AI Research

Composite AI Market Size And Trends

Composite AI Market Summary

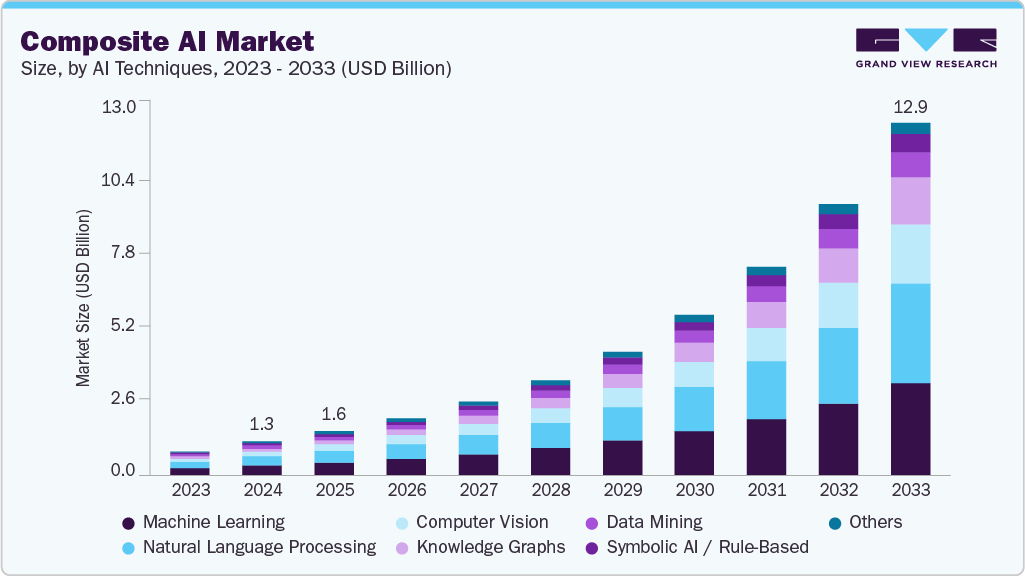

The global composite AI market size was estimated at USD 1,264.2 million in 2024 and is projected to reach USD 12,989.0 million by 2033, growing at a CAGR of 29.6% from 2025 to 2033. The integration of symbolic reasoning with machine learning is propelling the composite AI industry by enhancing model transparency and contextual accuracy.

Key Market Trends & Insights

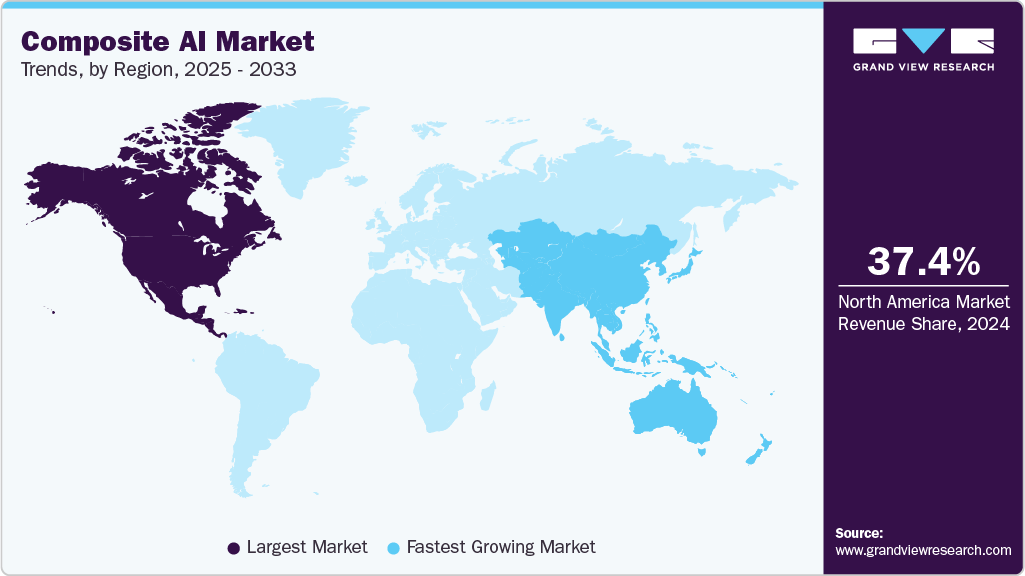

- North America dominated the composite AI market with the largest revenue share of 37.4% in 2024.

- The composite AI market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By AI techniques, the machine learning led the market with the largest revenue share of 31.2% in 2024.

- By application, the customer service segment led the market with the largest revenue share of 21.3% in 2024.

- By end use, the healthcare & life sciences segment is expected to grow at the fastest CAGR of 32.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,264.2 Million

- 2033 Projected Market Size: USD 12,989.1 Million

- CAGR (2025-2033): 29.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

This combination allows systems to not only learn from data but also apply structured logic, making them more reliable in regulated environments. Enterprises are adopting these hybrid models to meet the growing demand for explainable and compliant AI solutions.

The composite AI industry is witnessing increased development of industry-specific solutions. Enterprises are combining techniques such as LLMs, computer vision, simulation, and symbolic reasoning. These models are designed to incorporate industry knowledge and align with specific operational requirements. There is a growing use of cloud-based platforms to scale composite AI deployments. Strategic collaborations are helping integrate advanced AI into sector-specific workflows. Adoption is expanding rapidly across manufacturing, finance, retail, telecom, and automotive industries. For instance, in October 2024, Tata Consultancy Services (TCS), an Indian IT company, expanded its partnership with NVIDIA Corporation by setting up a dedicated NVIDIA Business Unit within its AI. Cloud division to speed up AI adoption across various industries. Through this collaboration, the companies launched composite AI solutions for key industries using NVIDIA AI Enterprise, Omniverse, and agentic AI.

Data environments are becoming more varied and complex. Traditional AI models struggle to perform across such diverse conditions. They are often limited in adapting to multiple data formats and real-time inputs. Organizations now require flexible frameworks to manage and process different data types efficiently. Customizable AI enables better alignment with operational goals and regulatory requirements. It also improves integration across structured, unstructured, and semi-structured datasets. This need is driving broader adoption and development of composite AI solutions. Companies across sectors are actively implementing such frameworks to enhance performance and scalability. For instance, in August 2024, NVIDIA Corporation introduced NIM Agent Blueprints, a set of customizable AI workflows designed for enterprise applications such as customer service, drug discovery, and PDF data extraction. The company aims to accelerate the development of scalable, data-driven AI systems using tools such as NeMo, NIM microservices, and Tokkio.

Organizations increasingly face scrutiny over the decision-making process of AI systems. Regulatory pressures and ethical concerns are raising the need for greater model transparency. Explainable AI (XAI) has emerged as a key requirement to ensure trust and accountability in automated decisions. Traditional black-box models often fail to provide clear reasoning behind their outputs. Composite AI addresses this by integrating interpretable symbolic methods with machine learning. This combination helps in delivering more understandable and auditable results. As enterprises adopt AI in sensitive areas such as finance, healthcare, and public services, the demand for explainability becomes critical. Composite AI frameworks allow human-in-the-loop models that align better with compliance standards. The market is responding with platforms that embed XAI features into hybrid systems. This change is accelerating the adoption of composite AI across regulated and high-risk environments.

AI Techniques Insights

The machine learning segment led the market with the largest revenue share of 31.2% in 2024. The machine learning segment has established dominance in the composite AI industry owing to its versatility and proven ability to process vast volumes of structured and unstructured data. Its integration within composite AI architectures enhances predictive capabilities by enabling systems to learn from evolving patterns and continuously improve performance. As organizations pursue more adaptive and intelligent decision-making systems, machine learning serves as the foundational layer that supports the fusion of other AI techniques such as natural language processing, knowledge graphs, and symbolic reasoning.

The knowledge graphs segment is anticipated to grow at the fastest CAGR during the forecast period, due to their ability to represent structured relationships between entities in a machine-readable format. They provide a semantic backbone that helps AI systems understand context, disambiguate meanings, and support logical inference. This structured understanding complements other AI techniques such as machine learning, natural language processing, and computer vision, allowing for more accurate and explainable decision-making. In domains such as healthcare, finance, and telecommunications, Knowledge Graphs are used to unify fragmented datasets, identify hidden connections, and provide traceable outputs.

Application Insights

The customer service segment accounted for the largest market revenue share in 2024, due to the widespread deployment of intelligent assistants and automated support systems. Enterprises are integrating technologies such as natural language processing, machine learning, and knowledge graphs to improve response accuracy and contextual relevance. These solutions allow for seamless resolution of queries across chat, email, and voice channels. Composite AI helps reduce customer wait times while improving agent productivity through real-time recommendations. The focus on improving customer experience and reducing operational costs is a key driver behind this trend. Sectors such as banking, telecom, and e-commerce are scaling AI-driven service platforms to handle growing volumes efficiently.

The product design and development segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing need for agile and innovation-driven processes. Companies are using AI to simulate designs, forecast performance, and iterate faster using real-world data. Integration of simulation models, computer vision, and symbolic reasoning is improving accuracy and reducing prototyping cycles. These technologies help identify flaws early and align product features with consumer demands. Composite AI is also enabling co-creative design tools that assist engineers in generating alternatives based on specified parameters. Sectors such as automotive, consumer electronics, and industrial machinery are applying these tools to streamline R&D.

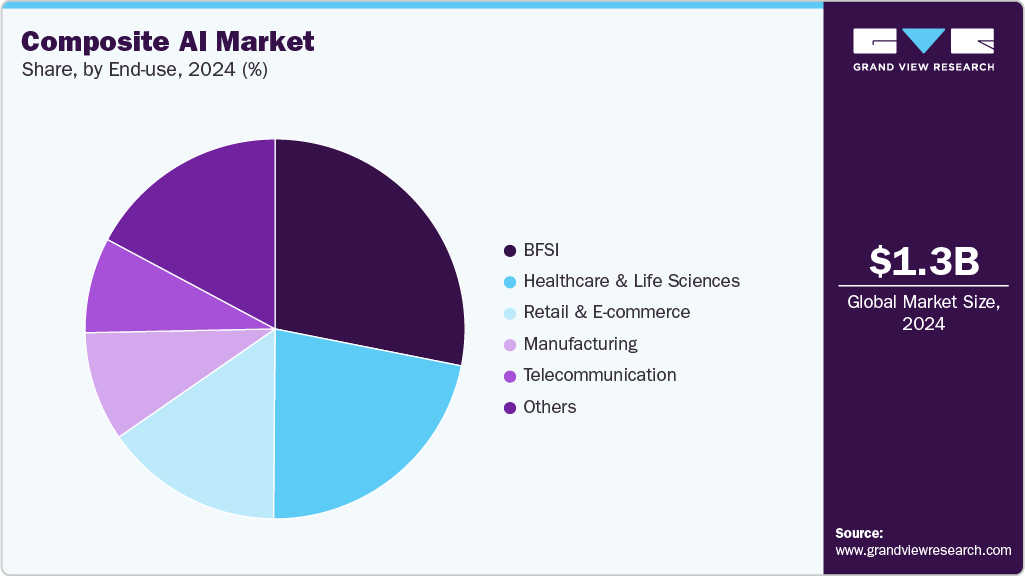

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2024, owing to its early adoption of advanced analytics, risk modeling, and fraud detection solutions. Financial institutions are leveraging composite AI frameworks that combine symbolic reasoning, machine learning, and natural language processing to enhance decision-making. These systems help in automating loan approvals, detecting anomalies in transactions, and ensuring compliance with evolving regulatory frameworks. Composite AI also supports real-time customer personalization in digital banking services. The need for secure, explainable AI in high-stakes environments further accelerates adoption in this sector. Major banks and insurance firms are deploying hybrid AI models to achieve operational efficiency and gain competitive advantages.

The healthcare & life sciences segment is anticipated to grow at the fastest CAGR during the forecast period, due to increasing demand for precision diagnostics and personalized treatment planning. Composite AI enables the integration of unstructured medical records, imaging data, and genomic information for improved clinical decision support. Hospitals and research institutions are applying hybrid AI models to accelerate drug discovery, optimize patient pathways, and predict disease progression. The ability to explain AI outputs is crucial in medical settings, making composite frameworks more suitable than black-box models. Regulatory shifts toward AI transparency further reinforce this transition.

Regional Insights

North America dominated the composite AI market with the largest revenue share of 37.4% in 2024, due to mature digital ecosystems and high enterprise AI adoption. Companies are utilizing composite AI to integrate multiple models for better decision-making. The region benefits from strong institutional support for AI innovation and funding. Demand for context-aware and explainable AI is pushing further development. Cloud infrastructure enables flexible deployment of AI components. Continuous investment across sectors reinforces the region’s leadership in this space.

U.S. Composite AI Market Trends

The composite AI market in the U.S. is driven by advanced AI research and a strong tech ecosystem. Enterprises are rapidly adopting composite AI for automation, personalization, and predictive insights. High investment from both private and public sectors accelerates innovation. Use cases span finance, healthcare, manufacturing, and defense. Regulatory discussions are also shaping responsible composite AI deployment.

Europe Composite AI Market Trends

The composite AI market in Europe growth is rising due to growing emphasis on explainability and data privacy. Companies are integrating symbolic and statistical AI to meet strict regulatory standards. Demand is growing in sectors such as automotive, energy, and public services. EU-funded AI initiatives support collaborative research and deployment. Regional players are focusing on ethical AI frameworks and interoperability.

Asia Pacific Composite AI Market Trends

The composite AI market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Rapid digital transformation across industries is accelerating AI adoption. Governments are investing heavily in national AI strategies and infrastructure. Enterprises are deploying composite AI to enhance efficiency and decision-making. Countries such as China, India, and Japan are driving regional momentum. Expanding tech ecosystems and data availability further support growth.

Key Composite AI Company Insights

Some of the key companies in the composite AI industry include Fujitsu, Google LLC, IBM Corporation, Microsoft, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

IBM Corporation integrates symbolic reasoning, machine learning, and natural language processing to deliver enterprise-grade composite AI solutions. Its Watson platform applies hybrid AI across industries such as healthcare, finance, and customer support. IBM Research focuses on neurosymbolic AI to enhance transparency and decision quality. The company designs adaptable AI systems aligned with specific operational contexts. These developments support scalable and explainable AI adoption in complex business environments.

-

Microsoft combines large language models with knowledge graphs, simulation, and rule-based systems to support composite AI deployments. Through Azure AI, it enables advanced workflows that span data analysis, automation, and decision support. Microsoft collaborates with enterprises to build customized, domain-specific AI solutions. Its platforms help integrate structured and unstructured data into cohesive AI systems. These efforts address real-time business needs while maintaining flexibility and traceability.

Key Composite AI Companies:

The following are the leading companies in the composite AI market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- BlackSwan Technologies

- C3.ai, Inc.

- Fujitsu

- Google LLC

- IBM Corporation

- Microsoft

- NVIDIA Corporation

- SAP SE

- TATA Consultancy Services Limited (TCS)

Recent Developments

-

In July 2025, Accenture and Google Cloud collaborated with Air France-KLM to launch a generative AI factory that supports agentic AI capabilities, streamlining AI use case development across operations. The initiative accelerates digital transformation by enabling rapid design, testing, and deployment of gen AI solutions with measurable business impact.

-

In January 2025, Accenture, an IT company in Ireland, launched the AI Refinery for Industry, featuring 12 industry-specific agentic AI solutions to streamline business processes using multi-agent networks. Built on NVIDIA AI software, these solutions aim to reduce deployment time and accelerate value creation across sectors such as clinical trials, industrial maintenance, and marketing.

-

In January 2025, NVIDIA Corporation launched AI foundation models as NIM microservices for RTX AI PCs, enabling users to build digital humans, creative workflows, and agentic AI locally. These models, supported by GeForce RTX 50 Series GPUs, power applications such as Project R2X, AI Blueprints, and various developer tools to accelerate AI deployment and performance on PCs.

Composite AI Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1,630.4 million

|

|

Revenue forecast in 2033

|

USD 12,989.0 million

|

|

Growth rate

|

CAGR of 29.6% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 – 2023

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive sector, growth factors, and trends

|

|

Segment scope

|

AI techniques, application, end-use, region

|

|

Region scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

|

|

Key companies profiled

|

Accenture; BlackSwan Technologies; C3.ai, Inc.; Fujitsu; Google LLC; IBM Corporation; Microsoft; NVIDIA Corporation; SAP SE; TATA Consultancy Services Limited (TCS)

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Composite AI Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global composite AI market report based on the AI techniques, application, end-use, and region.

-

AI Techniques Outlook (Revenue, USD Million, 2021 – 2033)

-

Application Outlook (Revenue, USD Million, 2021 – 2033)

-

End-use Outlook (Revenue, USD Million, 2021 – 2033)

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

Frequently Asked Questions About This Report

b. The global composite AI market size was estimated at USD 1,264.2 million in 2024 and is expected to reach USD 1,630.4 million in 2025.

b. The global composite AI market is expected to grow at a compound annual growth rate of 29.6% from 2025 to 2033 to reach USD 12,989.1 million by 2033.

b. North America dominated the composite AI market with a share of 37.4% in 2024. This is attributable to early adoption of AI technologies, strong R&D investments, and the presence of major technology firms in the region.

b. Some key players operating in the Composite AI market include Accenture, BlackSwan Technologies, C3.ai, Inc., Fujitsu, Google LLC, IBM Corporation, Microsoft, NVIDIA Corporation, SAP SE, and TATA Consultancy Services Limited (TCS)

b. Key factors driving the market growth include rising demand for advanced decision-making systems, growing adoption of AI across industries, and the need for more accurate and context-aware AI models.

AI Research

Nebius Raises $3.7 Billion in Wake of Microsoft AI Deal

Dutch cloud computing company Nebius has raised $3.75 million via sales of stock and convertible notes.

AI Research

Artificial Intelligence Stocks Rally as Nvidia, TSMC Gain on Oracle Growth Forecast

This article first appeared on GuruFocus.

Sep 11 – Oracle (ORCL, Financial) projected its cloud infrastructure revenue will surge to $114 billion by fiscal 2030, a forecast that triggered strong gains across artificial intelligence-related stocks.

The company also outlined plans to spend $35 billion in capital expenditures by fiscal 2026 to expand its data center capacity.

Shares of Oracle soared 36% on Wednesday on the outlook, as investors bet on rising demand for GPU-based cloud services. Nvidia (NASDAQ:NVDA), which supplies most of the chips and systems for AI data centers, climbed 4%. Broadcom (NASDAQ:AVGO), a key networking and custom chip supplier, gained 10%.

Other chipmakers also advanced. Advanced Micro Devices (AMD,) added 2%, while Micron Technology (MU, Financial) increased 4% on expectations for higher memory demand in AI servers. Taiwan Semiconductor Manufacturing Co. (NYSE:TSM), which produces chips for Nvidia and other AI players, rose more than 4% after reporting a 34% jump in August sales.

Server makers Super Micro Computer (SMCI, Financial) and Dell Technologies (DELL) each rose 2%, supported by their role in assembling Nvidia-powered systems. CoreWeave (CRWV), an Oracle rival in the neo-cloud segment, advanced 17% as investors continued to bet on accelerating AI compute demand.

AI Research

Oracle Health Deploys AI to Tackle $200B Administrative Challenge

Oracle Health introduced tools aimed at easing administrative healthcare burdens and costs.

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi