Business

Jersey cost of living and cold weather payments open

BBC News, Channel Islands

PA Media

PA MediaJersey’s government has opened up two grants to help islanders who are struggling financially.

The Community Costs Bonus is for people who need help with cost of living pressures, while the Cold Weather Bonus helps pensioners with heating costs.

Eligible islanders can claim £516.50 within the community costs grant, with the cold weather payments varying depending on the temperatures.

The government said people should wait until they have received their 2024 tax liability to apply.

Who can apply?

The Community Costs Bonus is open to households where all of the following apply:

- at least one adult has lived in Jersey for the last five years

- the household had a combined tax liability of less than £2,735 for 2024

- no member of the household has had an open Income Support Claim within the last seven days

To get the Cold Weather Bonus the household must be eligible for the Community Cost Bonus and also:

- have at least one person who is 65 or older living there who gets a Jersey old age pension or has 10 years’ continuous residency

- the person applying or their spouse/partner must be a home owner or responsible for the lease (people paying for board or lodgings only will not qualify)

- no adult in the household should have received a cold weather payment from income support

Business

Innovative AI Solutions Transforming Business Operations and Customer Interactions

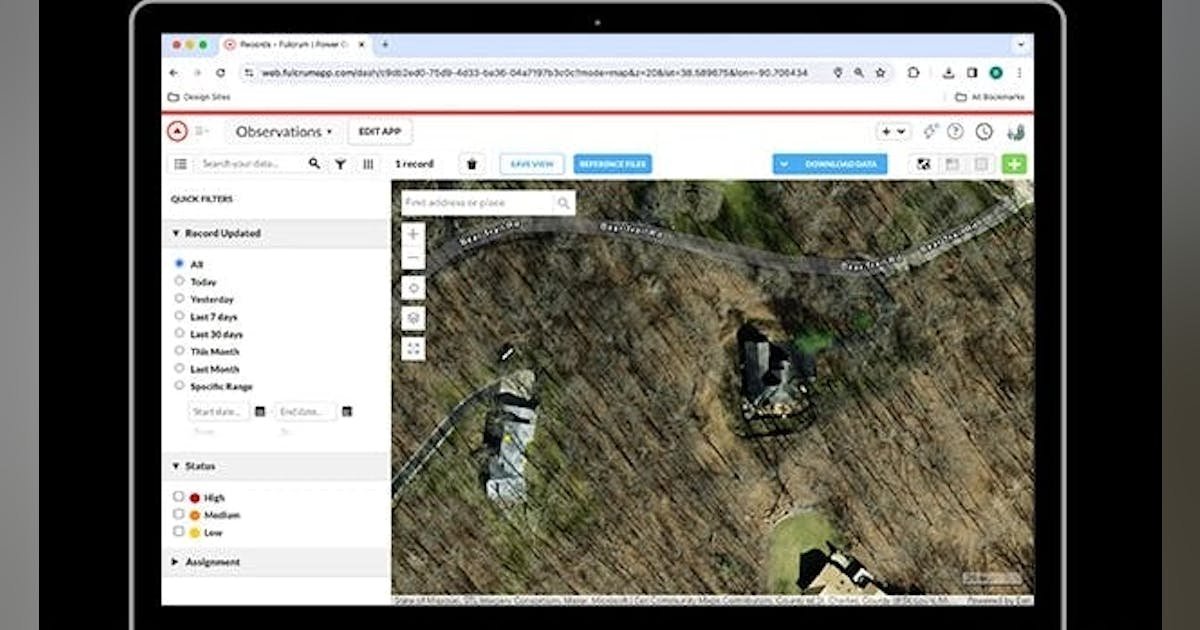

Fulcrum (www.fulcrumapp.com) field-focused process and data collection platform for geospatial field processes and data collection recently launched Audio FastFill, a voice-powered, multi-field AI data collection tool.

It integrates advanced AI within the platform to create a textual scribe for field teams, eliminating inefficiencies of manual entry, and allows users in the field to dictate forms naturally and produce richer more actionable data input, with the system understanding and accurately populating fields.

Fulcrum dynamically understands context to populate complex fields like picklists and conditional logic, eliminating inefficiencies of manual entry and simplifying workflow, helping ensure ease of use in demanding environments. It can also dissect one continuous audio file to place all of the information into the correct corresponding fields and input to fields that aren’t text, like numbers or drop-down lists.

Pricing: structure not actual cost, free demo, free trial.

AIPhone

AIPhone (www.aiphone.ai) is a cross language calling app utilizing AI translation. It translates phone calls in real time—speak in your language and the other party hears it in theirs instantly and vice versa. How it works: you invite anyone via a simple link—no extra app needed for them.

The app, which supports several dozen languages and dialects, is trained to both translate words and understand the context behind them. In addition, it also supports camera translation—snap a photo or select a saved image (e.g. a sign) and get instant translation. It also translates video and voice calls in WhatsApp and other apps.

Pricing: weekly, monthly, annual plans available with free trial package available through X, TikTok, and Facebook.

ServiceMonster

ServiceMonster management software (www.servicemonster.com, 888/901-3300, covered in September 2022 column) recently introduced the ServiceMonster Payments mobile app, which features capabilities that facilitate both immediate branded invoicing that can be sent by email or text and collection of payments via credit cards, debit cards, and ACH. Suitable for solo operators and multi-crew service businesses, it has the ability to automate reminders and follow-ups. You can store cards on file securely for repeat customers or recurring billing.

ServiceMonster Payments includes built-in surcharging, allowing you to legally pass along credit card processing fees to your customers where permitted by law. Surcharging is automatically configured during setup based on your location. Most credit card and debit card transactions are deposited into your bank account in as little as two business days. The solution Payments offers an integration with QuickBooks Online and QuickBooks Desktop. A demo is available.

Plannit

Plannit (www.plannit.io), covered in August 2021 column, recently added a smart call answering system designed to function as a virtual assistant, handling calls when team members are unavailable. The system, which is available 24/7 and has multi-language support, features intelligent call routing, utilizing advanced algorithms to direct calls to appropriate departments or personnel based on predefined criteria.

Users can customize menu options and the software, which can take messages, can be programmed to answer FAQs. It can also qualify and prioritize prospective customers by asking questions and recording their answers and saving them in the messaging center as audio files. The service requires a new phone number acquired by Plannit, but calls to existing business numbers can be redirected for message taking when needed.

Gorilla Desk

Update: Gorilla Desk (www.Gorilladesk.com), initially covered in January 2025 tech column, has several new AI Agents to its platform (both desktop and mobile app) which are designed to heighten proficiency of field service management and handle customer interactions across multiple channels, including SMS, Web Chat, VOIP phone, and client portals.

The new capabilities, available on the customer portal and by text message, enable customers to book services 24/7, with the solution streamlining and automating the entire process, from inquiry to booking and confirmation, as well as route planning and optimization.

How it works: you embed your AI agent options directly on your web site and, as desired, your customer initiates the process by making contact with your embedded company AI receptionist through one of those portals, facilitating making, logging, and finding all calls without jumping among apps; the Client Portal Agent enables customers to request new work securely and view previous documents anytime. Gorilla Desk will notify you via in-app and email alerts whenever a new work request is submitted.

There are two types of AI conversations: static and dynamic. Static conversations provide general Q&As with informational responses. Dynamic conversations involve the system taking actions, such as capturing new lead info or scheduling a pending booking. (Pricing: $1.00 per completed static conversation, $1.75 per completed dynamic conversation.)

Gorilla Desk also has four new agents in the works: Kong AI (Supreme Intelligence), acting as the central intelligence, which will provide advanced analytics and generate custom reports; Mantis AI (Ops & Admin), which will automate the role of administrator and help run day-to-day operational workflows flawlessly; Atrax AI, which will help you deploy your website, aiding in page generation and optimization; Lotus AI (Customer Sentiment), which focuses on delivering analysis of customer standpoint so you know what conversations need real human attention; and SMS & Customer Portal Agents, enabling 24/7 handling of incoming customer SMS messages their conversations with your AI.

Business

Your browser is not supported

democratandchronicle.com wants to ensure the best experience for all of our readers, so we built our site to take advantage of the latest technology, making it faster and easier to use.

Unfortunately, your browser is not supported. Please download one of these browsers for the best experience on democratandchronicle.com

Business

Samsung’s Dual Challenge: Foldables Face Android Onslaught as Chip Business Navigates AI Boom and Foundry Woes

Samsung Electronics (005930.KS) finds itself at a pivotal juncture, navigating intense competition and dynamic market shifts across its crucial mobile and semiconductor divisions. The recent launch of its highly anticipated Galaxy Z Fold 7 is poised to test the company’s innovation prowess in the burgeoning foldable smartphone segment, while its dominant semiconductor business grapples with a rebound in memory prices alongside significant challenges in its foundry operations and fierce rivalry in high-bandwidth memory (HBM).

As the global technology landscape continues to evolve, Samsung’s ability to capitalize on the growing demand for AI-driven devices and maintain its leadership in core markets will be critical. Investors and industry observers are closely watching how the South Korean giant strategizes to fend off intensifying competition in the Android ecosystem and overcome manufacturing hurdles in its advanced chipmaking processes, all of which will profoundly impact its stock performance and long-term trajectory.

Galaxy Z Fold 7 Arrives Amidst a Shifting Semiconductor Landscape

The technology world recently witnessed the unveiling of Samsung’s latest foldable flagship, the Galaxy Z Fold 7, launched in July 2025. This highly anticipated device represents Samsung’s continued commitment to innovating within the premium smartphone market, aiming to solidify its leadership in the foldable segment where it currently commands a substantial 62% market share. The Z Fold 7 introduces a slimmer, lighter design, an expanded cover screen, an 8-inch main display, and integrates advanced Galaxy AI features powered by a customized Snapdragon 8 Elite chip. This launch is critical as Samsung seeks to differentiate itself in an increasingly crowded Android market, where rivals are aggressively adopting AI and pushing innovative form factors.

Simultaneously, Samsung’s colossal semiconductor division is undergoing a significant transformation. After a challenging period, the Device Solutions (DS) division returned to profitability in Q1 2025, primarily driven by a robust rebound in memory chip prices and surging demand for AI-specific memory solutions. In 2024, Samsung reclaimed its position as the world’s top semiconductor supplier by revenue. This resurgence is vital, as the semiconductor business alone contributed nearly half of Samsung’s total revenue in 2024. The company’s strategic pivot towards high-value memory products, particularly those catering to AI infrastructure, has been a key catalyst in this recovery.

However, the path forward is not without its obstacles. While memory sales are strong, Samsung’s foundry segment faces an uphill battle. Its market share in chip manufacturing declined from 9.1% in Q4 2024 to 7.7% in Q1 2025, widening the gap with industry leader TSMC (67.6% in Q1 2025). This decline is attributed to lower-than-expected yield rates for its cutting-edge 3nm and 2nm processes, leading to a loss of orders from major clients. Compounding this, Samsung is locked in an intense rivalry with SK Hynix (000660.KS) in the high-bandwidth memory (HBM) market, crucial for powering AI servers. SK Hynix surpassed Samsung in DRAM market share in Q1 2025, largely due to its dominance in HBM chips. Samsung is actively working to improve its 2nm process yields and is striving to secure supply deals for its HBM chips with key AI players like Nvidia (NVDA).

Winners and Losers in the Tech Tug-of-War

The current market dynamics present a mixed bag of opportunities and challenges for various players within the tech ecosystem, with Samsung Electronics (005930.KS) at the epicenter. On the winning side, Samsung itself stands to benefit significantly from the successful market reception of the Galaxy Z Fold 7. Increased production plans for the device signal strong internal confidence, and if the device resonates with consumers, it will reinforce Samsung’s premium brand image and innovative edge in the foldable segment. Furthermore, the robust rebound in its memory chip business, particularly for DRAM and NAND, driven by AI demand, is a major positive, directly boosting its Device Solutions division’s profitability. Its ability to secure a substantial chip manufacturing contract (2025-2033) despite foundry challenges also indicates long-term confidence from some clients.

However, Samsung faces considerable pressure. In the semiconductor arena, TSMC (TSM) continues to consolidate its position as the undisputed leader in advanced foundry services. Samsung’s struggles with 3nm and 2nm yield rates directly translate into market share gains for TSMC, which boasts superior manufacturing capabilities and a more established client base for cutting-edge nodes. In the critical High-Bandwidth Memory (HBM) market, SK Hynix (000660.KS) has emerged as a clear winner, taking the lead in DRAM market share thanks to its early dominance in HBM chips for AI applications. This puts Samsung in a challenging position, as it plays catch-up to secure its share of the burgeoning HBM market, an essential component for the AI revolution.

On the mobile front, while Samsung leads, the intensifying Android competition means other players are vying for market share. Xiaomi (1810.HK), Vivo, Transsion, and Oppo continue to capture significant portions of the global smartphone market, particularly in developing regions. These companies often offer compelling devices at competitive price points, putting pressure on Samsung’s overall volume share. Even in the premium segment, Google (GOOGL) with its Pixel line, and especially the rumored entry of Apple (AAPL) into the foldable market, could pose a substantial threat to Samsung’s early mover advantage and market dominance in foldables. If Apple enters, it could fundamentally shift consumer perceptions and demand within the high-end foldable segment, creating a new and formidable rival for Samsung.

Industry Impact and Broader Implications

Samsung’s current trajectory, marked by innovation in mobile and a recovering but complex semiconductor business, reflects and amplifies several broader industry trends. The most prominent is the pervasive influence of Artificial Intelligence (AI) across all segments of technology. The surge in demand for AI-capable devices and high-bandwidth memory chips is a primary driver for Samsung’s semiconductor recovery and informs its mobile strategy with features like Galaxy AI. This trend indicates a fundamental shift in computing, where processing power and specialized memory for AI will be key differentiators. Competitors are rapidly integrating AI, suggesting that future device success will heavily rely on seamless, powerful AI capabilities, pushing innovation cycles further.

This event also highlights the increasing premiumization of the smartphone market, particularly the rise of foldable devices. Samsung’s continued investment in the Galaxy Z Fold series demonstrates confidence in this niche, which is projected for accelerated growth. However, this premiumization also intensifies competition at the high end. The rumored entry of Apple into the foldable market would not only validate the segment but also profoundly reshape its competitive landscape, forcing all players, including Samsung, to innovate more aggressively to maintain market share and pricing power. The push for thinner, lighter designs, larger screens, and integrated AI features underscores the battle for differentiation in a mature smartphone market.

From a semiconductor perspective, the challenges faced by Samsung’s foundry business underscore the immense technical complexity and capital intensity of leading-edge chip manufacturing. The struggles with 3nm and 2nm yield rates are not isolated to Samsung; they represent the hurdles all foundries face in pushing the boundaries of Moore’s Law. This situation reinforces TSMC’s formidable lead and suggests that achieving parity in advanced nodes will require sustained, massive investment and engineering breakthroughs. Furthermore, the HBM rivalry between Samsung and SK Hynix reveals a critical bottleneck in the AI supply chain. Whichever company can consistently deliver high-yield, high-performance HBM chips will gain a significant strategic advantage in supplying the burgeoning AI server market, potentially influencing the pace of AI development globally. Regulatory or policy implications could arise if one or two players gain too much dominance in these critical component markets, prompting governments to consider strategies for supply chain diversification. Historically, similar battles for technological supremacy, such as the DRAM wars of the 1980s and 90s, have often led to consolidation and shifts in global economic power.

What Comes Next

Looking ahead, Samsung Electronics (005930.KS) faces a dynamic period that will require strategic agility and flawless execution across its diverse business units. In the short term, the market’s reception of the Galaxy Z Fold 7 will be crucial. A strong sales performance could provide immediate uplift to its mobile division and reinforce investor confidence in its premium segment strategy. The company is already rumored to be considering a “wide-type” foldable in 2026, possibly in anticipation of Apple’s entry, indicating an ongoing commitment to evolving its foldable lineup. Simultaneously, Samsung’s semiconductor division must demonstrate continued improvement in its memory business, especially by increasing its share and yield in the critical HBM market, potentially through securing supply deals with major AI chip designers like Nvidia (NVDA). Efforts to improve 2nm process yield, targeting 60% by late 2025, are paramount for regaining foundry credibility and attracting lost orders.

In the long term, Samsung’s success hinges on its ability to leverage its unique strengths across its vast ecosystem. This includes seamless integration of its semiconductor, display, and mobile divisions to create truly differentiated products. Strategic pivots might include further vertical integration to control more of the AI supply chain, from chip design and manufacturing to device-level AI implementation. There are significant market opportunities in the broader semiconductor market, which is projected for robust growth of over 11% in 2025 and 8.5% in 2026, driven by AI, cloud, and advanced consumer electronics. However, challenges persist, particularly in overcoming the foundry yield issues and maintaining competitiveness against SK Hynix (000660.KS) in HBM. Potential scenarios include Samsung either solidifying its position as a holistic tech leader through integrated innovation or facing continued pressure in specific component markets if its manufacturing hurdles persist.

The strategic importance of AI cannot be overstated. Samsung will need to continue investing heavily in AI research and development, not just for its Galaxy AI features but also for its semiconductor design and manufacturing processes. Collaborative efforts with ecosystem partners, including software developers and other hardware manufacturers, will also be key to building a robust AI platform that can compete with rival offerings. The company’s ability to adapt its supply chain, secure critical materials, and navigate geopolitical complexities will also play a significant role in its future trajectory.

A Comprehensive Wrap-Up

Samsung Electronics finds itself at a defining moment, balancing the promise of its innovative mobile devices with the formidable challenges and opportunities within its core semiconductor business. The launch of the Galaxy Z Fold 7 underscores the company’s commitment to leading the premium, foldable smartphone segment, offering a beacon of innovation in an otherwise maturing market. However, this push for mobile differentiation occurs against a backdrop of aggressive competition in the Android ecosystem, where every major player is now vying for market share with increasingly sophisticated, AI-enhanced devices.

The true lynchpin of Samsung’s future performance lies within its semiconductor division. While the memory business is experiencing a significant and welcome rebound, fueled by insatiable demand for AI-related chips, its foundry operations face an uphill battle. Yield rate issues for advanced nodes present a critical obstacle to regaining market share from industry behemoth TSMC (TSM). Simultaneously, the fierce rivalry with SK Hynix (000660.KS) in the high-bandwidth memory (HBM) market highlights a critical arena where leadership will determine who powers the next generation of AI.

Moving forward, investors should closely monitor several key indicators. The sales performance and market reception of the Galaxy Z Fold 7 and subsequent foldable iterations will signal the strength of Samsung’s mobile innovation. More importantly, the company’s progress in improving foundry yield rates for 3nm and 2nm processes, along with its ability to secure substantial HBM supply contracts, will be crucial. These semiconductor milestones will directly impact its profitability and long-term standing in the global tech hierarchy. Samsung’s ability to synergize its hardware prowess with cutting-edge AI software and overcome manufacturing hurdles will ultimately determine its sustained leadership and lasting impact on the market in the coming months and years.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi