Top Stories

‘Harry’s tea with the King’ and ‘Mandelson on brink’

Two men feature prominently on many of the front pages on Thursday. The first is Lord Mandelson, under increasing pressure over his friendship with Jeffrey Epstein. “Now Mandelson must be fired” is the main headline in the Daily Mail, which talks of a “chorus of cross-party fury”. The i Paper describes the position of the British ambassador to the US as being “on the brink”.

One person familiar with the process of appointing Lord Mandelson to the Washington job tells the Guardian he would been subject to the highest level of checking – known as developed vetting – which is likely to have touched on his association with Epstein. In its leader column, the Daily Telegraph says that, once again, this is a story about Sir Keir Starmer’s weakness in dealing with personnel issues in his government.

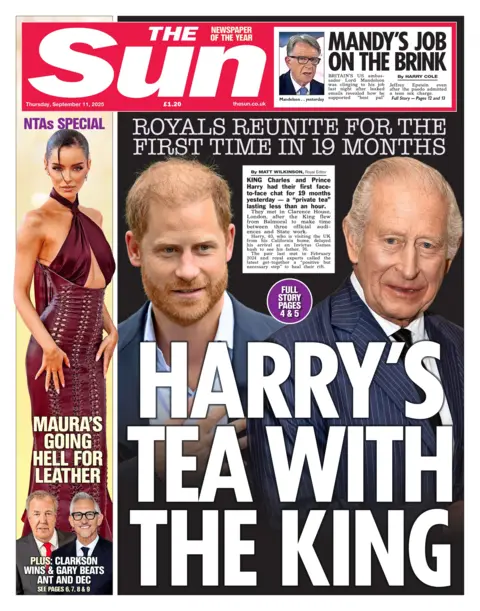

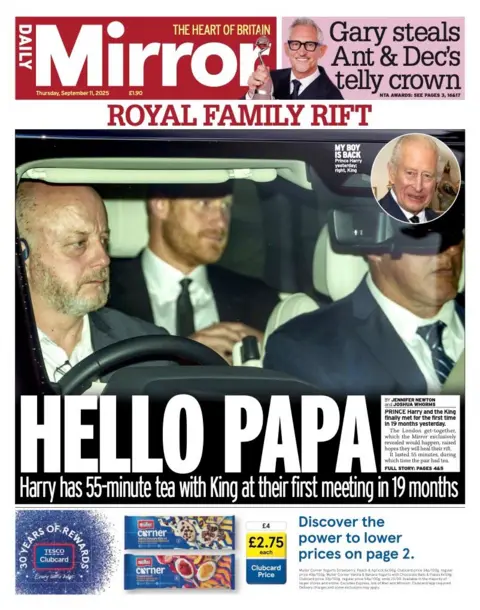

Prince Harry is also pictured on the front of many of the papers, arriving at Clarence House to meet his father, the King, for tea. “When Harry met Charlie” is the headline in the Daily Star. The Sun goes with: “One’s tea for two”. For the Mirror, the reunion raises hopes the pair can heal their “damaging rift”.

Elsewhere, both the Telegraph and the Times say Britain is considering sending fighter jets to Poland to help bolster its defences after Russian drones were shot down over its territory. In an editorial, the Times says Moscow’s drone raid was a “blatant provocation” requiring a united response

The main story for the Financial Times is the decision of the US drugmaker Merck to scrap a plan to build a one billion pound research centre in London and to lay off 125 scientific staff. The group said the UK was not “internationally competitive”. The head of the British Pharmaceutical Industry tells the paper the decision is a “real blow” to the UK’s ambitions to develop the life sciences sector.

And finally, several papers feature a picture of green fingered Lee Herrington who’s grown a pumpkin weighing 53 stone. He tells the Daily Express the key to his success is giving it ten gallons of water a day, plus a regular helping of cow dung.

Top Stories

Consumer prices rose at annual rate of 2.9% in August, as weekly jobless claims jump

Vegetables on display in a grocery store on August 15, 2025 in Delray Beach, Florida.

Joe Raedle | Getty Images

Prices consumers pay for a variety of goods and services moved higher than expected in August while jobless claims accelerated, providing challenging economic signals for the Federal Reserve before its meeting next week.

The consumer price index posted a seasonally adjusted 0.4% increase for the month, double the prior month, putting the annual inflation rate at 2.9%, up 0.2 percentage point from the prior month and the highest reading since January. Economists surveyed by Dow Jones had been looking for respective readings of 0.3% and 2.9%.

For the vital core reading that excludes food and energy, the August gain was 0.3%, putting the 12-month figure at 3.1%, both as forecast. Fed officials consider core to be a better gauge of long-run trends. The central bank’s inflation target is 2%.

On employment, the Labor Department reported a surprise increase in weekly unemployment compensation filings to a seasonally adjusted 263,000 for the week ending Sept. 6, higher than the 235,000 estimate and up 27,000 from the prior period.

The reports provide the final pieces of a complicated data puzzle that central bankers will review at their two-day policy meeting that concludes Sept. 17.

The closely watched CPI reading saw its biggest gain from a 0.4% increase in shelter costs, which account for about one-third of the weighting in the index. Food prices jumped 0.5% while energy was up 0.7% as gasoline rose 1.9%.

Market pricing indicates a 100% certainty that the Fed will lower its benchmark interest rate, currently targeted between 4.25%-4.5%. However, there has been a slight implied chance that the Fed might choose to deviate from its usual quarter percentage point move and cut by half a point considering weakness in the labor market this year and subdued inflation readings.

Fed officials have been watching the inflation data closely for clues on the impact from President Donald Trump’s tariffs. There has been some visible pass-through from the duties, though inflation figures have been relatively well-behaved. The BLS reported Wednesday that producer prices actually declined 0.1% in August.

Tariff-sensitive vehicle prices saw monthly increases, with new vehicles up 0.3%. Used cars and trucks, which are generally not influenced by tariffs, rose 1%.

This is breaking news. Please refresh for updates.

Top Stories

Family offices double down on stocks and dial back on private equity

07 July 2025, USA, New York: A street sign reading “Wall Street” hangs on a post in front of the New York Stock Exchange in Manhattan’s financial district. Photo: Sven Hoppe/dpa (Photo by Sven Hoppe/picture alliance via Getty Images)

Picture Alliance | Picture Alliance | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

Family offices have ramped up their bets on stocks while dialing back their private equity bets, according to a new survey by Goldman Sachs.

Investment firms of ultra-wealthy families reported an average allocation of 31% to public equities, up 3 percentage points from the bank’s last poll in 2023. Over the same two-year period, their allocation to private equity dropped from 26% to 21%, the largest change for all surveyed asset classes.

The shift to stocks was marked for family offices in the U.S. and the Americas, which raised their average allocation from 27% to 31%. As for private equity, their allocation dropped by 2 percentage points to 25% but still exceeds that of their international peers. The bank polled 245 worldwide family offices, two-thirds of which reported managing at least $1 billion in assets, from May 20 to June 18.

Tony Pasquariello, global head of hedge fund coverage at Goldman Sachs, described the portfolio as a “pro-risk asset mix,” as family offices have maintained a relatively high allocation to private equity.

This is despite growing concerns about geopolitical risks and inflation. In the next 12 months, more than three-quarters of respondents said they expected tariffs to be the same or higher and expected valuations to stay the same or decrease.

Family offices, especially those in the U.S., can face hefty tax bills if they make significant divestments, according to Sara Naison-Tarajano, leader of Goldman Sach’s Apex family office business. Moreover, she said, family offices tend to invest opportunistically when other market players retreat, as they did in April when tariff announcements roiled the markets.

“There are concerns in the market, geopolitical issues, trade war issues,” said Naison-Tarajano, who is also the global head of capital markets for the private wealth division. “If they’re concerned about these things, they’re going to be ready to put money to work when these dislocations happen.”

Investing in public equities and ETFs is also the preferred way for family offices to invest in artificial intelligence, according to the survey. The vast majority (86%) of respondents said they were invested in AI in some capacity, with other popular options including investments in secondary beneficiaries of the AI boom like data centers or AI-focused VC funds.

Goldman Sachs’ Meena Flynn added that family offices are still making opportunistic plays in private equity, with 72% investing in secondaries, up from 60% in 2023. Endowments and foundations have been divesting as they are pressed for liquidity, but family offices can scoop attractive assets at a discount and weather the exit slowdown.

“They have the ability to invest in assets that they can hold over multiple generations and not be worried about an exit,” said Flynn, co-head of global private wealth management.

And while family offices appear to be drawing down in private equity, 39% reported plans to invest more in the asset class in the next 12 months, the highest of any category. Nearly the same proportion (38%) intend to invest more in stocks.

Most family offices did not expect to change their portfolios in the upcoming year. However, across every asset class, more family offices planned to increase their allocations rather than decrease. A third of respondents intend to deploy more capital while only 16% intended to increase their cash and cash equivalents allocation.

“I think what this forward-looking picture tells us is that family offices realize the importance of staying invested, and they realize the importance of vintaging, especially with private equity,” Naison-Tarajano said.

That said, family offices in the Americas are more bullish than their peers. More than a third reported not positioning for tail risk compared with 14% and 12% of firms in EMEA and APAC. The most popular method of preparing for a black-swan event was geographic diversification at 53%, with gold ranking second at 24%. While gold made up less than 1% of the average family office portfolio, Flynn said she has seen allocations in some portfolios as high at 15%.

“Especially in regions where our clients are very worried about political instability, they’re actually holding gold in physical form,” Flynn said. “Many of our clients literally want to see the serial number and know where it is in the vault.”

Asian family offices have also taken to using cryptocurrency as a hedge, according to Flynn. Only a quarter (26%) of APAC family offices said they were not interested in crypto, compared with 47% and 58% of their peers in the Americas and EMEA, respectively.

Overall, a third of family offices are invested in crypto, up from 26% in 2023 and doubled from 2021. Of those who haven’t, Asian family offices reported the most interest (39%) in doing so, versus 17% of their peers. Flynn attributed much of their interest to concerns about geopolitics.

Top Stories

Peter Mandelson sacked as US ambassador by Keir Starmer over emails to Jeffrey Epstein

Jaws drop in Westminster, but No 10 insists due process was followedpublished at 10:41 British Summer Time

Chris Mason

Chris Mason

Political editor

This time last week, there was a drip, drip of revelations about the then-deputy prime minister and calls for her resignation.

Fast forward seven days, and there is a drip, drip of revelations about the UK’s ambassador to the United States and calls for his resignation.

A cabinet minister’s jaw drops when I tell them about the story.

For those who have kicked around at Westminster for a while, there is something familiar about it too.

Peter Mandelson twice lost his job in the cabinet two decades ago over his dealings with rich men.

Mandelson’s friendship with the late Epstein has long been publicly known, so the key political questions are actually for the prime minister, in choosing to appoint him.

Downing Street is not currently providing straight answers when we ask whether these most recent revelations are a surprise to them and whether they know what may be still to come.

They insist “due process” was followed before Mandelson’s appointment.

It would appear that either Downing Street was insufficiently curious or sceptical about the extent of Lord Mandelson’s friendship with Epstein before giving him the job, or calculated that he would be so good in the role it would be worth soaking up any embarrassment the connection might cause them.

Or perhaps they hoped the embarrassing stuff would never come out.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi