Ethics & Policy

Financial Market Applications of LLMs

The AI revolution drove frenzied investment in both private and public companies and captured the public’s imagination in 2023. Transformational consumer products like ChatGPT are powered by Large Language Models (LLMs) that excel at modeling sequences of tokens that represent words or parts of words [2]. Amazingly, structural understanding emerges from learning next-token prediction, and agents are able to complete tasks such as translation, question answering and generating human-like prose from simple user prompts.

Not surprisingly, quantitative traders have asked: can we turn these models into the next price or trade prediction [1,9,10]? That is, rather than modeling sequences of words, can we model sequences of prices or trades. This turns out to be an interesting line of inquiry that reveals much about both generative AI and financial time series modeling. Be warned this will get wonky.

LLMs are known as autoregressive learners — those using previous tokens or elements in a sequence to predict the next element or token. In quantitative trading, for example in strategies like statistical arbitrage in stocks, most research is concerned with identifying autoregressive structure. That means finding sequences of news or orders or fundamental changes that best predict future prices.

Where things break down is in the quantity and information content of available data to train the models. At the 2023 NeurIPS conference, Hudson River Trading, a high frequency trading firm, presented a comparison of the number of input tokens used to train GPT-3 with the amount of trainable tokens available in the stock market data per year HRT estimated that, with 3,000 tradable stocks, 10 data points per stock per day, 252 trading days per year, and 23400 seconds in a trading day, there are 177 billion stock market tokens per year available as market data. GPT-3 was trained on 500 billion tokens, so not far off [6].

But, in the trading context the tokens will be prices or returns or trades rather than syllables or words; the former is much more difficult to predict. Language has an underlying linguistic structure (e.g., grammar) [7]. It’s not hard to imagine a human predicting the next word in a sentence, however that same human would find it extremely challenging to predict the next return given a sequence of previous trades, hence the lack of billionaire day traders. The challenge is that there are very smart people competing away any signal in the market, making it almost efficient (“efficiently inefficient”, in the words of economist Lasse Pedersen) and hence unpredictable. No adversary actively tries to make sentences more difficult to predict — if anything, authors usually seek to make their sentences easy to understand and hence more predictable.

Looked at from another angle, there is much more noise than signal in financial data. Individuals and institutions are trading for reasons that might not be rational or tied to any fundamental change in a business. The GameStop episode in 2021 is one such example. Financial time series are also constantly changing with new fundamental information, regulatory changes, and occasional large macroeconomic shifts such as currency devaluations. Language evolves at a much slower pace and over longer time horizons.

On the other hand, there are reasons to believe that ideas from AI will work well in financial markets. One emerging area of AI research with promising applications to finance is multimodal learning [5], which aims to use different modalities of data, for example both images and textual inputs to build a unified model. With OpenAI’s DALL-E 2 model, a user can enter text and the model will generate an image. In finance, multi-modal efforts could be useful to combine information classical sources such as technical time series data (prices, trades, volumes, etc.) with alternative data in different modes like sentiment or graphical interactions on twitter, natural language news articles and corporate reports, or the satellite images of shipping activity in a commodity centric port. Here, leveraging multi-modal AI, one could potentially incorporate all these types of non-price information to predict well.

Another strategy called ‘residualization’ holds prominence in both finance and AI, though it assumes different roles in the two domains. In finance, structural `factor’ models break down the contemporaneous observations of returns across different assets into a shared component (the market return, or more generally returns of common, market-wide factors) and an idiosyncratic component unique to each underlying asset. Market and factor returns are difficult to predict and create interdependence, so it is often helpful to remove the common element when making predictions at the individual asset level and to maximize the number of independent observations in the data.

In residual network architectures such as transformers, there’s a similar idea that we want to learn a function h(X) of an input X, but it might be easier to learn the residual of h(X) to the identity map, i.e., h(X) – X. Here, if the function h(X) is close to identity, its residual will be close to zero, and hence there will be less to learn and learning can be done more efficiently. In both cases the goal is to exploit structure to refine predictions: in the finance case, the idea is to focus on predicting innovations beyond what is implied by the overall market, for residual networks the focus is on predicting innovations to the identity map.

A key ingredient for the impressive performance of LLMs work is their ability to discern affinities or strengths between tokens over long horizons known as context windows. In financial markets, the ability to focus attention across long horizons enables analysis of multi-scale phenomena, with some aspects of market changes explained across very different time horizons. For example, at one extreme, fundamental information (e.g., earnings) may be incorporated into prices over months, technical phenomena (e.g., momentum) might be realized over days, and, at the other extreme, microstructure phenomena (e.g., order book imbalance) might have a time horizon of seconds to minutes.

Capturing all of these phenomena involves analysis of multiple time horizons across the context window. However, in finance, prediction over multiple future time horizons is also important. For example, a quantitative system may seek to trade to profit from multiple different anomalies that are realized over multiple time horizons (e.g., simultaneously betting on a microstructure event and an earnings event). This requires predicting not just the next period return of the stock, but the entire term structure or trajectory of expected returns, while current transformer-style predictive models only look one period in the future.

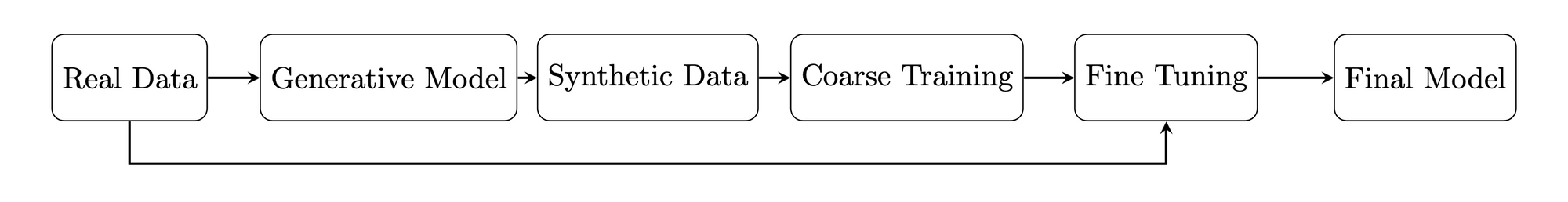

Another financial market application of LLMs might be synthetic data creation [4,8]. This could take a few directions. Simulated stock price trajectories can be generated that mimic characteristics observed in the market and can be extremely beneficial given that financial market data is scarce relative to other sources as highlighted above in the number of tokens available. Artificial data could open the door for meta-learning techniques which have successfully been applied, for example, in robotics. In the robotic setting controllers are first trained using cheap but not necessarily accurate physics simulators, before being better calibrated using expensive real world experiments with robots. In finance the simulators could be used to coarsely train and optimize trading strategies. The model would learn high level concepts like risk aversion and diversification and tactical concepts such as trading slowly to minimize the price impact of a trade. Then precious real market data could be employed to fine-tune the predictions and determine precisely the optimal speed to trade.

Financial market practitioners are often interested in extreme events, the times when trading strategies are more likely to experience significant gains or losses. Generative models where it’s possible to sample from extreme scenarios could find use. However extreme events by definition occur rarely and hence determining the right parameters and sampling data from the corresponding distribution is fraught.

Despite the skepticism that LLMs will find use in quantitative trading, they might boost fundamental analysis. As AI models improve, it’s easy to imagine them helping analysts refine an investment thesis, uncover inconsistencies in management commentary or find latent relationships between tangential industries and businesses [3]. Essentially these models could provide a Charlie Munger for every investor.

The surprising thing about the current generative AI revolution is that it’s taken almost everyone – academic researchers, cutting edge technology firms and long-time observers – by surprise. The idea that building bigger and bigger models would lead to emergent capabilities like we see today was totally unexpected and still not fully understood.

The success of these AI models has supercharged the flow of human and financial capital into AI, which should in turn lead to even better and more capable models. So while the case for GPT-4 like models taking over quantitative trading is currently unlikely, we advocate keeping an open mind. Expecting the unexpected has been a profitable theme in the AI business.

References

- “Applying Deep Neural Networks to Financial Time Series Forecasting” Allison Koenecke. 2022

- “Attention is all you need.” A Vaswani, N Shazeer, N Parmar, J Uszkoreit, L Jones… Advances in Neural Information Processing Systems, 2017

- “Can ChatGPT Forecast Stock Price Movements? Return Predictability and Large Language Models” . Lopez-Lira, Alejandro and Tang, Yuehua, (April 6, 2023) Available at SSRN

- “Generating Synthetic Data in Finance: Opportunities, Challenges and Pitfalls.” SA Assefa, D Dervovic, M Mahfouz, RE Tillman… – Proceedings of the First ACM International Conference …, 2020

- “GPT-4V(ision) System Card.” OpenAI. September 2023

- “Language models are few-shot learners.” T Brown, B Mann, N Ryder, M Subbiah, JD Kaplan… – Advances in Neural Information Processing Systems, 2020

- “Sequence to Sequence Learning with Neural Networks.” I.Sutskever,O.Vinyals,and Q.V.Le in Advances in Neural Information Processing Systems, 2014, pp. 3104–3112.

- “Synthetic Data Generation for Economists”. A Koenecke, H Varian – arXiv preprint arXiv:2011.01374, 2020

- C. C. Moallemi, M. Wang. A reinforcement learning approach to optimal execution. Quantitative Finance, 22(6):1051–1069, March 2022.

- C. Maglaras, C. C. Moallemi, M. Wang. A deep learning approach to estimating fill probabilities in a limit order book. Quantitative Finance, 22(11):1989–2003, October 2022.

Citation

For attribution in academic contexts or books, please cite this work as

Richard Dewey and Ciamac Moallemi, "Financial Market Applications of LLMs," The Gradient, 2024@article{dewey2024financial,

author = {Richard Dewey and Ciamac Moallemi},

title = {Financial Market Applications of LLMs},

journal = {The Gradient},

year = {2024},

howpublished = {\url{https://thegradient.pub/financial-market-applications-of-llms},

}Ethics & Policy

7 Life-Changing Books Recommended by Catriona Wallace | Books

7 Life-Changing Books Recommended by Catriona Wallace (Picture Credit – Instagram)

Some books ignite something immediate. Others change you quietly, over time. For Dr Catriona Wallace—tech entrepreneur, AI ethics advocate, and one of Australia’s most influential business leaders, books are more than just ideas on paper. They are frameworks, provocations, and spiritual companions. Her reading list offers not just guidance for navigating leadership and technology, but for embracing identity, power, and inner purpose. These seven titles reflect a mind shaped by disruption, ethics, feminism, and wisdom. They are not trend-driven. They are transformational.

1. Lean In by Sheryl Sandberg

A landmark in feminist career literature, Lean In challenges women to pursue their ambitions while confronting the structural and cultural forces that hold them back. Sandberg uses her own journey at Facebook and Google to dissect gender inequality in leadership. The book is part memoir, part manifesto, and remains divisive for valid reasons. But Wallace cites it as essential for starting difficult conversations about workplace dynamics and ambition. It asks, simply: what would you do if you weren’t afraid?

2. Women and Power: A Manifesto by Mary Beard

In this sharp, incisive book, classicist Mary Beard examines the historical exclusion of women from power and public voice. From Medusa to misogynistic memes, Beard exposes how narratives built around silence and suppression persist today. The writing is fiery, brief, and packed with centuries of insight. Wallace recommends it for its ability to distil complex ideas into cultural clarity. It’s a reminder that power is not just a seat at the table; it is a script we are still rewriting.

3. The World of Numbers by Adam Spencer

A celebration of mathematics as storytelling, this book blends fun facts, puzzles, and history to reveal how numbers shape everything from music to human behaviour. Spencer, a comedian and maths lover, makes the subject inviting rather than intimidating. Wallace credits this book with sparking new curiosity about logic, data, and systems thinking. It’s not just for mathematicians. It’s for anyone ready to appreciate the beauty of patterns and the thinking habits that come with them.

4. Small Giants by Bo Burlingham

This book is a love letter to companies that chose to be great instead of big. Burlingham profiles fourteen businesses that opted for soul, purpose, and community over rapid growth. For Wallace, who has founded multiple mission-driven companies, this book affirms that success is not about scale. It is about integrity. Each story is a blueprint for building something meaningful, resilient, and values-aligned. It is a must-read for anyone tired of hustle culture and hungry for depth.

5. The Misogynist Factory by Alison Phipps

A searing academic work on the production of misogyny in modern institutions. Phipps connects the dots between sexual violence, neoliberalism, and resistance movements in a way that is as rigorous as it is radical. Wallace recommends this book for its clear-eyed confrontation of how systemic inequality persists beneath performative gestures. It equips readers with language to understand how power moves, morphs, and resists change. This is not light reading. It is a necessary reading for anyone seeking to challenge structural harm.

6. Tribes by Seth Godin

Godin’s central idea is simple but powerful: people don’t follow brands, they follow leaders who connect with them emotionally and intellectually. This book blends marketing, leadership, and human psychology to show how movements begin. Wallace highlights ‘Tribes’ as essential reading for purpose-driven founders and changemakers. It reminds readers that real influence is built on trust and shared values. Whether you’re leading a company or a cause, it’s a call to speak boldly and build your own tribe.

7. The Tibetan Book of Living and Dying by Sogyal Rinpoche

Equal parts spiritual guide and philosophical reflection, this book weaves Tibetan Buddhist teachings with Western perspectives on mortality, grief, and rebirth. Wallace turns to it not only for personal growth but also for grounding ethical decision-making in a deeper sense of purpose. It’s a book that speaks to those navigating endings—personal, spiritual, or professional and offers a path toward clarity and compassion. It does not offer answers. It offers presence, which is often far more powerful.

The books that shape us are often those that disrupt us first. Catriona Wallace’s list is not filled with comfort reads. It’s made of hard questions, structural truths, and radical shifts in thinking. From feminist manifestos to Buddhist reflections, from purpose-led business to systemic critique, this bookshelf is a mirror of her own leadership—decisive, curious, and grounded in values. If you’re building something bold or seeking language for change, there’s a good chance one of these books will meet you where you are and carry you further than you expected.

Ethics & Policy

Hyderabad: Dr. Pritam Singh Foundation hosts AI and ethics round table at Tech Mahindra

The Dr. Pritam Singh Foundation and IILM University hosted a Round Table on “Human at Core: AI, Ethics, and the Future” in Hyderabad. Leaders and academics discussed leveraging AI for inclusive growth while maintaining ethics, inclusivity, and human-centric technology.

Published Date – 30 August 2025, 12:57 PM

Hyderabad: The Dr. Pritam Singh Foundation, in collaboration with IILM University, hosted a high-level Round Table Discussion on “Human at Core: AI, Ethics, and the Future” at Tech Mahindra, Cyberabad.

The event, held in memory of the late Dr. Pritam Singh, pioneering academic, visionary leader, and architect of transformative management education in India, brought together policymakers, business leaders, and academics to explore how India can harness artificial intelligence (AI) while safeguarding ethics, inclusivity, and human values.

In his keynote address, Padmanabhaiah Kantipudi, IAS (Retd.), Chairman of the Administrative Staff College of India (ASCI),

paid tribute to Dr. Pritam Singh, describing him as a nation-builder who bridged academia, business, and governance.

The Round Table theme, Leadership: AI, Ethics, and the Future, underscored India’s opportunity to leverage AI for inclusive growth across healthcare, agriculture, education, and fintech—while ensuring technology remains human-centric and trustworthy.

Ethics & Policy

AI ethics: Bridging the gap between public concern and global pursuit – Pennsylvania

(The Center Square) – Those who grew up in the 20th and 21st centuries have spent their lives in an environment saturated with cautionary tales about technology and human error, projections of ancient flood myths onto modern scenarios in which the hubris of our species brings our downfall.

They feature a point of no return, dubbed the “singularity” by Manhattan Project physicist John von Neumann, who suggested that technology would advance to a stage after which life as we know it would become unrecognizable.

Some say with the advent of artificial intelligence, that moment has come. And with it, a massive gap between public perception and the goals of both government and private industry. While states court data center development and tech investments, polling from Pew Research indicates Americans outside the industry have strong misgivings about AI.

In Pennsylvania, giants like Amazon and Microsoft have pledged to spend billions building the high-powered infrastructure required to enable the technology. Fostering this progress is a rare point of agreement between the state’s Democratic and Republican leadership, even bringing Gov. Josh Shapiro to the same event – if not the same stage – as President Donald Trump.

Pittsburgh is rebranding itself as the “global capital of physical AI,” leveraging its blue-collar manufacturing reputation and its prestigious academic research institutions to depict the perfect marriage of code and machine. Three Mile Island is rebranding itself as Crane Clean Energy Center, coming back online exclusively to power Microsoft AI services. Some legislators are eager to turn the lights back on fossil fuel-burning plants and even build new ones to generate the energy required to feed both AI and the everyday consumers already on the grid.

– Advertisement –

At the federal level, Trump has revoked guardrails established under the Biden administration with an executive order entitled “Removing Barriers to American Leadership in Artificial Intelligence.” In July, the White House released its “AI Action Plan.”

The document reads, “We need to build and maintain vast AI infrastructure and the energy to power it. To do that, we will continue to reject radical climate dogma and bureaucratic red tape, as the Administration has done since Inauguration Day. Simply put, we need to ‘Build, Baby, Build!’”

To borrow an analogy from Shapiro’s favorite sport, it’s a full-court press, and there’s hardly a day that goes by that messaging from the state doesn’t tout the thrilling promise of the new AI era. Next week, Shapiro will be returning to Pittsburgh along with a wide array of luminaries to attend the AI Horizons summit in Bakery Square, a hub for established and developing tech companies.

According to leaders like Trump and Shapiro, the stakes could not be higher. It isn’t just a race for technological prowess — it’s an existential fight against China for control of the future itself. AI sits at the heart of innovation in fields like biotechnology, which promise to eradicate disease, address climate collapse, and revolutionize agriculture. It also sits at the heart of defense, an industry that thrives in Pennsylvania.

Yet, one area of overlap in which both everyday citizens and AI experts agree is that they want to see more government control and regulation of the technology. Already seeing the impacts of political deepfakes, algorithmic bias, and rogue chatbots, AI has far outpaced legislation, often to disastrous effect.

In an interview with The Center Square, Penn researcher Dr. Michael Kearns said that he’s less worried about autonomous machines becoming all-powerful than the challenges already posed by AI.

– Advertisement –

Kearns spends his time creating mathematical models and writing about how to embed ethical human principles into machine code. He believes that in some areas like chatbots, progress may have reached a point where improvements appear incremental for the average user. He cites the most recent ChatGPT update as evidence.

“I think the harms that are already being demonstrated are much more worrisome,” said Kearns. “Demographic bias, chatbots hurling racist invectives because they were trained on racist material, privacy leaks.”

Kearns says that a major barrier to getting effective regulatory policy is incentivizing experts to leave behind engaging work in the field as researchers and lucrative roles in tech in order to work on policy. Without people who understand how the algorithms operate, it’s difficult to create “auditable” regulations, meaning there are clear tests to pass.

Kearns pointed to ISO 420001. This is an international standard that focuses on process rather than outcome to guide developers in creating ethical AI. He also noted that the market itself is a strong guide. When someone gets hurt or hurts someone else using AI, it’s bad for business, incentivizing companies to do their due diligence.

He also noted crossroads where two ethical issues intersect. For instance, companies are entrusted with their users’ personal data. If policing misuse of the product requires an invasion of privacy, like accessing information stored on the cloud, there’s only so much that can be done.

OpenAI recently announced that it is scanning user conversations for concerning statements and escalating them to human teams, who may contact authorities when deemed appropriate. For some, the idea of alerting the police to someone suffering from mental illness is a dangerous breech. Still, it demonstrates the calculated risks AI companies have to make when faced with reports of suicide, psychosis, and violence arising out of conversations with chatbots.

Kearns says that even with the imperative for self-regulation on AI companies, he expects there to be more stumbling blocks before real improvement is seen in the absence of regulation. He cites watchdogs like the investigative journalists at ProPublica who demonstrated machine bias against Black people in programs used to inform criminal sentencing in 2016.

Kearns noted that the “headline risk” is not the same as enforceable regulation and mainly applies to well-established companies. For the most part, a company with a household name has an investment in maintaining a positive reputation. For others just getting started or flying under the radar, however, public pressure can’t replace law.

One area of AI concern that has been widely explored in the media is the use of AI by those who make and enforce the law. Kearns said, for his part, he’s found “three-letter agencies” to be “among the most conservative of AI adopters just because of the stakes involved.

In Pennsylvania, AI is used by the state police force.

In an email to The Center Square, PSP Communications Director Myles Snyder wrote, “The Pennsylvania State Police, like many law enforcement agencies, utilizes various technologies to enhance public safety and support our mission. Some of these tools incorporate AI-driven capabilities. The Pennsylvania State Police carefully evaluates these tools to ensure they align with legal, ethical, and operational considerations.”

PSP was unwilling to discuss the specifics of those technologies.

AI is also used by the U.S. military and other militaries around the world, including those of Israel, Ukraine, and Russia, who are demonstrating a fundamental shift in the way war is conducted through technology.

In Gaza, the Lavender AI system was used to identify and target individuals connected with Hamas, allowing human agents to approve strikes with acceptable numbers of civilian casualties, according to Israeli intelligence officials who spoke to The Guardian on the matter. Analysis of AI use in Ukraine calls for a nuanced understanding of the way the technology is being used and ways in which it should be regulated by international bodies governing warfare in the future.

Then, there are the more ephemeral concerns. Along with the long-looming “jobpocalypse,” many fear that offloading our day-to-day lives into the hands of AI may deplete our sense of meaning. Students using AI may fail to learn. Workers using AI may feel purposeless. Relationships with or grounded in AI may lead to disconnection.

Kearns acknowledged that there would be disruption in the classroom and workplace to navigate but it would also provide opportunities for people who previously may not have been able to gain entrance into challenging fields.

As for outsourcing joy, he asked “If somebody comes along with a robot that can play better tennis than you and you love playing tennis, are you going to stop playing tennis?”

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Business2 days ago

Business2 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies