Tools & Platforms

CO professor offers advice for weighing pros and cons using AI in school work

DENVER — As the new school year kicks off, it reignites a familiar debate: how much will technology help or hinder students this year, particularly when it comes to artificial intelligence.

A recent study by the Massachusetts Institute of Technology (MIT) highlights the potential impacts of AI on brain activity and memory. To delve deeper into this topic, we spoke with Roselinde Kaiser, a psychology and neuroscience professor at the University of Colorado Boulder. Kaiser emphasized the importance of critical thinking in academic work, particularly when it comes to writing essays and completing homework assignments.

“So one place that we’re looking at helpful or harmful effects is in learning and cognition, so how young people perform at school,” Kaiser said. “But also, how do they develop critical thinking skills? How do they foster those self control skills that are really important and happening during that period of time? So how does technology help or harm learning and cognition? But also, how does that help or harm communication and relationships, and how does that help or harm mental health?

She offered an important question to ask yourself when potentially tapping into AI when working on homework: “Is it helping or taking away from your ability to critically think and problem solve?”

CO professor offers advice for weighing pros and cons using AI in school work

Kaiser said it isn’t the first time we’ve grappled with this issue.

“No human can write as quickly as someone can speak,” Kaiser explained. “When you write, you have to put information into your own words, which involves synthesizing that information. But when typing, especially if you’re practiced, you can do it almost as quickly as someone is speaking. This can prevent students from truly processing the material.”

However, researchers also acknowledge that this technology is here and weaved into our lives. They also know it’s about balancing academic stress and time management and that many people see AI, technology and social media benefiting their day to day.

“One of the pieces that I think about a lot as a researcher who works with young people who often are grappling with difficult, academic stress, mental health concerns, just a shifting landscape in terms of technology, is to start by identifying what are the values that really guide who you want to be and what you want to be about, and in what ways can AI or technology help support you in moving towards those values, and in what ways will it get in the way? And that might be a very personal kind of a navigation that happens, right?,” Kaiser said.

Denver7

Denver7 | Your Voice: Get in touch with Anusha Roy

Denver7 morning anchor Anusha Roy tells stories that impact all of Colorado’s communities, but specializes in reporting on our climate, mental health, and the opioid crisis. If you’d like to get in touch with Anusha, fill out the form below to send her an email.

Tools & Platforms

AI-Enhanced Pedagogy Provost Endorsement open for enrollment until Sept. 30

UNIVERSITY PARK, Pa. — Teaching and Learning with Technology at Penn State is enrolling faculty and staff until Sept. 30 in the Provost Endorsement Program: AI-Enhanced Pedagogy, which will be held during the fall 2025 semester. Participants will explore and integrate generative AI technologies into their teaching practices.

To complete the endorsement program, participants must attend seven internal Penn State events related to generative AI in instruction during the fall 2025 semester. Events will vary between in person and online options. Events will be offered by experts from Teaching and Learning with Technology, Commonwealth Campus instructional designers, the University Libraries, and the Schreyer Institute for Teaching Excellence.

Additionally, participants will use Canvas to submit a revised assignment, an insights post, and a philosophy video to receive individualized feedback from the endorsement program leads.

The goals of this endorsement program are to support the discovery of generative AI teaching and learning opportunities as a University-wide community and to support the tailoring of GenAI uses to enhance student skills development.

By completing this endorsement program, participants will:

- Identify teaching and/or learning opportunities for equity, ethical practices or disciplinary skills afforded by generative AI technologies.

- Explore and use at least three generative AI tools.

- Review and revise a course or teaching approach with generative AI to support student success.

- Create a video of an instructional philosophy with generative AI that could be given to students.

Faculty and staff can find more information and enroll on the AI-Enhanced Pedagogy webpage.

Tools & Platforms

New AI Partnerships Could Be a Game Changer for DXC Technology (DXC)

- DXC Technology recently announced partnerships with startups Acumino, CAMB.AI, and GreenMatterAI to advance AI solutions in the automotive and manufacturing industries, focusing on smart factory robotics, real-time speech translation, and synthetic data projects.

- This collaboration, made as part of the STARTUP AUTOBAHN initiative, highlights DXC’s commitment to transforming emerging technology into practical industry impact by accelerating AI adoption.

- We’ll examine how these new AI partnerships could reshape DXC Technology’s investment narrative and long-term prospects in digital transformation.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

DXC Technology Investment Narrative Recap

To be a shareholder in DXC Technology today, you need to believe that the company’s efforts in digital transformation and AI can counter persistent revenue declines and revive organic growth. While the new partnerships with Acumino, CAMB.AI, and GreenMatterAI showcase momentum in AI, the immediate effect on stabilizing short-term revenues or addressing the ongoing decline in the GIS segment is likely to be modest, given the inherent scale and timing of these projects.

Of recent announcements, DXC’s deal to create the DXC Agentic Security Operations Center with 7AI stands out as especially relevant alongside the new automotive and manufacturing AI partnerships. This reflects a deepening focus on expanding digital offerings through AI-driven solutions, which underpins the most important catalyst for the stock: improved client demand and bookings growth from digital modernization, even as near-term performance remains pressured.

However, investors should not overlook that, despite these innovation efforts, persistent challenges in revenue and margin stabilization continue to weigh on the company’s outlook, especially if…

Read the full narrative on DXC Technology (it’s free!)

DXC Technology’s outlook projects $12.1 billion in revenue and $208.6 million in earnings by 2028. This implies a 1.7% annual revenue decline and a $170.4 million decrease in earnings from the current $379.0 million.

Uncover how DXC Technology’s forecasts yield a $15.12 fair value, in line with its current price.

Exploring Other Perspectives

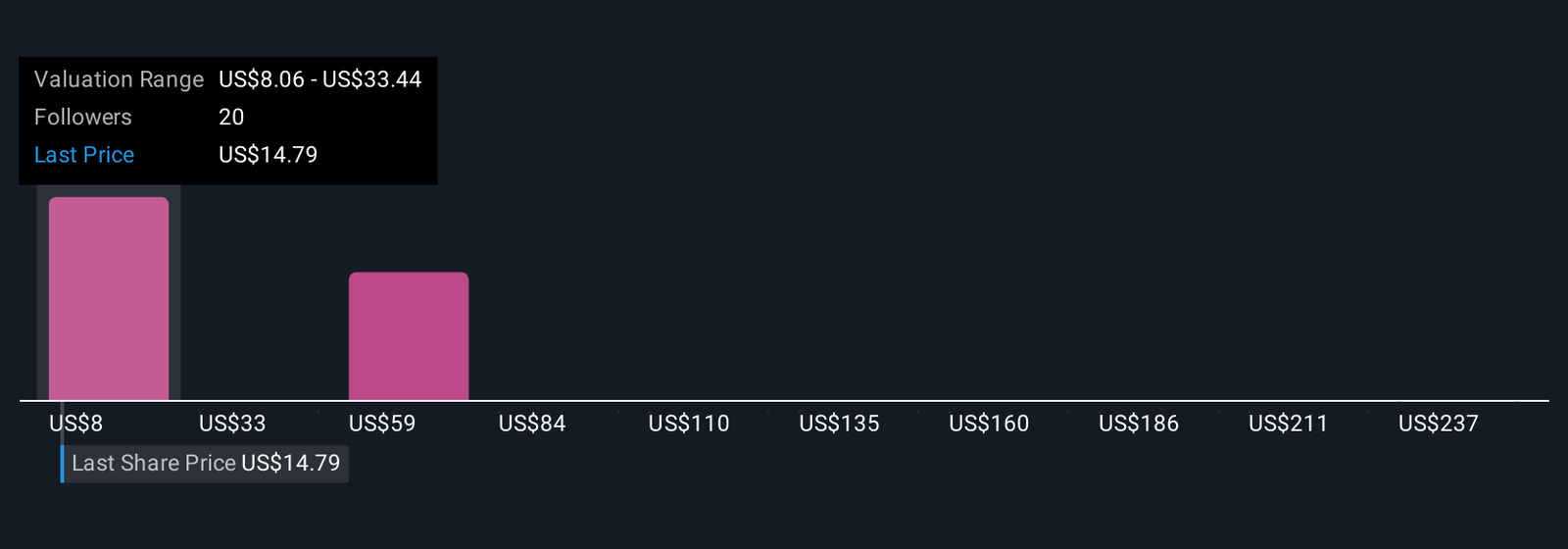

Six Simply Wall St Community members estimate DXC’s fair value between US$8.06 and US$261.89, indicating significant differences in growth assumptions. Balance these viewpoints with persistent risks to revenue and backlog conversion that could impact near-term earnings and investor sentiment.

Explore 6 other fair value estimates on DXC Technology – why the stock might be worth 46% less than the current price!

Build Your Own DXC Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Interested In Other Possibilities?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Tools & Platforms

Will Sea Dagger’s AI-Driven Tech Shift Leidos Holdings’ (LDOS) Role in Government Defense Contracts?

- Leidos recently unveiled the Sea Dagger, a next-generation Commando Insertion Craft for the Royal Navy, featuring high speed, modular mission systems, and autonomous technologies tailored for modern maritime operations.

- This unveiling positions Leidos as a prominent innovator in advanced maritime defense solutions, aligning with major UK and AUKUS defense modernization priorities.

- We’ll explore how the Sea Dagger launch, leveraging autonomy and AI, could shape Leidos Holdings’ government contract growth outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Leidos Holdings Investment Narrative Recap

To be a shareholder in Leidos Holdings, you need confidence in the company’s ability to capture long-term government spending on defense modernization and advanced technology, while managing its reliance on large public sector contracts. The announcement of Sea Dagger enhances Leidos’ credentials in maritime autonomy and aligns with top spending priorities, but gives only an incremental boost to near-term government contract momentum, which remains the company’s key catalyst. The largest risk continues to be shifts in government funding priorities, which could disrupt expected revenue growth if budgets tighten.

Among recent developments, Leidos winning a $128 million FBI task order for agile software development illustrates how its expertise in secure, high-tech government solutions is translating into new business opportunities. This aligns with the same digital innovation and defense modernization themes seen in the Sea Dagger project, further supporting the company’s biggest catalyst: continued multi-year growth in national security and technology contracts.

Yet, despite these advances, if defense spending priorities change faster than expected, investors need to be aware that…

Read the full narrative on Leidos Holdings (it’s free!)

Leidos Holdings is projected to reach $18.6 billion in revenue and $1.5 billion in earnings by 2028. This outlook requires a 3.0% annual revenue growth rate and a $0.1 billion increase in earnings from the current $1.4 billion.

Uncover how Leidos Holdings’ forecasts yield a $186.69 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from US$102 to US$285.81. While high expectations for government modernization support optimism, investor forecasts remind you opinions vary widely and signal multiple possible outcomes for Leidos’ future.

Explore 8 other fair value estimates on Leidos Holdings – why the stock might be worth as much as 60% more than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

-

Business1 week ago

Business1 week agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms4 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi