government has repeatedly said that boosting the economy is a key priority.

A growing economy usually means people spend more, extra jobs are created, more tax is paid and workers get better pay rises.

The latest figures show that growth in the UK economy has slowed in recent months. The economy was flat in July, after growing by 0.4% in June.

Looking at the longer term trend, the economy grew by 0.2% in the three months to July, down from the 0.3% growth seen in the three months to June, and from the 0.6% growth seen between March and May.

Meanwhile prices in the shops are still rising faster than wanted.

Inflation – the rate at which prices rise – was 3.8% in the year to July, which is above the Bank of England’s 2% target.

Despite this, in August the Bank cut its key interest rate to 4%, taking the cost of borrowing to the lowest level for more than two years.

The Bank moves interest rates to try to keep inflation on target, and cuts are less likely when price rises are above 2%.

However, the Bank cut rates because of concerns that the jobs market is weakening, with data showing job vacancies are continuing to fall and wage growth is slowing.

Lower interest rates can make loans, credit cards and some mortgages cheaper, but can also mean worse returns for savers.

Business

AI cloud surge: Oracle’s Nvidia moment? What to know about Larry Ellison co-founded firm’s sudden rise

On Wednesday, Oracle stunned Wall Street when its shares surged 36% in a single day, the company’s biggest one-day gain since 1992. The rise followed its announcement of a series of multibillion-dollar deals in artificial intelligence (AI) cloud infrastructure, including a landmark agreement with OpenAI. The rally was so dramatic that Oracle co-founder Larry Ellison briefly overtook Elon Musk as the world’s richest person before market corrections set in.The $300 billion OpenAI deal and moreAt the centre of the surge is Oracle’s $300 billion, five-year agreement with OpenAI, one of the largest cloud computing contracts ever signed. The company will provide computing resources and infrastructure to power OpenAI’s advanced models. Oracle has also struck deals with Nvidia, SoftBank, Meta, and xAI, signalling its transformation into a core provider of AI infrastructure.Backlog signals long-term growthCEO Safra Catz revealed that Oracle’s backlog of finalised contracts has reached $455 billion, four times higher than last year, and is expected to cross $500 billion soon. This backlog offers investors confidence in sustained long-term revenue, even as quarterly results sometimes fall short of projections, as reported by ET.Competing with cloud giantsOracle’s position in AI cloud computing now puts it in direct competition with Amazon Web Services and Microsoft Azure. The company expects revenue from its cloud infrastructure business to rise 77% to $18 billion this year, and reach $144 billion within four years, according to news agency AP.The billionaire shuffleThe surge in Oracle’s stock briefly added around $100 billion to Ellison’s wealth, pushing him past Elon Musk in Bloomberg’s billionaire rankings. Musk, whose fortune is closely tied to Tesla, regained the top spot later in the day. But as AP noted, the episode highlighted how AI-driven optimism is reshaping wealth dynamics among tech leaders.Why it matters for AIOracle’s resurgence positions it as a critical enabler of global AI adoption. By providing high-performance, reliable cloud infrastructure, the company is not just fuelling chatbot development but also supporting applications in robotics, pharmaceuticals, finance, and automation. Or as Ellison himself summed it up during an earnings call: “AI changes everything.”

Business

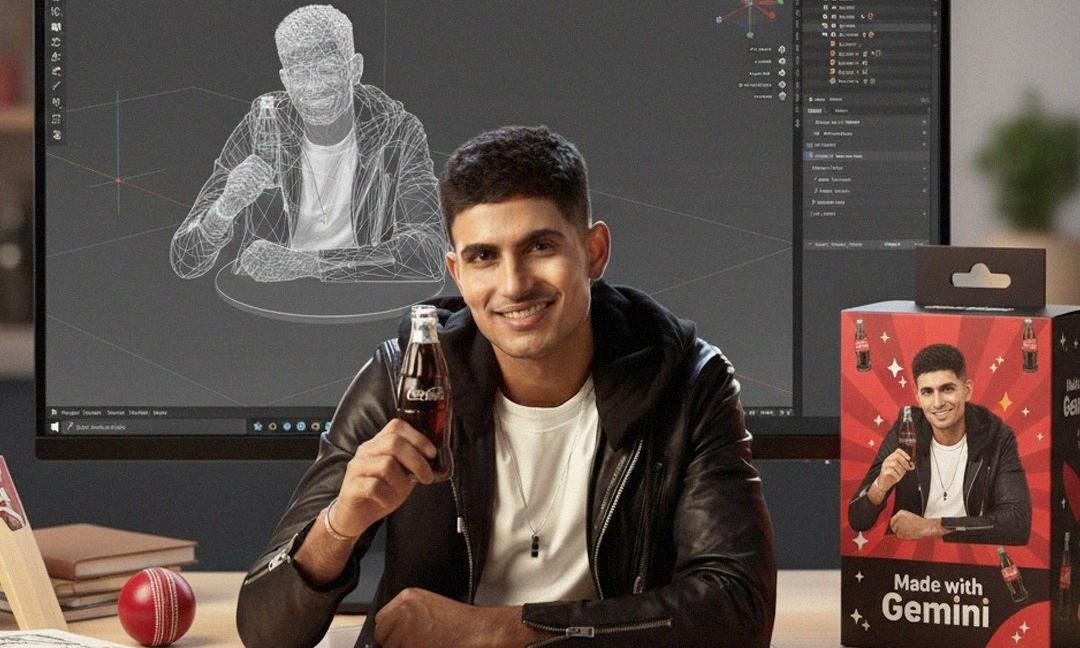

Google’s Gemini Nano Banana AI goes viral, generating 3D Figurines

Nano Banana, the latest image-generating tool of Google’s AI chatbot Gemini, has taken the internet by storm with “gemini nano banana ai 3d figurines” trending on Google.

So, how to use Gemini Nano Banana? Users only have to give simple prompts to Google Gemini to generate realistic figurines of the image uploaded with the prompt. The generated figurine not only looks realistic but can also be put in a setting of the user’s choice.

Steps for using Gemini Nano Banana

First, the user has to open Google Gemini on his or her mobile or computer and log in with their credentials.

Then, the user has to upload an image of their choice that they want to convert into a figurine. However, the image should be clear so the AI can detect it properly. Once the image is uploaded, the user can give a prompt to generate the figurine of his or her choice.

Also Read: OpenAI vs Grok vs Gemini in world’s first AI chess tournament: Guess who won?

How to prompt Gemini Nano Banana

A suitable and easy prompt for the purpose has been shared by Google Gemini on its official X handle. “Create a 1/7 scale commercialised figurine of the characters in the picture, in a realistic style, in a real environment. The figurine is placed on a computer desk,” stated the prompt.

“The figurine has a round transparent acrylic base, with no text on the base. The content on the computer screen is a 3D modelling process of this figurine. Next to the computer screen is a toy packaging box, designed in a style reminiscent of high-quality collectable figures, printed with original artwork. The packaging features two-dimensional flat illustrations,” it added.

Also Read: Eight free AI tools to create Studio Ghibli-style images easily

Other features of Nano Banana

Apart from generating images, Nano Banana can also be used for adding or removing elements in a picture. It can be done with this simple saying: “Using the provided image, please [add/remove/modify] [element] to/from the scene. Ensure the change is [description of how the change should integrate],” reported the Hindustan Times.

Users can also combine multiple images and create a new one. All the user has to do is use this prompt: “Create a new image by combining the elements from the provided images. Take the [element from image 1] and place it with/on the [element from image 2]. The final image should be a [description of the final scene].”

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi