AI Research

La Crosse Public Library event explores generative artificial intelligence | News

We recognize you are attempting to access this website from a country belonging to the European Economic Area (EEA) including the EU which

enforces the General Data Protection Regulation (GDPR) and therefore access cannot be granted at this time.

For any issues, contact news8@wkbt.com or call 608-784-7897.

AI Research

Meta Details AI Research Efforts at TBD Lab

This article first appeared on GuruFocus.

Meta Platforms Inc. (META, Financials) is advancing its artificial intelligence ambitions through a small research group called TBD Lab, which consists of a few dozen researchers and engineers, Chief Financial Officer Susan Li said Tuesday at the Goldman Sachs Communacopia + Technology conference.

The unit, whose placeholder name has stuck, is tasked with developing next-generation foundation models over the next one to two years. Li described the team as talent-dense and said its work would help push Meta’s AI portfolio closer to the frontier.

TBD Lab is one of four groups within Meta’s Superintelligence Labs, created earlier this year after the company reorganized its AI strategy. The other groups include a products team anchored by the Meta AI assistant, an infrastructure team, and the Fundamental AI Research (FAIR) lab.

The restructuring followed senior staff departures and what was seen as a muted reception for Meta’s latest open-source Llama 4 model. CEO Mark Zuckerberg has since taken a direct role in recruiting AI talent, making offers to startups and contacting candidates himself through WhatsApp with multimillion-dollar packages.

Investors will look to Meta’s next earnings update for signs of progress in AI development and how new models could fit into its products and services.

AI Research

Commanders vs. Packers NFL props, SportsLine Machine Learning Model AI picks: Jordan Love Over 223.5 passing

The NFL Week 2 schedule gets underway with a Thursday Night Football matchup between NFC playoff teams from a year ago. The Washington Commanders battle the Green Bay Packers beginning at 8:15 p.m. ET from Lambeau Field in Green Bay. Second-year quarterback Jayden Daniels led the Commanders to a 21-6 opening-day win over the New York Giants, completing 19 of 30 passes for 233 yards and one touchdown. Jordan Love, meanwhile, helped propel the Packers to a dominating 27-13 win over the Detroit Lions in Week 1. He completed 16 of 22 passes for 188 yards and two touchdowns.

NFL prop bettors will likely target the two young quarterbacks with NFL prop picks, in addition to proven playmakers like Terry McLaurin, Tucker Kraft and Josh Jacobs. Green Bay’s Jayden Reed has been dealing with a foot injury, but still managed to haul in a touchdown pass in the opener. The Packers enter as a 3.5-point favorite with Green Bay at -187 on the money line. Before betting any Commanders vs. Packers props for Thursday Night Football, you need to see the Commanders vs. Packers prop predictions powered by SportsLine’s Machine Learning Model AI.

Built using cutting-edge artificial intelligence and machine learning techniques by SportsLine’s Data Science team, AI Predictions and AI Ratings are generated for each player prop.

For Packers vs. Commanders NFL betting on Monday Night Football, the Machine Learning Model has evaluated the NFL player prop odds and provided Bears vs. Vikings prop picks. You can only see the Machine Learning Model player prop predictions for Washington vs. Green Bay here.

Top NFL player prop bets for Commanders vs. Packers

After analyzing the Commanders vs. Packers props and examining the dozens of NFL player prop markets, the SportsLine’s Machine Learning Model says Packers quarterback Love goes Over 223.5 passing yards (-112 at FanDuel). Love passed for 224 or more yards in eight games a year ago, despite an injury-filled season. In 15 regular-season games in 2024, he completed 63.1% of his passes for 3,389 yards and 25 touchdowns with 11 interceptions.

In a 30-13 win over the Seattle Seahawks on Dec. 15, he completed 20 of 27 passes for 229 yards and two touchdowns. Love completed 21 of 28 passes for 274 yards and two scores in a 30-17 victory over the Miami Dolphins on Nov. 28. The model projects Love to pass for 259.5 yards, giving this prop bet a 4.5 rating out of 5. See more NFL props here, and new users can also target the FanDuel promo code, which offers new users $300 in bonus bets if their first $5 bet wins:

How to make NFL player prop bets for Washington vs. Green Bay

In addition, the SportsLine Machine Learning Model says another star sails past his total and has four additional NFL props that are rated four stars or better. You need to see the Machine Learning Model analysis before making any Commanders vs. Packers prop bets for Thursday Night Football.

Which Commanders vs. Packers prop bets should you target for Thursday Night Football? Visit SportsLine now to see the top Commanders vs. Packers props, all from the SportsLine Machine Learning Model.

AI Research

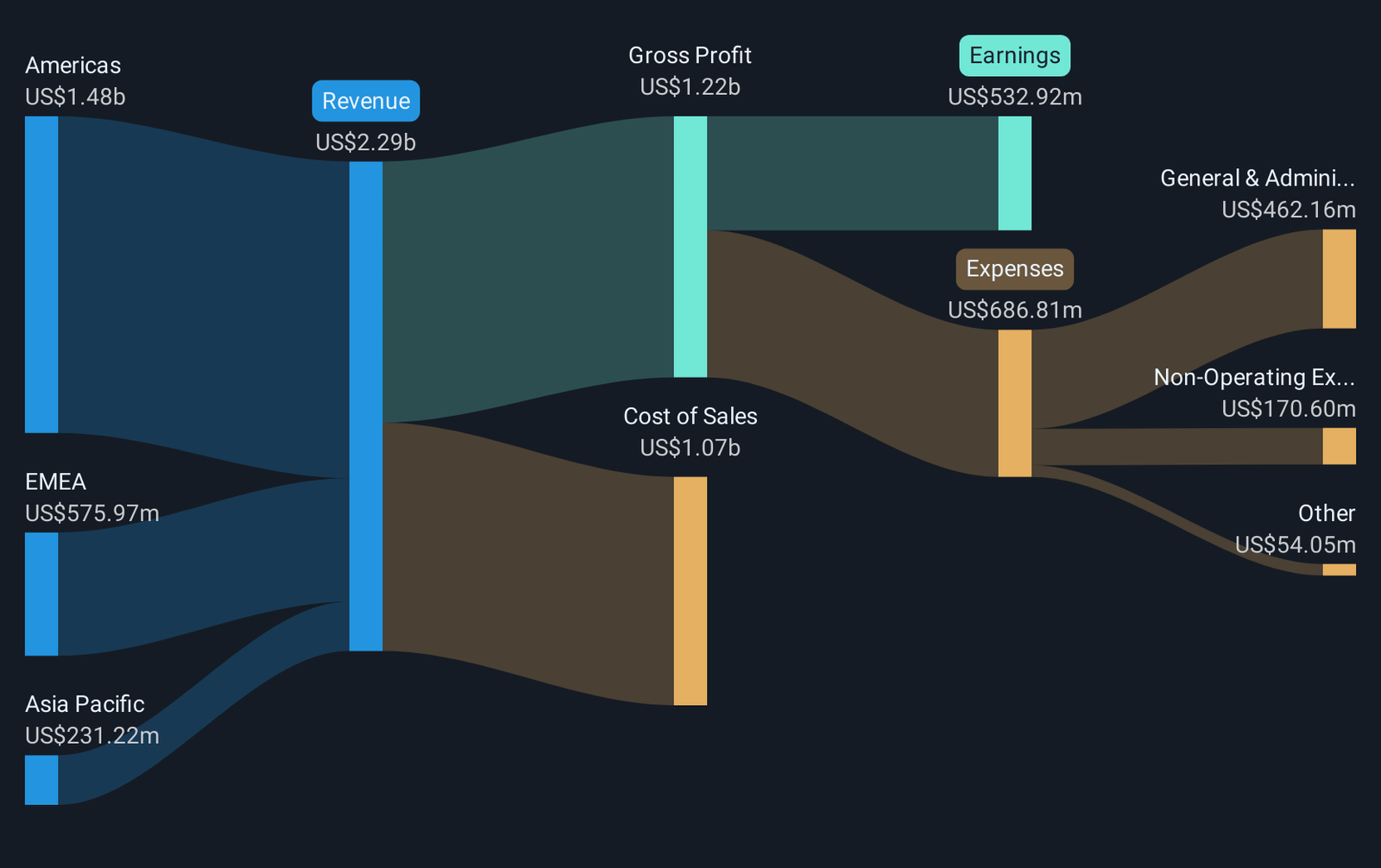

FactSet Research Systems (FDS) Integrates MarketAxess AI-Powered Data Into Workstation

FactSet Research Systems (FDS) has recently integrated MarketAxess’ AI-powered CP+ data into its workstation, making it the sole provider of such capabilities in a terminal desktop environment. This integration is designed to provide users with real-time bond pricing and insights on a vast array of securities, centralizing financial data and enhancing trade execution. Over the past week, FDS saw a 1.08% price increase, aligning with broader market trends as the S&P 500 and Nasdaq reached record highs. FactSet’s addition of cutting-edge features may have added positive weight to its recent price movement amid a generally robust technology sector.

You should learn about the 1 warning sign we’ve spotted with FactSet Research Systems.

The integration of MarketAxess’ AI-powered CP+ data into FactSet’s workstation could significantly enhance the company’s appeal by providing advanced data analytics to its users. This move aligns with FactSet’s strategy of expanding its service offerings through acquisitions and new product launches, potentially boosting revenue and earnings in the future. As FactSet continues to integrate acquisitions and enhance its product lineup, these innovations could strengthen the firm’s position in the competitive financial services market. The recent 1.08% share price increase may partly reflect investor optimism about these enhancements and their potential to drive growth.

Over the last five years, FactSet’s total return, including share price and dividends, was 16.06%. However, the company’s recent performance over the past year fell short of both the broader US market, which achieved a 20.5% return, and the Capital Markets industry, which returned 34.2%. This underperformance could highlight investor concerns regarding rising technology costs and potential challenges in the asset management sector.

The current share price of US$372.86 remains at a discount compared to the consensus analyst price target of US$428.38, suggesting additional upside potential if the company can successfully execute its growth strategies. With revenue forecasted to grow at 5.4% annually, analysts project earnings to rise to US$725.4 million by 2028. To align with these projections, FactSet’s strategic moves in technology and acquisitions will be crucial in achieving the expected revenue and earnings growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi