Funding & Business

Investors Are Flocking To Fund Incontinence-Focused Startups

While they’re not favorite subjects for sharing personal experiences, incontinence and medical issues around urination are incredibly common.

Adult women are particularly vulnerable. It’s estimated that roughly half are affected to some degree, with prevalence rising sharply with age. Men are also at risk.

With senior populations on the rise across industrialized nations, treating and managing these conditions has proven increasingly costly as well. Global spending on adult diapers and other incontinence products is projected to reach $9.7 billion in 2025 and rise steadily in coming years. The market for treatment devices, currently estimated at over $4 billion annually, is expected to grow even faster.

Bottom line: For a topic that people mostly avoid bringing up in casual conversation, incontinence represents a huge addressable market. And startup founders and investors have taken note.

Funding rounds abound

Per Crunchbase data, more than a dozen companies tied to incontinence and urinary health have raised funding rounds in 2024 and 2025. Our sample cohort, listed below, has collectively raised over $500 million to date.

It’s a diverse lineup, both in geography and specialization, although a majority are medical device startups.

In this area, the most recent big round went to ProVerum Medical, a startup developing a stent to alleviate lower urinary tract symptoms associated with benign prostatic hyperplasia (BPH), a noncancerous enlargement of the prostate gland that occurs as men age. The Dublin-based company closed on $80 billion in Series B funding this week.

Neuromodulation

In terms of total funding to date, the leading name on our list is Neuspera Medical, developer of a neuromodulation therapy for urinary urge incontinence, an overactive bladder symptom it says affects 1 in 5 U.S. women. San Jose-based Neuspera has raised $135 million in known funding to date, per Crunchbase data.

Neuspera is also progressing on the commercialization front. This summer, it received FDA approval for a miniaturized neurostimulator implant said to be effective in reducing or eliminating urinary leaks.

Valencia Technologies, based in Valencia, California, is also applying neuromodulation technology to treat bladder dysfunction. The 14-year-old company raised up to $35 million in a financing earlier this year to pursue commercializing the eCoin, a coin-sized neurostimulator implanted under the skin near the ankle. The device delivers periodic stimulation to the tibial nerve with the aim of reduced episodes of incontinence.

Seed and early stage

We’re also seeing smaller rounds at seed and early stage for startups tackling incontinence.

Two-year-old Axena Health, for instance, closed on a $9.4 million Series A last year for a system for women to train and strengthen their pelvic floor muscles. And Minnesota-based Flyte closed on seed funding last year for an in-home treatment for incontinence and weakened pelvic floor muscles.

On the consumer products side, Hazel has also raised multiple seed financings, per Crunchbase data, to scale its offerings of disposable leakproof briefs.

A new reason not to talk about incontinence

While it will inevitably take time for the current pipeline of funded startups to scale enough to measurably impact the problems they’re addressing, the hope is that they will eventually prevail.

If all works out exceedingly well, the expectation is that incontinence will still be a subject people don’t talk about much. However, it will not be because they’re embarrassed, but rather because they don’t have to worry about it.

Related Crunchbase query:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

Elliott Recommended as Citgo Buyer With $5.89 Billion Proposal

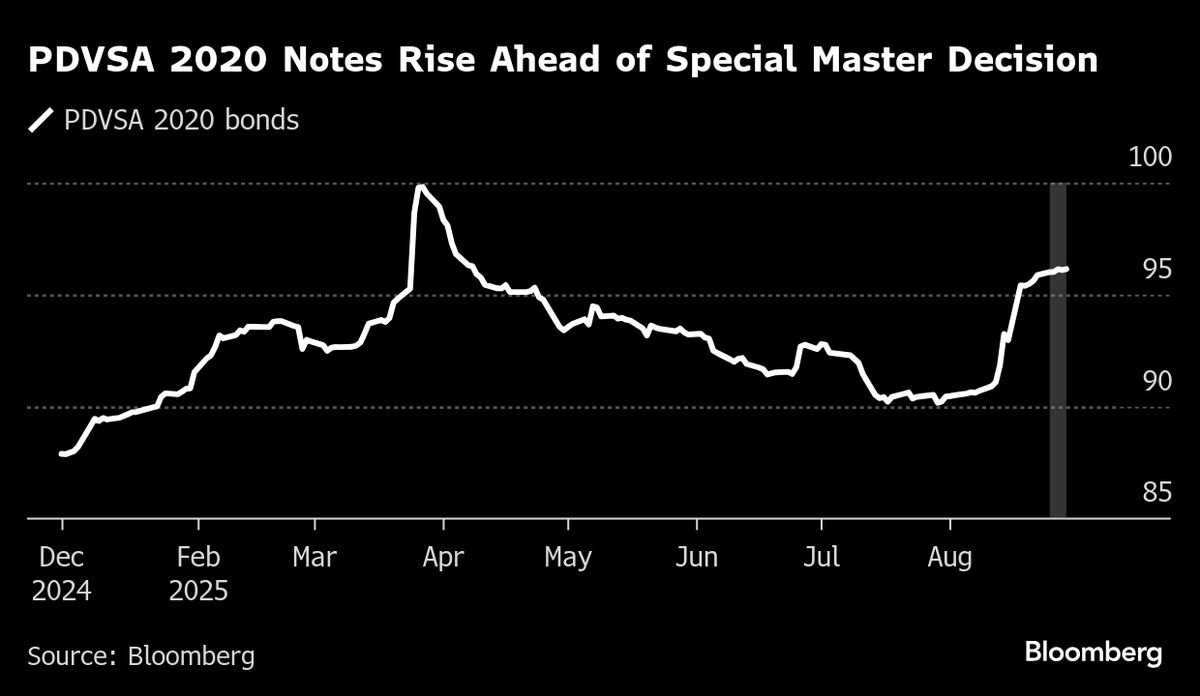

An Elliott Investment Management affiliate emerged as the recommended bidder in the court-ordered auction of Citgo Petroleum Corp.’s parent, offering $5.89 billion and a deal to pay off bondholders that have a pledge on the asset.

On the other side of the legal fight was Gold Reserve Ltd., a Venezuelan creditor suing the country for the expropriation of its mining assets. The firm was also offering to buy US-based PDV Holding, Citgo’s parent, for more than $7 billion in a proposal that would exclude bondholders.

Funding & Business

CDC asks all staff to return to office Sept. 15 after HQ shooting

A sign for the CDC sits outside of their facility at the Centers for Disease Control and Prevention Roybal campus in Atlanta, Georgia, U.S., May 30, 2025.

Megan Varner | Reuters

The Centers for Disease Control and Prevention told staff it expects them to return to offices by Sept. 15, roughly five weeks after a gunman’s deadly attack on the agency’s headquarters in Atlanta, CNBC has learned.

“Your safety remains our top priority. We are taking necessary steps to restore our workplace and will return to regular on-site operations no later than Monday, September 15,” Lynda Chapman, the agency’s new chief operating officer, said in an email sent Thursday that was viewed by CNBC.

Chapman said all staff will be expected to return to their offices by that date, according to the email. For employees whose workspaces remain impacted by the shooting — including physical damage from the gunman’s attack — the CDC will provide alternative spaces on its campus, Chapman wrote in the email.

She said the agency has made “significant progress” on repairs at the CDC Roybal Campus in Atlanta. CDC leadership and a “Response and Recovery Management” team are working to address staff concerns and ensure a safe environment as the agency transitions back to in-office work, Chapman added.

CDC staff had been instructed to work remotely following the Aug. 8 shooting, with options to return to the office in the weeks that followed, according to two people familiar with the matter, who requested anonymity for fear of retribution for speaking to the media.

The Department of Health and Human Services did not immediately respond to a request for comment.

The internal announcement comes at a tumultuous time for the CDC and its workforce. The shooting didn’t result in injuries among CDC staff but shell-shocked a workforce that was already reeling from sweeping changes under HHS Secretary Robert F. Kennedy Jr., including staff cuts and heated controversy over his efforts to change CDC immunization policies and fire the agency’s panel of vaccine advisors.

The return-to-office guidance also comes as the CDC grapples with a leadership upheaval: The White House earlier this week said President Donald Trump had fired the agency’s director, Susan Monarez. Four other top officials resigned, some of them citing the politicization of the agency and a threat to public health.

Authorities identified the gunman behind the shooting at CDC headquarters as Patrick Joseph White and said they recovered five guns and more than 500 shell casings from the scene. During the attack, agency employees were forced to barricade themselves in offices.

White fatally shot a responding police officer, 33-year-old David Rose, and then killed himself. White had blamed the Covid-19 vaccine for making him depressed and suicidal.

Before her firing, Monarez appeared to directly blame the role of misinformation in the shooting, according to an email sent to staff on Aug. 12 that was viewed by CNBC.

In the note, Monarez said, “the dangers of misinformation and its promulgation has now led to deadly consequences. I will work to restore trust in public health to those who have lost it- through science, evidence, and clarity of purpose. I will need your help.”

Funding & Business

Spirit Airlines Bankruptcy Tees Up Painful Cuts in Survival Bid

Spirit Aviation Holdings Inc.’s second bankruptcy filing in a year signals that the low-cost carrier is finally facing up to the painful steps needed to ensure its survival.

But its board faces daunting challenges on the path ahead, including how to downsize its fleet of leased aircraft while managing the roller coaster market conditions for US air travel that complicate the prospects for a long-term recovery.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle