Funding & Business

Disney (DIS) earnings Q3 2025

Disney reported results for its fiscal third quarter on Wednesday – posting earnings that topped expectations but revenue that came in just shy of analyst projections – as the company’s streaming business grew and its theme parks saw higher spending from consumers.

CFO Hugh Johnston credited the quarter in part to the success of Disney’s streaming unit, anchored by its flagship service, Disney+.

“Just as a reminder, it was only a couple of years ago that we were losing a billion dollars a quarter on that business,” Johnston told CNBC’s “Squawk Box” on Wednesday. “It was trading purely on subs and not on financial results. We now really have a solid foundation.”

The growth in streaming has recently started to help to supplant the losses of the cash cow traditional TV business, which has been bleeding customers for years now.

Disney shares were down 2% in premarketing trading Wednesday.

Here is what Disney reported for the quarter ended June 28 compared with what Wall Street expected, according to LSEG:

- Earnings per share: $1.61 adjusted vs. $1.47 expected

- Revenue: $23.65 billion vs. $23.73 billion expected

Net income for the quarter was $5.26 billion, or $2.92 per share, more than double the $2.62 billion, or $1.43 a share, that the company reported for the same period last year. Adjusting for one-time items, primarily related to tax benefits associated with Disney’s purchase of Comcast’s Hulu stake, Disney reported earnings per share of $1.61.

Disney’s overall revenue rose 2% to $23.65 billion, missing analyst expectations for the first time since May 2024.

The company reported continued growth in its streaming business despite headwinds in the traditional TV bundle, which has suffered from declining customers.

Disney upped its fiscal 2025 guidance on Wednesday and now expects adjusted EPS of $5.85 – an increase of 18% from fiscal 2024. In May, Disney issued guidance for expected full-year adjusted EPS of $5.75.

Streaming, parks, ESPN results

A statue of Walt Disney and Mickey Mouse stands in a garden in front of Cinderella’s Castle at the Magic Kingdom Park at Walt Disney World on April 3, 2025, in Orlando, Florida.

Gary Hershorn | Corbis News | Getty Images

Revenue for Disney’s experiences segment, which includes theme parks, resorts and cruises as well as consumer products, increased 8% to $9.09 billion. Domestic theme parks revenue was up 10% to $6.4 billion, in particular as there was an increase in spending at theme parks and higher volumes in passenger cruise days and resort stays.

Johnston told “Squawk Box” on Wednesday that Walt Disney World had its “biggest” third quarter ever, adding that traffic at the Orlando, Florida, park was solid.

“I know there’s a lot of concern about the consumer in the U.S. right now. We don’t see it. Our consumer is doing very, very well,” he said.

International parks and experiences revenue was up 6% to about $1.7 billion. In May, Disney announced it reached a deal to bring a theme park and resort to Abu Dhabi. The expansion into the United Arab Emirates is not part of the earlier Disney pledge to spend $60 billion on theme parks over the next decade.

Meanwhile, revenue for Disney’s entertainment segment, which includes traditional TV networks, direct-to-consumer streaming and films, was up 1% to $10.7 billion.

While revenue for the direct-to-consumer streaming business rose 6% to $6.18 billion, the entertainment segment as a whole was weighed down by the traditional TV business, which saw revenue dip 15% to $2.27 billion.

The direct-to-consumer streaming business was lifted, however, by the company’s flagship service, Disney+, which added 1.8 million subscribers, bringing its total to nearly 128 million. Total Hulu subscribers grew 1% to 55.5 million.

The atmosphere at the Disney Bundle Celebrating National Streaming Day at The Row in Los Angeles on May 19, 2022.

Presley Ann | Getty Images Entertainment | Getty Images

The company said it expects a modest increase in Disney+ subscribers in its fiscal fourth quarter compared with its fiscal third quarter. Total Disney+ and Hulu subscriptions are expected to increase more than 10 million during the current period.

Disney also raised its operating income expectation for direct-to-consumer streaming to $1.3 billion for fiscal year 2025.

Domestic revenue for ESPN increased 1% to $3.93 billion, while its domestic operating income dropped 7% to $1.01 billion. Those results were impacted by higher programming and production costs, particularly due to NBA and college sports rights.

ESPN on Tuesday announced a deal with the NFL in which the pro football league will take a 10% stake in the company.

And separately on Wednesday, ESPN announced that its forthcoming full-service streaming app will launch on Aug. 21 and that WWE live events are coming to the app and in some cases to the linear ESPN network.

Johnston said he expects the new streaming service to be “accretive to overall earnings growth.”

The traditional TV business once again dragged down the entertainment unit. Total operating income for the linear networks – which includes broadcaster ABC as well as pay TV channels like FX – fell 28% to $697 million, impacted by a decline in advertising revenue due to lower viewership and rates.

A still from Disney and Pixar’s animated film “Elio.”

Disney

Disney’s theatrical unit, comprised of content sales and licensing, suffered from tough comparisons to the year-earlier period, which saw the release of “Inside Out 2.” The Pixar movie was the highest-grossing animated movie ever, surpassing Disney’s “Frozen II.”

The division reported an operating loss of $21 million for the most recent period, compared with operating income of $254 million in the same period last year.

Revenue for the unit was up 7% to $2.26 billion during the quarter, as Disney released “Elio,” “Thunderbolts*” and “Lilo & Stitch.” The original animated film “Elio” set a record low for the Pixar animation studio, notching just $21 million in ticket sales during its first three days in theaters.

– CNBC’s Robert Hum contributed to this report.

Disclosure: Comcast is the parent company of CNBC.

Correction: This story has been updated to correct that Disney raised its operating income expectation for direct-to-consumer streaming to $1.3 billion for fiscal 2025. A previous version misstated the guidance.

Funding & Business

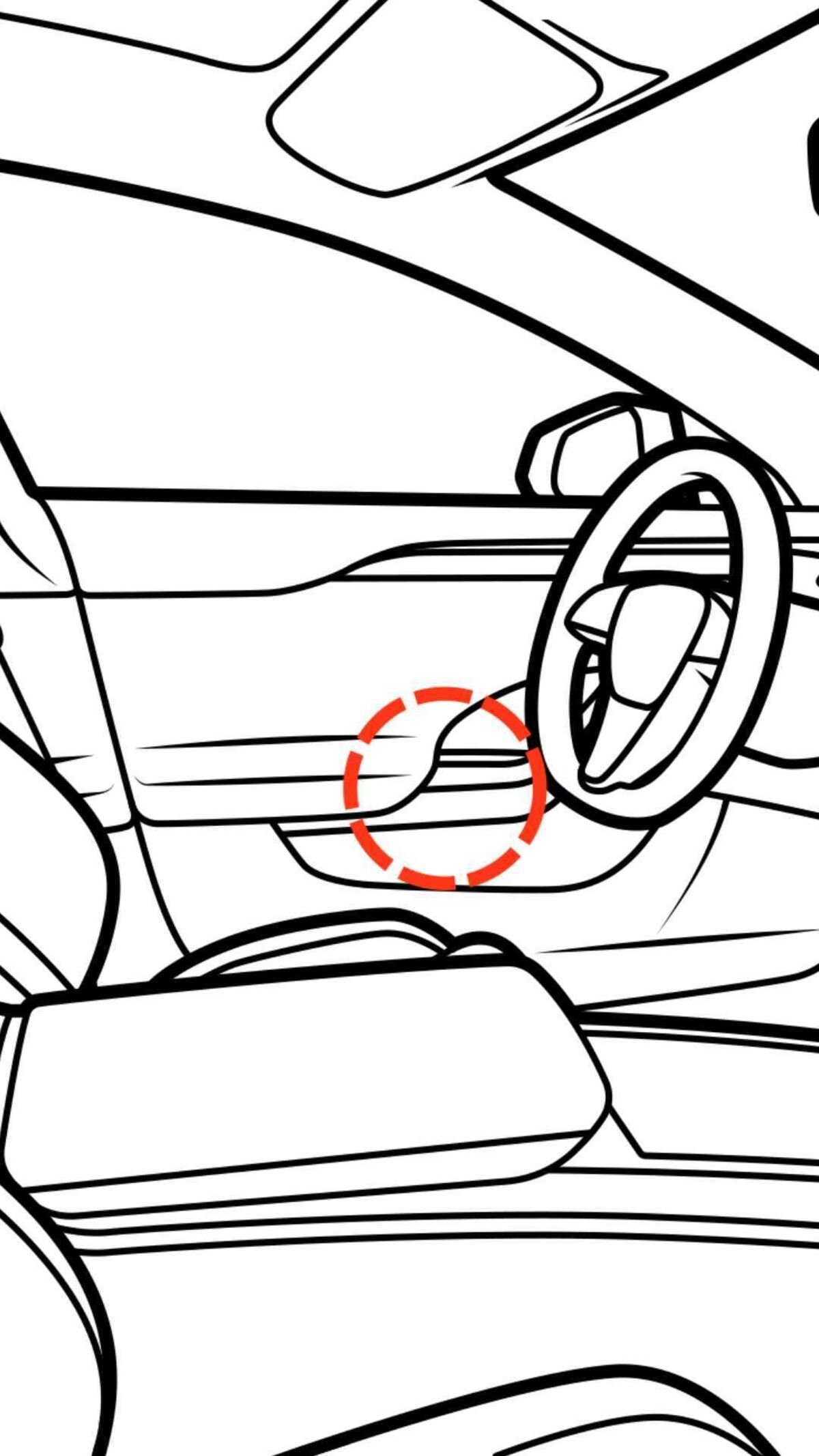

Tesla's Door Design Can Trap People Inside

When Tesla car doors lose power, you need to use the manual door release to get out. But riders and drivers can get stuck inside. Emily Chang explains. (Source: Bloomberg)

Source link

Funding & Business

AI-driven insurtech company Pathwork raises $3.5m in seed funding

Pathwork, an AI-powered autonomous distribution platform targeting the life and health insurance sector, has secured $3.5m in seed investment.

The funding round was spearheaded by Costanoa and was joined by Logos Fund, American Family Ventures and Meridian Ventures, along with “industry angels”.

The capital will be used to expedite the nationwide adoption of Pathwork’s technology among brokers and carriers.

Pathwork CEO and co-founder Ian Levinsky said: “The last 20 years of digitisation made insurance distribution more complex, not less. AI will reimagine everything from how the work gets done to the tools professionals rely on. Pathwork is shaping this future so the people behind every policy can focus back on creating impact and building trust.”

The company said that its technology transforms manual insurance workflows into “intelligent systems”, enabling faster movement of brokers and carriers, more accurate quoting and reduced administrative exchanges.

Pathwork’s suite of products includes Case Underwriter, which automates underwriting by analysing unstructured data and identifying optimal carrier options, and Knowledge Assistant, which provides instant expertise on underwriting rules and carrier specifics.

Additionally, the Pre-App Manager tool is designed to assist insurance carriers in more effectively evaluating case eligibility, requirements and risk classification.

Since its launch in 2024, Pathwork has analysed more than 10,000 cases, contributing to the retention of millions of commission payments for its users.

The company currently supports a network of more than 65 brokerages and carriers including AIMCOR, Highland Capital Brokerage, Hilb, LifeQuotes, Merit Insurance and NFP.

Earlier this month, Elysian, another AI-driven third-party administrator for commercial insurance, raised $6m in its seed funding round.

Funding & Business

Buyer of Goldman Sachs’ Russian Unit Steps Into the Middle East

David Amaryan, the former hedge fund manager who bought Goldman Sachs Group Inc.’s business in Russia, is expanding into the Middle East, looking to draw on the region’s deep pools of capital to broaden his firm’s real estate and infrastructure portfolio.

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi