Funding & Business

Capital One builds agentic AI modeled after its own org chart to supercharge auto sales

Join the event trusted by enterprise leaders for nearly two decades. VB Transform brings together the people building real enterprise AI strategy. Learn more

Inspiration can come from different places, even for architecting and designing agentic systems.

At VB Transform, Capital One explained how it built its agentic platform for its auto business. Milind Naphade, SVP of Technology and Head of AI Foundations at Capital One, said during VB Transform that the company wanted its agents to function similarly to human agents, in that they problem-solve alongside customers.

Naphade said Capital One began designing its agentic offerings 15 months ago, “before agentic became a buzzword.” For Capital One, it was crucial that, in building its agent systems, they learn from how their human agents ask customers for information to identify their problems.

Capital One also looked to another source of organizational structure for its agents: itself.

“We took inspiration from how Capital One itself functions,” Naphade said. “Within Capital One, as I’m sure within other financial services, you have to manage risk, and then there are other entities that you also observe, evaluate, question and audit.”

>>See all our Transform 2025 coverage here<<This same structure applies to agents that Capital One wants to monitor. They created an agent that evaluates existing agents, which was trained on Capital One’s policies and regulations. This evaluator agent can kick back the process if it detects a problem. Naphade said to think of it as “a team of experts where each of them has a different expertise and comes together to solve a problem.”

Financial services organizations recognize the potential of agents to provide their human agents with information to resolve customer issues, manage customer service, and attract more people to their products. Other banks like BNY have deployed agents this year.

Auto dealership agents

Capital One deployed agents to its auto business to assist the bank’s dealership clients in helping their customers find the right car and car loan. Consumers can look at the vehicle inventories of dealerships that are ready for test drives. Naphade said their dealership customers reported a 55% improvement in metrics such as engagement and serious sales leads.

“They’re able to generate much better serious leads through this more conversational, natural conversation,” he said. “They can have 24/7 agents working, and if the car breaks down at midnight, the chat is there for you.”

Naphade said Capital One would love to bring this type of agent to its travel business, especially for its customer-facing engagements. Capital One, which opened a new lounge in New York’s JFK Airport, offers a very popular credit card for travel points. However, Naphade pointed out that the bank needs to conduct extensive internal testing.

Data and models for bank agents

Like many enterprises, Capital One has a lot of data for its AI systems, but it has to figure out the best way to bring that context to its agents. It also has to experiment with the best model architecture for its agents.

Naphade and Capital One’s team of applied researchers, engineers and data scientists used methods like model distillation for more efficient architectures.

“The understanding agent is the bulk of our cost because that’s the one that has to disambiguate,” he said. “It’s a bigger model, so we try to distribute it down and get a lot of bang for our buck. Then there’s also multi-token prediction and aggregated pre-fill, a lot of interesting ways we can optimize this.”

In terms of data, Naphade said his team had undergone several “iterations of experimentation, testing, evaluation, human in the loop and all the right guardrails” before releasing its AI applications.

“But one of the biggest challenges we faced was that we didn’t have any precedents. We couldn’t go and say, oh somebody else did it this way, so we couldn’t ask how it worked out for them?” Naphade said.

Editor’s Note: As a thank-you to our readers, we’ve opened up early bird registration for VB Transform 2026 — just $200. This is where AI ambition meets operational reality, and you’re going to want to be in the room. Reserve your spot now.

Source link

Funding & Business

China Factory Activity Slump Continues Despite US Tariff Relief

China’s factory activity remained stuck in contraction in August, as a government crackdown on price wars holds back production offset the boost for manufacturers of the US’ extended trade truce.

Source link

Funding & Business

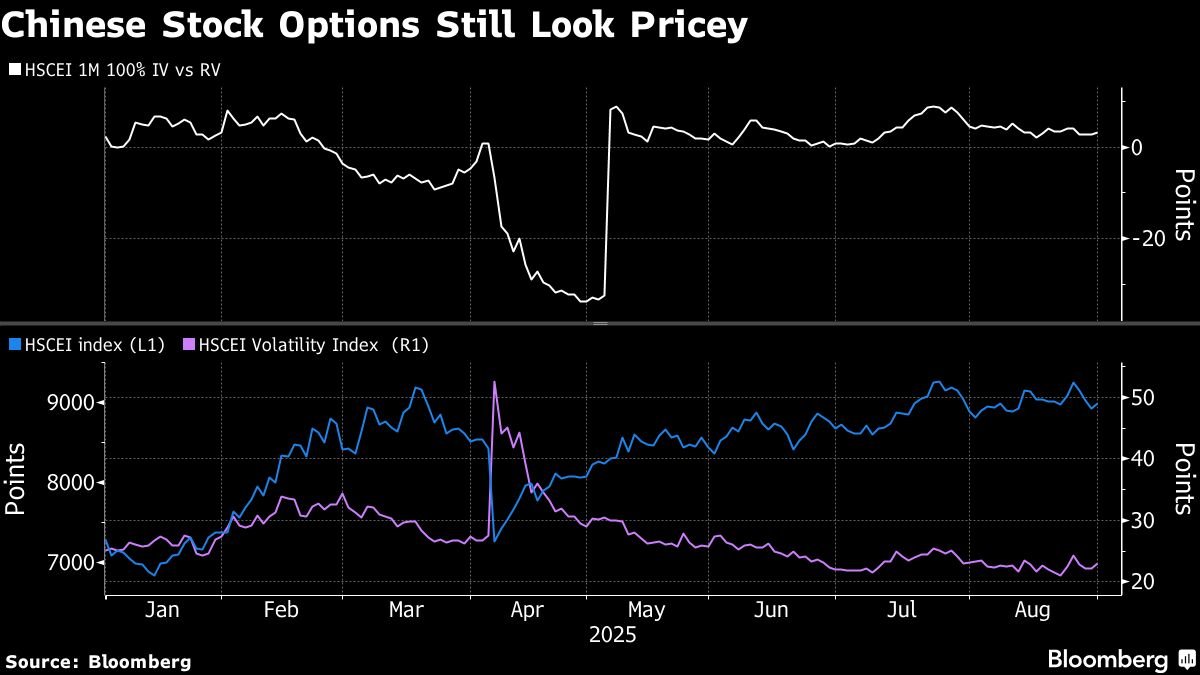

China’s Stock Rally Is Met With Skepticism in Options Market

While Chinese stocks traded in Hong Kong climbed for a fourth straight month, derivatives wagers show investors are skeptical about the market.

Source link

Funding & Business

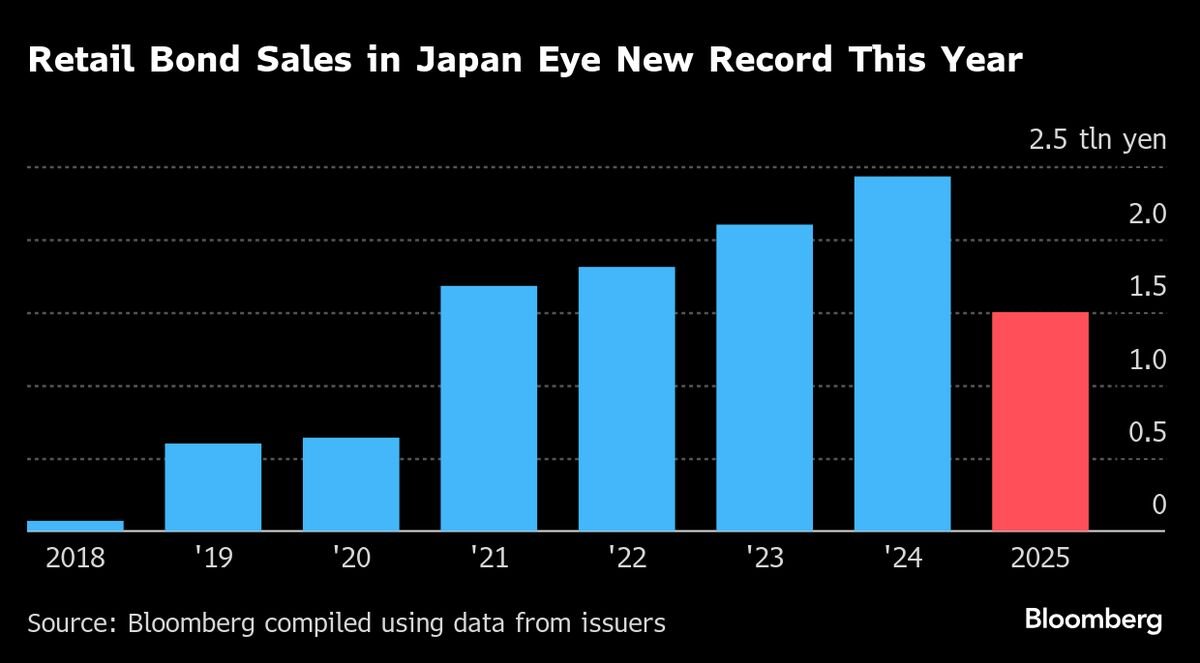

SoftBank, Rakuten Tap Japan’s Booming Retail Demand for Bonds

Sales of corporate bonds to Japan’s mom and pop investors are booming, on track to surpass last year’s record as bigger returns draw buyers looking to protect their savings from inflation.

Well-known names such as railway operator Keio Corp. and supermarket giant Aeon Co. are among those tapping the retail bond market, with the latter selling its debut retail bond on Friday.

-

Tools & Platforms3 weeks ago

Building Trust in Military AI Starts with Opening the Black Box – War on the Rocks

-

Ethics & Policy1 month ago

Ethics & Policy1 month agoSDAIA Supports Saudi Arabia’s Leadership in Shaping Global AI Ethics, Policy, and Research – وكالة الأنباء السعودية

-

Events & Conferences3 months ago

Events & Conferences3 months agoJourney to 1000 models: Scaling Instagram’s recommendation system

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoMumbai-based Perplexity Alternative Has 60k+ Users Without Funding

-

Business1 day ago

Business1 day agoThe Guardian view on Trump and the Fed: independence is no substitute for accountability | Editorial

-

Funding & Business2 months ago

Funding & Business2 months agoKayak and Expedia race to build AI travel agents that turn social posts into itineraries

-

Education2 months ago

Education2 months agoVEX Robotics launches AI-powered classroom robotics system

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoHappy 4th of July! 🎆 Made with Veo 3 in Gemini

-

Podcasts & Talks2 months ago

Podcasts & Talks2 months agoOpenAI 🤝 @teamganassi

-

Jobs & Careers2 months ago

Jobs & Careers2 months agoAstrophel Aerospace Raises ₹6.84 Crore to Build Reusable Launch Vehicle