Funding & Business

Crunchbase’s Global Unicorn List Tops $6 Trillion In Value In August For The First Time Despite Slowdown

The Crunchbase Unicorn Board reached a new milestone in August, cresting above $6 trillion in total value for the first time.

Still, only four companies joined the unicorn board last month — the lowest count so far this year, mirroring the slower pace of venture funding in August.

August’s newly minted unicorns

Here are last month’s four new unicorns, by sector.

AI

- Decart takes live video and transforms its own GenAI models. Last month, the company raised a $100 million Series B at a $3.1 billion valuation. The 2-year-old San Francisco-based company raised from existing investors Sequoia Capital, Benchmark and Zeev Ventures along with new investor Aleph.

Robotics

Web Design

Biotechnology

Value jumped in 2025

Year to date through August, the value of the board has increased by close to $600 billion — including valuation additions from existing and new unicorns on the board — a significant increase from 2024 and 2023.

Of that, $154 billion was added by 91 newcomer companies who joined in the first eight months of the year.

The most highly valued new unicorns this year so far are AI lab Thinking Machines Lab at $12 billion, healthcare clinical notetaker Abridge at $5.3 billion, and 27-year-old AI data storage company DataDirect Networks at $5 billion.

But by far the largest new value added to the board this year so far was by companies that initially joined in prior years. The largest valuation increases through August went to OpenAI, SpaceX, Anthropic, Safe Superintelligence and Anduril.

And while August saw a slowdown in unicorn creation, two large raises by unicorns Anthropic and Databricks in the first few weeks of September have already pushed the Unicorn Board’s total valuation further this month, to $6.2 trillion as of this writing.

Related Crunchbase unicorn lists:

Related reading:

Methodology

The Crunchbase Unicorn Board is a curated list that includes private unicorn companies with post-money valuations of $1 billion or more and is based on Crunchbase data. New companies are added to the Unicorn Board as they reach the $1 billion valuation mark as part of a funding round.

The unicorn board does not reflect internal company valuations — such as those set via a 409a process for employee stock options — as these differ from, and are more likely to be lower than, a priced funding round. We also do not adjust valuations based on investor writedowns, which change quarterly, as different investors will not value the same company consistently within the same quarter.

Funding to unicorn companies includes all private financings to companies that are tagged as unicorns, as well as those that have since graduated to The Exited Unicorn Board.

Exits analyzed here only include the first time a company exits.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

Funding & Business

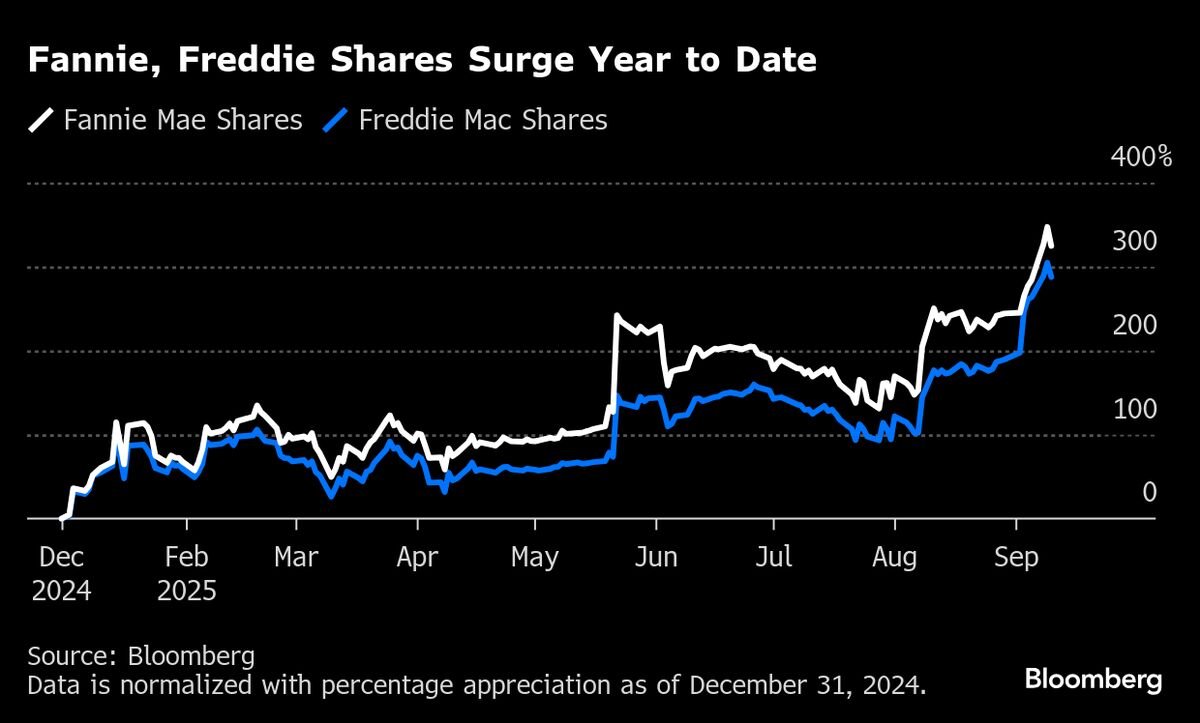

Deutsche Bank Says Buy Fannie Mae, Freddie Mac on IPO Outlook

Deutsche Bank sees shares of Federal National Mortgage Association and Federal Home Loan Mortgage Corp. gaining further on expectations the mortgage giants will possibly be released from government control in the near future.

Source link

Funding & Business

US Economy: Core CPI Rises, Jobless Claims Jump to 263,000

Underlying US inflation rose as expected in August, as the core consumer price index increased 0.3% from July. Initial jobless claims rose by 27,000 to 263,000 in the week ended Sept. 6, the highest level in almost four years. Michael McKee reports on Bloomberg Television.

Source link

Funding & Business

US Treasuries Rise as Mixed Data Leave Fed Rate Cuts Intact

Treasuries oscillated with yields ultimately pushing lower as readings on consumer prices and the labor market left intact the prospect of Federal Reserve cuts next week.

Source link

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi