Tools & Platforms

Grammarly Is Rolling Out a New Interface and More AI Tools

If you use Grammarly to keep tabs on your spelling and grammar, you’re going to notice some changes.

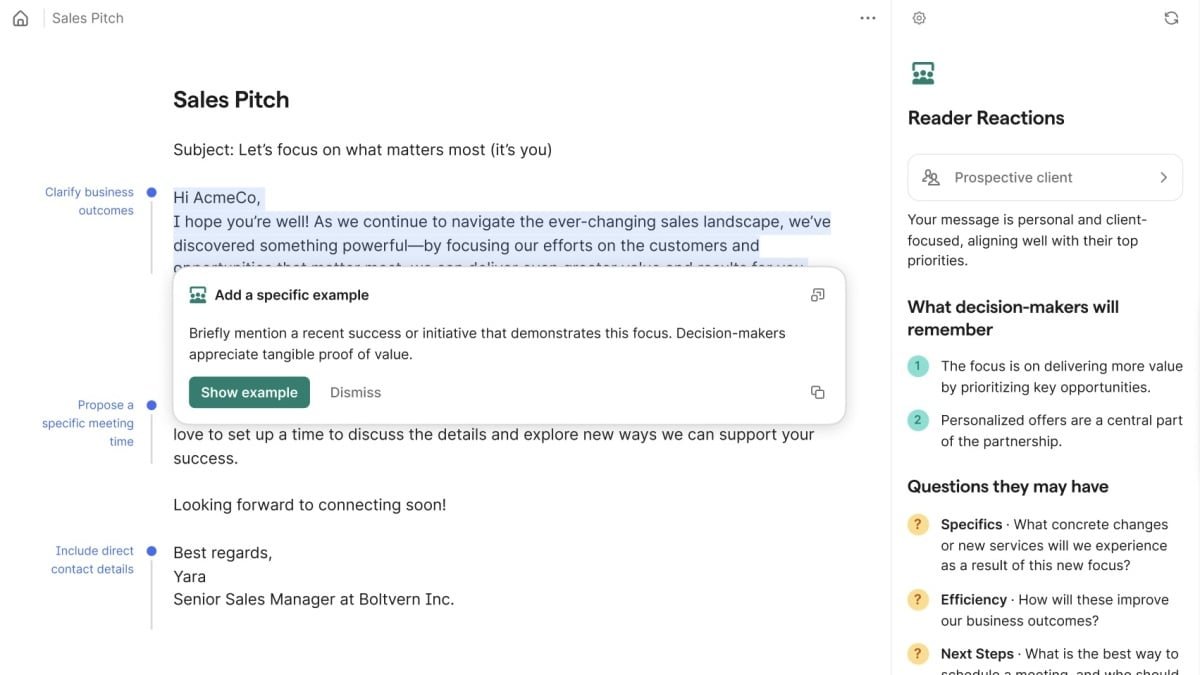

That’s because Grammarly is introducing an overhauled experience for both free and paid users today. The immediate change you’ll notice is the new UI, “docs,” Grammarly’s new take on a word processor. (The company calls this an “AI writing surface.”) Like before, you can use rich text (bolding, italics, and underlining), headers, and lists, but as TechCrunch notes, the new writing interface works using blocks. You can add new blocks to add rich text, but also blocks to add things like separators, columns, and tables. It sounds to me like if you’ve used WordPress, you’ll be familiar with this setup.

You’ll also notice AI Chat in docs’ sidebar, which acts as a traditional AI chatbot. You can use it to ask for AI assistance, rather than leaving the app to do so. But beyond this, Grammarly is rolling out new AI features for its writing tool—namely, AI agents. AI Agents are designed to automate tasks for you, and in this case, Grammarly wants its agents to help writers—especially students and teachers—across a spectrum of issues. There are eight agents in total rolling out with this update, responsible for the following:

-

Reader Reactions: Identifies the target reader of your work, and anticipates questions or concerns they might want from your current draft.

-

AI Grader: This agent lets you add information about your schoolwork, so it can offer advice and grade estimations before you submit an assignment.

-

Citation Finder: Not only is this agent supposed to generate your citations for you, Grammarly says it can find evidence to support or dispute claims in your writing.

-

Expert Review: This agent folds in “subject-matter expertise” to punch up your piece to meet certain academic standards.

-

Proofreader: This sounds like more of the traditional Grammarly experience, offering line-by-line advice for improving your writing,

-

AI Detector: This agent gives an estimation of whether any given text appears to be human or AI-generated.

-

Plagiarism Checker: Compares your writing against “vast databases” of text to see if you’re infringing on any existing work.

-

Paraphraser: This agent can rework your writing to fit a certain tone.

While all writers can use these tools, Grammarly seems keen to target education with these updates. In the company’s view, students can use the AI tools to improve their writing, especially in relation to the target audience—say a teacher or instructor’s expectations. The company wants teachers, on the other hand, to use tools like AI Detector to weed out any students that might be relying a bit too much on AI tools. In Grammarly’s world, students and teachers can use AI for good, not cheating.

Like many AI tools, the advertised experience sounds great: Grammarly’s new AI experience sounds like working with eight experts at once on any given writing task. However, in practice, things might turn out differently. AI plagiarism detectors, for example, are less reliable than many believe. (These tools have told me that the U.S. Constitution was written almost entirely by AI.) Grammarly’s VP of enterprise product told TechCrunch as much regarding their AI Detector agent, though he says its agent is more accurate than any other product you can find, and there is evidence to suggest the tools are improving overall.

What do you think so far?

I also worry about the quality and accuracy of other tools. “Reader Reactions” relies on “publicly available” information about a given instructor. If a classroom of students follows AI advice generated from the same pool of data about this instructor, will the end results all sound exactly the same? AI also hallucinates, occasionally making up information entirely—will students take the time to review “Citation Finder’s” generations, to ensure that some of the sources aren’t bogus?

I get Grammarly’s mission here: AI isn’t going away, and students are increasingly using it in ways that might not necessarily help them learn. Rather than attempt to ban AI, why not embrace the technology, in a way that is beneficial to everyone involved? I do appreciate Grammarly isn’t offering students a way to generate whole paragraphs (or essays), but rather use the AI to engage with their existing work. But we also need to be wary of these tools limitations, something that often goes overlooked in all the AI hype and excitement.

Tools & Platforms

Sector Spotlight: Where Smart Money is Flowing as AI and Rate Cuts Loom

The global financial markets are currently a crucible of transformative forces, where the relentless march of artificial intelligence (AI) innovation converges with the anticipated easing of monetary policy by the Federal Reserve. This dynamic environment is prompting a significant reallocation of “smart money”—the capital managed by institutional investors, hedge funds, and other financial professionals—as they strategically position themselves for the next phase of economic growth and market performance. While a cautious optimism permeates the landscape, astute investors are keenly eyeing sectors poised to reap the rewards of AI-driven productivity gains and the reduced borrowing costs that lower interest rates promise.

The Dual Engines of Change: AI’s Ascent and the Fed’s Pivot

The investment landscape is characterized by a nuanced blend of short-term prudence and long-term bullish conviction. At the heart of this sentiment lies the undeniable impact of AI, which is no longer merely a speculative concept but a tangible force driving capital expenditures and reshaping business models across industries. Tech giants are pouring billions into AI infrastructure and development, signaling a strategic shift from hype to execution. This massive influx of investment is expected to catalyze innovation and sustainable growth, creating profound ripple effects throughout the economy.

Simultaneously, the widespread expectation of Federal Reserve interest rate cuts—with a high probability of a 25-basis-point reduction by September 2025 and further easing thereafter—is a critical factor influencing smart money flows. Lower interest rates translate to reduced borrowing costs for businesses, particularly for capital-intensive sectors like technology and AI. This easing makes it more affordable to fund research, development, and expansion, thereby enhancing the present value of future earnings for growth-oriented companies. Historically, such environments have favored sectors that can leverage cheaper capital for rapid scaling and innovation. While a deeper, more aggressive cut could signal underlying economic weakness, the prevailing hope is for a “soft landing” that allows for sustained economic expansion, especially beneficial for technology and AI firms.

Winners Emerge as Capital Seeks Growth and Stability

In this bifurcated market, several sectors are emerging as clear favorites for smart money, benefiting from either the direct tailwinds of AI and rate cuts or acting as defensive havens amidst lingering uncertainties.

US Technology continues its reign as a primary beneficiary. Companies at the forefront of AI development and infrastructure are seeing unprecedented investment. Chipmakers like NVIDIA (NASDAQ: NVDA), which designs graphics processing units (GPUs) essential for AI, are experiencing booming demand. Cloud service providers such as Microsoft (NASDAQ: MSFT) Azure, Amazon (NASDAQ: AMZN) Web Services (AWS), and Alphabet (NASDAQ: GOOGL) Cloud are foundational to AI deployment and scalable computing power, making them central to investor strategies. Lower borrowing costs will further fuel their ability to invest in R&D and expand their global data center footprints, driving renewed growth and innovation. The focus here is on “execution-based plays,” where real-world applications and scalable solutions are driving tangible results.

Healthcare is another sector undergoing a significant transformation through AI. From advanced diagnostics and personalized treatment plans to operational efficiencies and drug discovery, AI is revolutionizing patient care. Reduced borrowing costs enable healthcare institutions and pharmaceutical companies to more readily invest in expensive AI systems, accelerating research, improving patient outcomes, and potentially lowering long-term costs. This makes the sector attractive for investors seeking both growth and defensive characteristics, given the inelastic demand for healthcare services.

Utilities are drawing attention as a defensive play, particularly in an environment where inflation concerns and geopolitical uncertainties persist. These companies offer stable cash flows and are generally less sensitive to interest rate fluctuations, making them a relatively safe haven if the Federal Reserve is slower to cut rates or if economic volatility increases. While not directly tied to AI-driven growth, their consistent dividends and regulated revenue streams provide a crucial ballast for diversified portfolios.

Financials are also strategically leveraging AI to enhance customer service, automate trading algorithms, improve risk management, and ensure regulatory compliance. Anticipated rate cuts provide financial institutions with lower-cost capital to invest further in these AI technologies, especially in an environment where real-time data analysis is critical for generating higher returns and maintaining a competitive edge. The operational efficiencies gained through AI are expected to boost profitability, while a stable economic environment spurred by rate cuts could also improve lending volumes.

Beyond these established sectors, Small-Cap Stocks are poised for a potential comeback. These companies, often more reliant on borrowing for growth, are particularly sensitive to interest rate changes. Lower rates translate directly to reduced financing costs, which can significantly improve their profitability and growth prospects. After years of underperformance relative to their larger brethren, a sustained period of rate cuts could unlock substantial upside potential for the Russell 2000 and similar small-cap indices, as their growth narratives become more compelling with cheaper capital.

Industry Impact and Broader Implications

The convergence of AI and anticipated rate cuts is not merely an isolated event but a powerful catalyst reshaping broader industry trends. The pervasive nature of AI means its ripple effects will extend far beyond the technology sector, driving efficiency and innovation across manufacturing, logistics, and even agriculture. Companies that successfully integrate AI into their operations are likely to gain a significant competitive advantage, potentially leading to market share shifts and industry consolidation. For instance, manufacturers adopting AI-powered automation will see optimized processes and reduced waste, while lower interest rates encourage further investment in these advanced technologies.

Regulatory bodies are also keenly observing these developments. As AI becomes more integral to critical infrastructure and decision-making, discussions around data privacy, algorithmic bias, and ethical AI deployment will intensify. Potential policy implications could range from stricter data governance laws to increased oversight of AI-driven financial models, which could introduce new compliance costs for companies. Historically, periods of rapid technological advancement coupled with monetary policy shifts have often led to significant re-evaluations of market leaders and the emergence of entirely new business models, akin to the dot-com boom but with a more fundamental and pervasive technological underpinning.

What Comes Next

Looking ahead, the short-term market trajectory will likely remain influenced by the precise timing and magnitude of the Federal Reserve’s rate cuts, as well as inflation data. Any deviation from the anticipated easing schedule could introduce volatility, particularly for rate-sensitive growth stocks. However, the long-term possibilities are robust, driven by the continued maturation and widespread adoption of AI. Strategic pivots will be crucial for companies across all sectors to adapt to the AI-driven paradigm. This involves not just investing in AI tools but fundamentally reimagining business processes, workforce training, and competitive strategies.

Market opportunities will emerge in areas where AI can address complex problems, from sustainable energy solutions to personalized medicine. Challenges, however, will include managing the immense capital expenditure required for AI infrastructure, navigating ethical considerations, and mitigating the risk of technological disruption for incumbents. Potential scenarios range from a “Goldilocks” soft landing with sustained AI-fueled growth to a more volatile path if inflation proves stickier or rate cuts are delayed, potentially leading to a renewed focus on defensive assets. Investors should closely monitor the earnings reports of key AI players and the Federal Reserve’s communications.

Conclusion

The current financial landscape is a testament to the powerful interplay between technological innovation and monetary policy. Smart money is strategically positioning itself, recognizing AI as a long-term transformative force, amplified by the anticipated easing of monetary policy through Federal Reserve interest rate cuts. Key sectors like US technology, healthcare, utilities, and financials are attracting significant capital, each for distinct reasons ranging from direct AI leverage to defensive stability and rate sensitivity. The potential for small-cap stocks to outperform their larger counterparts underpins an intriguing dimension of this market shift.

For investors, the coming months will demand a watchful eye on inflation trends, the Federal Reserve’s interest rate decisions, and the continued progress of AI development and adoption. The market moving forward will likely reward companies that demonstrate clear strategies for integrating AI, coupled with robust fundamentals. Ultimately, the lasting impact of this period will be defined by how effectively industries harness AI’s potential while navigating the evolving economic currents shaped by central bank policy, setting the stage for a new era of growth and innovation.

Tools & Platforms

State Superintendent champions AI in schools to prepare students for a tech-driven future

OKLAHOMA CITY, OKLA (KOKH) — Artificial Intelligence (AI) programs have been implemented in Oklahoma classrooms.

State Superintendent Ryan Walters said Oklahoma was one of the first states in the nation to integrate AI learning and training programs in schools.

AI is being used in four ways:

- Human-centered approach: AI augments, never replaces, instruction

- Equity and access: All students benefit, regardless of zip code or economic status

- Transparency: Clear communication with parents, teachers, and students

- Safety first: Strong protections for student data and well-being

The goal is to bring cutting-edge technology to schools and provide districts with a framework for safety, transparency, and academic integrity.

“This is about preparing Oklahoma students for the world they’re stepping into,” Walters added. “President Trump has made his directives clear: education must reflect the rapidly changing world, starting with AI. We’re making sure the next generation of Oklahomans doesn’t get left behind.”

For more local news delivered straight to your inbox, sign up for our daily newsletter by clicking here.

Tools & Platforms

Your browser is not supported

usatoday.com wants to ensure the best experience for all of our readers, so we built our site to take advantage of the latest technology, making it faster and easier to use.

Unfortunately, your browser is not supported. Please download one of these browsers for the best experience on usatoday.com

-

Business6 days ago

Business6 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics