Can artificial intelligence stop the planet burning?

There is both good and less good news about the answer to this question.

But since this column is being written at the end of yet another sweltering UK heatwave, let’s start with the more pleasing thought that AI could soon help to cut a non-trivial chunk of global transport, power and food emissions every year.

So says a new paper from a research team led by British economist, Nicholas Stern, that is worth reading on several counts.

For a start, the transport, power and food sectors account for roughly half of global emissions, so anything that shrinks their emissions matters.

The researchers think AI systems can make inroads in parts of these sectors by, say, boosting the use of renewables on power grids; identifying proteins that make lab-grown meat tastier; and making electric cars more affordable (with cheaper batteries) and desirable (by predicting the best charging sites).

This could amount to annual emission reductions of between 3.2 and 5.4 billion tonnes by 2035, meaning AI could cut emissions in these areas by as much as 25 per cent. Even a 3.2bn-tonne cut would outweigh the estimated rise in emissions from power hungry AI and data centres, the researchers say.

These findings are not all theoretical. Google’s DeepMind artificial intelligence team says its technology has already been able to enhance the value of wind farm energy by roughly 20 per cent, and cut energy for Google’s data centre cooling by up to 40 per cent.

DeepMind’s Nobel Prize-recognised AlphaFold model has helped researchers predict the structure of millions of proteins in a breakthrough that could accelerate the use of meat alternatives.

Also, unlike previous studies that have tried to quantify AI’s planet-saving prospects, Stern’s is peer-reviewed and was not done by Microsoft, Google or any another company that produces AI products.

Stern led the eponymous 2006 UK government-commissioned Stern Review that jolted climate thinking by showing the benefits of early, robust climate action far outweigh the economic costs of not acting. He remains an influential climate policy voice, even if the world has failed to act on his findings at anything like the pace and scale needed.

Which brings us to the less good news about AI and climate change.

Point one: AI climate tech that looks great in the lab can struggle in real life. Scientists this week claimed a Meta research project raised false hopes about sucking carbon out of the air, arguing its approach lacked scientific rigour.

Point two: AI might be good for the other side. Energy companies say the technology is, in the words of Saudi Aramco, the world’s largest oil company, “really making a big difference” to their operations.

This is unlikely to stop because of a larger obstacle to using AI for climate good: money.

Designing an AI system for a company like Saudi Aramco may make a lot of commercial sense for today’s tech companies. Doing it for an emerging market grid operator may not, even if it does a lot more for the planet, as AI researchers like Jack Kelly know.

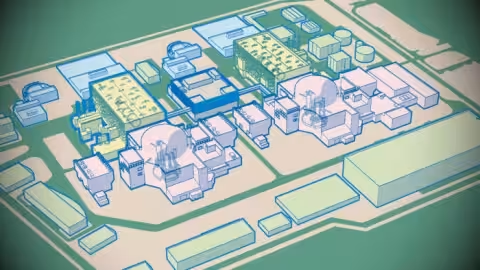

Kelly is, in his words, “terrified” by climate change and was an engineer at Google DeepMind in 2017 when the group revealed it was in early talks with the UK’s National Grid about using AI to help maximise the use of renewables.

“Those first few meetings were really exciting,” Kelly told me. “It felt like we could do something really interesting.”

Alas, the effort was abandoned for reasons that remain unclear. DeepMind declined to comment on reports that there may have been disagreement over intellectual property ownership. The UK’s energy operator did not respond by deadline.

Kelly ended up leaving DeepMind and co-founding Open Climate Fix, a non-profit group that develops AI systems to cut energy emissions.

Its solar power forecasting technology is being used by the electricity system operator in the Indian state of Rajasthan and in Britain, where Kelly says it is helping to cut emissions by allowing operators to schedule less gas generation. His group is doing other work that promises to aid the planet but, as he says, “Lots of things have to go right for that scenario to play out.”

Stern’s paper also recognises that market forces alone may not “unlock the full potential of AI”. What’s needed is what it calls an “active state” where governments, cities, grid operators or other big players become clients for AI technologies. That argument is compelling. Now we just need to see it happen.