Funding & Business

Digital Banking Financing Has Increased More Than 10X Since 2010

Accel is the most active investor in digital banking startups at the early-stage and overall.

Startups are unbundling banks across the financial value chain, from bill pay and lending to wealth management and personal finance.

Using CB Insights data, we examined companies attacking these four core business areas for consumer-facing banks. Funding to these digital banking startups is projected to reach over $6.9B in 2015, more than triple that of the 2014’s record-breaking figure.

This report contains detailed information on:

Yearly deals and dollars

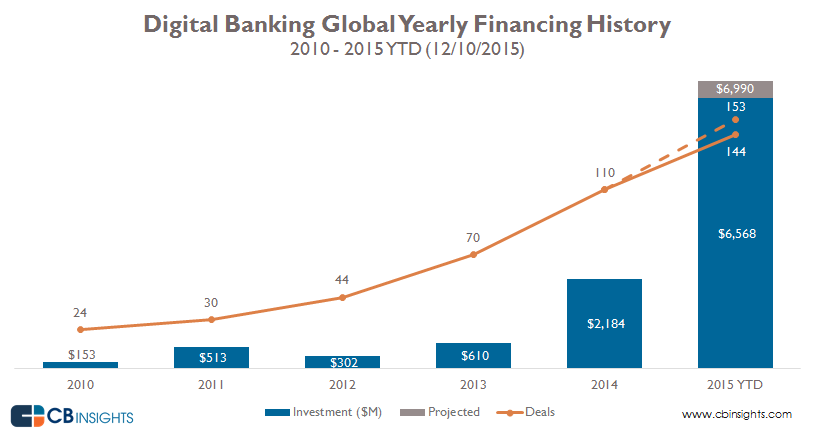

Deal activity to digital banking startups has skyrocketed since 2010, with deal count more than quadrupling from 24 in 2010 to 110 in full-year 2014. Total funding jumped an order of magnitude, from just $153M in 2010 to over $2.1B in 2014.

As of December 10, 2015 year-to-date deal activity has soared to 144 deals, already a 31% increase from the previous full-year high in 2014. Funding dollars have already reached over $6.5B, representing a 201% increase from the $2.2B in full-year 2014.

Several mega-rounds headlined the explosion in funding, including SoFi’s $1B Series E in August 2015 and the $680M corporate minority financing of One97 Communications in September 2015.

At the current run-rate, this year’s deal count is on track to hit 153 deals, and funding will reach $6.9B.

Quarterly deals and dollars

The last two quarters both topped $2B in funding to digital banking startups. Funding hit an all-time quarterly high of $2.9B in Q3’15, despite deal count slipping to 31 deals in Q3’15, compared to 46 in Q2’15.

The previously mentioned SoFi and One97 deals drove the Q3’15 funding figure, as did the $325M Series E raised by online lender Avant. Q2’15 featured large private equity investments in Chinese lenders Lufax ($485M) and Jiuxin Finance ($322M).

Deal activity in digital banking has also risen significantly, with at least 20 deals in the each of the 9 most recent quarters. By contrast, 10 of the preceding 14 quarters had single-digit deal counts. The 4 most recent quarters have seen more than 30 completed deals each.

Deal share by investment stage

Digital banking deal share saw large variations between 2010 and 2012.

2010 saw a spurt of early-stage activity, with Seed and Series A deals representing 75% of the total. In 2011, that share dropped to just 27%, while mid-stage deals (Series B and C) rose to account for 50% of all deals. Note that these early years featured lower deal volumes, with just 24 deals in 2010 and 30 in 2011.

Since 2013, deal share has stabilized somewhat, though late-stage deals have risen from 1% of the total in 2013 to 11% in 2015 year-to-date. Meanwhile, early-stage deals have ticked down from 65% in 2013 to 58% over the same timeframe.

Dollar share by investment stage

Dollar share fluctuated significantly across the six-year period. In 2010, early-stage companies captured the highest share of funding at 51%. From 2011 to 2013, mid-stage funding accounted for the largest share, with 48% to 66% of the total.

2014 and 2015 have seen late-stage deals take a plurality of dollar share, with Series D and E+ rounds accounting for 39% of dollars in 2014 and 45% in 2015 year-to-date.

Several key digital banking startups sprang from 2010’s Series A rounds, including financial wellness advisor LearnVest (recently acquired by Northwestern Mutual at a valuation north of $250M). Robo-advisors Betterment and Motif Investing also raised Series A rounds in 2010; both have since raised over $100M in total funding.

Most active investors

Accel Partners took the top spot as the most active investor in digital banking, while QED Investors and Sequoia Capital tied for second.

Accel has backed a diverse array of digital banking startups, from money transfer platforms such as Circle to financial advisors like LearnVest. This year, the firm has also financed several digital banking startups in emerging markets, including the billing app Mubble (India) and social credit evaluator Lenddo (Philippines) in Q3’15.

Most active early-stage investors

Accel Partners also tops the list of most active early-stage investors in digital banking. QED Investors and Sequoia Capital again tied for second, joined by Google Ventures.

Most well-funded companies: lending startups take 6 of top 10 spots

The 10 most well-funded digital banking companies have all raised at least $300M, with the top 3 securing more than $1B apiece.

Online and social lenders are well-represented, including SoFi, Avant, Prosper Marketplace, and Harmoney, as well as the China-based Lufax and Juixin Finance.

See the full list below. Note that these funding figures are exclusive of debt rounds and lines of credit.

Want more data about top digital banking startups? Login to CB Insights or sign up for free below.

If you aren’t already a client, sign up for a free trial to learn more about our platform.

Funding & Business

China Factory Activity Slump Continues Despite US Tariff Relief

China’s factory activity remained stuck in contraction in August, as a government crackdown on price wars holds back production offset the boost for manufacturers of the US’ extended trade truce.

Source link

Funding & Business

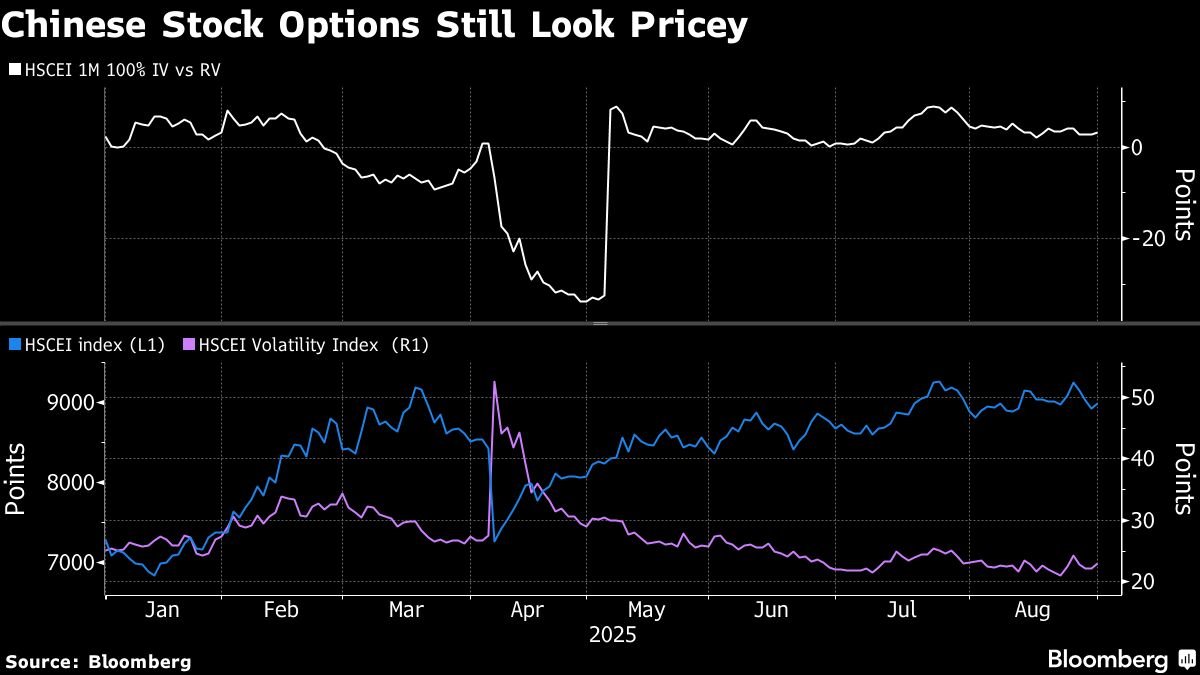

China’s Stock Rally Is Met With Skepticism in Options Market

While Chinese stocks traded in Hong Kong climbed for a fourth straight month, derivatives wagers show investors are skeptical about the market.

Source link

Funding & Business

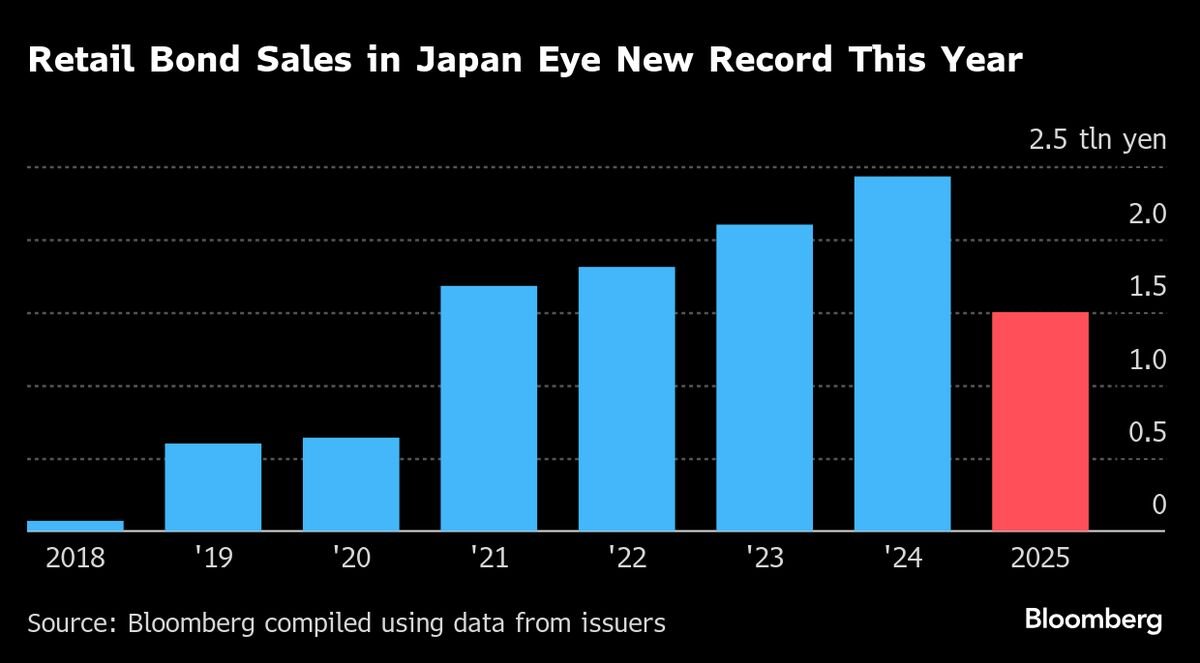

SoftBank, Rakuten Tap Japan’s Booming Retail Demand for Bonds

Sales of corporate bonds to Japan’s mom and pop investors are booming, on track to surpass last year’s record as bigger returns draw buyers looking to protect their savings from inflation.

Well-known names such as railway operator Keio Corp. and supermarket giant Aeon Co. are among those tapping the retail bond market, with the latter selling its debut retail bond on Friday.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle