Funding & Business

Korea’s Lee Says No Need to Stick to Capital Gains Tax Proposal

South Korean President Lee Jae Myung said he doesn’t see the need to stick to a proposal that would have expanded the pool of stock investors subject to capital gains tax.

Source link

Funding & Business

A Busy Week For Big Financings, Led By Databricks And PsiQuantum

Want to keep track of the largest startup funding deals in 2025 with our curated list of $100 million-plus venture deals to U.S.-based companies? Check out The Crunchbase Megadeals Board.

This is a weekly feature that runs down the week’s top 10 announced funding rounds in the U.S. Check out last week’s biggest funding rounds here.

This past week was a busy period for mega-sized funding rounds, with all 10 of the largest U.S. financings exceeding the $100 million mark. Topping the list were billion-dollar financings for AI data platform Databricks and quantum computing startup PsiQuantum. Overall, we saw robust investor interest across AI, healthcare, spacetech and fintech.

1. (tied) Databricks, $1B, AI data platform: Databricks said it raised $1 billion in Series K funding co-led by Andreessen Horowitz, Insight Partners, MGX, Thrive Capital and WCM Investment Management. The financing sets a valuation of over $100 billion for the San Francisco-based company, which says it has surpassed a $4 billion revenue run-rate and is growing over 50% year over year.

1. (tied) PsiQuantum, $1B, quantum computing: Palo Alto, California-based PsiQuantum, which is hoping to build the “world’s first commercially useful, fault-tolerant quantum computers,” announced that it secured $1 billion in Series E funding. BlackRock, Temasek and Baillie Gifford led the round, which set a $7 billion valuation for the company.

3. Cognition, $400M, AI: AI coding startup Cognition locked up over $400 million at a $10.2 billion post-money valuation. Founders Fund led the financing for the 2-year-old, San Francisco-based company.

4. Strive Health, $300M, kidney care: Denver-based Strive Health, a care provider for patients with kidney disease, closed on $300 million in Series D equity funding led by New Enterprise Associates. Strive also raised $250 million in debt financing led by Hercules Capital.

5. Odyssey Therapeutics, $213M, biopharma: Odyssey Therapeutics, a biopharmaceutical startup focused on autoimmune and inflammatory diseases, picked up $213 million in Series D funding from a long list of new and existing investors. Boston-based Odyssey filed to go public in January but withdrew the planned offering in June.

6. (tied) Perplexity, $200M, GenAI: GenAI startup Perplexity reportedly secured $200 million in fresh capital at a $20 billion valuation. To date, San Francisco-based Perplexity has raised $1.5 billion in known funding, per Crunchbase data.

6. (tied) Torus, $200M, modular power plants: Utah-based Torus, a provider of modular power plants for utilities, data centers and other customers, announced a $200 million investment by Magnetar Capital. The company is also now preparing to open GigaOne, a 540,000-square-foot manufacturing campus in Salt Lake City.

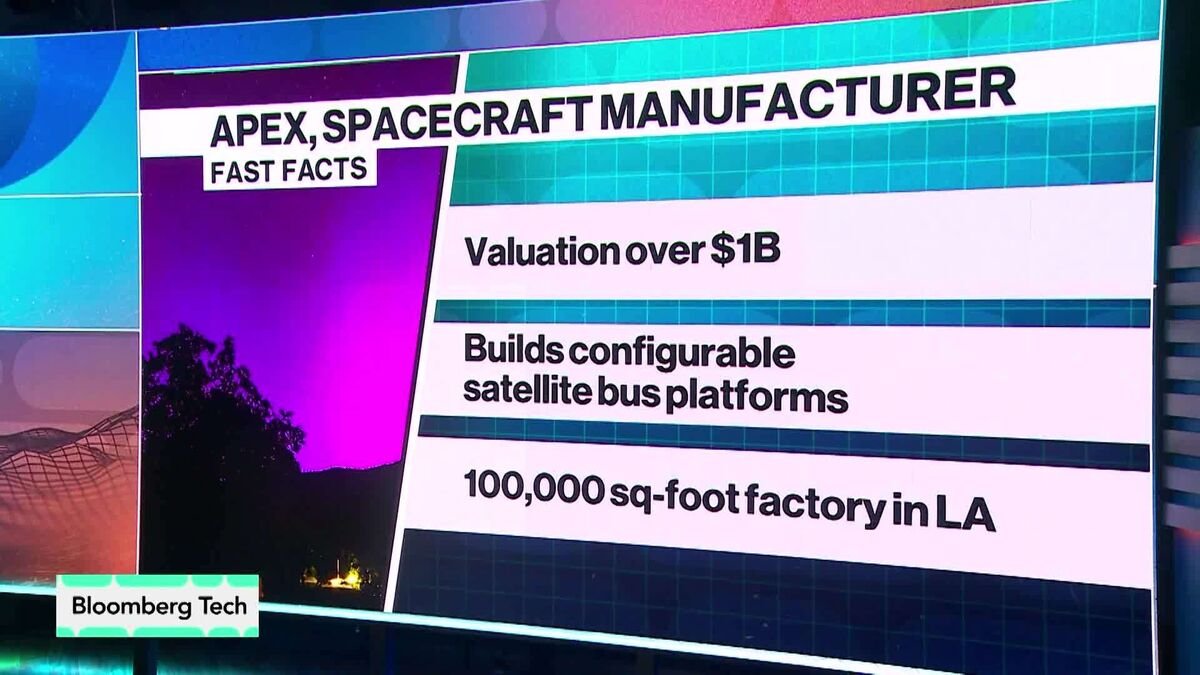

6. (tied) Apex, $200M, spacetech: Los Angeles-based Apex, a manufacturer of satellite products, landed $200 million in Series D funding led by Interlagos Capital. The round reportedly brings Apex’s valuation to $1 billion.

9. Harbour Health, $130M, health care and insurance: Harbour Health, a provider of primary care services and coverage, picked up $130 million in new funding co-led by General Catalyst, 8VC 1 and Alta Partners. To date, the 4-year-old, Austin, Texas-based company has raised over $255 million in known funding.

10. Speedchain, $111M, fintech: Atlanta-based Speedchain, a provider of credit cards and expense management tools for businesses, secured $111 million in equity and debt funding. Community Investment Management extended the debt financing, while GTMfund, Village Global, TTV Capital, K5 Global, Tandem Ventures and Emigrant Bank provided the equity.

Methodology

We tracked the largest announced rounds in the Crunchbase database that were raised by U.S.-based companies for the period of Sept. 6-12. Although most announced rounds are represented in the database, there could be a small time lag as some rounds are reported late in the week.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

CalPERS Is the $2 Billion Whale Behind JPMorgan’s Junk-Bond ETF

Funding & Business

We're In the Middle of a New Space Race: Apex CEO

Apex, a spacecraft manufacturer of mass-produced satellite bus platforms, has just raised a $200 million Series D funding round that brings the company’s valuation over $1 billion dollars. Apex CEO and co-founder Ian Cinnamon joins Caroline Hyde to discuss his outlook for the industry on “Bloomberg Tech.” (Source: Bloomberg)

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi