Funding & Business

Data center operator DataBank nets $250M equity investment

The data center market is booming, driven by AI demand. Just last week, OpenAI said that it plans to team up with backers including SoftBank to spend at least $100 billion on data center infrastructure in the U.S. Microsoft aims to put around $80 billion toward AI infrastructure this year, and rival tech giants have also upped their footprints.

Firms like DataBank, which provide high-performance compute-ready data centers for enterprise clients, are the big winners in the race for more compute. Case in point: DataBank on Thursday announced that it raised $250 million in an investment from private equity firm TJC and an additional $600 million in a secondary share offer.

Raul K. Martynek, DataBank’s CEO, said in a press release that the new capital “signals both confidence in our strategy and our proven ability to execute and scale.”

DataBank, founded in 2005, was acquired in 2016 by a group of blue-chip investors led by DigitalBridge, an asset manager, and merged with several other data center operators. The company has expanded through acquisitions over the years, in 2018 acquiring Indianapolis-based data center provider Lightbound and in 2020 purchasing zColo’s U.S. and U.K. data center assets.

DataBank claims to manage over 65 data centers across more than 27 markets. In the past year and a half alone, the firm has raised $5 billion.

“We could not be more excited to partner with Raul, DataBank, and the other world-class digital infrastructure investors supporting DataBank’s robust growth plans,” Eion Hu, a partner at TJC, said in a statement. “Data centers are the cornerstone of the digital transformation and artificial intelligence, and we believe DataBank is uniquely positioned to capitalize on the sustained demand for reliable, scalable, and energy-efficient infrastructure in an increasingly data-driven world.”

In a sector adjacent to DataBank, there’s a booming market for “neocloud” startups like Crusoe and others building low-cost, on-demand clouds primarily for AI workloads.

CoreWeave, the GPU infrastructure provider with several Big Tech partnerships, is valued at $19 billion. Lambda Labs last April secured a special-purpose financing vehicle up to $500 million. The nonprofit Voltage Park in October 2023 announced it is investing $500 million in GPU-backed data centers. And Together AI, a cloud GPU host that also conducts generative AI research, last March landed $106 million in a Salesforce-led round.

Per a McKinsey report, capital spending on procurement and installation of mechanical and electrical systems for data centers could eclipse $250 billion in the next five years. That’s in spite of growing calls to examine the environmental externalities of data centers, including their high water usage.

Funding & Business

Nigeria Cuts Oil Firms’ Cost-Recovery Cap to Boost Budget Income

Nigeria has set a lower threshold by which oil companies can recover their expenses as it seeks to boost government revenue amid lower crude oil prices threatening to widen the budget deficit in the West African nation.

Source link

Funding & Business

Swaps Pioneered by Credit Suisse Take On New Life in Age of War

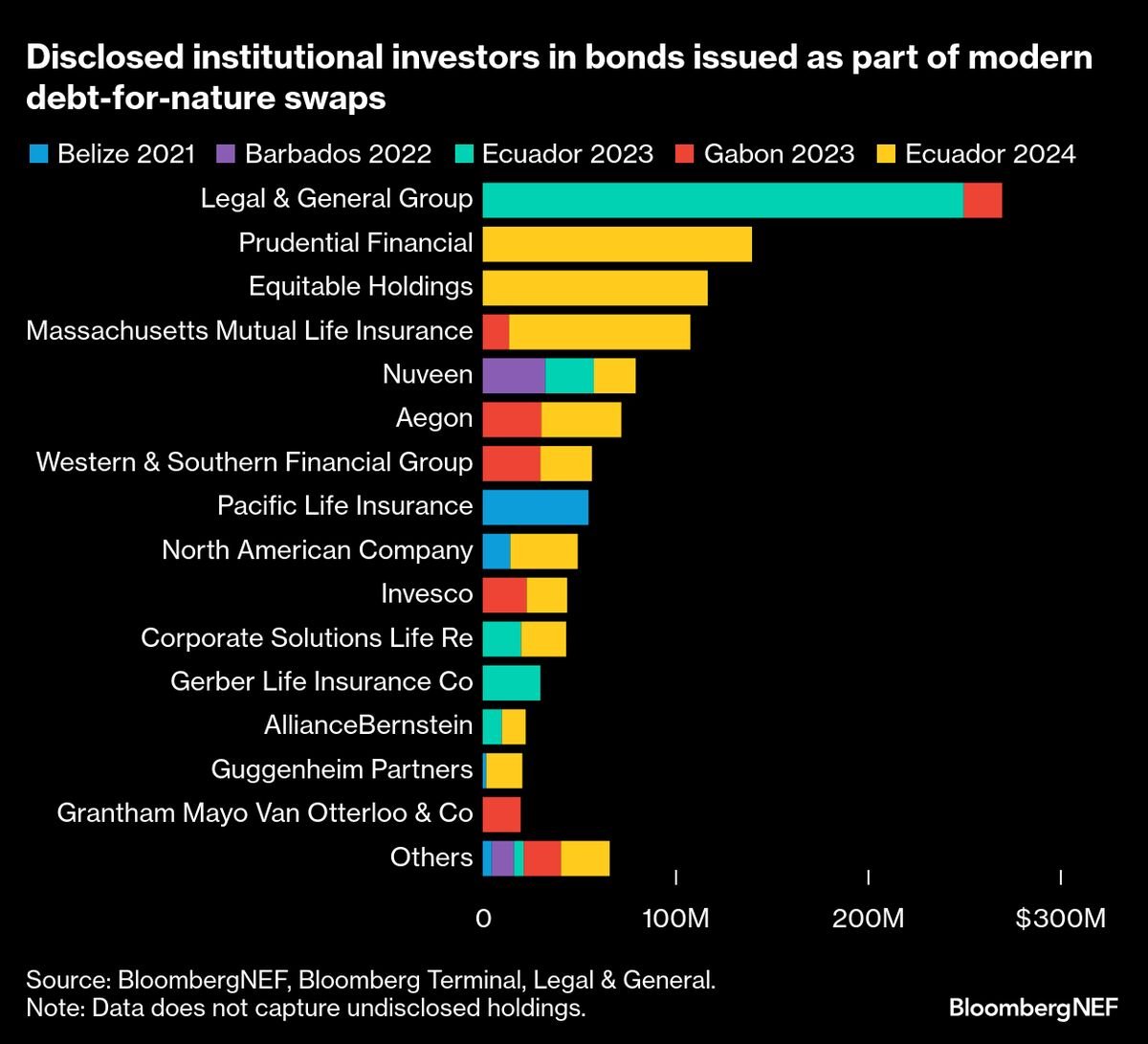

Debt swaps pioneered by Credit Suisse to fund nature conservation are enjoying a second life, as bankers see an opportunity to apply the model to everything from post-war reconstruction to energy security.

Source link

Funding & Business

Saudi Arabia, Iraq Stop Oil Shipments to Nayara After Sanctions

Saudi Arabia and Iraq aren’t shipping any crude to Nayara Energy Ltd.’s refinery in western India after it was sanctioned by the European Union.

Source link

-

Business3 days ago

Business3 days agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Mergers & Acquisitions2 months ago

Mergers & Acquisitions2 months agoDonald Trump suggests US government review subsidies to Elon Musk’s companies