Business

Car finance: Drivers using claims firms could face 36% add-on charge on compensation payouts | Motor finance

Adverts claiming consumers could be entitled to compensation for mis-sold car finance are popping up everywhere. “You could be owed thousands … File your car finance claim today” is a typical call to action.

With only weeks to go, however, until we find out whether there could be payouts for millions of people, there are warnings that signing up with a claims management company (CMC) could be a bad idea.

The payment protection insurance (PPI) debacle led to claims firms pocketing billions of pounds of the compensation paid to victims, and it seems some are keen to cash in on this latest consumer issue.

It has been said the scandal could result in a £44bn bill for lenders, and this week a survey revealed that more than 23 million people believe they could be due some compensation for a mis-sold car loan.

However, the main UK regulator, the Financial Conduct Authority (FCA), told Guardian Money: “Consumers should be aware that by signing up now with a CMC or law firm, they may end up paying for a service they do not need and losing up to 30% of any money they may receive.”

The amount that can be swallowed up in fees is actually up to 36%, as claims companies can charge VAT on top of a percentage cap applied by the FCA. As we explain later, there is a mechanism that allows some law firms to charge even more.

Here we recap the story so far and run through your options.

How we got here

This is all about the alleged large-scale mis-selling of car loans involving the payment of secret commissions to car dealers and – it would appear – millions of car buyers unknowingly paying more for their finance than they should have.

Across the UK, an estimated 80% to 90% of new cars, and an increasing number of used vehicles, are bought with motor finance, by which we typically mean personal contract purchase plans and hire purchase agreements.

Everyone is anxiously awaiting a ruling from the supreme court that is expected some time this month. The FCA has said that if, after the judgment, it concludes that consumers have lost out, it is likely it will consult on an industry-wide consumer compensation scheme.

In broad terms, the people who appear to have the best chance of getting compensation are those who used car finance to buy a new or secondhand motor vehicle – for example, a car, van or motorbike – before 28 January 2021 (and, we think, after April 2007), where the finance included something known as a discretionary commission arrangement (DCA).

However, a court of appeal ruling last autumn sent shock waves through the sector as it suggested anyone with any type of car finance that included commission that was not properly disclosed could be owed money.

So it is possible the FCA could set the scope of any scheme to include other types of car finance where people were not given all the necessary information.

It has previously indicated that for a typical £10,000, four-year car finance deal where a DCA was used, a customer might have paid £1,100 too much interest. However, there could be a requirement for firms to pay interest on top of that, which could add up to a lot if it is several years’ worth.

If you think you are affected you could do one of the following.

1) Wait to see how things pan out

This is the easiest option, and we shouldn’t have long to wait before we get a lot more clarity.

The FCA says it will confirm within six weeks of the supreme court judgment whether it is proposing to launch a compensation scheme. If so, it will carry out a consultation before making its final decision, with any scheme likely to commence next year.

The FCA says it will aim to make any scheme “easy to take part in, without needing to use a CMC or law firm”.

It has been suggested that if a scheme does go ahead, banks and other lenders will have to proactively contact all their customers who meet the mis-selling criteria and offer them compensation.

Martin Lewis, the founder of MoneySavingExpert.com, says that would mean “people won’t need to complain – they will be paid out an amount dictated by the FCA to firms based on their situation”.

Of course we will need to wait to see what happens.

2) Lodge a complaint now

Let’s first talk about the people whose car finance included a DCA: some would say that logging a complaint now means you are “in the system”.

It gives the company concerned a chance to track down your information, and you can point out things that may help with that. If there is a problem – for example, the firm says it has mislaid or deleted your data – it is probably better to know now rather than later.

“Submitting a complaint could be helpful if you’ve changed your contact details or moved house since taking out your car finance, as the information you provide will help the providers match you with your car finance agreement,” the MoneySavingExpert website says. It adds that logging a complaint now could help reduce the risk of being ruled out if a time limit is imposed in future.

It has a free tool on its website that it says can help people check if they had a DCA and, if they did, get their complaint logged. You have to answer a few questions on the details of your car finance, then it creates an email for you to send to the relevant lender.

Or you can complain yourself. It is free and simple, the FCA says. You will need to complain to the company you were paying each month, and ideally do it in writing. If you don’t get a response or your complaint is rejected, you can take it to the free Financial Ombudsman Service. Official websites such as the government-backed MoneyHelper have guides to how to do this.

In terms of non-DCA car finance complaints, things are now a lot less clear. However, you can still put in a complaint now if you believe you were not told about commission and may have paid too much for your finance.

Much of the previous advice applies to these people, too, although for non-DCA complaints the end date is looking like October 2024. MoneySavingExpert has a different free tool for these people that could be useful to you.

The FCA has given companies until after 4 December this year before they have to start responding to any type of car finance commission complaint, so you may not hear anything substantial for a while. However, your provider should send you an acknowledgment within eight weeks.

The Financial Ombudsman Service has about 100,000 motor finance commission cases lodged with it, with the legal proceedings affecting its ability to issue final decisions in these cases.

3) Use a claims company or law firm

It is a busy time for companies offering to help people make a claim for car finance compensation, usually on a “no win, no fee” basis. There are lots jostling for our attention, from one-man-band operations to high-profile consumer law firms. Many of the adverts talk of sizeable potential refunds.

However, as highlighted previously, the FCA has made its views very clear on this potential route to compensation. It adds: “We’ve seen law firms and CMCs touting highly speculative figures to sign people up for motor finance claims.”

The MoneyHelper site advises people to “avoid using a claims management company to get any compensation you’re owed”.

Some CMCs are merely fishing for customer “leads”, which are then passed on to third-party law firms for a fee.

A claims company will usually be regulated by either the FCA or the Solicitors Regulation Authority (SRA) – it should say at the bottom of its website.

In both cases the maximum fee you can be charged is 30% (36% including VAT), although solicitors are able to apply to the SRA to charge more for complex claims. That’s a lot of money to give up.

If you are determined to use a firm, you would be best advised to choose one with a proven record of winning cases in this area, such as the solicitors Bott and Co.

Hundreds, if not thousands, of people have taken their cases to court, and in many cases the judge has found in the individual’s favour, although Coby Benson at Bott and Co says: “As far as we’re aware, no firms are now issuing court proceedings. This is because any case will just be ‘stayed’ (placed on hold) by the court until the supreme court has handed down its decision.”

However, he adds: “When we last issued court proceedings, we saw a success rate of 90% and average compensation of about £1,600.”

Benson also says: “The remedy available through the courts is often more generous than that which can be achieved through FCA rules.” That reflects the view that if it does end up setting up a compensation scheme, the FCA will need to balance the interests of consumers, firms and the broader economy. The regulator says that as well as being “fair to consumers who’ve lost out”, any scheme must “ensure the integrity of the motor finance market so it works well for future consumers”.

What are DCAs?

Before 2021, many motor finance lenders allowed brokers – usually car dealers – to adjust the interest rates on the finance deals they offered to customers. The higher the interest rate, the more commission the dealer received, so there was an incentive for them to increase consumers’ costs. This was known as a discretionary commission arrangement.

The Financial Conduct Authority banned DCAs with effect from 28 January 2021 after finding that commission models giving dealers discretion over interest rates could be costing customers about £500m in total more a year than flat fee arrangements. These are where the dealer gets the same commission regardless of the amount of work involved, the credit risk of the customer or the interest rate.

DCAs were “by far the most common commission arrangement” before they were outlawed: on average, between 2007 and 2020, about three-quarters of all motor finance agreements had a DCA of some sort, according to the FCA.

A number of car finance providers say they never used DCAs. The MoneySavingExpert website carries a list of firms and brands that say this – they include Bank of Scotland, Carmoola, Halifax, Lloyds (excluding Black Horse) and RateSetter.

Business

Fed governor Lisa Cook declared key property as ‘vacation home’, files show | US news

A loan estimate for an Atlanta home purchased by Lisa Cook, the Federal Reserve governor accused of mortgage fraud by the Trump administration, shows that Cook had declared the property as a “vacation home”, according to a document reviewed by Reuters.

The document, dated 28 May 2021, was issued to Cook by her credit union in the weeks before she completed the purchase and shows that she had told the lender that the Atlanta property would not be her primary residence. The document appears to counter other documentation that Cook’s critics have cited in support of their claims that she committed mortgage fraud by reporting two different homes as her primary residence, two independent real-estate experts said.

Reuters was unable to reach Cook for comment. She has repeatedly denied any wrongdoing regarding her properties, which also include a home in Ann Arbor, Michigan, and an investment property in Massachusetts.

Administration officials led by Bill Pulte, director of the Federal Housing Finance Agency, have used mortgage documents from her Atlanta and Michigan properties to accuse Cook of claiming both as her “primary residence”. The allegedly false claims of residence, which could improve mortgage and tax implications for a homeowner, led Pulte to refer the matter to the Department of Justice, prompting a federal investigation and an order by Donald Trump to dismiss her.

Cook, who remains at the Federal Reserve, has sued the president to resist her dismissal. Reuters was unable to determine whether Pulte or administration officials are aware of Cook’s Atlanta loan estimate. Spokespeople at the FHFA, the agency led by Pulte, did not respond to a request for comment.

The documents cited by Pulte include standardized federal mortgage paperwork which stipulates that each loan obtained by Cook for the Atlanta and Michigan properties is meant for a “primary residence”. But documentation reviewed by Reuters for the Atlanta home, filed with a court in Georgia’s Fulton county, clearly says the stipulation exists “unless Lender otherwise agrees in writing”. The loan estimate, a document prepared by the credit union, states “Property Use: Vacation Home”.

The document appears to help Cook’s case, said two real-estate experts who aren’t involved in representing her. That’s because it indicates that during the loan-application process, she told the lender she intended to use the property as a vacation home.

The lender, Washington-based Bank-Fund Staff Federal Credit Union, did not respond to a request for comment.

In another point that could help Cook’s case, she never requested a tax exemption for the Georgia home as a primary residence, according to property records and a Fulton county tax official.

A separate document reviewed by Reuters, related to a federal form completed by Cook as she obtained security clearance for her role at the Federal Reserve, shows that in December 2021 she also declared the Atlanta property as a “second home.” Though unrelated to the mortgage, the declaration on that document, a supplement to a US government national security form known as SF-86, is consistent with the claim on her Atlanta loan summary.

Surrounding the accusations against Cook is a battle over Trump’s effort to wield more control over the Federal Reserve, the central bank of the United States and an independent institution meant to be free of political meddling. Trump has often criticized Fed governors because of their reluctance to cut interest rates since he returned to the White House earlier this year.

Amid the controversy, the personal finances of other government officials and their families have also come into question by rival politicians, the media and others.

Last week, Reuters reported that Pulte’s own father and stepmother had declared two homes in two different states as their primary residence, prompting a town in Michigan to remove a tax exemption for their home there and charge the couple for back taxes. Pulte and his parents didn’t respond to requests for comment about the matter.

Business

As US edges closer to stagflation, economists blame Trump policies | US economy

It’s a strange time for the US economy. Prices are rising, jobs growth has stalled, uncertainty is everywhere and stock markets have soared to record highs. Against this background a scary word last used in the 1970s is being uttered again: stagflation.

Stagflation is the term that describes “stagnant” growth combined with “inflation” of prices. It means that companies are producing and hiring less, but prices are still going up. It’s a scenario that some economists say can be worse than a recession.

The last time the US saw a period of prolonged stagflation was in the 1970s during the oil shock crisis. Higher oil prices caused inflation to rise, while unemployment rose as consumers cut back on spending.

For now, the US economy isn’t experiencing stagflation, but recent data has shown it is edging closer to it.

After Donald Trump’s tariffs were announced in the spring, official data initially suggested the economy was shaking them off. New jobs were being added to the economy at a stable pace, while inflation went down to 2.3% – the lowest it had been since 2021.

However, when new labor market data was released in August, it became clear that there had been an impact on hiring that had been slow to appear in the data. Initial job figures for May and June were revised down by 258,000. While figures in July and August were slightly stronger, it was still a marked drop compared with earlier in the year.

Meanwhile, inflation started crawling back up in April. In August, the annualized inflation rate hit 2.9%, the highest since January.

Brett House, an economist at Columbia Business School, said that surveys of economists showed expectations of a recession for the year ahead was at a three-year low in January. Growth was expected to remain solid, and inflation was expected to continue easing.

“Both of those expectations have been turned around by the set of policies and their erratic implementation,” House said. “We’ve seen growth forecasts for the remainder of this year cut substantially, and we have seen inflation forecasts pushed up.”

In other words, the economy has both become more stagnant and inflationary – stagflation.

Economists are pointing to two policies coming out of the White House that are pushing the economy closer toward stagflation.

Trump’s crackdown on immigration has cut down the number of available workers and also increased the cost of hiring. And when it comes to prices, tariffs have just started to have a noticeable impact as companies pass tariff costs on to consumers.

Investors are banking on hopes the Federal Reserve cutting interest rates next week, but the future of the US economy remains uncertain.

In his closely watched speech at the Fed’s Jackson Hole symposium last month, the Fed chair, Jerome Powell, outlined the “shifting balance of risks” that have appeared over the summer.

“While the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers,” Powell said. Meanwhile, “higher tariffs have begun to push up prices in some categories of goods.”

Stagflation weakens the Fed’s ability to balance the economy. Adjusting interest rates can help balance out unemployment and inflation, but only if one is rising. When inflation surged to 9.1% in summer 2022, raising interest rates helped bring prices down. Inflation went down to below 2.5%, but the unemployment rate went up in the meanwhile, from a low of 3.4% in 2023 to 4.3% this past August.

The Fed actually has more power during a recession, which economists broadly define as a period of slowed economic activity. When Covid lockdowns caused a recession, with massive unemployment, in 2020, the Fed lowered interest rates down to near zero to stimulate the economy.

Because we’re not seeing stagflation yet, the Fed moving rates down next week could help the labor market without causing prices to soar. But the move comes with uncertainty.

“Say stagflation is happening, but at a very slow pace, because firms are waiting to pass through [the cost of tariffs],” said Sebnem Kalemli-Ozcan, an economist at Brown University. “Firms are going to start seeing demand increase and say: ‘Oh, now I can pass through my higher costs on to more consumers.’ … Then we are going to see inflation.”

One analysis from Goldman Sachs said that US consumers had already absorbed 22% of the cost of tariffs, and that they could eventually take on 67% if current tariffs continue.

If prices continue to rise, and the labor market continues to slow, stagflation will get stronger.

“If [stagflation] happens, it’s a very depressive situation because people are going to lose their jobs, unemployment is going to increase and people who are looking for jobs are going to have a very hard time finding jobs. That’s going to be the hard part,” Kalemli-Ozcan said.

The Yale Budget Lab estimated that Trump’s tariffs could increase the number of Americans living in poverty by at least 650,000 as tariffs become what the lab calls an “indirect tax”.

The Trump administration has urged Americans to be patient with the impacts of the tariffs and has claimed that recent economic data has been “rigged” against the president.

“The real numbers that I’m talking about are going to be whatever it is, but will be in a year from now,” Trump said earlier this month. “You’re going to see job numbers like our country has never seen.”

Business

CEO of company behind Harwood AI data center answers commonly asked questions – InForum

HARWOOD, N.D. — As a Texas company prepares to break ground this month on a

$3 billion artificial intelligence data center

north of Fargo, readers have asked several questions about the facility.

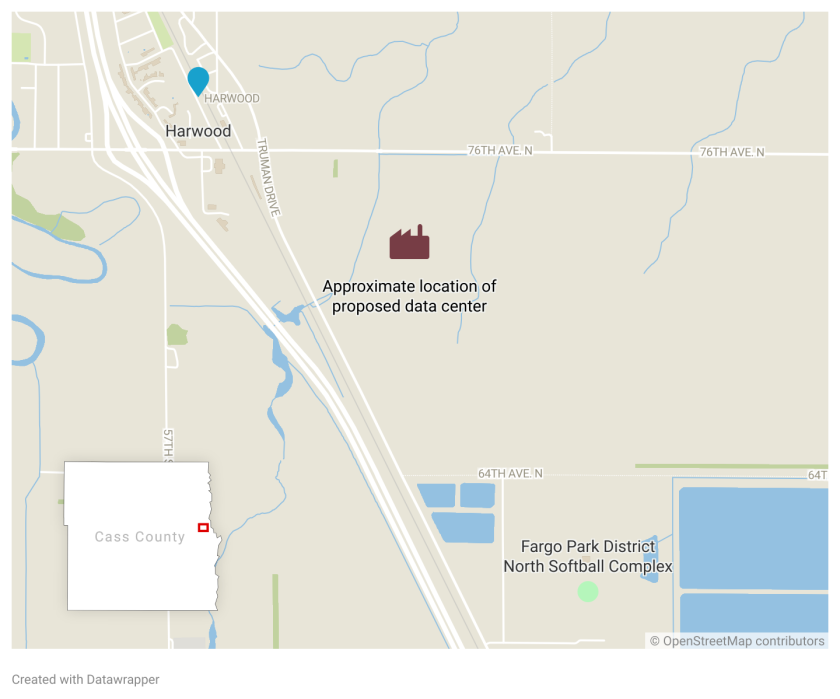

The Forum spoke this week with Applied Digital Chairman and CEO Wes Cummins about the 280-megawatt facility planned for east of Interstate 29 between Harwood and Fargo. The 160-acre center will sit on 925 acres near the Fargo Park District’s North Softball Complex.

The Harwood City Council voted unanimously on Wednesday, Sept. 10, to rezone the land for the center from agricultural to light industrial. With the vote also came final approval of the building permit for the center, meaning Applied Digital can break ground on the facility this month.

“We’re grateful for the City of Harwood’s support and look forward to continuing a strong partnership with the community as this project moves ahead,” Cummins said after the vote.

Alyssa Goelzer / The Forum

Applied Digital plans to start construction this month and open partially by the end of 2026. The facility should be fully operational by early 2027, the company said.

The project should create 700 construction jobs while the facility is built, Applied Digital said. The center will need more than 200 full-time employees to operate, the company said. The facility is expected to generate tax revenue and economic growth for the area, but those estimates have not been disclosed.

The facility has generated

Here are some questions readers had about the facility.

What will the AI data center be used for?

Applied Digital said it develops facilities that provide “high-performance data centers and colocations solutions for artificial intelligence, cloud, networking, and blockchain industries.” AI is used to run applications that make computers functional, Cummins said.

“ChatGPT runs in a facility like this,” he said. “There’s just enormous amounts of servers that can run GPUs (graphic processing units) inside of the facility and can either be doing training, which is making the product, or inference, which is what happens when people use the product.”

Map by The Forum

Applied Digital hasn’t announced what tenants would use Polaris Forge 2, the name for the Harwood facility. At a Harwood City Council meeting, Cummins said the company markets to companies in the U.S. like Google, Meta, Amazon and Microsoft.

“The demand for AI capacity continues to accelerate, and North Dakota continues to be one of the most strategic locations in the country to meet that need,” he said. “We have strong interest from multiple parties and are in advanced negotiations with a U.S. based investment-grade hyperscaler for this campus, making it both timely and prudent to proceed with groundbreaking and site development.”

AI data centers need significant amounts of electricity to operate, Cummins said. Other centers have traditionally been built near heavily populated areas, but that isn’t necessary, he said.

North Dakota produces enough energy to export it out of state, Cummins said. The Fargo area also has the electrical grid in place to connect to that energy, he said.

“A lot of North Dakotans, especially the leaders of North Dakota, want to better utilize the energy produced by North Dakota for economic benefit inside of the state versus exporting it to neighboring states or to Canada,” he said.

North Dakota’s cold climate much of the year also will keep the center cooler than in states like Texas, meaning the facility will use significantly less power than in warmer states, Cummins said.

“We get much more efficiency out of the facility,” he said. “Those aspects make North Dakota, in my opinion, an ideal place for this type of AI infrastructure.”

David Samson / The Forum

How much water will the center use?

Cummins acknowledged other AI data centers around the world use millions of gallons of water a day. Applied Digital designed a closed-loop system so the North Dakota centers use as little water as possible, Cummins said.

He compared the cooling system to a car radiator. The centers will use glycol liquid to run through the facilities and servers, Cummins said. After cooling the equipment, the liquid goes through chillers, much like a heat pump outside of a house. Once cooled, the liquid will recirculate on a continuous loop, he said.

People who operate the facility will use water for bathroom breaks and drinking, much like a person in a house or a car, he said.

“The data center, even with the immense size, we expect it to use the same amount of water as roughly a single household,” he said. “The reason is the people inside.”

Alyssa Goelzer / The Forum

Will the AI center increase electricity rates?

Applied Digital claims that electricity rates will not go up for local residents because of the data center.

“Data centers pay a large share of fixed utility costs, which helps spread expenses across more users,” the company said.

Applied Digital’s center in Ellendale, North Dakota, much like the one to be built in Harwood, uses power produced in the state, Cummins said. The Ellendale center, which runs on about 200 megawatts a year, saved ratepayers $5.3 million in 2023 and $5.7 million last year, he said.

“Utilizing the infrastructure more efficiently can actually drive rates down,” Cummins said, adding he expects rate savings for Harwood as well.

How much noise will the center make?

Applied Digital’s concrete walls should content the noise from computers, Cummins said. What residents will hear is fan noise from heat pumps used to cool the facility, he said.

“It will sound like the one that runs outside of your house,” he said in describing that the facility will create minimal noise.

The loudest noise will be construction of the facility, Cummins said.

The facility only will cover 160 acres, but Applied Digital is buying 925 acres of land, with the rest of the space serving as a sound buffer, he said. People who live nearby may hear some sound, he acknowledged.

“If you’re a half mile or more from the facility, you will very unlikely hear anything,” he said.

Chris Flynn / The Forum

Has Applied Digital conducted an environmental study?

The facility won’t create emissions or other hazards that would require an environmental impact study, Cummins said.

Why move so fast to approve the facility?

Some have criticized Applied Digital and the Harwood City Council for pushing the approval process so quickly. Applied Digital announced the project in mid-August, and the city approved it in less than a month.

Cummins acknowledged that concern but noted the industry is moving fast. The U.S. is competing with China to create artificial intelligence, an industry that is not going away, Cummins said.

“I do believe we are in a race in the world for super intelligence,” he said. “It’s a race amongst companies in the U.S., but it’s also a race against other countries. … I do think it’s very important the U.S. win this AI race to super intelligence and then to artificial general intelligence.”

Applied Digital said it wanted to finish foundation and grading work on the project before winter sets in, meaning it needed an expedited approval timeline.

People in Harwood have shown overwhelming support, Cummins said, adding that protesters mostly came from other cities.

“I can’t think of a project that would spend this amount of money and have this kind of economic benefit for a community and a county and a state and have this low of a negative impact,” he said. “I think these types of projects are fantastic for these types of communities.”

-

Business2 weeks ago

Business2 weeks agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms1 month ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy2 months ago

Ethics & Policy2 months agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi