Business

Kroger stock wavers, Oracle turns lower after massive post-earnings rally

Macy’s (M) raised its fiscal year outlook on Wednesday after posting better-than-expected quarterly results across the board, with same-store sales growth a bright spot.

While revenue and adjusted earnings fell, both came in higher than Wall Street had forecast. Shares in the retail giant jumped more than 12% in premarket trading after the earnings report.

Macy’s second quarter revenue fell 2.53% to $4.81 billion but topped expectations of $4.71 billion, per Bloomberg consensus data. Adjusted earnings per share declined 41% to $0.41, compared to expectations of $0.18.

Same-store sales increased 1.9%, marking the company’s best growth in 12 quarters. Analysts had forecast a decline of 0.51%. At the 125 stores where Macy’s has recently invested in improving merchandise and service, same-store sales grew 1.4% overall.

Its luxury chain Bloomingdale’s and cosmetics retailer Bluemercury booked gains in same-store sales of 3.6% and 1.2%, respectively.

These results led the company to raise its outlook when it comes to net sales, comparable sales and adjusted earnings guidance.

“Our teams achieved better than expected top- and bottom-line results during the second quarter … reflecting the strong performance in Macy’s Reimagine 125 locations, Bloomingdale’s and Bluemercury,” Macy’s chairman and CEO Tony Spring said in the results release.

Spring said Macy’s performance benefited from its turnaround plan and from its being “multi-brand, multi-category, omni-channel retailer.”

Macy’s now projects revenue to be in the range of $21.15 billion to $21.45 billion, slightly higher than the previous range of $21 billion to $21.4 billion. For 2025, same-store sales are expected to decrease by between 0.5% and 1.5% year over year. It previously expected that the lower end would be down 2.0%.

Adjusted earnings are now also expected to be higher, between $1.70 to $2.05, compared to the previous range of $1.60 and $2.00.

“We think this was a strong performance in a tough operating environment,” CFRA analyst Zachary Warring said in a note to clients.

Macy’s stock is under pressure, down nearly 19.5% year-to-date prior to Wednesday’s open, compared to the S&P 500’s 9% gain, as the retailer faced ongoing pressure around tariffs and from an activist investor, as well as moved forward with the turnaround which included closing stores.

Business

Elon Musk calls for dissolution of parliament at far-right rally in London | Elon Musk

Elon Musk has called for a “dissolution of parliament” and a “change of government” in the UK while addressing a crowd attending a “unite the kingdom” rally in London, organised by the far-right activist Stephen Yaxley-Lennon, known as Tommy Robinson.

Musk, the owner of X, who dialled in via a video link and spoke to Robinson while thousands watched and listened, also railed against the “woke mind virus” and told the crowd that “violence is coming” and that “you either fight back or you die”.

He said: “I really think that there’s got to be a change of government in Britain. You can’t – we don’t have another four years, or whenever the next election is, it’s too long.

“Something’s got to be done. There’s got to be a dissolution of parliament and a new vote held.”

This is not the first time Musk has involved himself in British politics. He started a war of words with the UK government over grooming gangs and also criticised 2023’s Online Safety Act, calling the legislation a threat to free speech.

He had a warm relationship with Nigel Farage, and there were even rumours he could channel a donation to his party before the Tesla boss called for the Reform UK leader to be replaced during a dispute over his support for Robinson.

Musk told the crowd in central London: “My appeal is to British common sense, which is to look carefully around you and say: ‘If this continues, what world will you be living in?’

“This is a message to the reasonable centre, the people who ordinarily wouldn’t get involved in politics, who just want to live their lives. They don’t want that, they’re quiet, they just go about their business.

“My message is to them: if this continues, that violence is going to come to you, you will have no choice. You’re in a fundamental situation here.

“Whether you choose violence or not, violence is coming to you. You either fight back or you die, that’s the truth, I think.”

Musk also told the crowd “the left are the party of murder”, referring to the death of Charlie Kirk.

He said: “There’s so much violence on the left, with our friend Charlie Kirk getting murdered in cold blood this week and people on the left celebrating it openly. The left is the party of murder and celebrating murder. I mean, let that sink in for a minute, that’s who we’re dealing with here.”

He also criticised what he called the woke mind virus and said decisions for advancement should be on merit rather than “discrimination on the basis of sex, or religion or any race or anything else”.

He said: “A lot of the woke stuff is actually super-racist, it’s super-sexist and often it’s anti-religion, but only anti-Christian, like why anti-Christian? That’s unfair … that should be all that matters, the woke mind virus, that I call it, is against all that.”

More than 110,000 people were estimated to have taken part in the far-right street rally, in what is thought to be one of the largest nationalist events in decades. The marchers were faced by about 5,000 anti-racist counter-protesters.

In addition to Musk, figures including Katie Hopkins and French far-right politician Éric Zemmour were invited to speak at the event.

PA Media contributed to this report

Business

Can Veritone’s (VERI) Expanding Government AI Focus Reshape Its Long-Term Business Model?

- In the past week, Veritone completed a US$25 million follow-on equity offering and presented at the H.C. Wainwright Global Investment Conference, showcasing its AI-driven solutions for government and law enforcement sectors as well as a promising Veritone Data Refinery pipeline.

- An interesting insight is Veritone’s focus on securing direct government contracts and progressing toward a pure AI-centric model, supported by validation from early proof-of-concept contracts with agencies such as the U.S. Navy.

- We’ll examine how Veritone’s accelerated push into government AI and recent contract validation influences the company’s investment outlook.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Veritone Investment Narrative Recap

Investors in Veritone need conviction in the company’s ability to grow its AI and Data Refinery offerings, particularly through pipeline momentum and government contracts, while the threat of continued net losses and cash needs looms large. The recent US$25 million equity raise bolsters short-term liquidity and reduces near-term capital constraints, but it is not a fundamental game changer, persistent operating losses and the need for future fundraising remain the most pressing risk for shareholders.

Among the recent developments, completion of the US$25 million follow-on equity offering stands out as the most directly relevant. This fundraising, together with revised credit covenants, helps support operational runway as Veritone works to convert government and enterprise pipeline into revenue. However, the increased share count introduces further dilution, reinforcing the importance of achieving sustainable, profitable growth as a key catalyst.

By contrast, sustained access to capital is not guaranteed for any loss-making company for long, making it critical that investors pay close attention to…

Read the full narrative on Veritone (it’s free!)

Veritone’s narrative projects $158.0 million revenue and $20.7 million earnings by 2028. This requires 20.2% yearly revenue growth and a $114.1 million increase in earnings from -$93.4 million today.

Uncover how Veritone’s forecasts yield a $5.25 fair value, a 41% upside to its current price.

Exploring Other Perspectives

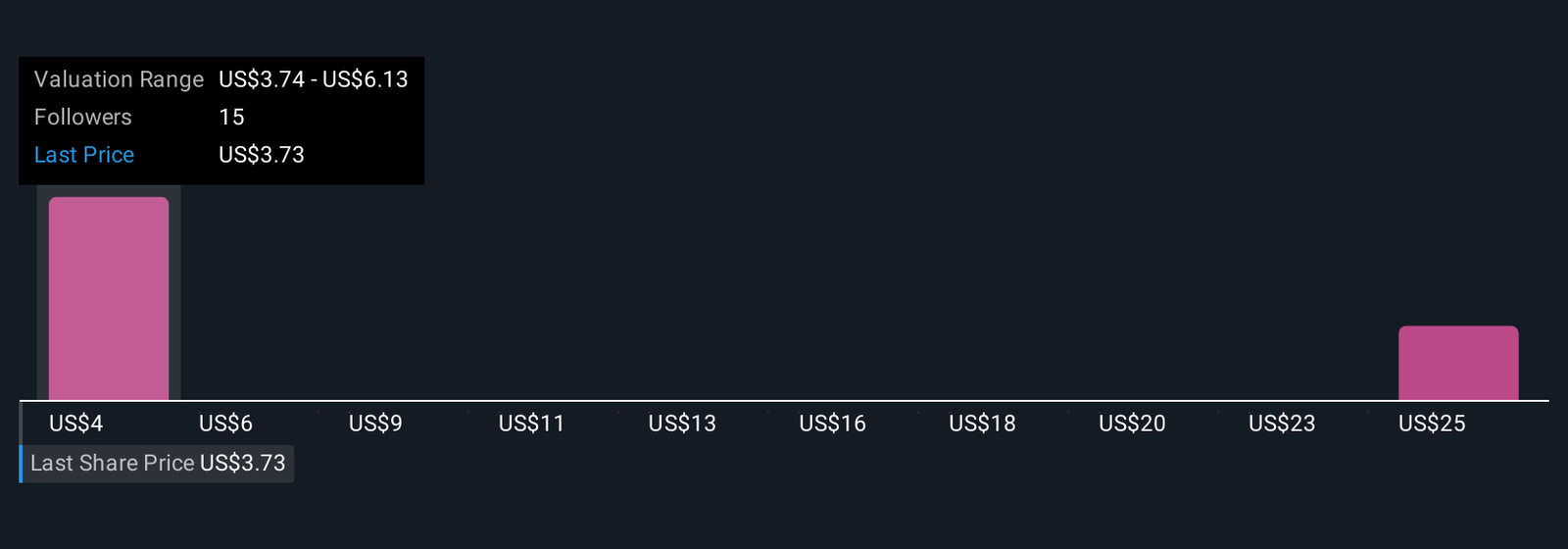

Six fair value estimates in the Simply Wall St Community span from US$3.74 to US$27.68, revealing sharply conflicting outlooks. With persistent net losses still a critical challenge, you can see why opinions differ so widely on Veritone’s future, explore how these diverse perspectives could shape your own view.

Explore 6 other fair value estimates on Veritone – why the stock might be worth just $3.74!

Build Your Own Veritone Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Business

One of Apple’s top AI executives is reportedly leaving the company

Apple is losing one of its top AI minds, according to Bloomberg.

Robby Walker, who had been the senior director of Apple’s Answers, Information, and Knowledge team since earlier this year, is reportedly set to leave the tech giant next month. Walker had previously been in charge of Siri prior to moving over to AI development. This is on top of Apple losing other high-level AI employees to Meta back in July, also reported by Bloomberg.

The report doesn’t give an explicit reason for why Walker or the other employees have left the company, but it certainly doesn’t paint an entirely positive picture of Apple’s AI development from the outside looking in. The company’s Apple Intelligence suite of AI features has notably lagged behind competitors like Google. One very noteworthy example is that Google’s Gemini Live naturalistic chatbot has been up and running for a while, even as Apple’s long-awaited AI-powered Siri upgrade has been reportedly delayed into next year.

Mashable Light Speed

It remains to be seen whether or not all of this AI business is a bubble just waiting to burst or something that’s truly here to stay, but at the pace Apple is moving, one might get the impression that the company is betting on the former.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries