AI Research

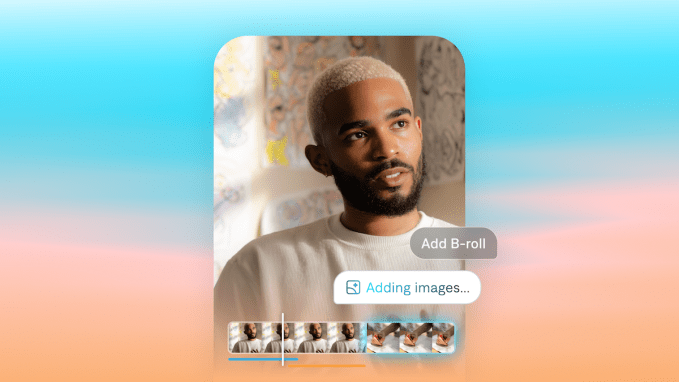

Captions rebrands as Mirage, expands beyond creator tools to AI video research

Captions, an AI-powered video creation and editing app for content creators that has secured over $100 million in venture capital to date at a valuation of $500 million, is rebranding to Mirage, the company announced on Thursday.

The new name reflects the company’s broader ambitions to become an AI research lab focused on multimodal foundational models specifically designed for short-form video content for platforms like TikTok, Reels, and Shorts. The company believes this approach will distinguish it from traditional AI models and competitors such as D-ID, Synthesia, and Hour One.

The rebranding will also unify the company’s offerings under one umbrella, bringing together the flagship creator-focused AI video platform, Captions, and the recently launched Mirage Studio, which caters to brands and ad production.

“The way we see it, the real race for AI video hasn’t begun. Our new identity, Mirage, reflects our expanded vision and commitment to redefining the video category, starting with short-form video, through frontier AI research and models,” CEO Gaurav Misra told TechCrunch.

The sales pitch behind Mirage Studio, which launched in June, focuses on enabling brands to create short advertisements without relying on human talent or large budgets. By simply submitting an audio file, the AI generates video content from scratch, with an AI-generated background and custom AI avatars. Users can also upload selfies to create an avatar using their likeness.

What sets the platform apart, according to the company, is its ability to produce AI avatars that have natural-looking speech, movements, and facial expressions. Additionally, Mirage says it doesn’t rely on existing stock footage, voice cloning, or lip-syncing.

Mirage Studio is available under the business plan, which costs $399 per month for 8,000 credits. New users receive 50% off the first month.

Techcrunch event

San Francisco

|

October 27-29, 2025

While these tools will likely benefit brands wanting to streamline video production and save some money, they also spark concerns around the potential impact on the creative workforce. The growing use of AI in advertisements has prompted backlash, as seen in a recent Guess ad in Vogue’s July print edition that featured an AI-generated model.

Additionally, as this technology becomes more advanced, distinguishing between real and deepfake videos becomes increasingly difficult. It’s a difficult pill to swallow for many people, especially given how quickly misinformation can spread these days.

Mirage recently addressed its role in deepfake technology in a blog post. The company acknowledged the genuine risks of misinformation while also expressing optimism about the positive potential of AI video. It mentioned that it has put moderation measures in place to limit misuse, such as preventing impersonation and requiring consent for likeness use.

However, the company emphasized that “design isn’t a catch-all” and that the real solution lies in fostering a “new kind of media literacy” where people approach video content with the same critical eye as they do news headlines.

AI Research

Ketryx Closes $39M Series B Round to Power the Future of Regulated Artificial Intelligence for Life Sciences

Insider Brief

- Ketryx raised $39M Series B led by Transformation Capital, with participation from Lightspeed, MIT’s E14 Fund, Ubiquity Ventures, and 53 Stations, bringing total funding to over $55M; Vinay Shah of Transformation Capital joins the board.

- Its AI-native compliance platform automates validation, traceability, and regulatory workflows (FDA/EU MDR-ready), enabling life sciences teams to achieve up to 90% faster documentation and 10x quicker release cycles without sacrificing safety.

- Already used by three of the top five global medtech companies and innovators like DeepHealth and Heartflow, Ketryx is positioning itself as the key AI infrastructure layer for regulated product development in healthcare and beyond.

Ketryx, the AI-powered compliance platform helping life sciences companies ship safer products faster, has announced a $39 million Series B led by Transformation Capital, with participation from existing investors including Lightspeed Venture Partners, MIT’s E14 Fund, Ubiquity Ventures, and 53 Stations. This latest round brings the company’s total funding to over $55 million, and Vinay Shah, Partner and Founding Team Member at Transformation Capital, will join Ketryx’s board.

Ketryx is solving one of the most difficult challenges in the life sciences: the need to accelerate product innovation without compromising safety or compliance. This challenge is more urgent than ever with teams racing to incorporate AI into regulated workflows and products.

“I’ve spent the last decade at the intersection of AI and life sciences, watching it evolve from an emerging tool to a critical application for patients,” said Erez Kaminski, CEO and founder of Ketryx. “It’s now time to accelerate adoption and ensure AI is safe, reliable, and ready for regulated environments.”

Life sciences teams are struggling to balance rigorous compliance requirements amid the rapidly accelerating pace of innovation. While cloud-based tools and rapidly evolving LLMs are transforming what’s possible, these regulated teams are still operating on infrastructure not designed for this velocity of change.

Ketryx is an AI-native compliance platform built to meet this challenge. It automates validation, traceability, and regulatory workflows — including FDA/EU MDR-ready documentation — across the product development lifecycle to help teams release safer products faster. Customers report up to a 90% reduction in documentation time and over 10x faster release cycles.

“In Medtech, long-term success depends on balancing innovation with the uncompromising demands of safety and compliance,” said Bill Hawkins, former CEO of Medtronic and new Ketryx investor. “This balance has historically been hard to achieve. Ketryx has built the infrastructure that allows both to advance together. Their ability to deliver this level of rigor at true enterprise scale is why I’m proud to support them as they shape the future of regulated software.”

The company’s platform is built for the enterprise and already used by three of the top five global medtech companies, several Fortune 500 organizations, and AI-powered companies such as DeepHealth, Heartflow, and Aignostics. With adoption accelerating, Ketryx is emerging as the key AI infrastructure layer for product development in regulated industries.

“Medtech teams are leading the way in applying artificial intelligence to improve patient outcomes, creating products that meet the highest safety and regulatory standards,” said Vinay Shah, Partner and Founding Team Member at Transformation Capital. “In our diligence, Fortune 500 giants and fast-growing innovators consistently praised Ketryx for proving that compliance can accelerate, rather than slow, technological progress. We believe Ketryx is defining the future of regulated infrastructure across industries and are proud to back them in their next stage of growth.”

Kaminski continued, “Having Transformation Capital, the pre-eminent digital health VC & growth equity firm, as our lead partner, gives us more than just capital. They understand exactly what it takes to build and scale healthcare technology companies. With their backing and industry connections, we’re continuing our global expansion, accelerating our product roadmap, and hiring rapidly in both Boston and Austria.”

With real-time traceability and documentation, Ketryx brings zero-lag compliance to the heart of product development, empowering teams to release more products, more safely, and faster than ever before.

About Ketryx

Ketryx transforms the product lifecycle of life science teams to deliver safer products, faster. Trusted by three of the world’s top five medical device manufacturers, its AI-powered compliance platform overlays existing tools to automate documentation, create traceability, and accelerate release cycles — without disrupting existing workflows. Ketryx AI Agents cut manual work by 90 percent and close compliance gaps, elevating speed and quality across the entire product lifecycle. For more information, visit www.ketryx.com.

AI Research

How could an OpenAI partnership with Broadcom shake up Silicon Valley’s chip hierarchy?

Broadcom Inc. is helping OpenAI design and produce an artificial intelligence accelerator from 2026, getting into a lucrative sphere dominated by Nvidia Corp. Its shares jumped by the most since April.

The two firms plan to ship the first chips in that lineup starting next year, a person familiar with the matter said, asking to remain anonymous discussing a private deal. OpenAI will initially use the chip for its own internal purposes, the Financial Times reported earlier.

Broadcom’s shares surged as much as 16% in New York trading on Friday, adding more than $200 billion to the company’s market value. Nvidia’s stock was down as much as 4.3% at $164.22, its biggest intraday decline since May.

Chief Executive Officer Hock Tan made veiled references to that partnership on Thursday when he said Broadcom had secured a new client for its custom accelerator business. Tan said the company has secured more than $10 billion in orders from the new customer, which the person identified as OpenAI.

Accelerators are essential to the development of AI at big tech firms from Meta Platforms Inc. to Microsoft Corp. Bloomberg News has previously reported that OpenAI and Broadcom were working on an inference chip design, intended to run or operate artificial intelligence services after they had been trained.

“Last quarter, one of these prospects released production orders to Broadcom,” Tan said, without naming the customer.

Broadcom is among the chip designers benefiting from a post-ChatGPT boom in AI development, in which companies and startups from the US to China are spending billions to build data centers, train new models and research breakthroughs in a pivotal new technology. On Thursday, Tan told investors the chipmaker’s outlook will improve “significantly” in fiscal 2026, helping allay concerns about slowing growth.

Tan had previously said that AI revenue for 2026 would show growth similar to the current year — a rate of 50% to 60%. Now, with a new customer that he said has “immediate and pretty substantial demand,” the rate will accelerate in a way that will be “fairly material,” Tan said.

“We now expect the outlook for fiscal 2026 AI revenue to improve significantly from what we had indicated last quarter,” he said.

Broadcom’s quarterly results initially drew a tepid reaction from investors, a sign they were anticipating a bigger payoff from the AI boom. After fluctuating in the wake of the report, the stock gained more than 3% during the conference call.

Sales will be about $17.4 billion in the fiscal fourth quarter, which runs through October, the company said in an earlier statement. Analysts had projected $17.05 billion on average, though some estimates topped $18 billion, according to data compiled by Bloomberg.

Expectations were high heading into the earnings report. Broadcom shares more than doubled since hitting a low in April, adding about $730 billion to the company’s market value and making them the third-best performer in the Nasdaq 100 Index.

Investors have been looking for signs that tech spending remains strong. Last week, Nvidia gave an underwhelming revenue forecast, sparking fears of a bubble in the artificial intelligence industry.

Though Broadcom hasn’t experienced Nvidia’s runaway sales growth, it is seen as a key AI beneficiary. Customers developing and running artificial intelligence models rely on its custom-designed chips and networking equipment to handle the load. The shares had been up 32% for the year.

During the call, Tan said he and the board have agreed that he will stay as Broadcom CEO until 2030 “at least.”

In the third quarter ended Aug. 3, sales rose 22% to almost $16 billion. Profit, excluding some items, was $1.69 a share. Analysts had estimated revenue of about $15.8 billion and earnings of $1.67 a share.

Sales of AI semiconductors were $5.2 billion, compared with an estimate of $5.11 billion. The company expects revenue from that category to reach $6.2 billion in the fourth quarter. Analysts projected $5.82 billion.

Other AI-focused chipmakers have stumbled in recent days. Shares of Marvell Technology Inc., a close Broadcom competitor in the market for custom semiconductors, plunged 19% on Friday after the company’s data center revenue missed estimates.

Broadcom’s Tan has been upgrading the company’s networking equipment to better transfer information between the pricey graphics chips at the heart of AI data centers. As his latest comments suggest, Broadcom is also making progress finding customers who want custom-designed chips for AI tasks.

Tan has used years of acquisitions to turn Broadcom into a sprawling software and hardware giant. In addition to the AI work, the Palo Alto, California-based company makes connectivity components for Apple Inc.’s iPhone and sells virtualization software for running networks.

Bass writes for Bloomberg.

AI Research

Google, Intel, AMD, Meta, Quantum Technology, Finance

SOUTH BEND, Ind. (WNDU) – Last week we talked about the newest updates in A.I. technology, specifically regarding Google, Microsoft, Apple, NVIDIA, Intel, and Meta.

Since then, we’ve received updates regarding Google, Intel, AMD, Meta (Facebook/Instagram), quantum technology, and finance.

Google Gemini released a major new image-editing upgrade on Aug. 26, which includes multi-turn edits, background/costume changes, and SynthID watermarking.

Google OpenAI/ChatGPT Realtime API updates released on Aug. 28, which OpenAI also published a joint safety evaluation with Anthropic, on Aug. 27.

OpenAI’s August safety post says that GPT-5 is now the default model that powers ChatGPT, with new training to better handle crisis content included.

IBM and AMD announced a partnership on quantum-centric supercomputing (hybrid quantum + HPC/AI) on Aug. 26, which includes a deep dive into AMD detailed CDNA 4 / MI350 accelerator architecture, at Hot Chips 2025.

Reports about an alleged Instagram chatbot engaged in dangerous guidance to minors, have been coming since Aug. 28. Since then, there’s been calls for bans under 18, and Meta says it’s tightening policies.

The European Union announced broader cloud access to European trapped-ion quantum systems (QCDC), on Aug. 28.

Sanger Institute and Quantinuum teamed up for new quantum-for-genomics efforts, on Aug. 28 as well.

JPMorgan made the largest move recently in finance, using their A.I. -run hedge fund, Numerai; a crowdsourced, machine-learning equity fund. JPMorgan Asset Management committed up to $500M to this A.I.

Summit Financial expanded its advisor platform, with eight A.I.-driven tools (intended for lead-gen, private-wealth intelligence, marketing automation, etc.), to push A.I. deeper into client acquisition and portfolio workstreams.

Stay up to date on local news with WNDU on-air and online. Be sure to download the 16 News Now App and follow our YouTube page as we continue to bring you the latest coverage on this developing story.

Copyright 2025 WNDU. All rights reserved.

-

Business1 week ago

Business1 week agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences4 months ago

Events & Conferences4 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Education2 months ago

Education2 months agoMacron says UK and France have duty to tackle illegal migration ‘with humanity, solidarity and firmness’ – UK politics live | Politics