Funding & Business

HR Tech Funding Hits $1B in A Single Quarter

HR tech funding aka human capital management has exploded over the last few quarters.

Software is eating the world, and that includes the traditional workplace. We used CB Insights data to track funding to the startups transforming companies’ human resources departments, aka human capital management.

Q2’15, as we’ll see below, represented a peak in human resources technology funding, with more investment than any other quarter across the last five years, at $1.1B.

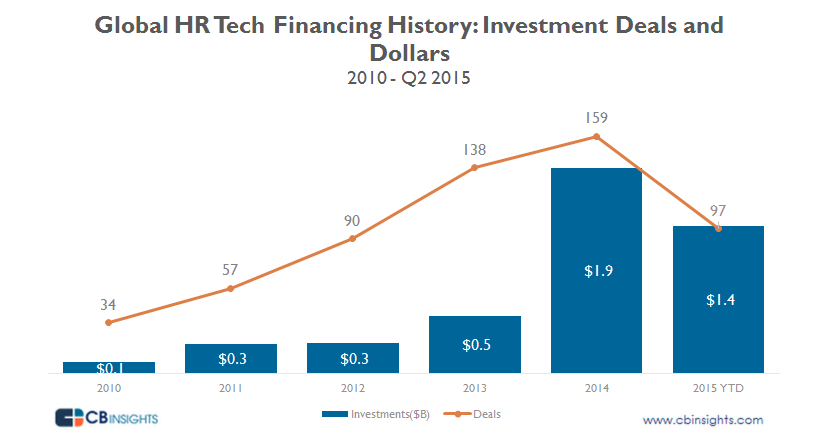

HR Tech Deals And Dollars

Over the last 5 years, HR tech startups have seen an explosion in investment. Funding for full-year 2014 was $1.9B, compared to ~$100M in 2010. Deal count, similarly, almost quadrupled between 2011 and 2014.

During the first two quarters of 2015, HR tech startups have taken in $1.4B across 99 deals, putting the industry on pace for $2.8B total in funding this year, which would be a 47% increase over 2014.

Quarterly Trends

Looking at trends on a quarterly basis, Q2’15 has been a record-breaking quarter in the 2010 to 2015 period, in both deal-count and dollar terms.

The next-largest quarter for funding was Q1’14, after which funding halved but deal flow continued to climb.

In the last four quarters, including Q2’15, HR tech startups attracted $1.97B, up 17% compared to the previous four quarters.

Notable recent deals include a whopping $500M Series C round for Zenefits, from investors including Khosla Ventures, TPG Growth, and Founders Fund in Q2’15; and a $60M Series B round for ZenPayroll, from investors including Google Ventures and KPCB, also in Q2’15.

Deals And Dollars By Investment Stage

Early-stage deals have accounted for around 70% of deal share since 2010, with the exception of 2011 — when they only accounted for about 57% of deal count. Mid-stage deal share has been pretty variable but has tended to hover around 15% to 20%. Late-stage deal share has fluctuated between 3% to 11%.

Early-stage rounds’ share of dollar funding has stood at around 15% in 2014 and the first half of 2015. In 2013, early-stage dollar share was 30%. Mid- and late-stage dollar share has also been highly variable, influenced by a few large mid-stage deals in the last couple of years. Large mid-stage deals in 2014 and 2015 included Zenefits’ Series C and ZenPayroll’s Series B.

Most Active Investors

Over the last five years, the most active investors in HR Tech were 500 Startups and Khosla Ventures, followed closely by Lerer Hippeau Ventures and SV Angel. Notable portfolio companies of the top 10 include Zenefits, Campus Job, and ZenPayroll. Google Ventures is the only corporate VC among the top 10 most active investors.

| Rank | Investor |

|---|---|

| 1 | Khosla Ventures |

| 1 | 500 Startups |

| 2 | Lerer Hippeau Ventures |

| 2 | SV Angel |

| 2 | East Ventures |

| 3 | New Enterprise Associates |

| 3 | Index Ventures |

| 3 | Slow Ventures |

| 3 | Google Ventures |

| 3 | Andreessen Horowitz |

The most active early-stage investors were Khosla Ventures, East Ventures, and 500 Startups. The overwhelming majority of Khosla Ventures’ HR tech investments were early stage.

| Rank | Investor |

|---|---|

| 1 | Khosla Ventures |

| 1 | East Ventures |

| 1 | 500 Startups |

| 2 | Andreessen Horowitz |

| 2 | Lerer Hippeau Ventures |

| 2 | Google Ventures |

| 3 | Qualcomm Ventures |

| 3 | Felicis Ventures |

| 4 | Kleiner Perkins Caufield & Byers |

| 4 | CyberAgent Ventures |

Most Well-Funded Startups

The most well-funded HR tech startup by far is Zenefits, which has accumulated almost $600M in funding, including its latest funding round in Q2’15, which valued the company at $4.5B. Following Zenefits in total funding were SilkRoad Tech, FXiaoKe, and GlassDoor, each of which has raised more than $150M in funding through Q2’15.

Major funding rounds included a $100M Series D for FXiaoKe, which closed in early July 2015; and a $70M Growth Equity round to GlassDoor in January 2015.

| Rank | Company |

|---|---|

| 1 | Zenefits |

| 2 | SilkRoad Technology |

| 3 | OneSource Virtual |

| 4 | FXiaoKe |

| 5 | GlassDoor |

If you aren’t already a client, sign up for a free trial to learn more about our platform.

Funding & Business

China Factory Activity Slump Continues Despite US Tariff Relief

China’s factory activity remained stuck in contraction in August, as a government crackdown on price wars holds back production offset the boost for manufacturers of the US’ extended trade truce.

Source link

Funding & Business

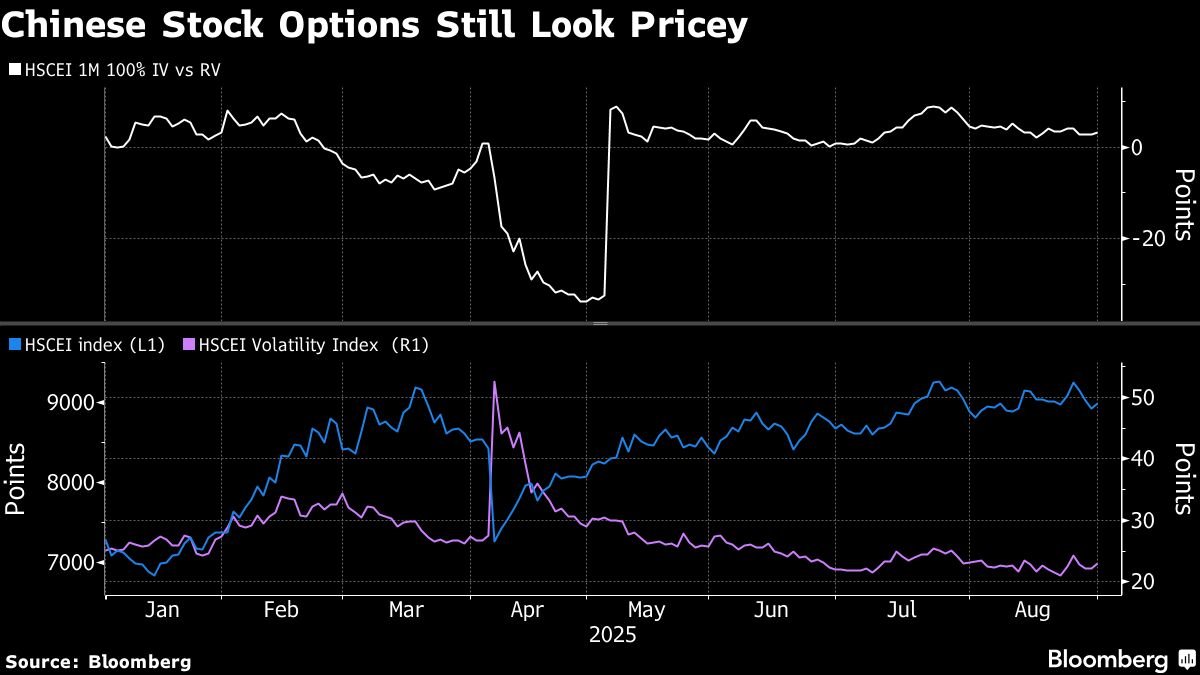

China’s Stock Rally Is Met With Skepticism in Options Market

While Chinese stocks traded in Hong Kong climbed for a fourth straight month, derivatives wagers show investors are skeptical about the market.

Source link

Funding & Business

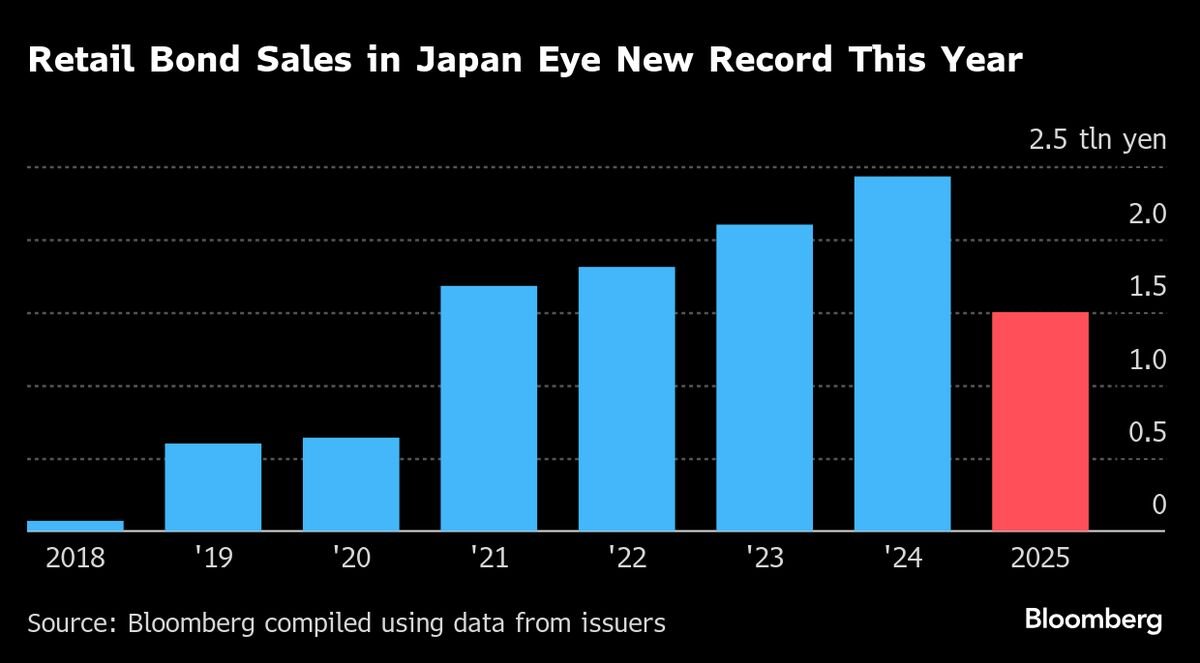

SoftBank, Rakuten Tap Japan’s Booming Retail Demand for Bonds

Sales of corporate bonds to Japan’s mom and pop investors are booming, on track to surpass last year’s record as bigger returns draw buyers looking to protect their savings from inflation.

Well-known names such as railway operator Keio Corp. and supermarket giant Aeon Co. are among those tapping the retail bond market, with the latter selling its debut retail bond on Friday.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle