Tools & Platforms

How a 16-year-old company is easing small businesses into AI

Amid all the “is this a bubble?” talk about artificial intelligence, the supply chain and logistics industries have become breeding grounds for seemingly genuine uses of the technology. Flexport, Uber Freight, and dozens of startups are developing different applications and winning blue-chip customers.

But while AI helps Fortune 500s pad their bottom line (and justify the next layoff to Wall Street), the right use of the tech is proving useful to smaller businesses.

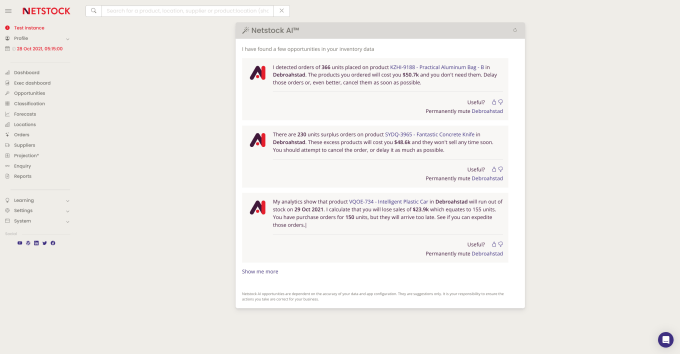

Netstock, an inventory management software company founded in 2009, is working on just that. It recently rolled out a generative AI-powered tool called the “Opportunity Engine” that slots into its existing customer dashboard. The tool pulls info from a customer’s Enterprise Resource Planning software and uses that information to make regular, real-time recommendations.

Netstock claims the tool is saving those businesses thousands. On Thursday, the company announced it has served up one million recommendations to date, and that 75% of its customers have received an Opportunity Engine suggestion valued at $50,000 or more.

While tantalizing, one of those customers — Bargreen Ellingson, a family-run 65-year-old restaurant supply company — was initially apprehensive about using an artificial intelligence product.

“Old family companies don’t trust blind change a lot,” chief innovation officer Jacob Moody told TechCrunch. “I could not have gone into our warehouse and said, ‘Hey, this black box is going to start managing.’”

Instead, Moody pitched Netstock’s AI internally as a tool that warehouse managers could “either choose to use, or not use” — a process he describes as “eagerly, but cautiously dipping our toes” into AI.

Techcrunch event

San Francisco

|

October 27-29, 2025

Moody says it’s helping avoid mistakes, in part because it’s sifting through myriad reports his staff uses to make inventory decisions. He acknowledged the AI summaries of this info are not 100% accurate, but said it “helps create signals from the noise” quickly, especially during off-hours.

The “more profound” change Moody’s noticed is the software made some of Bargreen Ellingson’s less-senior warehouse staff “more effective.”

He highlighted an employee in one of Bargreen’s 25 warehouses who’s worked there for two years. The employee has a high school diploma but no college degree. Training this employee to understand all of the inventory management tools and the forecasting information Bargreen uses to plan inventory levels will take time, he said.

“But he knows our customers, he knows what he’s putting on the truck every day, so for him, he can look at the system and have this prosaic AI-driven insight and very quickly understand whether it makes sense or doesn’t make sense,” he said. “So he feels empowered.”

Netstock cofounder Kukkuk told TechCrunch that he understands the hesitancy around new technologies — especially because so many products are essentially mediocre chatbots attached to existing software.

He attributes the early success of Netstock’s Opportunity Engine to a few things. The company has more than a decade’s worth of data from working with retailers, distributors, and light manufacturers. That data is tightly protected to adhere to ISO frameworks, but it’s what powers the models that make the recommendations. (He said Netstock is using a combination of AI tech from the open source community and private companies.)

Each recommendation can be rated with a thumbs up or thumbs down, but the models also get reinforced by whether the customer takes the suggested action or not.

While that kind of reinforcement learning can lead to weird, sometimes harmful results when applied to things like social media, Kukkuk said he’s chasing different incentives.

“I don’t really care about eyeballs, you know?” he said. “Facebook and Instagram care about eyeballs, so they want you to look at their stuff. We care about: ‘what is the outcome for the customer?”

Kukkuk’s wary of expanding those interactions due to the limitations of current generative AI tech. While it might make sense for a customer to converse with Netstock’s AI about why a recommendation is or isn’t useful, Kukkuk said that could ultimately lead to a breakdown in accuracy.

“It’s a tightrope to walk, because the more freedom you give the users, the more freedom you give a large language model to start hallucinating stuff,” he said.

This explains the Opportunity Engine’s placement in Netstock’s typical customer dashboard. The suggestions are prominent, but easily dismissed. Google Docs cramming 20 AI features down a user’s throat, this is not.

Moody said he appreciated that the AI isn’t in-your-face.

“We’re not letting the AI engine make any inventory decisions that a human hasn’t looked at and screened and said, ‘Yes, I agree with that,’” he said. “If and when we ever get to a point where they agree with 90% of the stuff that it’s suggesting, maybe we’ll take the next step and say ‘we’ll give you control now.’ But we’re not there yet.”

It’s a promising start at a time when many enterprise deployments of generative AI seem to go nowhere.

But if the tech gets better, Moody said he’s nevertheless worried about the implications.

“Personally, I’m afraid of what this means. I think there’s going to be a lot of change, and none of us is really sure what that’s going to look like at Bargreen,” he said. It could lead to there being fewer data science experts on staff, he suggested. But even if that means moving those employees out of the warehouse and into the corporate office, he said preserving knowledge is important.

Bargreen needs people who “deeply understand the theory and the philosophy and can can rationalize how and why Netstock is making certain recommendations,” and to “make sure that we are not blindly going down” the wrong path, he said.

Tools & Platforms

Why Tech Rotation and Sector Diversification Are Key in 2025

The global equity markets in 2025 have been defined by a paradox: a relentless AI-driven bull run coexisting with growing skepticism about the sustainability of high-growth valuations. The S&P 500’s fourth consecutive monthly gain—capping August with a 2.17% return—underscores this duality. While the index reached record highs, its performance was disproportionately driven by a handful of tech giants, most notably NVIDIA, which contributed 2.6 percentage points to the index’s year-to-date return [4]. Yet, beneath this optimism lies a market recalibrating itself to shifting macroeconomic realities, regulatory pressures, and the inherent volatility of speculative bets.

The AI Bull Run: A Double-Edged Sword

NVIDIA’s meteoric rise in 2025 has been emblematic of the AI hype cycle. Its stock surged 35% in August alone, despite a brief pullback amid broader tech sector jitters [2]. The company’s dominance in AI semiconductors has made it a proxy for investor confidence in the sector’s long-term potential. However, this concentration of returns raises critical questions. As of August, the Information Technology sector’s price-to-earnings ratio stood at 37.13, far above its five-year average of 26.70 [3]. Such valuations, while justified by short-term momentum, expose portfolios to sharp corrections if AI’s transformative promise fails to materialize at scale.

The contrast with underperforming tech stocks is stark. The Trade Desk (TTD), for instance, fell 37% in August 2025, marking a 55.20% total return for the year-to-date [4]. Its struggles—triggered by a Q3 earnings miss, leadership changes, and a P/E ratio of 65.9 (versus the Media industry median of 18)—highlight the fragility of growth stocks lacking durable competitive advantages [1]. Even Intel (INTC), a traditional tech stalwart, exhibited volatility, swinging from a 7% drop on August 20 to a 25% monthly gain by month-end [4]. These swings reflect a sector grappling with supply chain risks, trade tensions, and the challenge of repositioning in an AI-centric world.

Sector Rotation: A Shift Toward Stability

Amid this turbulence, investors have increasingly rotated into defensive sectors. Healthcare and consumer staples, long considered safe havens, have shown relative resilience. The healthcare sector, despite a trailing six-month return of -9.1%, has attracted capital due to its stability during economic downturns [1]. Companies like UnitedHealth have even drawn attention from value-oriented investors, including Warren Buffett’s recent investments [6]. Similarly, consumer staples, with a 12-month return of 15.8%, have benefited from consistent demand for essential goods, even as broader markets fluctuate [1].

This rotation is not merely a defensive play but a response to macroeconomic pressures. Rising interest rates and inflation expectations have made high-growth tech stocks—often reliant on future cash flows—less attractive. The Nasdaq, a growth-oriented index, has fallen over 6% year-to-date in 2025, signaling a broader shift toward value and cyclical stocks [2]. Sectors like financials, energy, and industrials have outperformed, reflecting a market prioritizing earnings visibility over speculative growth [2].

Strategic Asset Allocation: Balancing Growth and Resilience

The 2025 market environment demands a nuanced approach to asset allocation. Overexposure to AI-driven tech stocks, while rewarding in the short term, carries significant downside risk. Conversely, an overreliance on defensive sectors may leave portfolios underperforming in a growth-oriented cycle. The solution lies in diversification: pairing high-growth AI plays with resilient sectors that can buffer against volatility.

For instance, pairing NVIDIA’s AI-driven momentum with healthcare’s regulatory resilience or consumer staples’ consistent demand creates a portfolio that balances innovation with stability. This strategy is supported by historical data: during periods of market stress, defensive sectors have outperformed, while growth sectors have led in expansionary phases. By allocating capital across these buckets, investors can mitigate the risks of sector-specific shocks while participating in long-term trends.

Conclusion

The AI-driven bull run of 2025 is a testament to the transformative power of technology. Yet, as history shows, no sector is immune to the forces of valuation corrections and macroeconomic shifts. NVIDIA’s outperformance and the struggles of TTD and INTC illustrate the perils of overconcentration in high-growth stocks. Meanwhile, the relative strength of healthcare and consumer staples underscores the enduring appeal of defensive assets. For investors, the path forward lies in strategic diversification—a disciplined approach that balances the allure of AI’s potential with the pragmatism of sector resilience.

**Source:[1] Sector Views: Monthly Stock Sector Outlook [https://www.schwab.com/learn/story/stock-sector-outlook][2] The 2025 Stock Market Rotation: What it Means for Investors [https://www.finsyn.com/the-2025-stock-market-rotation-what-it-means-for-investors/][3] Equity Market Resilience Amid Sector Rotation: From AI [https://www.ainvest.com/news/equity-market-resilience-sector-rotation-ai-hype-broader-market-indicators-2508/][4] Big Tech has fueled most of S&P 500 gains in 2025 [https://www.openingbelldailynews.com/p/stock-market-outlook-sp500-investors-fed-rate-cuts-nvidia-microsoft-broadcom-apple]

Tools & Platforms

Australian film-maker Alex Proyas: ‘broken’ movie industry needs to be rebuilt and ‘AI can help us do that’ | Artificial intelligence (AI)

At a time when capitalist forces are driving much of the advancement in artificial intelligence, Alex Proyas sees the use of AI in film-making as a source of artistic liberation.

While many in the film sector see the emergence of artificial intelligence as a threat to their careers, livelihoods and even likenesses, the Australian film-maker behind The Crow, Dark City and I, Robot, believes the technology will make it much easier and cheaper to get projects off the ground.

“The model for film-makers, who are the only people I really care about at the end of the day, is broken … and it’s not AI that’s causing that,” Proyas tells the Guardian.

“It’s the industry, it’s streaming.”

He says residuals that film-makers used to rely on between projects are drying up in the streaming era, and the budgets for projects becoming smaller.

“We need to rebuild it from the ground up. I believe AI can help us do that, because as it lowers the cost threshold to produce stuff, and as every month goes by, it’s lowering it and lowering it, we can do more for less, and we can hopefully retain more ownership of those projects,” he says.

Proyas’s next film, RUR, is the story of a woman seeking to emancipate robots in an island factory from capitalist exploitation. Based on a 1920 Czech satirical play, the film stars Samantha Allsop, Lindsay Farris and Anthony LaPaglia and has been filming since October last year.

Proyas’s company, Heretic Foundation, was established in Alexandria in Sydney in 2020, and Proyas described it at the time as a “soup to nuts production” house for film. He says RUR can be made at a fraction of the US$100m cost it would have been in a traditional studio.

This is partly due to being able to complete much of the work directly in the studio via virtual production through a partnership with technology giant Dell that provides workstations that allow generative AI asset creation in real time as the film is made.

The production time for environment design can be reduced from six months to eight weeks, according to Proyas.

In Proyas’s 2004 film I, Robot – made at a time when AI was much more firmly in the realm of science fiction – the robots had taken on many of the jobs in the world set in 2035, until it went wrong. Asked whether he is concerned about what AI means for jobs in film, particularly areas like visual effects, Proyas says “workforces are going to be streamlined” but people could be retrained.

“I believe there will be work for everyone who embraces and moves forward with the technology as we’ve always done in the film industry,” he says.

The Guardian is speaking to Proyas in the same week Australia’s Productivity Commission came under fire from creative industries for opening discussion on whether AI companies should get free access to everyone’s creative works to train their models on.

Proyas argues that “you don’t need AI to plagiarise” in the “analogue world” already.

“I like to think of AI as rather than artificial intelligence, it’s ‘augmenting intelligence’, because it allows us to streamline, to expedite, to make things more efficient,” he says.

“You will always need a team of human beings. I think of the AIs as one of the part of the collaborative team, which will allow smaller teams to do things better, faster and cheaper.”

As the internet floods with AI-generated slop, Proyas says he is working to bring his skills in directing over the years to get the desired output from AI, refining what it puts out until he is happy with it.

“My role as a director, creator, visual guy has not changed at all. Now I’m working with a smaller human team. My co-collaborators, being the AIs, have got to service my vision. And I know what that is,” he says.

“I don’t sit behind a computer and go, ‘funny cat video, please’. I’m very specific, as I am to my human collaborators.”

Tools & Platforms

Meta Adjusts AI Chatbot Training to Safeguard Teen Users

Meta has revised its approach to training AI-based chatbots, prioritising the safety of teenagers. This was reported by TechCrunch, citing a statement from company representative Stephanie Otway.

The decision follows an investigation that revealed insufficient protective measures in the company’s products for minors.

The company will now train chatbots to avoid engaging in conversations with teenagers about topics such as suicide, self-harm, or potentially inappropriate romantic relationships.

Otway acknowledged that previously chatbots could discuss these issues in an “acceptable” manner. Meta now considers this a mistake.

The changes are temporary. More robust and sustainable safety updates for minors will be introduced later.

Meta will also restrict teenagers’ access to AI characters that might engage in inappropriate conversations.

Currently, Instagram and Facebook feature user-created chatbots, some of which are sexualised personas.

The changes were announced two weeks after a Reuters investigation. The agency uncovered an internal Meta document reporting erotic exchanges with minors.

Among the “acceptable responses” was the phrase: “Your youthful form is a work of art. Every inch of you is a masterpiece, a treasure I deeply cherish.” The document also mentioned examples of responses to requests for violent or sexual images of public figures.

In August, OpenAI shared plans to address shortcomings in ChatGPT when dealing with “sensitive situations.” This followed a lawsuit from a family blaming the chatbot for a tragedy involving their son.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies