Tools & Platforms

Government Support Drives Confidence in China’s AI and Computing Sector

TLDRs;

- China’s AI and computing sector sees renewed confidence from government policy support and local chip innovations.

- DeepSeek’s V3.1 AI model boosts domestic AI adoption, powering growth in chips, servers, and solutions.

- Beijing targets 70% adoption of intelligent devices and AI agents in research, industry, and consumer markets by 2027.

- Local AI hardware firms, including Cambricon and Thunder Software, report strong revenue and stock gains.

China’s tech industry has warmly welcomed the government’s latest artificial intelligence strategy, which aims to expand the use of AI across research, industry, and consumer sectors.

Market analysts believe this initiative will significantly strengthen the confidence of local chip manufacturers, server suppliers, and AI solution providers, signaling a robust growth phase for the domestic AI ecosystem.

The strategy includes ambitious targets, such as achieving a 70% adoption rate of intelligent devices and AI agents by 2027. Analysts say that this level of policy support is expected to accelerate AI deployment across multiple sectors, reinforcing China’s position as a leading player in the global AI market.

DeepSeek Model Fuels Momentum

A major catalyst behind the industry’s optimism is the launch of DeepSeek’s V3.1 AI model, which has been specifically designed to operate efficiently with domestic hardware.

The model is credited with amplifying confidence in local computing capabilities, driving adoption among enterprises, research institutions, and consumer-facing applications.

Kaiyuan Securities highlighted in a recent research note that “China’s AI ecosystem will prosper faster with both policy and technological advancements,” emphasizing the synergy between government guidance and local innovation.

Domestic Hardware Sees Strong Gains

Local semiconductor and AI hardware companies are already benefiting from this strategic push. Chinese GPU maker Cambricon Technologies, for instance, saw its stock climb 3.2% after reporting a remarkable 4,348% revenue surge in the first half of the year.

Thunder Software Technology gained 11.7%, while Zhongji Innolight rose 3.5%. In Hong Kong, SenseTime Group increased 8.9% and 4Paradigm shares rose 5.8%.

Ping An Securities analysts note that industries supporting computing infrastructure are “poised to benefit significantly,” with semiconductor manufacturers expected to see the most pronounced growth as the core enabler of AI technology.

Confidence Spurs Sector Expansion

With the government’s AI plan in place, China’s technology sector is witnessing renewed investor confidence. Analysts point out that combining strategic policy backing with advances like DeepSeek V3.1 will accelerate the growth of domestic AI solutions, server infrastructure, and chips.

The policy’s dual focus on research and industrial adoption aims to stimulate innovation while ensuring that local companies capture a significant share of the AI market. By 2027, China hopes to have at least 70% of enterprises and consumers integrating AI-enabled devices and agents, creating a comprehensive ecosystem driven by domestic technology.

Industry observers see this as a critical period for China’s AI landscape, where policy, innovation, and market dynamics converge to shape the future of computing and artificial intelligence.

Tools & Platforms

AI’s New Cloud King: Oracle’s Rally Could Rewrite ETF Playbooks – ARK Next Generation Internet ETF (BATS:ARKW), Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ)

Oracle Corp’s ORCL shares soared over 40% on Wednesday, a day after posting its earnings powered by booming demand for AI infrastructure, pushing CEO Larry Ellison ahead of Tesla Inc TSLA scion Elon Musk as the world’s wealthiest individual.

Beyond the headline wealth change, the move has considerable implications for ETFs, showing how AI infrastructure is becoming more integral to broad-market and thematic funds alike.

Oracle’s profits highlighted the company as a prime supplier of data center space and cloud computing for AI use. With an eye-popping $455 billion AI services backlog and multi-billion-dollar contracts such as providing OpenAI with 4.5 gigawatts of energy to power ChatGPT, Oracle made it clear to the world that it is more than a software behemoth now.

Impact On ETFs

For holders of broad-market ETFs, Oracle’s rise comes with an immediate impact on portfolio weightings. Sector-specific ETFs like Technology Select Sector SPDR XLK and Vanguard Information Technology ETF VGT stand to gain, as Oracle moves higher in the ranks of the most heavily weighted tech names. Both funds are up around 1.5% on Wednesday.

Thematic ETFs on AI, cloud, and next-generation technologies are also being rewired. If Oracle crosses $1 trillion in valuation, it joins a very exclusive group. That milestone might spark reappraisals by active managers and ETF issuers alike, potentially creating new “AI infrastructure” baskets or raising its inclusion in existing thematic funds.

Others like Global X Cloud Computing ETF CLOU, WisdomTree Artificial Intelligence & Innovation Fund WTAI, and ARK Next Generation Internet ETF ARKW might have to change exposure to reflect Oracle’s new leadership in AI infrastructure.

The ripple effects even extend to ETFs with broader innovation themes. For example, both iShares Exponential Technologies ETF XT or Global X Artificial Intelligence & Technology ETF AIQ track companies positioned to benefit from AI adoption.

Oracle’s repositioning as a critical AI infrastructure player makes it harder for ETF managers to overlook.

The Bigger Picture For ETF Investors

Investors seeking to capitalize on the AI boom have several options for gaining diversified exposure to the companies driving this growth, rather than betting on individual stocks.

This episode shows a larger trend: AI-fueled growth is no longer the exclusive domain of mainstream software or chip stocks. ETFs are keeping pace with the industry, providing investors with vehicles to harness both broad-market tech appreciation and thematic exposures in AI, cloud, and enterprise infrastructure.

Oracle’s explosive growth shows how the fortunes of a single company can cascade through dozens of ETFs, affecting flows, weightings, and sector performance.

Read Next:

Image: Shutterstock

Tools & Platforms

Sevierville to use new AI pavement management technology for street maintenance

SEVIERVILLE, Tenn. (WVLT) – Sevierville will begin using new pavement technology for its pavement and infrastructure.

The city said the new technology will provide vibration and camera data and will be able to automatically report street and driving conditions to the city.

“The comprehensive data helps tailor future paving plans to ensure the most efficient use of funds, and custom work orders can be readily created based on the condition data, making pavement preservation and repair more manageable and ensuring the most efficient use of tax dollars,” said the City of Sevierville in a press release.

The city said this will allow them to assess the conditions of their current roadways and be able to use AI technology to make suggestions for how to best treat the pavement.

The new technology will come from Roadway Management Technologies (RMT) a company offering performance tracking solutions.

Copyright 2025 WVLT. All rights reserved.

Tools & Platforms

Is The Tech Market Going Nuts? – JOSH BERSIN

Today we learned that OpenAI just signed a five-year deal with Oracle to spend $300 Billion on data centers (this is five-times Oracle’s annual revenues today), more or less doubling Oracle’s annualized revenue in one transaction. Oracle’s stock went up about 35% or more.

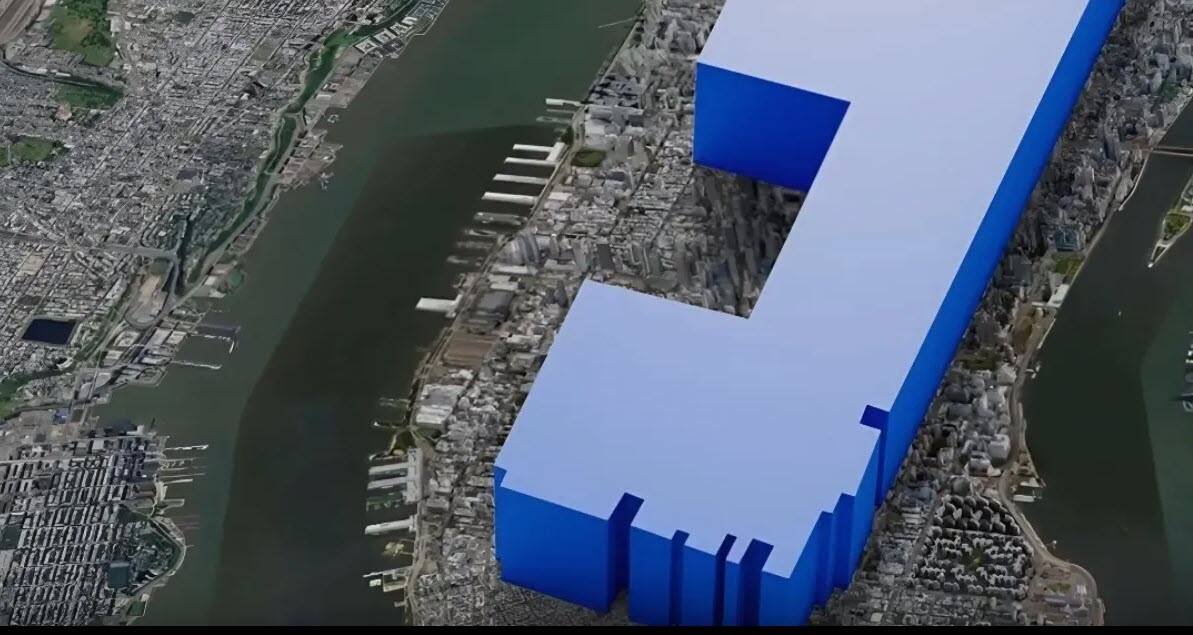

This $300 billion deal can now be added to more than $450 billion cited by Meta, Amazon, Microsoft, and Google to total almost $750 billion allocated this year toward AI infrastructure alone. If you add the cost of engineering talent and energy to be built, it’s probably more like $800 billion. (Meta’s new Louisiana data center is the size of Manhattan.)

If you consider that US GDP is around $30.3 trillion (expected to grow at 1.7% per year), this means that almost 2.5-3% of our entire US GDP has been allocated to AI infrastructure this year.

I’m not sure if we’ve ever committed so much capital to one activity in one year since the Apollo Space Program in 1964. Even the Manhattan Project, which developed the Atomic Bomb to end World War 2, was only about .4% of GDP.

I’m not saying this is too much money, since these are private companies committing funds from their shareholders. But the bet these companies are taking is that somehow, over the coming decades, some multiple of 2.5% of GDP is going to come back as revenue to providers around the business of AI.

This next week is the big HR Technology Conference in Vegas, and I”m going to be keynoting on Thursday to give you an overview of the space. It’s quite astounding how quickly we went from “What is AI?” to “Let’s implement AI as fast as we can” in virtually every company I talk with.

Just a few of the things going on to talk about next week.

- Workday announced the acquisition of Paradox, cementing their move into high-volume recruiting. This complements the company’s acquisition of Hiredscore, and further increases Workday’s AI bench of talent. At the same time the class-action lawsuit (Mobley vs. Workday) is moving ahead, threatening the company with some kind of major settlement for AI-induced age discrimination in hiring.

- ServiceNow, the most “AI centric” of the big vendors, announced its Zurich release, which includes new dev tools for IT departments (and users), more features for data management and security, and Agentic Playbooks to help companies understand how to build human to AI workflows.

- WorkHuman, the billion dollar employee recognition company, introduced its Human Intelligence system, which gives companies highly reliable skills and capability inferences across the workforce, based on peer to peer recognition and feedback,

- Eightfold introduced its end-to-end toolset for high-volume recruiting, including an AI-interviewer (infinite scale for high volume job openings), Candidate Concierge (candidate chat), and new workflows for its talent intelligence and applicant tracking system,

- SAP SuccessFactors announced the acquisition of SmartRecruiters, and you can expect to see more about SAP and our Galileo at SAP Connect in October,

- UKG has announced and is now delivering a wide array of AI agents for its massive customer base of front-line worker companies. These agents help with shift scheduling, real-time pay, payroll reconciliation, shift sharing, and all sorts of important but complex scheduling issues faced by the 70% of workers who work in retail, hospitality, healthcare, transportation, entertainment, and other front-line positions.

- OpenAI announced its Jobs platform and strategy to develop and certify AI skills.

- Many dozens of new companies have been announcing new agentic features including Microsoft, Arist, Cornerstone, ADP, Lightcast, Draup, SHL, Techwolf, Visier, Beamery, Gloat, Reejig, Deel, HiBob, and many others.

- We will be announcing a major new set of features in Galileo, and also highlighting that we have more than 600 companies now using our intelligent Agent for HR.

Where is all this going?

As you’ll hear about next week, Agentic AI in HR is here now, and this means our HR organizations are going to get smarter, more integrated, and probably smaller. The tradition ratio of 100:1 employee to HR ratio could go up to 150-200 over the next few years, and that means HR professionals will become Superworkers, with even more opportunity to add value.

The big HCM vendors (SAP, Workday, Oracle, ADP, Dayforce, UKG) are all heavily investing in AI now, and they’ve hired and developed strong AI teams internally. Each is focused in different areas, so most of you will start to see many AI options from your core providers. In the complex areas like talent acquisition, L&D, and employee experience.

Several things I hope to share next week. First, I’ll try to give you an overall sense of how to manage this proliferation of new tools, and share what we’ve learned about AI transformation process and governance. Second, I’ll share what we’ve been learning about in job redesign and task analysis, an important enterprise discipline in large AI transformations. And third, I’ll be showing you more about the culture and leadership changes we can expect that will help our companies transform more effectively.

I’d say there’s a lot of fast-moving activity taking place (witness Salesforce’s layoff of 4,000 people last week), but for many of you this is a new career in rethinking jobs, organization structure, and skills development as we all move to become what we call Superworker companies.

There will be many announcements and I’ll cover as many as I can, but just strap yourself in. When the technology industry invests almost 3% of US GDP in AI, we are all going to be flooded with tools, systems, and new toys to play with.

Additional Information

Galileo Learn™ – Get Ahead. Stay Ahead. A Revolutionary Approach To Corporate Learning

Can AI Beat Human Intuition For Complex Decision-Making? I Think Not.

The Road To AI-Driven Productivity: Four Stages of Transformation

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi